Why Your Credit Score Is Important

Many companies will look at your credit report before approving you for loans, credit cards, insurance, rental of a home or apartment and even employment. Lenders especially will focus on your credit score to determine your likelihood to pay back the debt on time. In other words, lenders consider these scores when assessing their risk.

Your credit score will often be used to determine the interest rate you will pay. Ultimately, the lender will be the one to determine the required score to obtain the best interest rates, but in general, credit scores in the higher range will generally mean the lowest interest rates. Even a difference of only a few points on your credit score can impact your monthly payments. For example, the difference between a 4% interest rate and a 4.5% interest rate on a $250,000 30-year mortgage is about $73 per month. That is nearly $26,000 more for the total cost of the mortgage.

You can order a free credit report from all three credit bureaus through AnnualCreditReport.com, which is a trusted source for credit reports and authorized by federal law. Credit scores are not included in the free report but are available for an additional fee.

Credit Score: Personal Loan Options

With a credit score between 700 and 749, youre just one step away from the top rung of the credit score ladder. Working to improve your 739 credit score means getting the best personal loan rates possible. However, interest rates with a score in this range are still ideal. Theyll very from fourteen to sixteen percent, often falling on the lower end of that spectrum.

Best Travel Card: Chase Sapphire Preferred

The Chase Sapphire Preferred Card is a top pick for an all-around travel card. It offers a range of rewards:

- 100,000 bonus points if you spend $4000 on the card in the first 3 months.

- 2 points per dollar spent on travel and dining expenses.

- 1 point per dollar spent on other purchases.

- If you redeem your points through the Chase Ultimate Rewards program you get 25% more value. 100,000 points are worth $1250.

- 1 to 1 points transfer program to many hotel and airline loyalty programs lets you combine your points for maximum effect.

Theres no foreign transaction fee. The APR is 15.99-22.99%

The downside: theres a $95 annual fee. If you travel frequently it may be worth it. If you dont its probably not.

Recommended Reading: How To Get My Own Credit Report

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Dealing With Negative Information Which Impacts Your 739 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 739 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 739 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

Read Also: Why Did My Credit Score Drop 20 Points

What Is A Good Credit Score For Buying A House

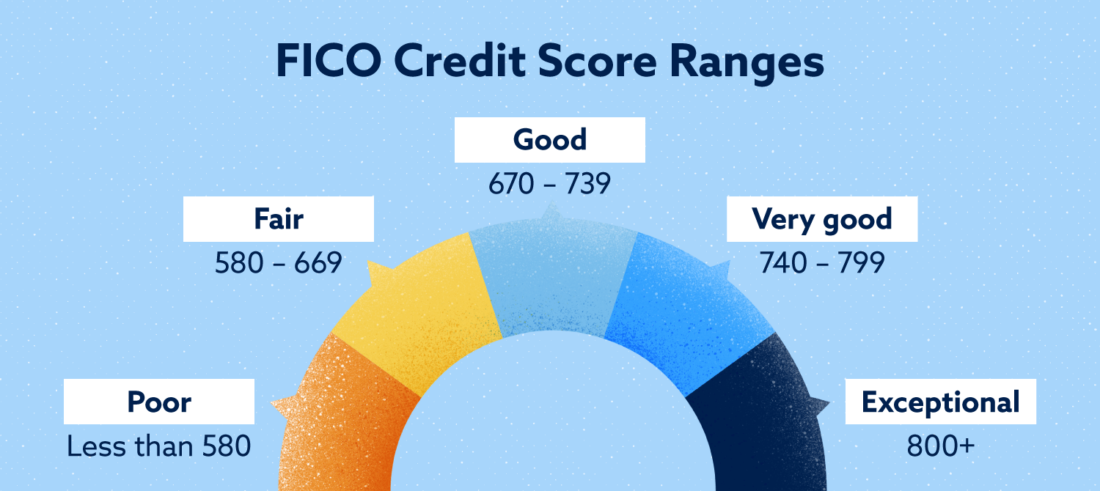

So far we’ve only discussed the minimum credit score that a mortgage lender will consider. But what type of credit score could qualify you for the best rates? FICO breaks its credit scores into five ranges:

|

FICO Credit Score Ranges |

| 800 and above | Exceptional |

Aiming to get your credit score in the “Good” range would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the “Very Good” range .

It’s important to point out that your credit score isn’t the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause the loan to fall through.

Why A Very Good Credit Score Is Pretty Great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 759 typically pay their bills on time; in fact, late payments appear on just 23% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Read Also: How To Up Credit Score

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Report Your Rent Payments

A history of punctual rent payments can also help to increase your score if your landlord is reporting them to one or both of Canadas credit bureaus.

