Immediate Steps To Take

need to immediately react and respond via phone and email to any unauthorized lines of credit, and make sure they are forgiven any potential debt quickly and efficiently, said Robert Siciliano, an identity theft expert who has written numerous books on the topic. Otherwise, like a tumor it metastasizes it becomes larger and more problematic.

Make sure to take detailed notes when you call, including the name, ID number and direct phone number of the representative that you talk to. Also be sure to ask about the possibility of putting a freeze on the account in question so that additional charges cannot be made while the creditor looks into the possibility of fraud.

What Information Is On A Credit Report

by Kailey Hagen | Dec. 2, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Everyone should know about their credit report information.

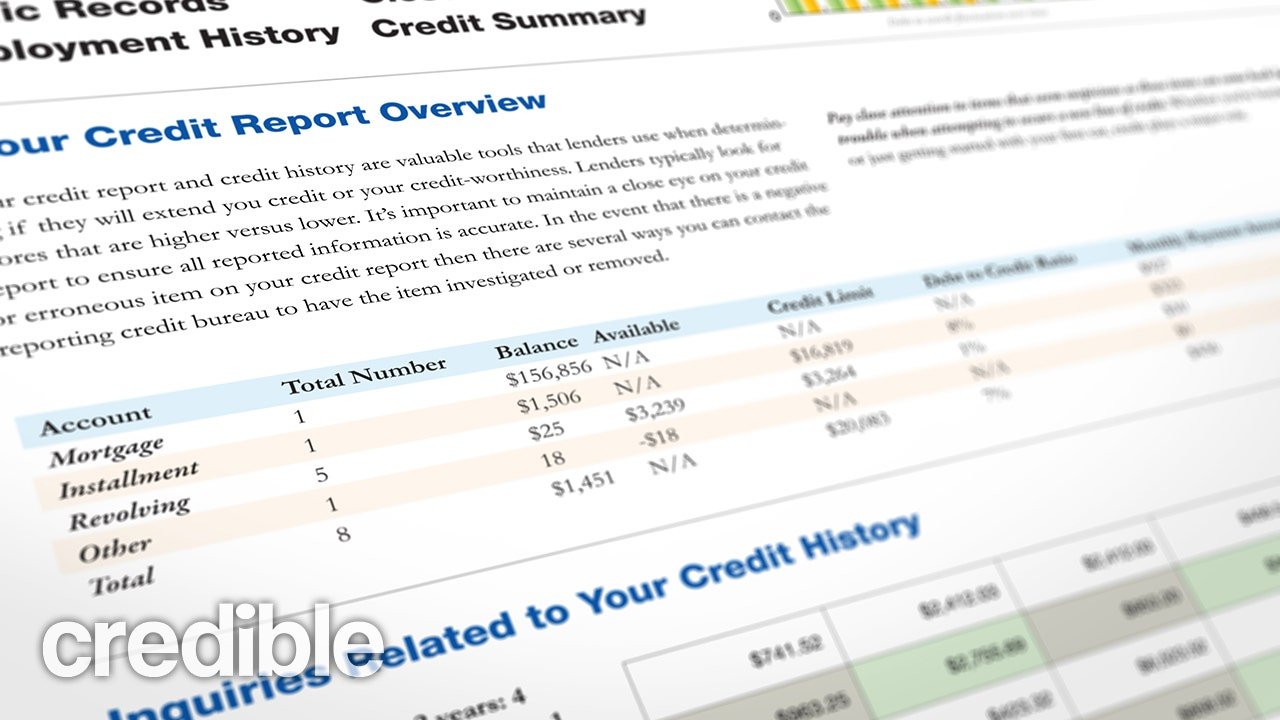

You probably think you’re done with report cards once you’re finished with school, but there’s one that follows you from the day you open your first credit card or loan account until the day you die — your credit report. Your credit report information is a record of how you manage borrowed money, and it can affect your chances of getting loans, , apartments, and even jobs.

It’s a pretty big deal, so you ought to know what yours is saying about you. Here’s everything you need to know about your credit report information and how you can check yours.

How Do You Get Around A Bad Rental History

Some landlords will overlook past irresponsible behavior, but you usually need compensating factors such as a co-signer or a larger security deposit.

Also Check: When Does Usaa Report To Credit Bureaus

What Do Companies See On A Credit Check

When companies perform credit checks, they are looking at your credit history. They want to get an accurate snapshot of who you are and your risk level if they lend you money or allow you to open a new credit account. First, companies see your personal information, including your name, address, Social Security number and date of birth.

Then, they will see all of your credit accounts. Accounts include credit cards and installment loans, like auto loans and mortgages. Listed under each account are your creditors names, current balances, payment history, and account status. If youre behind on your payments, companies will see that. If youve ever gone through a bankruptcy or had a civil judgment against you, they will see that too.

A Rental History Report Gives Potential Landlords A Comprehensive Timeline Of Your Time As A Tenant Including Any Outstanding Rent Or Evictions

As a potential tenant, you can expect to be thoroughly scrutinized. Good landlords will do , conduct personal interviews, and also request a copy of your rental history report. Its important to make sure you know whats on itand to dispute any errors you may findas these reports can be a deciding factor in your rental application.

Also Check: What Is Syncb Ntwk On Credit Report

Types Of Credit In Use: 10%

The final thing the FICO formula considers in determining your credit score is whether you have a mix of different types of credit, such as credit cards, store accounts, installment loans, and mortgages. It also looks at how many total accounts you have. Since this is a small component of your score, don’t worry if you don’t have accounts in each of these categories, and don’t open new accounts just to increase your mix of credit types.

