What Credit Score Do Lenders Look At

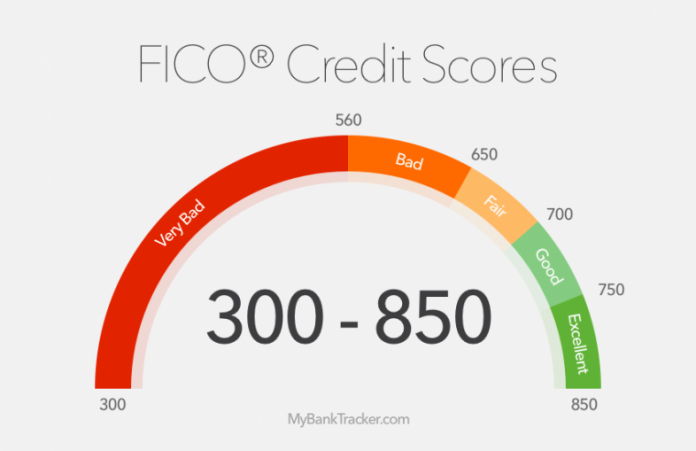

Each lender is going to have a different standard for credit scores when reviewing your application. Typically a credit score from 650 and over puts you in a good place to get a loan. A credit score in the 700s and over is considered excellent credit. Keep in mind that the nature of your loan and the province youre in will differ and the ranges may change.

Carecredit Credit Card Review

We publish unbiased reviews our opinions are our own and are not influenced by payments we receive from our advertising partners. Learn about our independent review process and partners in our advertiser disclosure.

The CareCredit Credit Card, issued by Synchrony Bank, is a medical credit card that gives you a way to pay for out-of-pocket health care and medical bills. Whether its to cover a high deductible, an emergency co-pay, or to pay for a necessary or elective procedure, many people often dont have the cash on hand for medical costs. CareCredit, which is offered by many health care providers, lets you spread out payments with deferred interest payments that could prove costly.

The Way You Use Your Credit Limits Can Help Your Score

Make sure you know your credit limits. Try checking your latest bill or banking app to find the limit for each card. With your limits in mind, you can focus on keeping your balances low.

