Final Thoughts On How To Handle An Ic System Debt Collection

If youre successful in proving that a debt collection from IC System is not legitimately yours, both the financial obligation and the negative entry on your credit report should disappear within 30 days of taking action.

But if the debt is legitimate, it will remain on your credit report for up to seven years. Paying it off should improve your credit score at least a little bit. Thats because a paid collection is always better than an open one. But even if it remains on your credit report, it will carry less weight the older it gets. And it will eventually disappear completely.

If you have multiple collection accounts, either with IC System or with other debt collectors, check out our article, How to Remove Collections From Your Credit Report, for a more comprehensive strategy for dealing with collection accounts.

About Prevent Loan Scams

Prevent Loan Scams provides guides, reviews & information to help consumers through every restorative step of their financial journey.

Ic System Inc Lawsuits

If you want to know just how unhappy consumers are with IC System, take a look at the number of lawsuits filed against the agency on the Public Access to Court Electronic Records . PACER is the U.S.s federal docket which lists federal complaints filed against a wide range of companies. A search for IC System will display over 370 lawsuits filed against the agency across the United States for violations of consumer rights and/or the Fair Debt Collection Practices Act .

What Do Our Clients Say

helped us win a settlement from an aggressive debt collection company. was very professional and explained the process and the plan of action. We really didnt have to do anything. Settlement was reached in a short amount of time. We recommend to anyone seeking settlement from a debt collection company.

won my case for me against the collection agency that was garnishing my wages. I was really stressed out & embarrassed about my situation, but successfully sued & they backed down we settled out of court, they paid me my damage reward & stopped all garnishments. went above & beyond for me & when I needed a competent professional who could deliver & be trusted, was the law firm I needed.

Also Check: What Should Your Credit Score Be To Buy A Car

Alternatives To Credit Repair Software

- Pay Once: Unlike hiring a professional to fix your credit, you typically dont pay monthly rates to use software. You simply buy the program and use it on your own terms.

- Pay Less: Since its a one-time purchase price rather than an ongoing subscription, you can pay less to buy software, especially compared to a credit repair service that charges you every month for a year or two.

- Stay In Control: Instead of hiring someone to do the legwork for you, credit software typically gives you the tools needed to improve your own score. This is important to consumers who value financial privacy.

Despite these advantages, there are times you may prefer hiring an actual credit repair professional to help fix your credit.

This may be especially true for people who have a wide variety of problems creating a multi-layered credit mess.

These more complex scenarios usually include:

- Delinquencies

- Debt-to-income ratio problems

Multi-layered problems often require more customized solutions and more persistent advocacy on your behalf both of which credit repair companies can provide for an ongoing monthly fee.

Who Is Ic System

IC System, Inc. is a debt collection agency located in St. Paul, Minnesota. They provide accounts receivable management out of offices in Minnesota, North Dakota, and Wisconsin.

Even though IC System shows up on your credit report they are often representing a client who believes that you owe them money. These clients include industries such as health and dental, small and medium businesses, communications companies, utility companies, financial services, and government organizations.

You may see IC System listed on your credit report as a collections account. This can happen if you owe a creditor money and theyve hired someone to collect that money.

Read Also: How To Check Credit Report

How To Decide If You Should Pay A Debt Collection Agency

There’s no silver bullet in a debt collection case. While ignoring a debt collector may be an option in some cases, it’s not available to some debtors.

Here are some general considerations.

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can’t just ignore them in the hopes that they’ll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction. For most areas in the US, that time frame is 14-30 days.

If a debt collection agency wins their lawsuit, they have several options available. For example, debt collectors may garnish earnings to collect a debt. A garnishment is a court order that takes money directly from a debtor’s earnings. This money goes towards repaying the debt they owe. Consider this possible outcome before ignoring a debt collector’s payment demands.

Here’s one more thing to keep in mind. Interest on your unpaid debt will continue to pile up as time passes. If you don’t pay a debt collection company, the amount of money you allegedly owe will keep increasing.

A piece of advice: pay the right person. If you receive a letter from a debt collector demanding money, do your research. Often, debt collection agencies sell debt to one another. Don’t just assume you’re paying the right debt collector. Make sure your debt hasn’t changed hands.

Consider these factors and situations

You may want to pay a collection agency

What Should I Do If Ic System Contacts Me

The first step is to determine whether the contact attempts made by IC System violate your rights.

If IC System is contacting you about a debt that is not yours or more than you owe, then that is a rights violation. They violate your rights if they are unable to prove that the debt belongs to you. They are in direct violation of your rights if they are trying to intimidate you or if they are using inappropriate language.

If IC System is threatening you with violence or negative credit reporting, then they are directly violating your rights. If they are calling you many times per week making automated robocalls to your phone or calling your friends, coworkers, and/or neighbors, then they are violating your rights.

If any of the above statements apply to your situation, you should consult an attorney immediately.