How Does A Consumer Proposal Affect Your Credit

There are various ways a consumer proposal can affect your credit. That said, keep in mind that these implications are only temporary.

When your consumer proposal is filed and approved, the Office of the Superintendent of Bankruptcy will obtain it and inform the credit bureau. This action will result in several things.

- You will likely receive either an R7 credit rating . Bankruptcy, on the other hand, results in an R9 score.

- The proposal will show up on two sections of your credit rating for three years .

- Each creditor will indicate that your account was included in a proposal

- The date of the filing is recorded and then updated upon completion.

- On occasion, your creditors may indicate a bankruptcy on your credit report instead of a proposal. You can request an update to rectify this.

These implications are removed once your consumer proposal is completed, leaving you with a fresh slate to rebuild your credit and achieve financial wellness. The sooner you complete the proposal, the sooner you can start rebuilding.

Read Also: Does Carvana Report To The Credit Bureaus

Filing Consumer Proposals With David Sklar & Associates

The hardest part of the consumer proposal process is asking for help. The team of compassionate Licensed Insolvency Trustees at David Sklar & Associates will guide you throughout the process, help you weigh your options, and make suggestions based on your unique situation.

There is no one size fits all debt relief solution, and our compassionate trustees work with you to identify the solution that will be best suited to you so that you achieve financial independence as soon as possible.

We provide the credit counselling required to file a proposal and establish debt management and financial plans for your future. Contact David Sklar & Associates to book your initial consultation.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Read Also: How To Remove Repossession From Credit Report

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

Read Also: How To Remove Repossession From Credit Report

If You See Errors Dispute Them

If you spot inaccuracies that may be lowering your scores, gather documentation to back up your claim. You can dispute credit report errors with the credit bureau showing them. You’ll need to provide copies of documents proving your identity and showing why the item is wrong. The bureau has 30 days to investigate and respond, although the Consumer Financial Protection Bureau has guidance extending that to 45 because of the pandemic

You can request your free credit reports from the three major bureaus or a personal finance site that provides free credit report details, like NerdWallet. Then, review the information and check for inaccuracies.

Credit reports include your personal information, accounts, credit inquiries and any negative marks you may have, such as bankruptcies.

A good credit score is generally between 690 and 719. Learn more about the and how to build credit.

About the authors:Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

How Lenders Interpret Your Credit Report

As mentioned on the previous page, your credit report only relays the history of your dealings with creditors. However, you need to look closely. There’s information there that may seem innocent to you but not to potential creditors. This includes information like:

Now, let’s look at how you and others can access your credit report.

You May Like: Does Paypal Credit Report To Credit Bureaus

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: Does Opensky Report To Credit Bureaus

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

Also Check: Are Evictions On Your Credit Report

Income And Employment Information

Current and past employers may appear in your credit report as part of your personal identifying information. However, your credit report won’t show any information related to your income. Income can play a role in the credit application process: Lenders often ask about your income to help them determine whether you have the financial means to repay a debt. But they generally get this information directly from you , not as part of your credit report. Also, since income is not part of your credit report, it is never a factor in calculating your credit scores.

Who Is Responsible For The Credit Check Fee

This depends on your landlord or property management company. But, for the most part, the credit and background check is a part of the application process and is the responsibility of the application. Usually, this comes in the form of an application fee that you pay when you submit your application.

Also Check: Is 698 A Good Credit Score

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Why You Should Never Pay A Collection Agency

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. Any action on your credit report can negatively impact your credit score even paying back loans. If you have an outstanding loan thats a year or two old, its better for your credit report to avoid paying it.

Recommended Reading: How Accurate Is Creditwise Credit Score

Whats The Purpose Of My Credit Report

Your credit report shows your credit history and tells a story of your financial health and responsibility to potential lenders like credit card companies, banks, and often even landlords and cell phone companies. Credit reporting empowers you to participate in the credit economy and have potential offers of credit extended to you.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Also Check: Does Balance Transfer Affect Credit Score

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

Dont Recognize An Account On Your Credit Report Heres What To Do

John S Kiernan, Managing EditorSep 18, 2020

Finding an unrecognized tradeline on your credit report or receiving a bill in the mail for an account you dont remember opening is enough to make anyones heart pound. But its not a problem that lacks a solution, and there may even be a plausible explanation.

There are a number of reasons why you might not recognize a new account, from it being issued by a partner of the company you applied to for credit, to the possibility of identity theft and fraud. In any case, following the steps laid out below will help you identify the origins of the mystery tradeline, get it removed from your credit report if indeed fraudulent, and ensure that your finances are as protected as possible moving forward.

Don’t Miss: How To Remove Hard Inquiries From Experian

How To Check Your Credit Record

You can get a free copy of your credit report from these three credit reporting companies:

My credit file â Equifax

They should deal with your request within 20 days. If it takes longer, they must tell you why. If you need your credit record urgently, you may need to pay a fee to get it more quickly.

These companies will often give you a copy of your credit record but may not give you a credit score â the number given to lenders, landlords and others.

One option to get an approximate credit score is the Credit Simple website. It will give you an idea if your credit score is good or bad. But if you want full details â your credit report and history â go through the three credit reporting companies above.

When you apply for a loan or insurance, the company will check your credit with one of these credit reporting companies. It’s a good idea to regularly check all three for errors.