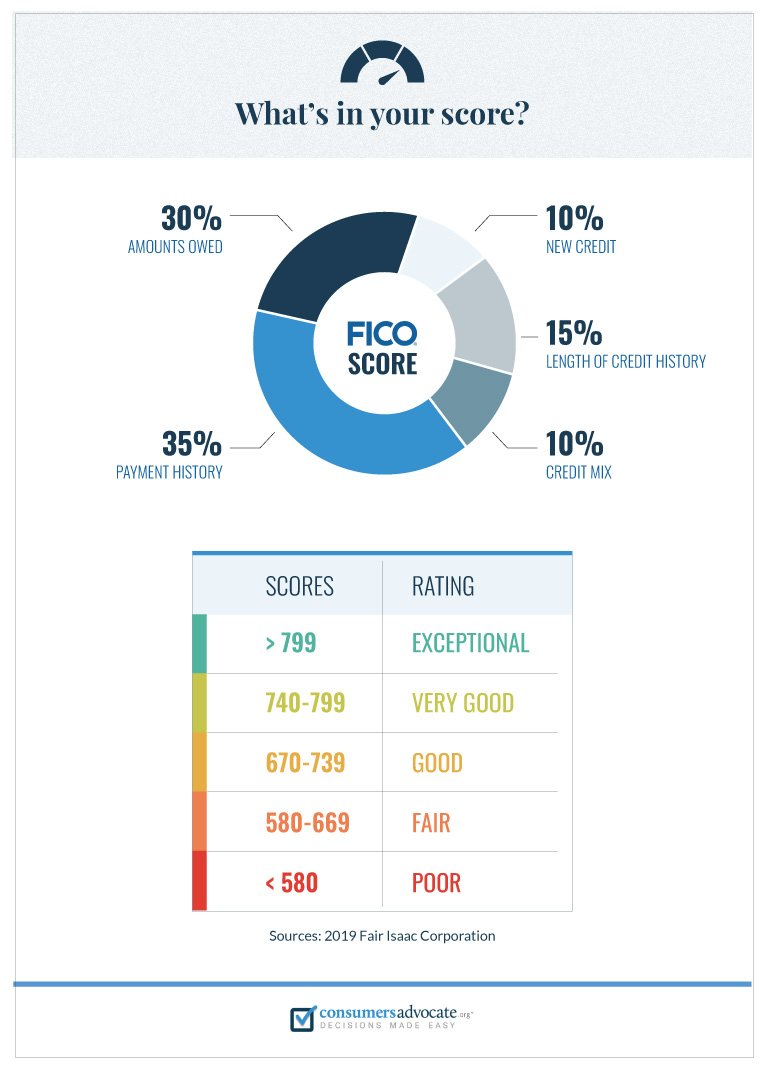

Ideally, you want to use no more than 30% of the credit limit on any card. The lower that credit utilization ratio, the less risky you seem as a potential borrower. People with the highest scores tend to use less than 10% of their limits. You can calculate your credit utilization ratio by dividing your balance by your credit limit. Multiply that number by 100 to get a percentage. Or you can use an online .

Keeping tabs on your credit usage is as simple as setting an alert once youve reached a certain spending threshold. Most cards will let you do that. Many personal finance websites and apps also have a dashboard that shows your utilization.

Other strategies can help you keep credit utilization low. Pay an amount before you get your statement, says Chi Chi Wu, an attorney at the National Consumer Law Center. Because utilization is calculated from what the balance is at the end of the billing cycle, if you pay it beforehand you now actually reduce that utilization.

Ulzheimer suggests two additional ways to keep your usage low: Start by trying to reduce your credit card balances if youre carrying debt from month to month. Or you can ask to increase your credit limit, which not only offers you more flexibility to make bigger purchases but also helps lower your credit utilization ratio.

Don’t Miss: How To Dispute A Missed Payment On Credit Report

Get Your Inquiries Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Read Also: Credit Report Without Ssn Or Itin

Dental Financing With Bad Credit

In a Nutshell If you need to finance necessary dental work, but dont have great credit, you may find it difficult to get approved for certain loan and credit card options. But there are other options you can consider, like finding less-expensive care or negotiating costs with your dentist.

What Are Two Things That Help Your Credit Score

If you cant make the full payments of a credit card balance, aim to pay off the minimum amount owed each month. So while you still have a left over balance, this shows your dedication and reliability in paying off your credit and keeps your credit score from taking a larger hit.

Stay well below your credit limit. Keeping your balance relatively low and within a reasonable amount shows that you can spend responsibly. Pushing your balance consistently towards the higher end of your credit limit shows erratic spending and makes you a higher risk.

Read Also: Removing Authorized User Hurt Credit Score

What Is A Credit Limit And Who Determines It

Your is the maximum amount youve been approved to spend by a creditor, based on factors like your payment history, income and credit score. A credit limit is not set in stone and is likely to change over the life of the account: Your card issuer can increase or decrease your limit without warning, and you can also ask for a credit limit increase .

What Is Care Credit And How Does It Work

Insurance can be tricky to navigate, especially when you are visiting the doctor or dentist for an emergency or even last minute procedure. With their convoluted requirements and ways of answering the question without actually answering the question, it is often difficult to figure out if a procedure is covered.

In fact, finding out that your insurance doesn’t cover a medical service you received is a common occurrence. Unfortunately, when this happens, it can leave people in a sticky spot where they’re scrambling to try and figure out how to pay their medical bills out of pocket.

Not everyone has thousands of unclaimed dollars sitting in savings, ready to be used for last-minute medical or dental procedures. Thankfully, CareCredit is a medical credit card that is available in these situations!

