Can Landlords Report To Credit Bureaus

Landlords Can Reportlandlordsreportreportinglandlords

Overall, rent payments remain rarely reported to credit bureaus. But all three major Equifax, Experian and TransUnion do include rent payment information in if they receive it. scores are based on the information in your .

Likewise, does Aarons report to credit bureaus? Aaron’s: Report to Credit Bureaus. Prompt Aaron’s to report payments to the three major to help people build !

Additionally, how do I report to credit bureaus?

How To Report Credit And Become A Data Furnisher

Does reporting rent increase credit score?

Timely rent payments will help boost your if your landlord reports through RentBureau. Unfortunately, these payments will only appear on your Experian and only affect based on your Experian data.

What To Do About Delinquent Tenants

Eviction and reporting to the credit bureaus should always be considered the last resort measures. It is safe to say that those are the most efficient ways of dealing with delinquent tenants, but there are many things you can do before going to extremes.

- Double-check the lease agreement and payment reports to make sure that your tenant is indeed late.

- Send a late rent notice saying that the rent is already past-due. Include a short warning about possible legal actions.

- Give your tenant a phone call to clarify the situation.

- Provide a quit notice that clearly conveys how much you are owed and the final due date by which the debt must be cleared. It is ok to tell about your intent to evict.

Should none of the above-mentioned measures help, feel free to report your tenant to the credit bureaus and start the eviction process.

Have Your Landlord Report Your Rent Payments

Your landlord is another source for reporting your rent payments. Companies like TransUnion accept rent payment information directly from landlords, but your landlord will need to sign up for one of the services and pay the associated fees.

Some landlords will be inclined to skip the extra effort of signing up for a reporting service, but reporting rent to a credit bureau actually helps encourage renters to pay their rent on time, since falling behind on multiple payments can lead to negative reporting and a decreased credit score.

Recommended Reading: How High Can A Credit Score Go

Get Approved As A Data Furnisher

Each customer must go through a credentialing process before their data can be loaded into the credit bureau database. They must become a data furnisher with each of the four credit reporting agencies.

This process includes providing documentation to verify your business as well as signing a Data Furnishers agreement with Datalinx. With nearly 20 years of experience in the credit reporting industry, Datalinx can help guide you through this process. Well work with the credit bureaus to make sure they have everything they need from you in order to proceed.

How To Report Rent Payments To The Credit Bureau: Landlord Tips

- How To Report Rent Payments To The Credit Bureau: Landlord Tips

As a landlord, you will often rely on information gathered up and reported in a tenants credit history. Do they have a history of managing their financial system appropriately? Were they ever evicted from a property in the past?

This type of information becomes a part of the credit report that every potential tenant out there has. Did you know that your experiences with tenants who rent your property can and should help to create their credit as well?

When a tenant pays their rent on time every month, theyre showing financial responsibility that they should be praised for. Often, however, these payments never make any impact on their credit score because they arent reported to the credit bureau. Together, you and your tenant can change that.

On the flip side, some tenants consistently pay late rent, and this could be reported, too. When you report good and bad rental behavior, youre helping make a tenants credit more indicative of who they really are.

But do you know how to report rent payments to the credit bureau?

Many landlords do not have rental payment reporting set up, but it isnt hard to do and can make a big difference in the way you interact with tenants moving forward.

Don’t Miss: What Does Charged Off Account Mean On My Credit Report

Warning: Alternative Data Isnt Always Helpful

But be careful. Adding more information to your credit profile can help. But it can also work against you.

For example, a credit score that takes into account alternative data, such as your bank account information, could potentially rate you more negatively if you have limited funds in your account or have recently had a lot of big expenses.

Similarly, just as a missed payment on your credit card can hurt you, so can a late electricity payment or a lapsed phone bill.

Before you share more information about yourself and your financial history, think carefully about whether you really want to show that much information to lenders.

