Whats In Your Credit Report

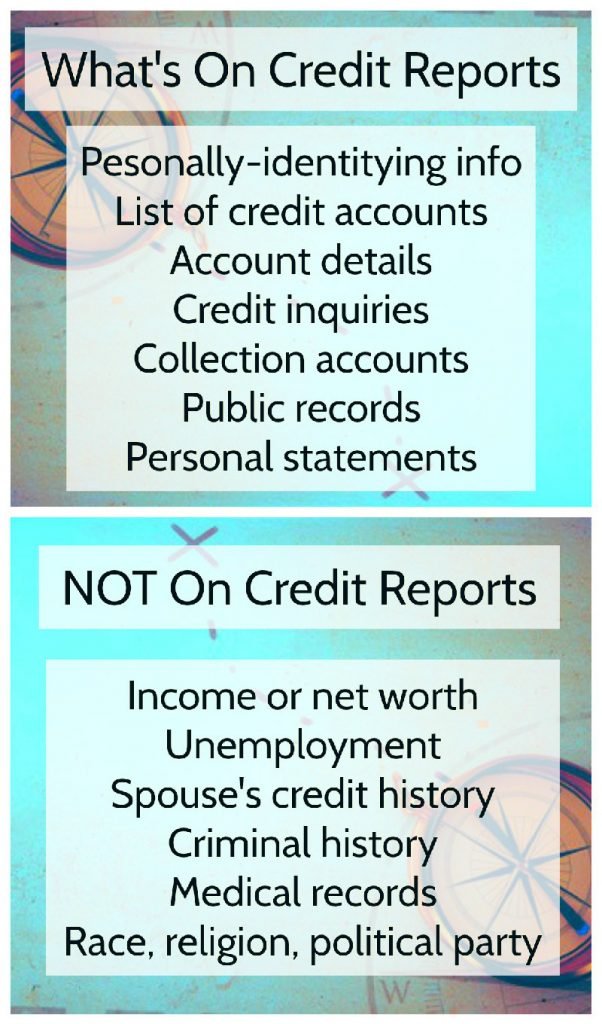

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

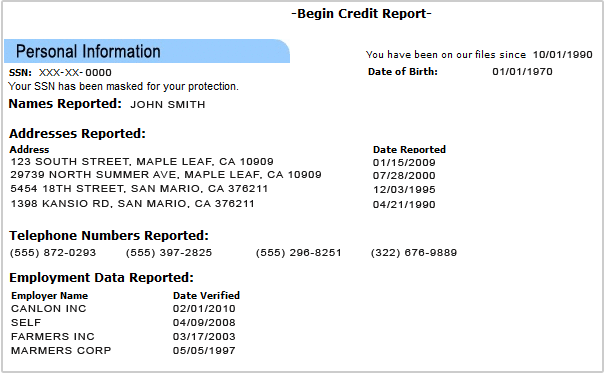

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.

Full Credit Report Services

Remember

;You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Could I Be Turned Down For Credit Because Of A Previous Occupant At My Address

When someone leaves a property, their financial details stay attached to them rather than the address. Someone else can affect your chances of getting credit but only if you have a financial association with them like a joint bank account or joint mortgage, not because you lived at the same address.

Read Also: Aargon Collection Agency Reviews

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.;

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Your Utility Bills Count As Credit

More good news for those with a thin file is that credit reference agencies are beginning to receive information from utilities providers. This means that if you have a direct debit set up for your electricity, water or even a mobile phone contract, then they might form part of your credit history. Of course, this also means that you have to make sure to pay these on time. You can read more on our blog and also check with your utilities provider.

If you have a thin file, remember that your credit score is not set in stone. You can work on it by managing debt responsibly and you can keep an eye on it for free with ClearScore.

Read Also: Opensky Billing Cycle

What Does Your Credit Report Show

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.;He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.;His background in tax accounting has served as a solid base supporting his current book of business.

When you’re reading your credit report;for the first time, it can be overwhelming, especially if you’ve had a lot of accounts over a long period of time. Knowing what types of things appear on your credit report can make it much easier to read and understand.

Income And Employment Information

Current and past employers may appear in your credit report as part of your personal identifying information. However, your credit report won’t show any information related to your income. Income can play a role in the credit application process: Lenders often ask about your income to help them determine whether you have the financial means to repay a debt. But they generally get this information directly from you , not as part of your credit report. Also, since income is not part of your credit report, it is never a factor in calculating your credit scores.

Read Also: Aargon Collection Agency

Negative Information If Any

The negative information;section will;list;accounts that haven’t been paid as agreed, collections and public records such as bankruptcies.;Negative information generally stays on your credit report for seven years, with the exception of Chapter 7 bankruptcies, which stay on your report for 10 years.

In this section, youll want to make sure any negative information is accurate. If you see incorrect accounts or collections or if something is being listed after it was supposed to have dropped off, dispute the entries immediately to have them removed from your report.

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.;

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

You May Like: Fingerhut Guitars

Review Your Credit Reports For Errors

Your are based on information provided by companies to the three major credit bureausExperian, Equifax and Transunion. To identify which credit reports contain errors, you have to review each report separately. You can do this by visiting AnnualCreditReport.com. Due to Covid-19, you can view all three of your reports for free weekly through April 20, 2022.

How Credit Bureaus Determine Your Current Address

The address information on your credit report comes from your current creditors. Generally, the only way the bureaus know there has been a change is when a creditor tells them. As long as your address in current with all of your creditors, your current address should be the one that is listed on your credit reports. You may have to give it a few billing cycles for the new address to show up, but eventually, it will.

You May Like: What Credit Report Does Comenity Bank Pull

My Report Has Old Or Outdated Information

You may have to wait between 4-6 weeks for new or updated information to be added to your ClearScore account. This is because the lender has to report to the first, and then they have to update their records.