We’ve done the research, so you don’t have to! Here is everything you need to know about CareCredit to help you make more informed financial decisions.

Already have CareCredit and want to know where you can use it? Read our list of stores that accept Care Credit or if you are looking for stores that accept FSA cards this handy list will help you use those FSA dollars before they expire.

In This Post:

Don’t Miss: Does Paypal Report To Credit Bureaus

How Can I Raise My Credit Limit Without Hard Inquiry

3 Ways to Get a Credit Card Limit Increase without Asking

What Hurts Your Credit Score The Most

What Hurts Your Credit Score The Most? Its a close one, but your payment history is what lowers your credit score the most. Since payment history affects 35% of your FICO® Score, its not a good idea to fall behind on your payments. Even one late payment thats more than 30 days late can have negative consequences.

You May Like: Ccb Mprcc On Credit Report

How A Carecredit Card Works

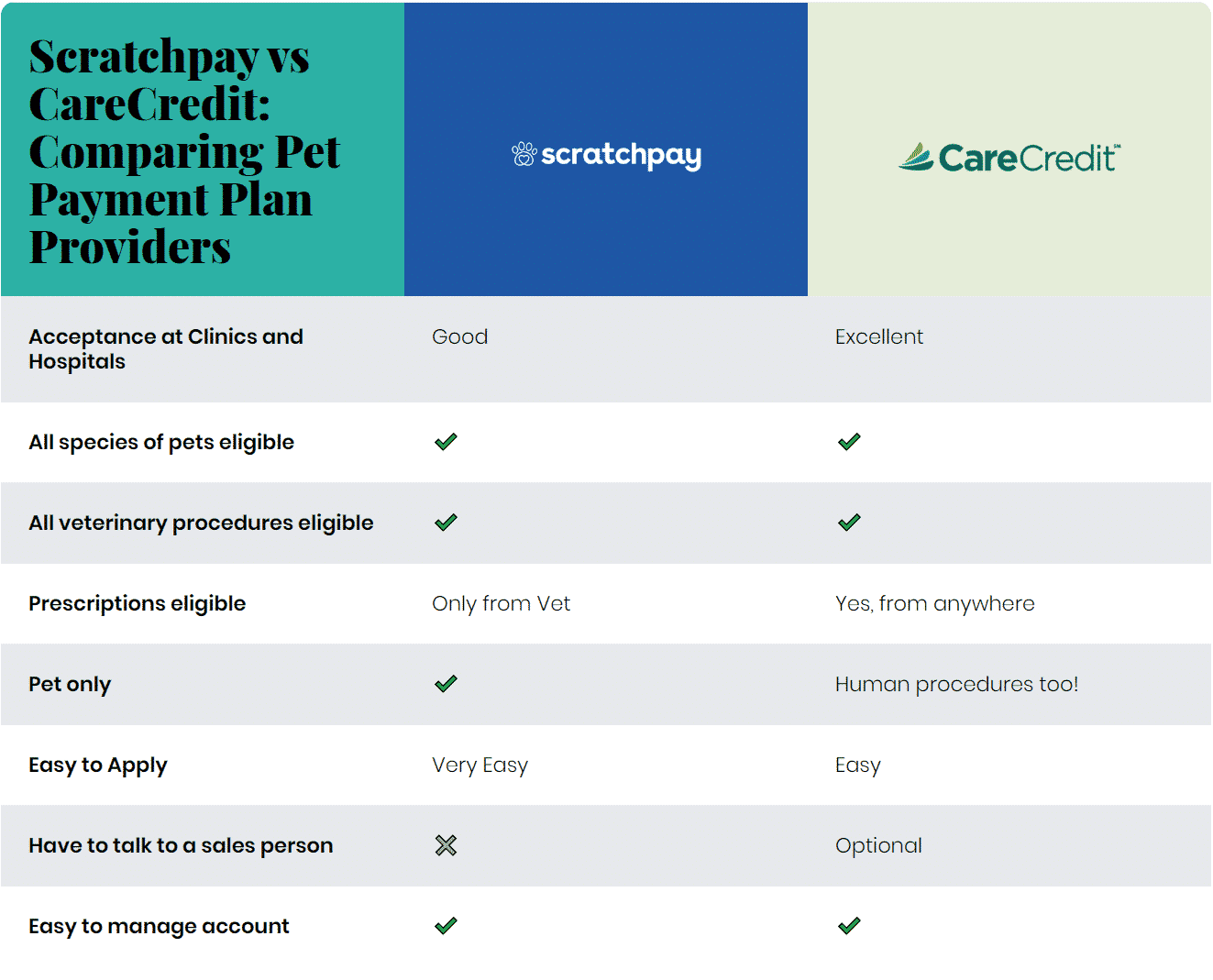

CareCredit cards are easy to use, especially if you already know how to use a regular credit card. You can , or through your medical provider. Check which specialist, clinic or treatment center accepts CareCredit and is closest to you, and charge the medical expenses to your card. The CareCredit card works with more than 200,000 health care providers across the country, so you are bound to find medical providers in your area that accept the card.

Read: 7 Lessons Entrepreneurs Wish They Learned Earlier

Carecredit Is In Business To Make A Profit

Though their marketing pitches focus on providing access to affordable healthcare, it is important for consumers to keep in mind that CareCreditand other similar healthcare credit card companiesare in business to make a profit.

They offer no-interest financing, counting on many consumers overextending themselves and being unable to pay their bills in full, thus incurring expensive financing charges. They may also count on consumers misunderstanding the terms.

According to the Consumer Financial Protection Bureau , CareCredit has “misled some consumers during the enrollment process by not providing adequate guidance clearly laying out the terms of the deferred-interest loans.” Such loans assess interest starting from the date of purchase throughout the promotional period if cardholders fail to pay the debt in full by the end of that period, they must pay all the accrued interest .

