How We Use Your Information

We use the information we collect about you to initiate the process for your free credit reports or other services you request. To do this, we give the information to each nationwide consumer credit reporting company you select to provide the free credit report or other service. We also use general information about how visitors use the site to monitor, maintain, and improve this website and other services needed to fulfill your request.

We may also use any information that is collected on this site as needed to help manage our everyday business needs, such as audits, reporting and legal compliance.

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.

Use it as often as you like, it wont affect your credit score.

There is no cost to using MyCredit Guide.

We provide a secure login that helps keep your information safe.

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

Also Check: Cbna Bby Inquiry

Who We Share Information With

We may share any of the information collected from or about you, as described above, with any of the three nationwide consumer credit reporting companies.

We may also disclose any of the information we collect to companies related to one of the three nationwide consumer credit reporting companies through common ownership or control.

We may also disclose the information to one of the companies that we hire to help us collect and maintain your information, for example, our website hosting providers.

Other companies may get access to your information because they help us process your requests for free credit reports or other services, for example, the company that hosts this website.

We require each third party receiving this information to abide by the restrictions in this privacy policy and not use or disclose the information for any purpose other than as described in this policy. We also require third parties to receive and use the information in compliance with the Fair Credit Reporting Act, Fair and Accurate Credit Transaction Act of 2003, Gramm-Leach-Bliley Act and other federal or state regulatory and legal requirements.

We may disclose any of the information collected in response to a valid legal process, such as a lawfully issued subpoena, search warrant, regulatory investigation or inquiry, or court order.

Importance Of Keeping Track Of Your Credit Report

We touched on why credit scores are important and Canadas different credit reporting agencies. Now we are going to shift gears. These are things you can do to improve your credit score and save money simultaneously.

You can order free copies of your credit report from TransUnion and Equifax. There is no cost to access these reports and your credit score. However, this next step is very important, so please pay close attention.

When you receive the credit reports, go through each one line by line. If there are any mistakes, you need to document them right away, write down the mistake, and keep it. Then, we are going to show you how to have those mistakes addressed.After you have gone through every line on one credit report, repeat this step with the other and note any mistakes, even if they may seem trivial.

Read Also: Paypal Credit Reporting To Credit Bureaus 2019

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Also Check: What Credit Score Do You Need For Chase Sapphire Reserve

What Is A Credit Score

The credit scores you get from different companies will not be the same. There are a number of reasons for that:

- There are many different formulas used to calculate credit scores. The differences in the formulas may lead to differences in your credit scores.

- Companies may produce scores that give results on different scales.

- Businesses don’t always report to every credit reporting company, and even when they do, they may send their information on different days. This means that on any given day, the information that one credit reporting company has may differ from the credit activity being reported to another credit reporting company.

Businesses use credit scores to estimate how likely you are to pay back loans or services. People with higher credit scores may be more likely to pay back their debts. People with lower credit scores may be less likely to pay their debts.

How Are Equifax’s Credit Scored Calculated

Understanding a credit score or how it is calculated can be very confusing for many Canadians however most people know a good credit score opens up more financial possibilities and sometimes even perks like significantly lower interest rates or higher credit limits.

In the most basic of terms, your credit score tells lenders how risky it would be to loan you money or give you a line of credit. The scores typically range from 300 and 900, with higher scores indicating better credit than lower scores.

To calculate your score, the positive and negative information in your credit report is broken down into five scoring categories. Equifax uses a credit score model to determine your score.

Here is an example of how Equifax calculates your credit score:

- Payment history: ~35%

- Any time you make a payment on time, that helps improve your score. If you are missing payments or have mostly late payments, that will harm your score.

