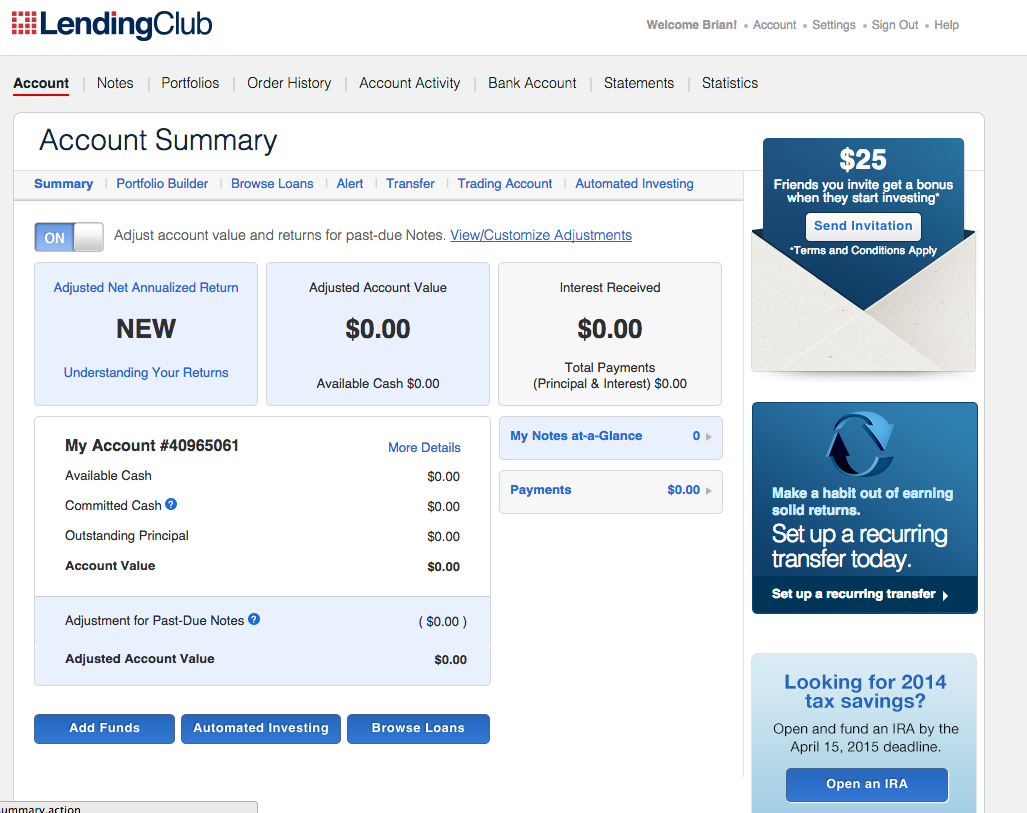

Lending Club Investing Strategy

Now I will discuss the lending club strategy with you. I am going to tell you, by minimizing the risk of how I have maximized my return.

But before following my strategies, you just need to do research on your own investment.

So, here Im showing you some filters that may guide you in the right path.;

- Loan purpose:

I mainly focused on the customers, who were looking for reducing their debt and getting better rates.

- The minimum employment length:

The minimum length is more than one year for employment. It is better to have a longer length of employment.

- Loan term:

The loan term is only 36 months. But according to my opinion, it is not worth having an additional return of 2%+/- for the five-year notes. This may cause additional risk.

- Interest rate:

I prefer to select from the categories B, C, and A. You can call them a butter zone as I say. But try to avoid the notes which are lower quality.

If the rates of notes that are of type A is less than 7.5%, then I also try to avoid them.

The credit score should be 675 or greater than that.

- The maximum ratio of debt-to-income:

There is a minimum ratio of debt to income in the lending club which is 30%. The ratio cant be less than 30%.

- Public records:

I try to exclude loans that are with public records.

- Debt refinance:

Its better to pay higher rates of interest than having the loans which can cause risk like the businesses which are new.

- Monthly income:

- Verified income:

- Review status:

- Delinquencies:

- Inquiries:

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

What If I Cant Make A Payment

While all borrowers have a 15-day grace period to make payments with no penalty, interest will accrue on your loan daily. If you accumulate extra interest because you delayed your payment, you may end up with an additional payment at the end of your loan term.

Payments that are not received within the 15-day grace period window are subject to a late fee. Depending on how late your payment is, your loan may be sent to a collection agency to recover the loan proceeds owed to investors.

Keep in mind that your loan repayment record will be shared with credit bureaus. As such, this can either positively or negatively affect your credit score. All late or missed payments as well as other account defaults will be reported and may affect your credit.

You May Like: Can You Have A Bankruptcy Removed From Your Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Lending Club Review: For Borrowers

Not only can you invest with Lending Club, but you can also borrow with Lending Club as well! Truly, whatever your needs are, you can get a fantastic deal through Lending Club.