Also Check: Do Lawsuits Go On Your Credit Report

Demand A Debt Validation Letter

As is the case with all collection agencies, Southwest Credit Systems is required to provide you with whats known as a debt validation letter.

The purpose of the letter is to provide you with complete information regarding the debt.

That includes details such as the

- name on the account

- date the account went deliquent

- amount of the debt

- any other information that would connect you to the debt

From the collection agencys standpoint, the debt verification letter will prove the debt is legitimate, and you are the responsible party.

But from your own standpoint, it will also open the possibility of challenging the debt.

Collection agencies often pursue collections on obligations that have actually been paid already, and in many cases, the debt is a case of mistaken identity.

The debt verification letter will provide you with the information that will enable you to prove either point.

And if you can, Southwest Credit Systems will need to cease collection activities and delete any negative information from your credit reports.

Ic System Collection Letter Class Action Lawsuit Overview:

- Who: A Texas consumer lodged a class action lawsuit against collections company, I.C. System, Inc.

- Why: The consumer claims that the I.C. System collection letters are unclear and violate federal law.

- Where: The class action lawsuit was filed in Texas federal court.

Debt collector I.C. System, Inc. harms consumers with its unclear debt collection letters, which violate federal law, a new class action lawsuit alleges.

The lawsuit was filed in Texas on August 30 by lead plaintiff Adonus Taylor who alleges that the company violates the Fair Debt Collections Practices Act by sending consumers letters that do not clearly explain their rights in contesting a debt.

Don’t Miss: How To Get Credit Score Report

Debt Collector Wins On Bona Fide Error Defense Where Dispute Letter Too Vague

http://www.insidearm.com/news/00047309-debt-collector-wins-bona-fide-error-defen/

Heres a bit of good news in an otherwise chaotic week for the accounts receivable industry: On April 13, 2021, in the case of Anderson v. I.C. System, Inc., 3:20-cv-00263 , a district court granted summary judgment in a debt collectors favor on a bona fide error defense. Before you say, this is just a district court case, why should I care in light of all of the other things-which-will-not-be-named going on this week? a positive case is a positive case, and this particular case covers a situation likely familiar to any entity which is credit reporting.

In the Anderson case, I.C. System received a letter from a consumers attorney, which referred to Charles D. Anderson and Carol Ann Hamblin and provided their social security numbers and address. According to the Court, the letter was vague, as it did not list the actual accounts in dispute. Instead, the letter stated it was to serve as written notice that the above referenced individual is in fact and in law represented by this office for all debts that he or she may have and the above referenced individual dispute the debt which you are attempting to collect. The letter did not include any additional information.

The Courts Order on I.C. Systems motion for summary judgment can be found here.

insideARM Perspective:

What Is Ic System

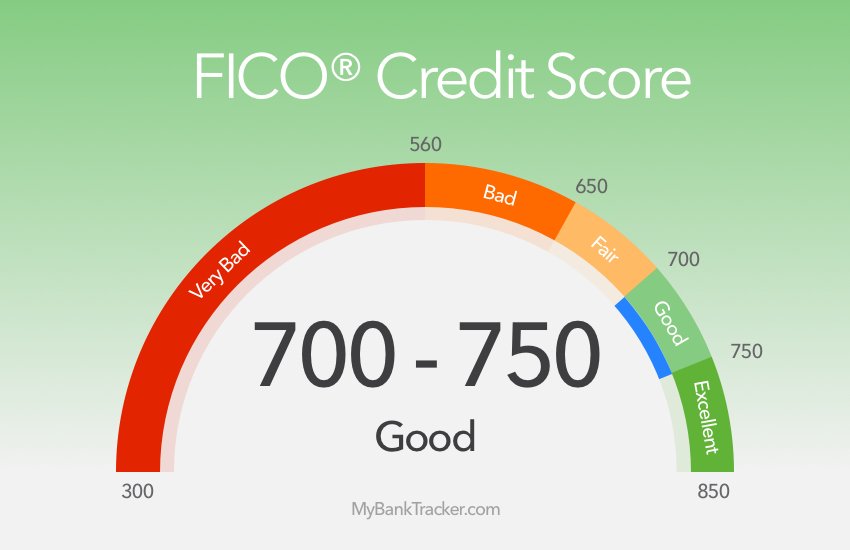

IC System is a debt collection agency. They’re probably on your credit report as a ‘collections’ account. This usually happens when you forget to pay a bill. If a collection is on your credit report, it’s damaging your credit score .

You might not have to pay your debts!Paying your debts may hurt your credit .Give Credit Glory a call . We’ll help navigate your Credit Report and understand if partnering w/ us to remove inaccurate, negative items makes sense! Call us, now, to learn more:

Read Also: How To Get Your Credit Rating Back

What To Do If The Debt Is Yours

What if you challenge the legitimacy of a collection account, and IC System provides evidence that its really yours?

The easiest course would be to pay the debt in full and get on with your life. However, thats not what Im recommending.