Read Also: Realpage Consumer Dispute

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

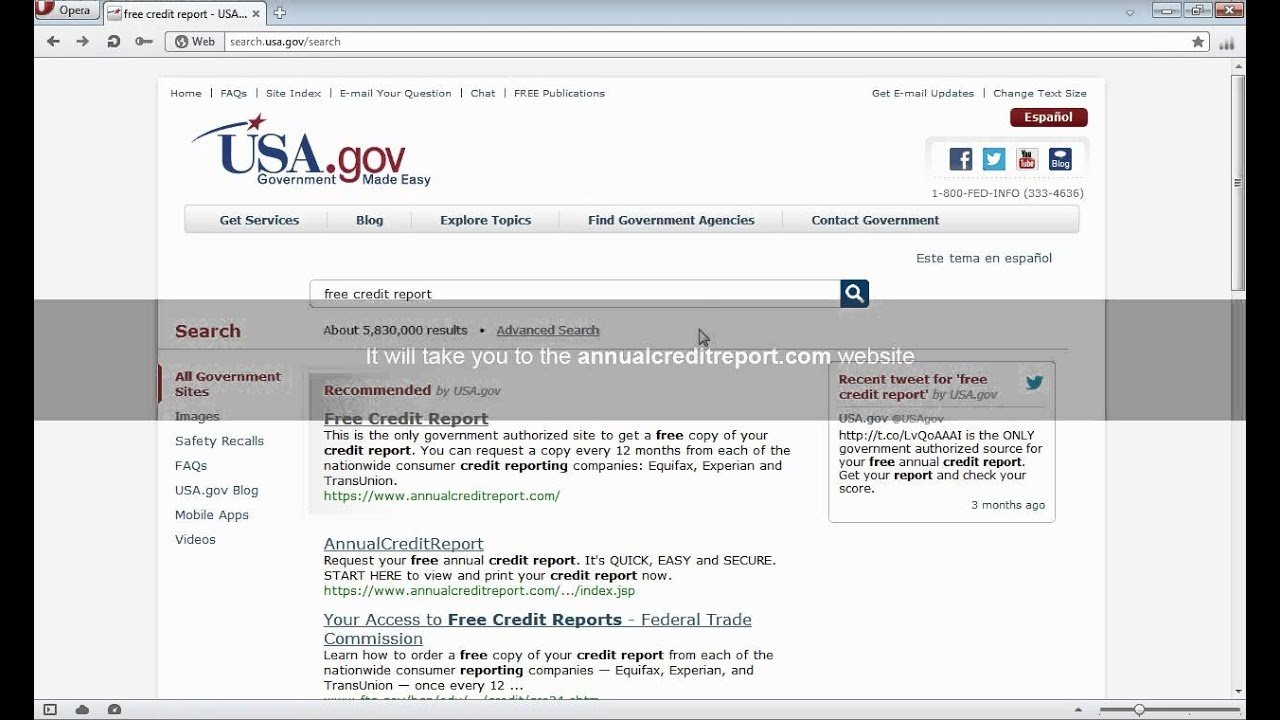

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Also Check: Carmax Credit Score Requirements

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Checking And Understanding Your Credit Score Just Got Easier

There are no limits to how often you can check your credit score. The CreditView Dashboard gives you the power to:

View your score anytime.

Your score1 is updated once per month upon log in and checking it will not affect the score.

Use the Score Simulator.

This tool estimates what your score could be if you make certain changes.

Review your progress.

Use the Score Trends Graph to view up to 12 months of your credit score history.

Access credit education.

Learn credit basics, how to raise your score and more.

Also Check: How To Unlock Experian Account

Csc Partners With Transunion To Provide Cibil Score

The Common Service Centre has partnered with TransUnion CIBIL Ltd. to provide the CIBIL score. The new partnership will provide access to individuals in rural areas, where over 2.5 lakh CSCs are present. CSCs allow individuals to avail bank loans quickly for their personal and entrepreneurial needs. Lenders access the CIBIL score to check the individuals financial health and credit worthiness. Lenders use this data before loans are provided. Individuals will have to go through the authentication process in order to get the CIBIL score via CSCs. The report can also be downloaded. According to the Chief Executive Officer of the CSC, Dinesh Tyagi, individuals in rural areas lack awareness about the CIBIL score. Customers who have a good credit score can negotiate for better interest rates.

14 July 2020

Can I Dispute My Credit Score

There are many different scoring models within your credit report that determine your credit score. Unfortunately, because of this you cannot dispute your credit score. But you can dispute items on your credit report. If you notice an item on your credit report that appears to be inaccurate, chances are it is negatively impacting your credit score. You are able to file a free dispute with Equifax by submitting a Consumer Credit Report Update Form and mailing it to:

Equifax Canada Co.

Box 190 Jean Talon Station

Montreal, Quebec

H1S 2Z2

Once you submit your dispute, Equifax will open an investigation into the potential inaccuracy. They will contact the creditor in question for verification. Once this process is complete, they will either change or delete the information in your credit report if it is deemed inaccurate. If the creditor verifies that the items are accurate, no changes will be made to your credit report.

Regardless of the outcome, Equifax Canada will send you a detailed summary of their investigation.

You May Like: What Fico Score Does Carmax Use

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Don’t Miss: Is Ic Systems A Legitimate Company

How We Help Safeguard Your Information

When you ask for free credit reports online, programs encrypt the information you provide on the request form before sending it to the nationwide consumer credit reporting company or companies you select. After the credit reporting company gets the information, it decrypts it. We always operate physical, electronic, and procedural safeguards to help guard your personally identifiable information. This site’s security protocols and measures protect your personally identifiable information from unauthorized access or alteration. These measures include internal and external firewalls, physical security and technological security measures, and encryption of certain information.

Please note, however, that no data transmission or storage can be guaranteed to be 100% secure. As a result, while we strive to protect the information we maintain, we cannot ensure or guarantee the security of the information you transmit to us or that we collect, retain or share.

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

Read Also: How To Get Repos Off Your Credit

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Equifax Canada Free Credit Report

Phone: Call 1-800-465-7166 to use Equifaxs Interactive Voice Response system.

You will need to confirm your identity and your credit report will be mailed to your address.

Download and complete the Credit Report Request Form and mail it alongside copies of two valid government-issued IDs to:

Equifax Canada Co., National Consumer Relations, Box 190, Montreal, Quebec H1S 2Z2.

In-person: Equifax has offices in Toronto, Halifax, and Charlottetown. You can go to any of these offices in person to request a copy of your credit report.

Read Also: Will Eviction Show Up On Credit Report