In 2013, CFPB ordered CareCredit to refund $34.1 million to cardholders. In response, the firm created a CareCredit Certification with its providers “in an effort to ensure that every CareCredit card applicant is given a clear, easy-to-understand explanation of financing options available.”

However, the firm’s “promotional financing options”the ones with no interest, or a relatively low interest rateare not available through every provider. Cardholders should check with their provider to determine the available options.

Also Check: Does Klarna Financing Report To Credit Bureaus

Care Credit Required Credit Score For 2021

Do you have a medical emergency and are interested in Care Credit? Will you be required to have at least a good credit score to be eligible for the card?

Those who are self-employed or without insurance are more likely to need the CareCredit credit card.

So lets review the details you need to know about the Care Credit required minimum credit score and other information you need to know before applying for your CareCredit credit card.

How Often Do Credit Reports Update

Your credit reports are updated when lenders provide new information to the nationwide credit reporting agencies for your accounts. This usually happens once a month, or at least every 45 days. However, some lenders may update more frequently than this. So, say you paid down a credit card recently. You may not see your account balance updated on your credit report immediately. If you look at the account in your TransUnion credit report, you may see a line that reads Date Updated. This would tell you the most recent day the account information was provided to TransUnion.

Because lenders dont all provide updates on the same day, new information may be added to your reports quite frequently. You can get your credit report from each of the three nationwide credit reporting agencies weekly at annualcreditreport.com. If youd like to more tools to help you manage your credit with confidence, consider a paid subscription to TransUnion Credit Monitoring. Youll get access to daily credit report and score refreshes and alerts when there are changes to your accounts, helping you better keep track of important account changes.

Also Check: How Bad Is A 500 Credit Score

Omg I Got Approved For Carecredit

OH MAN! I was so scared to apply, but i did, and I was APPROVED!

Requested $5000, approved for $3000!

Thats my highest Credit Card Limit! Closest i have is $1100 with Merrick Bank.

SYNCB did a hardpull on my TU CR.

