Is That High Score Worth The Effort

The good news is that many lenders consider 760 the cutoff for excellent credit. With a credit score above that number, you’ll receive most of the same benefits as someone with an 800 credit score. You’ll just have to work a little harder and wait a little longer if you also want the bragging rights.

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

Read Also: Does Klarna Help Build Credit

What Is An Average Credit Score

While the average credit score for the whole of Australia sits at 785, the numbers vary significantly between each state and territory. Interestingly, according to the Credit Simple survey, those in the southern states are doing better with their money, averaging much higher scores than their northern counterparts.

In saying that, it was the ACT that topped the list with an average score of 837. As for the 55-to-64 age bracket, those in the ACT scored an average of 758, while over-65s are doing extremely well with their money, sitting at 835.

However, despite the high scores of those living in the territory, there seems to be a lot wanting to further improve their financial situation with 91 per cent of of ACT resident saying theyd like to be better at budgeting.

Tasmania sits in second place with an average score of 815, followed by Victoria with 792, South Australia just a smidgen behind on 790 and New South Wales rounding out the top five with 786 just one point above the national average.

The scores were varied for Baby Boomers in those states, with 55-to-64-year-olds scoring an average of 751, 717, 715 and 710 respectively. This was compared to the over-65s who again impressed with average scores of 839, 790, 800 and 790 for each of the states listed.

The 55-to-64-year-olds averaged scores of 707, 707 and 709, while the over-65s proved things certainly do get better with age, sitting at an average of 804, 790 and 781 respectively.

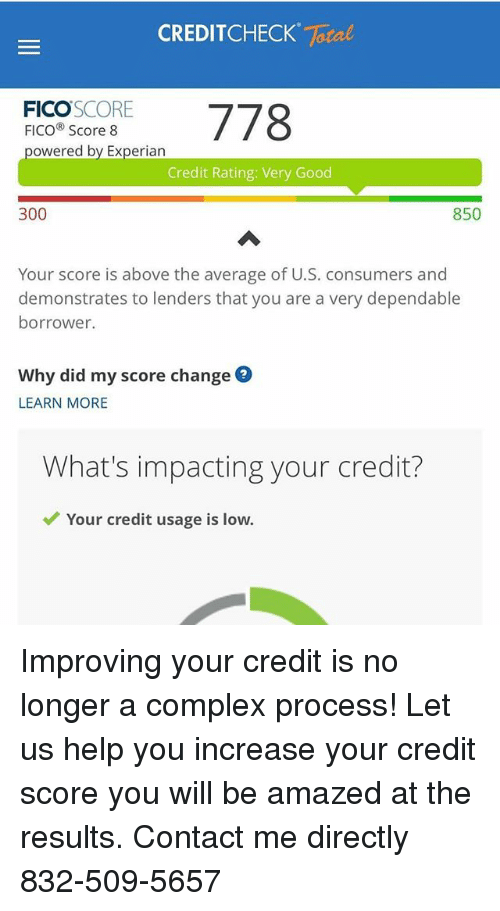

How To Improve A 778 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Also Check: How To Unlock My Experian Credit Report

Improving Your Credit Score Range

So now you know where your three-digit number falls in the credit score ranges. If you already have excellent credit ranging from 780 to 850 congratulations.

Your only job now will be to keep doing what youre doing to maintain stellar creditworthiness.

If you have very good credit, you may want to figure out how to optimize your score even more to achieve an even-better three-digit number. Keep reading to learn ways to fine-tune your credit life.

For everyone else, you probably have a little work to do to get into a better credit score range.

Like I said above, dont worry if your credit score has parked itself at the lower end of the spectrum. Ill show you exactly where to start working to achieve the best credit possible.

You can improve your credit score in no time if you dedicate some time to learning about how credit repair works.

How Can You Get A Good Credit Score

There are plenty of things you can do to help improve your score, but it can take time and patience, and some will-power too.

Ways to improve your score:

- Register on the electoral roll at your current address. This helps companies confirm your identity.

- Build up your credit history. If you have little or no credit history it can be difficult for companies to score you, which can result in a lower score. Thankfully, there are some relatively simple steps you can take in order to build up your credit history.

- Pay your accounts on time and in full each month. This shows lenders you’re a safe bet and can handle credit responsibly.

- Keep your credit utilisation low. This is the percentage of your credit limit you actually use. For example, if you have a limit of £3000 and you’ve used £1500 of it, your credit utilisation is 50%. A lower percentage is usually seen in a positive light and should help your score go up. To help improve your Experian Credit Score, try to keep your credit utilisation at 25%.

- Sign up to Experian Boost and see if you could raise your score instantly. By securely connecting your current account to your Experian account, you can show us how well you manage your money. Weâll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings or investment accounts.

Once you’ve got your score where you want it to be, here’s our tips on how to keep it healthy:

You May Like: Does Paypal Credit Report To Credit Bureaus

How To Keep On Track With A Very Good Credit Score

Your 778 credit score means you’ve been doing a lot right. To avoid losing ground, be mindful of avoiding behaviors that can lower your credit score.

Factors that can have negative effects on Very Good credit scores include:

Utilization rate on revolving credit Utilization, or usage rate, is a measure of how close you are to “maxing out” credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts recommend keeping your utilization rates at or below 30% on individual accounts and all accounts in totalto avoid lowering your credit scores. The closer any of these rates gets to 100%, the more it hurts your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Late and missed payments matter a lot. More than one-third of your score is influenced by the presence of late or missed payments. If late or missed payments are part of your credit history, you’ll help your credit score significantly if you get into the routine of paying your bills promptly.