You can typically get lower interest rates on loans through Lending Club than you can at a bank. You can also apply for a loan without ever leaving your home. Everything is done online through the website, virtually eliminating the need for an uncomfortable face-to-face meeting at the bank offices. And if your loan is approved, your funds will arrive within a few days.

Don’t Miss: How To Up Credit Score

Fixed Monthly Payments And Rates

LendingClub offers fixed interest rates and payments, so you don’t have to worry about your monthly payment amount changing as market rates fluctuate. This is a contrast to personal loans with a variable interest rate that can change over time and possibly cause your monthly payment to rise or fall.

Because the risk of a variable rate is mostly shifted to the borrowerâyou pay more if interest rates go upâthey typically start lower than fixed rates. However, if you’re paying off a loan over three or five years, a fixed interest rate may be better because it provides more certainty over a long period.

Alternatives To Borrowing From Lending Club

If Lending Club denies you a loan, there are some other options you may want to consider.

But before you move on to other lenders first review your credit report and make sure there are no negative marks that would affect your ability to get a loan. You can request your credit report information for free through annualcreditreport.com. Or you can review your credit score and report through .

If everything checks out ok, consider these alternatives to borrowing from Lending Club. Or check out Fiona which will allow you to compare interest rates from their trusted lending partners in under a minute.

You May Like: How Can A Landlord Report To Credit Bureau

Does A Lending Club Loan Hurt Your Credit

No, reviewing your rate and applying for a loan with LendingClub will not harm your credit score. It does a mild credit inquiry in order to obtain information about your creditworthiness. This is solely available to you, not creditors or anybody else who looks at your credit record. If you get a loan via LendingClub, your credit report will show a hard credit inquiry that might impact your credit score.

Keep in mind that your credit score is affected by new debts. They can help you enhance your credit over time by demonstrating that you can make on-time monthly payments.

Your credit score will not be affected if we are unable to provide you with a loan. Soft credit inquiries will be visible to you, but they will not be visible to creditors or other users of your credit report.

Does The Lending Club Verify Income

Your annual income may be verified so that the lending club can determine whether you are worthy for this loan or not.

Therefore, in the case of most applicants, who have applied for loans, their income is verified by the lending club.

After applying for a loan, the applicants go through the screening process. The data points about hundreds, is considered by this process.

It is needed to identify the applications that need further verification. The applicants need to submit some documents such as, tax records, W-2 forms as well as pay stubs, for the purposes of income verification.

Don’t Miss: How To Remove Items From Credit Report After 7 Years

Lending Club Investing Risks

You want to invest but dont want any kind of risk, thats almost impossible. Every investment including the secure one also goes through some risks.

Like other investments, if you are investing in the leading club, you may have to take some risks. So, now I will talk about the risks you may find.

- Inflation risk:

You can face the inflation risk with the lower rates but the higher rates can reduce the risk.

The lending club can be bankrupted and this risk is known as marketplace risk. If you see the history, you may find this type of risk is improbable in the case of Lending Club but its not exactly impossible.;

If the loans are paid precariously, then your return can be affected by this. So, for replacing it, you may have to find the other loan.

- Management risk:

The lending club has an annual fee and the rate is 1% for many years but in the near future, this rate may increase.

- Default risk:;

The investments are not FDIC insured. They are also not equivalent to treasure notes or bank CDs. So there remain some default risks.

- Pricing risk:

You may also find some risk in case of pricing the loan.

- Diversification risk:

While investing with this model, it is necessary to have 400 notes or more than that; in simple words, more than $10,000.;

The main reason behind this is, while you are dealing with loans which is really a small amount like less than 100, then there remains some risk through which the overall return can be affected.

- Liquidity risk:

Option A: Lower Rates Through Better Credit History

Your credit history is an important part of being a healthy person. It allows you to get a home mortgage or take out a loan to start a small business. Your credit report is something you should be aware of and nurture, like a garden. An entire article could be written on this section alone, but Ill cover the main points and hopefully you can get the big picture.

The three biggest ways to improve your credit history are:

First, you need to go to AnnualCreditReport.com and download your report. Then take an hour or so and go through it carefully, checking each account on the report for accuracy, especially accounts that are still open. If you spot an item that is open that you do not recognize then you may have had your identity stolen. This is rare, but it does happen! You need to contact the phone numbers on your credit report as quickly as possible.

More than likely you have not had your identity stolen. Instead, you may very well find an old loan or credit card that you are certain has been paid off, but that your credit report says is late. If you call this creditor up and get them to correct their error then your credit score will likely improve!

Finally, its a good idea to become current on any loans or credit cards youve fallen behind on. If an item on your credit history says In collections or Late then your credit score will get its biggest boost if you can fix these items.

