Hows Your Experian Credit Score Calculated

The Experian Free Credit Score runs from 0-999. Itâs based on information in your Experian â like how often you apply for credit, how much you owe, and whether you make payments on time.

Youâll lose points for having information on your report that suggests to lenders youâre unlikely to manage credit responsibly, such as previous late payments and defaults. Youâll gain points for things that lenders usually view positively, such as a track record of always paying on time and being on the electoral roll.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be one reason peopleâs credit scores tend to increase as they get olderâtheir accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just the age of your accounts.

How Are Credit Scores Calculated

Reading time: 4 minutes

-

You dont have just one credit score

-

Payment history, the number and type of credit accounts, your used vs. available credit and the length of your credit history are factors frequently used to calculate credit scores

Many people are surprised to find out they dont have just one . Credit scores will vary for several reasons, including the company providing the score, the data on which the score is based, and the method of calculating the score.

Credit scores provided by the three major credit bureaus — Equifax, Experian and TransUnion — may also vary because not all lenders and creditors report information to all three major credit bureaus. While many do, others may report to two, one or none at all. In addition, the credit scoring models among the three major credit bureaus are different, as well as those used by other companies that provide credit scores, such as FICO or VantageScore.

The types of credit scores used by lenders and creditors may vary based on their industry. For example, if youre buying a car, an auto lender might use a credit score that places more emphasis on your payment history when it comes to auto loans. In addition, lenders may also use a blended credit score from the three major credit bureaus.

In general, here are the factors considered in credit scoring calculations. Depending on the scoring model used, the weight each factor carries as far as impacting a credit score may vary.

Used credit vs. available credit

You May Like: How Often Can You Check Your Credit Score

Check Your Credit Reports Regularly For Free

Accounts listed on your credit report that you do not recognize may indicate that you have become a victim of identity theft. The next section contains specific information related to credit reports, credit scores and identity theft.

What is a Credit Report and How is it Used?A credit report contains detailed information about a person’s credit history, including credit accounts and loans, bankruptcies and late payments and recent inquiries. Credit reports are compiled by three major companies known as credit reporting agencies.

Typically, when a consumer applies for credit, the prospective lender obtains the applicant’s credit report to help determine creditworthiness. The information in a credit report is one of several factors that help lenders determine whether to offer credit, and on what terms, such as interest rate, annual percentage rate, grace period and other contractual obligations of the credit card or loan. This information is also used to generate a credit score, which is explained in greater detail below.

Requesting FREE Credit ReportsConsumers are entitled to one free credit report every twelve months from each of the three major credit reporting agencies. The official website from which consumers can request their free annual credit report is www.annualcreditreport.com.

What Is A Fico Score

A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. This, in turn, affects how much you can borrow, how many months you have to repay, and how much it will cost .

When you apply for credit, lenders need a fast and consistent way to decide whether or not to loan you money. In most cases, they’ll look at your FICO Scores.

You can think of a FICO Score as a summary of your credit report. It measures how long you’ve had credit, how much credit you have, how much of your available credit is being used and if you’ve paid on time.

Not only does a FICO Score help lenders make smarter, quicker decisions about who they loan money to, it also helps people like you get fair and fast access to credit when you need it. Because FICO Scores are calculated based on your credit information, you have the ability to influence your score by paying bills on time, not carrying too much debt and making smart credit choices.

Thirty years ago, the Fair Isaac Corporation debuted FICO Scores to provide an industry-standard for scoring creditworthiness that was fair to both lenders and consumers. Before the first FICO Score, there were many different scores, all with different ways of being calculated .

Read Also: What Is Considered A Very Good Credit Score

What Is A Credit Score

Understanding what a credit score is intended to measure requires you to understand three key concepts:

If you understand all three of these key concepts, youll know what a credit score from the credit bureau is intended to measure.

A better score will help you build better credit.

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

Recommended Reading: How Fast Will A Car Loan Raise My Credit Score

How To Check Your Fico Score

Knowing your FICO Score can help you get a handle on your finances and prepare you for the loan or credit card application process. Luckily, there are a number of ways to check your credit score. Start by reviewing your credit card statements and card providers website. Many issuers offer customers free FICO scores each month, while others even offer the service to non-cardholders.