Find out whether your landlord reports your rent payments, and if not, ask whether it would be possible to start.

Landlords are not obligated to report payments and in some cases it may not be worth it for them to do so, but it doesnt hurt to ask.

If they say no, you also have the option of reporting your rent on your own through a third-party service. These services usually charge fees though, so youll need to decide whether the boost to your credit score is worth the price.

You May Like: Does Credit Limit Increase Hurt Score

Getting Mortgages With 739 Credit Score

As with personal loans, credit scores in this range tend to produce favorable terms. With 739 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point five percent. If youre in the market for house, try pushing off your search until your credit slightly improves to lock in a more ideal rate.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 739 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 739 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

Poor Credit Score: Under 580

An individual with a score between 300 and 579 has a;significantly damaged credit history. This may be the result of multiple defaults on different credit products from several different lenders. However, a poor score may also be the result of a bankruptcy, which will remain on a credit record for seven years for Chapter 13 and 10 years for Chapter 11.

Borrowers with credit scores that fall in this range have very little chance of obtaining new credit. If your score falls in it, talk to a financial professional about steps to take to repair your credit. Additionally, so long as you can afford to pay a monthly fee, one of the best credit repair companies may be able to get the negative marks on your credit score removed for you. If you attempt to obtain an unsecured loan with this score, be sure to compare every lender youre considering in order to determine the least risky options.

Doing things such as paying down debt, making timely payments, and maintaining a zero balance on credit accounts can help improve your score over time.

You May Like: What Credit Score Does Carmax Use

A 739 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

Why do these three-digit numbers matter so much to your financial well-being? Well, lenders use your as a gauge of how likely you are to pay back any money they lend to you. So, a good credit score can give a lender the confidence to lend you money at terms favorable to you. It might not be enough to unlock the absolute best financial products or terms, but its a milestone indicating youre on the cusp of excellence.

People often talk about their credit score as if they have only one, so you might be surprised to learn that there are many different credit scores out there. A credit score is based on a credit-scoring model, which differs depending on the company that created it, like VantageScore or FICO. To generate your credit scores, these models can use data from different sources: Equifax, Experian or TransUnion .

Each model has its own standard for what qualifies as good. And to make matters even more confusing, its often not clear which credit score, model or bureaus data a particular lender is using and what other factors the lender may look at beyond scores.

Do You Need An 800 Credit Score

Have you always been insatiably curious about your credit score? I am. In my mind, my credit score is kind of like a report card, like a race toward personal best.

Despite widespread media reports of Americans’ debt challenges, most consumers have credit scores that fall between 600 and 750. More good news: In 2020, the average FICO Score in the U.S. reached a record high 710, according to Experian.

So, speaking of an 800 credit score what is it and should you work toward achieving it? Let’s dive in.

Also Check: Does Requesting A Credit Report Hurt Score

What Is A Credit Score

A credit score tells lenders about your creditworthiness . It is calculated using the information in your credit reports. FICO Scores are the standard for credit scoresused by 90% of top lenders.

When you apply for credit whether for a credit card, an auto loan or a mortgagelenders want to know what risk they’d take by loaning money. When lenders order a credit report, they can also request a credit score that’s based on the information in the report. A credit score helps lenders evaluate a credit report. It is a number that summarizes credit risk, based on a snapshot of a credit report at a particular point in time.

It’s important to understand that not every credit score offered for sale online is a FICO Score. Learn the difference between credit scores and FICO Scores.

About FICO ScoresThe most widely used credit scores are FICO Scores, the credit scores created by Fair Isaac Corporation. 90% of top lenders use FICO Scores to help them make billions of credit-related decisions every year. FICO Scores are calculated based only on information in a consumer’s credit report maintained by the credit bureaus, Experian, Equifax and TransUnion.By comparing this information to the patterns in hundreds of thousands of past credit reports, FICO Scores estimate your level of future credit risk, or how likely you are to repay a loan on time.

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be;used to determine;some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering;71 percent of Canadian families;carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

You May Like: How Do You Raise Your Credit Score

Improving Your 770 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

How To Get A ‘very Good’ Or ‘excellent’ Score

Having a good score doesnt mean you should stop trying to build your credit. Now that you have access to better products and rates, you can use them to access even better ones.

For example, taking out a personal loan at a low interest rate will help to diversify your credit mix and improve your payment history.

Likewise, increasing the limit on your credit cards will bring down your credit utilization ratio as long as you make your payments on time and in full.

Just remember to check your credit score every month, and if youre using Borrowell, follow its advice any time your score goes down.

Soon enough youll have a score that will leave lenders swooning.

Recommended Reading: How To Remove From Credit Report

What Factors Influence Your Credit Score

FICO Score

VantageScore