Read Also: How To Get A Bankruptcy Off Your Credit Report

Why Check Your Credit Score

There are many reasons to check your credit score. First, its good to know where you stand since the interest rate you receive on loans including mortgages, auto loans, personal loans and more is dependent on your score. And second, keeping an eye on your credit score can help alert you of any errors or fraudulent activity in your name. If you notice a sudden drop in your score, for example, you can pull your full credit report at Annual Credit Report and review it in detail.

Glossary Terms:

Are There Any Added Fees

LendingClub charges an origination fee that ranges from 2% to 6% of your loan amount. This fee is deducted from the amount you receive instead of being added to your loan amount, so you may need to borrow more than you actually need to account for it.

Your origination fee and annual percentage rate depend on your credit history and other information included in your application. The average LendingClub origination fee for the third quarter of 2019 was 4.86%.

LendingClub doesn’t charge an application fee, brokerage fee or prepayment penalty. However, you may be charged a late fee of 5% of the payment amount if you’re more than 15 days late on a loan payment.

You May Like: What Is The Worst Credit Score

Is A Personal Loan From Lendingclub Right For You

Before you apply for a loan with LendingClub, do a quick check-in with yourself to make sure its right for you. Getting a personal loan is a big decision. Make sure youre informed and financially prepared for everything that comes along with taking out a personal loan, whether its through LendingClub or any other lender.

The Biggest Disadvantage Of Lending Club

It is no surprise that there is not any financial company that is 100% beneficial for the users. Lending Club is not an exception as well. Some of the main disadgavnategs, based on the customer experience are:

Low credit score: The minimum credit score accepted by LendingClub is 600. Of course, with that credit score, the interest rate may not be optimal, but it may be a decent deal for consumers with poor credit who are often forced to accept substandard deals.

Origination Fee LendingClub will provide you an interest rate after evaluating your credit risk, but part of it will be an origination charge, which will be deducted from your loan. Its worthwhile to weigh the pros and cons of firms that dont charge an origination fee.

Other Costs: There are a variety of additional fees. If you pay by check, youll be charged $7, but theres no charge if you set up a debit from your bank account. If you dont have enough money in your bank account to cover the monthly amount, youll be charged $15. A late payment fee of 5% of the outstanding installment amount or $15, whichever is larger, is charged.

Don’t Miss: What Is A Vantage Credit Score

Convenient Debt Consolidation Options

LendingClub advertises loan options specifically for credit card debt consolidation and general debt consolidation. If that’s your purpose for borrowing money, the lender may be able to make a payment directly to your existing creditors so you don’t have to.

Depending on your credit profile, a debt consolidation loan may save you money by reducing your interest rate and making it easier to pay off your debt faster. The APR range offered on LendingClub loans is 8.05% – 35.89% , the lower end of which is smaller than the average credit card interest rate of about 16.6%.

But even if your interest rate on a new loan with LendingClub isn’t significantly lower than what you’re paying on your credit cards, the set repayment amounts and term can help give you more structure as you work to eliminate the balance.

Lending Club Review For Investors

With interest rates on safe, fixed income investments sitting generally at below 1%, Lending Club offers a real opportunity to get dramatically higher returns. In fact, you can get average returns of between 5.06% and 8.74% .

Those are attractive rates, but just so weâre clear, there are more risks with Lending Club investments than there are with bank certificates of deposit. Plus, there are certain requirements you have to meet as an investor. Remember, the higher the potential reward, the higher the risk.

You May Like: What Credit Score Do You Need To Refinance Your House

Lendingclub Requirements & Application Info

Category Rating: 4/5

- Minimum credit score: Not disclosed, but multiple third-party sources place the minimum score required to qualify between 600 and 640.

- Minimum income: LendingClub does not disclose minimum income requirements.

- Age: You must be at least 18 years old.

- Citizenship: You must be a U.S. citizen, permanent resident, or long-term visa holder living in the U.S.

- Identification: You must have a Social Security number.

- Bank account: You must have a verifiable bank account. Once approved, the loan amount will be deposited into your account.

- Pre-qualification: You can check your potential rates online by entering some personal information. This will have no effect on your credit score, though actually submitting an application will.

- Ways to apply: The only way to apply for a LendingClub personal loan is online.

- Joint loans: LendingClub accepts co-applicants. That means you can apply with someone who has a better credit score and income to improve your chances of being approved.

- Application status: You can check the status of a LendingClub loan application any time by logging into your online account.

Lendingclub Personal Loans: 2021 Review

Kim Porter is a personal finance expert who loves talking budgets, credit cards and student loans. In addition to serving as a contributing writer for Bankrate, Porter also writes for publications such as U.S. News & World Report, Credit Karma and Reviewed.com. When shes not writing or reading, you can usually find her planning a trip or training for her next race.

Chelsea has been with Bankrate since early 2020. She is invested in helping students navigate the high costs of college and breaking down the complexities of student loans.

You May Like: How Much Does Overdraft Affect Credit Rating