Alternatively, you can visit FICOs website and choose from one of three monthly plans that provide access to FICO scores, credit reports, identity monitoring and other services.

Why Are There Different Fico Scores

Don’t Miss: How To Obtain Credit Score

How The Fico Score Works

FICO scores are calculated based on information collected by the three main credit bureausExperian, Equifax and TransUnionand summarized in a consumers . Using this data, FICO scores are calculated based on five general metrics: payment history, amount owed, length of credit history, credit mix and new credit. Specific criteria and considerations vary slightly, however, depending on the type of FICO Score.

In addition to FICOs base scoresFICO Score 8 and FICO Score 9the company has a number of industry-specific versions, including for mortgages and auto lending. While FICO Score 8 is still the most widely used version, the majority of auto lending scenarios use FICO Auto Scores, and mortgage lending typically uses FICO Scores 2, 4 and 5.

How Is Your Credit Score Calculated

Your credit score is calculated by credit reporting agencies such as Veda, Australias largest.

Although these agencies score in different ways , in general the higher the number, the more likely you are to have your request for credit accepted.

To calculate your score, credit reporting agencies look at:

- Your debt , including any problems youve experienced repaying that debt

- Loans youve taken out for household, personal or family reasons or to buy, refinance or renovate a property or as a guarantor for someone

- Your credit cards and store cards

- Your current credit limit

- Accounts youve opened and/or closed

They will also check if you have a court writ or default judgment against you and look out for any history of bankruptcy.

Don’t Miss: What Day Does Wells Fargo Report To Credit Bureaus

Why Is A Good Credit Score Valuable

Now you know a little more about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit risk, credit cards, loan applications and other lending decisions. And having a good score could help you qualify for more financial products with better rates, terms and credit limits.

But the influence of credit scores goes beyond that. And even when youâre not borrowing money, good credit could help you. Good scores could lead to lower insurance rates and fewer and lower security deposits on things like telecom and utility accounts. And good scores may make it easier to rent a home, too. Your credit reportsâbut not your scoresâcould even impact some job prospects.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit offers if you have good credit scores. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how can affect your credit scores.

Interest Rates and Credit Limits

Beyond Credit Cards and Loans

Good credit could affect other parts of your life, too:

What Your Score Means To Lenders

- 800 900 EXCEPTIONAL

We think its important to provide our cardmembers with free access to information that will help them understand and stay on top of their credit status. Thats why were providing you with your FICO® Score and information to help you understand it.

Your FICO® Score is calculated based on data from Equifax using the FICO® Bankcard Score 8 model and is the same score we use, among other information, to manage your account. This model has a FICO® Score range from 250 through 900.

The FICO® Score Citi provides is based on information from your Equifax credit report based on the as of date included with your score. This may differ from scores you obtain elsewhere that may have been calculated at a different time using information from a different credit bureau or even a different score model. If you have additional questions regarding the FICO® Score model and how its calculated, please refer to the FICO® Score FAQ and Understanding FICO® Scores links under the Useful Links section below.

Your score wont be available if:

Recommended Reading: How To Improve Credit Score To Buy A House

Whats A Good Credit Score Range

A good credit-score range depends on where a score comes from, who calculates the credit score and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means that what FICO, VantageScore or anyone else considers good may not be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Whatâs a Good FICO Credit Score Range?

FICO scores that range between 670 and 739 qualify as good scores. Scores in that range are near or slightly above the U.S. average. In total, FICO breaks its scores into five categories:

How Does A Credit Score Work

Your credit score is calculated whenever you apply for credit, such as a loan, credit card, mortgage, or even a mobile phone contract. How your score is worked out depends on the company youâre applying to â different companies have different methods and may use different information, so your credit rating may vary between them.

Lenders typically look at your borrowing history, your current borrowing, and other relevant information such as your income. Usually, theyâll look at information taken from the following:

Your credit report

Recommended Reading: How To Remove Delinquency From Credit Report

How Can My Fico Score Help Me

How To Increase Your Credit Score

If you dont know what you can do to improve your credit score or why your credit score is essential, then youre stuck dealing with bad credit.