Remember earlier I said collection agencies often work on commission? Or that collection accounts are often several years old? Both factors can work in your favor.

The collection agency will be as anxious to get money on the account as you are to get it out of your life. Take advantage of that situation by offering to pay less than the full amount.

For example, start by offering to pay 50% of the full balance. If the collection is more than three or four years old, you may want to offer even less.

From there, be prepared to negotiate. The agent may come back at 80%. You counter at 60%. The agent re-counters at 70%. That may not be the 50% you are willing to pay, but its still 30% less than the full amount.

If the agent agrees to this arrangement, youll need to do the following:

Should I Negotiate A Settlement Or Pay Ic System

Unfortunately, settling may not help your credit. Once a collection account is added to your credit report, your score will be damaged for seven years regardless of payment. Fortunately, you have options. Credit Glory has successfully disputed collections from IC System and companies like them for thousands of clients nation-wide.

We can help you too.

Don’t Miss: Does Balance Transfer Affect Credit Score

Is Ic System A Real Company

IC System is not a scam and is an authorized debt collection agency. IC System, Inc. purchases packages of debt from other businesses and moves forward to collect that debt from consumers.

If you find yourself in this situation where IC System, Inc. has contacted you, it is important that you learn your rights and what to do next.

Best Ways To Deal With 11 Charter Communications

As we alluded to earlier, the best way to deal with 11 Charter Communications is by mail. Leaving a paper trail bolsters your case if you must escalate it to the CFPB.

With the number of complaints filed with the CFPB, certified mail is the only form of communication I would trust.

Furthermore, debt collection agencies are notorious for agreeing to one thing over the phone but backing down on their agreement last minute.

Read Also: Do Balance Transfers Hurt Credit Rating

How Long Can A Debt Collector Come After You

California has a statute of limitations of four years for all debts except those made with oral contracts. For oral contracts, the statute of limitations is two years. This means that for unsecured common debts like credit card debt, lenders cannot attempt to collect debts that are more than four years past due.

Re: I Paid Ic Systems For Deletion Of An Att Collection But They Didn’t Delete Just Changed Status

wrote:I called IC Systems and told the rep that I would pay the debt if they deleted it from my credit report. The guy agreed, I paid, but they have not deleted and just changed the status to “closed”.What can I do to resolve this?Thank you for your advice.

Unless you have the agreement in writing, it will be hard to get them to do anything at this point. Has it been updated with a zero balance?

Also Check: When Does An Account Come Off Credit Report

How To Deal With Southwest Credit Systems

Theres a lot of pleasant language on the Southwest Credit Systems website.

Though while they may use more accommodating language, never forget that youre dealing with a collection agency.

Whatever they do or say, its all part of the methodology to get you to pay up.

And though it may seem as if Southwest Credit Systems is primarily interested in setting you up on a payment plan, the preference is always to have the entire balance owed upfront.

And as you might expect, their approach to dealing with you may be less accommodating if you are unable to honor a payment agreement for any reason.

Remembering that Southwest Credit Systems is a collection agency, we recommend you use the following strategies in dealing with them.

Before we get into specific strategies for dealing with Southwest Credit Systems, lets start with some general information you need to know thats virtually standard in dealing with any collection agency.

Our Final Thoughts About Removing Ic System From Your Credit Report

One of the consequences for not being able to prove that a debt from IC System is legitimately yours, should both the financial obligation and negative entry on your credit report disappear within 30 days. If it turns out that this is legitimate debt, then you will have no choice but to pay off what you owe as soon as possible if want any chance at improving your credit score in time. The longer an account remains open with collections attached or unpaid balances due regardless of whether they are paid later by mistake or error can lead to serious damage down the line because all accounts age over time and eventually become less significant than newer ones.

Read Also: How To Access Free Credit Report

Who Does Ic System Collect Debts For

IC Systems is a company that collects on debts for private individuals, businesses and institutions. They collect from different industries including retail, telecommunications and pest control.

They offer services to everyone in need of collecting unpaid debt they are not exclusively looking for any one type of business or institution as long as you have money coming back your way then IC Systems will happily help!

It is difficult to find a company that can represent your interests after youve made bad business decisions. When it comes to debt, IC Systems works with clients from all backgrounds and industries- meaning if they call about an old transaction or past due payment, chances are good its yours!

Hire A Credit Repair Professional

If you are anything like me, then you want to remove IC Systems from your credit report quickly, safely, and efficiently.

The best way to do this is by hiring a credit repair company. With years of experience, the best credit repair companies can successfully remove negative items from your credit report, file disputes with all three credit bureaus, and help you rebuild your credit from scratch.

With their expertise and insight, your situation with IC System will be resolved in no time. In fact, companies like , have removed IC System, Inc from thousands of consumer credit reports. It is their bread and butter.

So, if you want to remain hands-off and let a professional handle the situation, then hire a credit repair company immediately. This is the best course of action and a sure shot way to remove I.C. System from your credit report.

> > More:

Read Also: How To See My Credit Score Free