Each lender has its own reporting procedure. For example, some lenders report at the start of the month, while others report closer to the end. ClearScore pulls your report from Equifax around the monthly anniversary of your sign-up date. So, if you signed up on the 8th but your lender reports on the 20th, youâll have to wait for your next report for new accounts to appear and information on closed accounts to be updated.

Similarly, any balance on your report is the balance on the date your lender reports. If your lender reports on the 15th but issues your statement on the 28th, your credit report will always show your balance halfway through the month, and the figures wonât align with your statement.

Filing A Dispute With A Credit Bureau

Once you find an error, check to see which credit bureau created the report. Then, you can mail a certified letter asking the credit bureau to correct the mistake or delete the offending account from your credit report. Remember, if the error is on all three of your credit reports, youll need to send a dispute to all three credit bureaus:

Equifax

Chester, PA 19016

Insider tip

Although you can also submit credit disputes online, we dont recommend doing so because the reasons youre allowed to give are pre-populated. Online disputes make it hard to tell your side of the story, so we recommend sending disputes by certified mail instead.

Also Check: Does Speedy Cash Report To Credit Bureaus

I Took Out A Mobile Phone Contract For My Ex

When you take out any type of credit for another person, if that credit agreement is in your name unfortunately the default will appear on your file. This is because it is you who the organisation has a relationship with, not your partner/child, etc.

This is why you have to be very careful about taking out credit for other people and always bear in mind that this may reflect badly on your credit status, not theirs, if they fail to make the agreed payments.

How Do I Get A Ccj Marked As Satisfied

If the judgment is paid more than one month after the original judgment, it can be marked as satisfied on your credit file. To do this, you need to send us the relevant Certificate of Satisfaction. The judgment will still remain on your credit report for six years from the judgment date, but lenders will be able to see the amount has been paid.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

What Is A Credit Rating

Your credit rating is an assessment of your creditworthiness based primarily upon your history of borrowing and repayment. The higher your credit rating, the lower your credit risk and the more likely you are to have your application for credit accepted.

Remember, a high credit rating isnt a guarantee youll be accepted for products you apply for, nor does a lower rating mean youll be turned down, as this is at the sole discretion of the product provider. Every credit provider will have their own rules and use a combination of the following to aid in decision-making:

How do I get an Bankruptcy or Insolvency marked as discharged or completed?

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Don’t Miss: Is 779 A Good Credit Score

How To Issue A Notice Of Disassociation

If you have financial ties with someone, their credit rating can positively or negatively affect yours. This means anyone you hold a joint mortgage or joint account with can affect whether or not youre accepted for other forms of credit. So, once these ties have been broken, its very important to let the credit reference agencies know. You do this by issuing a notice of disassociation.

Read on to find out more and discover what to do if someone elses credit history, who you are no longer financially linked to, is still affecting your credit applications.

For more information about how to check your credit report for incorrect information, read our guidance to checking your credit report.

And for more frequently asked questions about credit reports, return to our main Consumer Help Section.

If theres a search on my report I know nothing about, what should I do?

Check Your Own Credit Report

If you are applying for an overdraft, mortgage, credit card or other type ofloan, it is a good idea to check your credit report before you apply. It canhelp you spot any missed payments you did not realise were missed, or mistakesin your credit report.

Importantly, you can get incorrect information corrected. You also have theright to add a statement to your credit report to explain any specialcircumstance see Rules below.

Read Also: How Long A Repo Stay On Your Credit

What To Do If Information Is Missing

If youve spotted missing payment information from a credit report, your next steps may depend on your credit scores and what type of information is missing.

VantageScore® Solutions and FICO®, which create widely used credit-scoring models, both list payment history as the most important factor in determining a consumers credit scores.

Having multiple accounts, including credit cards and installment loans, with a long history of on-time payments can help you build good credit. Missing payments can hurt your scores.

One Of My Defaulted Accounts Has Been Sold On To A Debt Collection Company This Debt Is Now Appearing Twice On My Credit File Is This Right

If it is clear from looking at the two entries that they relate to the same account, with the same default date and balances and the original debt is clearly showing as settled then it is likely that we would consider this to be fair in terms of the data protection law. However, if the entries are recorded on your credit file in a way that may look like they are two different debts, or that could make the debt remain on your credit file for longer than six years from the date of the original default it is unlikely that we would consider this to be fair.

Also Check: Does Zzounds Report To Credit Bureau

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Don’t Miss: Experian Boost Paypal

Why Don’t You Have A Credit Report

If you have no credit accounts or have opened an account or accounts with lenders that do not report the payment status to a credit reporting company, you will not have a credit report.

Because information is deleted over time, it is also possible to have an existing credit report removed from Experian’s credit reporting system. This most commonly happens when a person moves out of the country.

What Else Do The Cras Do With Personal Data

All of the CRAs have different business functions running through them.

As well as credit referencing, CRAs also operate other activities such as direct marketing and lead generating functions. The data they sell in this area of their business may include information which the CRAs have bought from local authorities about individuals who had not previously opted-out of the full or open electoral register and information from other sources, such as lifestyle questionnaires and competition entries.

Recommended Reading: What Is Cbcinnovis On My Credit Report

What Is A Notice Of Correction

A Notice of Correction is a 200-word statement you can add to your credit file. You can use this to explain any entry for example, a missed payment.

If you add a Notice of Correction to your credit file, any organisation accessing your credit file through TransUnion will see it. Please bear in mind if you add a Notice of Correction to your credit file, lenders searching our database for information we hold about you are obliged under the Guide to Credit Scoring to read your Notice of Correction.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form; itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Read Also: Does Paypal Credit Affect My Credit Score