If you follow some basic tips, you can work towards having a great credit score and credit file that can open doors to great credit.

So, lets get started with the three key concepts to understand credit scores to learn what you can do to improve your score and better understand the scoring model being used.

Don’t Miss: Is 620 A Bad Credit Score

Fico Weighs These Five Components To Come Up With Your Score

The often referred to as a FICO score is a proprietary tool created by FICO, the data analytics company formerly known as the Fair Isaac Corporation. FICO is not the only type of credit score available, but it is one of the most common measurements lenders use to determine the risk involved in doing business with a borrower. Here’s a look at what FICO examines to come up with its credit scores.

Understanding Your Credit Score

Reviewing credit reports is time consuming, and in the business world, time is money. Instead of analyzing your credit report to make a decision about whether or not you are a good credit risk, lenders will most likely look at your credit score. The credit score boils all the information in your credit report down to a three-digit number between 350 and 850 anything over 720 is considered above average.

This number, your credit score, is based on complex equations utilizing mountains of data collected and analyzed over the years about the bill paying behavior of consumers. Like it or not, the credit score is a remarkably reliable predictor of who is and is not a good risk for a loan. The lower your credit score, the higher the risk and the more you will pay in finance charges for credit. The higher your score, the better you look to lenders.

To determine if your credit score is above average, compare your credit history with that of the average consumer. According to the Fair Isaacs Corporation, developer of the FICO credit score, the average consumer:

The information in your credit report does not change much from month to month, unless you do something different or something happens. Your credit score may vary by a few points with each new month and with any changes in the factors that make up the score.

Don’t Miss: How Often Do Credit Card Companies Report

Who Creates Credit Scores

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit you’re using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

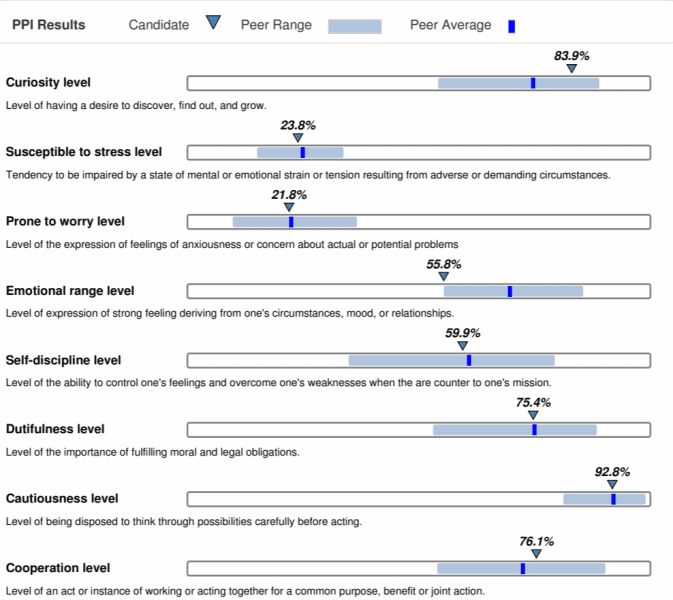

Elements Of Your Overall Financial Wellness

Financial wellness is a state in which you are in complete control of your finances and have a financial plan that assures you of financial security in the foreseeable future. The two main components of financial wellness are:

Financial Security: A state where you have a stable source of income, and you can maintain your desired lifestyle while still being able to save some money for the future. Being debt-free or having a clear time-bound plan to become debt free are crucial components of financial security.

Financial Independence: This is a state in which your interest in income/passive income exceeds your lifestyle expenses. This gives you complete freedom to pursue whatever goal you wish to follow in your life without having any financial worries.

So a good measure of your overall financial wellness would be to ask yourself some simple but important questions, like:

- Are you saving for your short-term and long-term financial goals?

- Do you have an emergency fund?

- Are you following a monthly budget?

- Have you cleared all your debt?

- Have you insured yourself and your family for unforeseen events?

Know Your Financial Wellness Score on Wizely

Read Also: How Long Do Medical Collections Stay On Your Credit Report