37% Individuals with a 778 FICO® Score have credit portfolios that include auto loan and 38% have a mortgage loan.

How To Improve Your 728 Credit Score

A FICO® Score of 728 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 728 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

53% of consumers have FICO® Scores lower than 728.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Also Check: Is 524 A Good Credit Score

Only Spend What You Can Afford

Dont use a credit card to live beyond your means, or to roll over the costs of everyday expenses to the next month, Nitzsche recommends. This will only lead to spiraling debt that will be difficult to get out of.

People with an 800+ credit score dont apply for more credit than they can afford and dont spend more than they earn.

While using a credit card for everyday expenses is OK if you can pay the credit card bill off in full each month, while gaining awards points in the process, dont let the accumulation of points convince you to spend more, Nitzsche says. And if youre running to your credit card when your car, refrigerator or something else breaks down, start an emergency fund to pay for such repairs.

Bill Balderaz, president of Fathom Healthcare, has an excellent credit score and attributes it to his family living below their means. As our income rises, we keep our spending flat, Balderaz says.

They also pay off all credit card bills each month, pay off their vehicle loans early, and have paid off their mortgage early to help get them to an 800+ credit score.

Their excellent credit score has allowed them to get the most preferred loan rate. After three houses and eight vehicles, Balderaz estimates theyve saved tens of thousands of dollars on loans by getting the lowest loan rates.

Getting A Mortgage With A 778 Credit Score

At React Mortgage we encompass A to Z lending. Meaning we source solutions and help in any situation when it comes to your borrowing needs:

To start off, a 778 credit score is considered very good. So just keep that in mind as youre shopping around for a mortgage. A lot of borrowers dont know this, but there is no set minimum credit score required to buy a house. Many lenders set their own credit score requirements, which is why it pays to go through a broker instead of a bank. With Banks, you are stuck with them as the lender, but brokers can shop around many, if not hundreds of lenders to find the right one for your situation. Now take your very good score of 778 many lenders would jump at the opportunity to get your mortgage. Its all about finding the right one.

There are other factors that lenders consider besides credit score when looking at your situation. For example:

- How much you have saved for a down payment

- Debts you may have in collections

- What your income level is

- Your overall amount of debt

These factors, along with your 778 score will help lenders determine what you are eligible for when it comes to a home loan. Now for your score, wed recommend to shop around for your best rate. Many lenders will compete for your mortgage at your credit score.

Remember, your 778 is made up of the following 5 things:

- Payment History 35%

- Type of Credit 10%

Recommended Reading: Does Les Schwab Report To Credit Bureaus

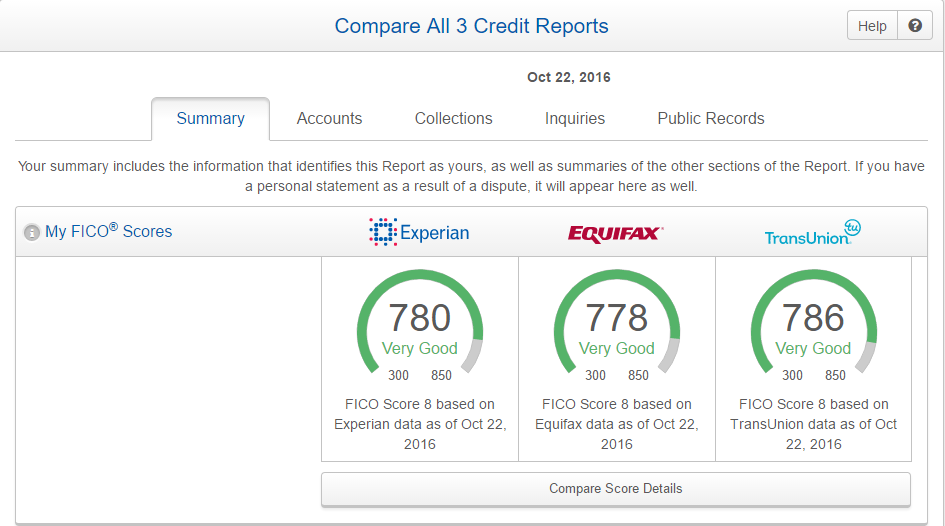

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 778 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Wait Wait Then Wait Some More

You simply have to be patient. Even when you make all the right decisions, itll take some time to see results.

Part of your score relates directly to the length of credit history. But even on more important credit reporting factors such as your payment history and credit utilization ratio, time is your friend.

This is especially true if your past credit behavior has been questionable. With each passing year, your past bad decisions have less of an impact on your current credit information.

So be patient and continue making good decisions to establish a positive credit history, even if you dont see immediate results.

Keep making your payments on time and make sure you dont get any negative entries like a collection account. And let your current credit accounts grow older. The older your accounts, the better your credit score can be.

For example, my oldest credit card is 15 years old, and my average credit card is 8 years old.

Learn More:

Read Also: Does Zzounds Report To Credit Bureau

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

was the most common form of identity theft , followed by employment or tax-related fraud , phone or utilities fraud , and bank fraud in 2017, according to the FTC.

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Also Check: How Accurate Is Creditwise Credit Score

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score