My Tu score is 638. It has 3 collections [2 PIF, 1 Unpaid, all over 3 years old}

Uti is at 25%

My questions are:

Can I request a CLI Right Away? Because i really need the whole $5000 for dental work.

Will this high Starting Credit Limit boost my Credit Score?

OMG, i almost didnt apply because i was so nervouse, but im sooo glad i did. Even if i never use it, it will definatly boost my UTI!

Care Credit Approval Odds And Starting Limit

Hi. I posted earlier about wanting to apply for care credit. I would like to get opinions on if I might get approved. Per credit karma I have one collection that is 3 years old for $1083 from breaking my lease before it was time. I have four store cards that are all 3months to 18 months old, a car loan which will be paid off in June of this year and student loans totalling $32k that are in a repayment plan for $0 but currently showing in ck that I have paid off -1% of my loan. My student loans are 12 years old and I consolidated the 5 into one loan 6 months ago. My car loan was a 3 year note. I am currently living with family and we split the rent and bills and I pay around $500 a month. My utilization is at 8 % and also per credit karma my payments history shows 100%. I would like to know if a. I have a good chance of getting approved and b. If I get approved what is the highest limit, both starting and months down the road with cli that I could possibly expect with a $35k annual income. I really need about $11k-$12k for the dental procedure. I am not sure on myfico scores but my credit karma shows 675 for transunion and 660 for equifax.

Don’t Miss: Is Chase Credit Journey Accurate

Before You Go Shopping

If you have time to delay your car purchase, work on building your credit. That means:

-

Paying bills on time. A payment that goes 30 days past due can devastate your score, so pay at least the minimum on time.

-

Keeping credit card balances low compared to your credit limits. How much of your limits youre using is called your credit utilization, and it has a big effect on your score. You can try a number of tactics to lower your credit utilization in order to bump up your score.

-

Avoiding applications for other credit within six months of applying for a car loan.

-

Keeping credit card accounts open unless theres a compelling reason to close them. Closing cards reduces your overall credit limit, which can hurt your credit utilization.

If you end up with a higher-rate loan than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

Dont Miss: Why Is My Credit Score Not Going Up

Who Can Apply For The Carecredit Card

Another appealing part of the CareCredit card is that it is really easy for you to get approved. Unlike other credit cards, there is no credit check involved, and you dont have to have impressive credit history, employment records and sterling debt to income ratio to be approved. In fact, you can get approved instantly for the CareCredit card, and there are only a few qualification requirements including:

- You must be at least 21 years old or 18 if applying online

- You must have a Social Security number or ITIN

Thats all it takes to apply. You arent guaranteed approval, but many people can qualify.

You May Like: Does Klarna Run Your Credit

Your Healthcare Credit Card

CareCredit ® is a healthcare credit card for every member of the family. CareCredit® offers special financing on purchase of $200 or more for healthcare costs not commonly covered by insurance, including hearing aids.

Its the convenient way to improve your hearing health. Learn more by contacting our office.

Also Check: Will A Sim Only Contract Improve Credit Rating

What Are Some Alternatives To Carecredit

First, check to see if your provider privately offers some sort of pay-over-time arrangement. Many large practices and facilities have repayment plans that don’t charge interest or fees as long as you pay regularly.

If it’s available through your health insurance plan, consider establishing a Health Savings Account : You contribute money on a pretax basisusually taken out of your paycheckand your money gets the chance to grow tax-free until you use it for qualified healthcare expenses. If you’re on your employer’s group insurance plan, there’s a similar tax-advantaged account, the flexible spending account but you usually have to use up all the funds in it within the year you contribute them.

Because CareCredit functions somewhat like a loan, with a set repayment period, you might consider just taking out a personal loan from a bank or credit union instead. You’ll pay interest along the way, but it’s likely to be at a lower rate than the interest charged by CareCredit if you don’t settle your entire debt by the period’s end.

You May Like: How To Raise Credit Score 100 Points