If you prefer to have more control over your information, you can also choose to only work with self-reporting services, such as Experian Boost or a rent reporting service, that let you choose exactly what gets reported.

Large Landlords Can Report Directly

The three major credit bureaus, Experian, Equifax and TransUnion, allow high-volume landlords to report their rental payments directly to the credit bureaus each month. However, you need to generate a high number of payment records to begin reporting. TransUnion, for example, requires that you have at least 100 accounts before you can report tenant data. Because of the subscription requirements, direct reporting is not usually possible for most landlords.

Don’t Miss: How To Boost Credit Score 100 Points

The Negative: Reporting Late Payments

If you do rental payment reporting and a tenant pays late or doesnt pay at all, this information will make it onto their credit report in various ways. You might get upset that a tenant keeps paying late and want to report a tenant to the credit bureau.

Most tenants will not want this to happen, so the knowledge that you report to credit bureaus monthly can help to keep tenants focused on making their payments on time. You may want to remind tenants that consistently paying late in the ways of this can affect them.

Even if late payments may not actually lower their credit score, every late payment issue will show up in the full report. If they plan to rent again in the future, this could be a problem for them. Ensuring that they know this can help encourage tenants to be more reliable while also protecting you and their future landlords.

How To Report Your Rent To Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A lot of people who dont have much of a credit history do have a history of paying rent on time. But that information doesn’t show up on their credit reports, and doesn’t help their .

You cant report rent payments yourself. But rent-reporting services can get your credit reports to reflect your rent payments fairly easily, at a cost that ranges from free if your landlord pays it to more than $100 a year.

To use a rent-reporting service effectively, youll need to know which credit bureaus it will report your payments to and which credit scores take those payments into account.

It’s also important to understand that this may not be the most cost-effective way for you to build your credit with all three credit bureaus and to understand your alternatives.

Read Also: Does Bluebird Report To Credit Bureaus

Tenants Are Staying Off The Roads

That same NMHC survey reveals that over 40% of tenants say they telecommute, at least some of the time. That trend may impact landlords. Tenants are around more, so landlord-provided utility costs could go up. There also may be an uptick in noise complaints, because working adults will be around while little kids are hopping around to their favorite morning cartoons.

At the same time, where a unit provides good space to work, being situated close to public transit might not rate as high on the list of tenant preferences, giving an advantage to landlords in the suburbs.

Preserving The Integrity Of The Credit Reporting Process

When you consider the impact of a consumers credit report, it is no surprise that the reporting process is regulated. Navigating that regulatory scheme can be daunting for those not familiar with the industry. Landlord Credit Bureau complies with or exceeds all applicable laws and regulations, protecting tenants from inaccurate entries as well as insulating the landlords who report rent payments from liability.;

You May Like: How To Get Something Removed From Credit Report

How Do You Report Tenants To A Credit Bureau

Landlords only recently gained the ability to report tenant pay habits to a credit bureau, but already this perk is catching on as more and more landlords discover the many benefits:

- Attracting tenants most likely to pay on time

- Reducing late payments and delinquencies

- Improving tenant retention

- Enhancing tenant screening abilities

- Putting landlords on par with other creditors

Tenants caught on quickly to the value of building credit through paying rent something they already are doing without the need to incur more debt or pay interest and annual fees. At the same time tenants build credit, they can create a positive Tenant Record and move to the front of the line when competing for preferred rental housing vacancies.

Rental Kharma Review: Get Credit For Your Rent

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

Many people assume rent payments are already part of their credit reports, but thats almost never;the case. The credit-scoring giant FICO says rent is an entry called a tradeline on less than 1% of credit files.

Yet theres some evidence that these new rent tradelines can be a stepping stone to achieving the kind of credit scores traditionally used to, say, qualify for a car loan or a mortgage.

A year or two of rent payments can create a credit history without the lump sum of cash required for a secured credit card or the additional monthly payment of a , two common ways to;build;credit history.

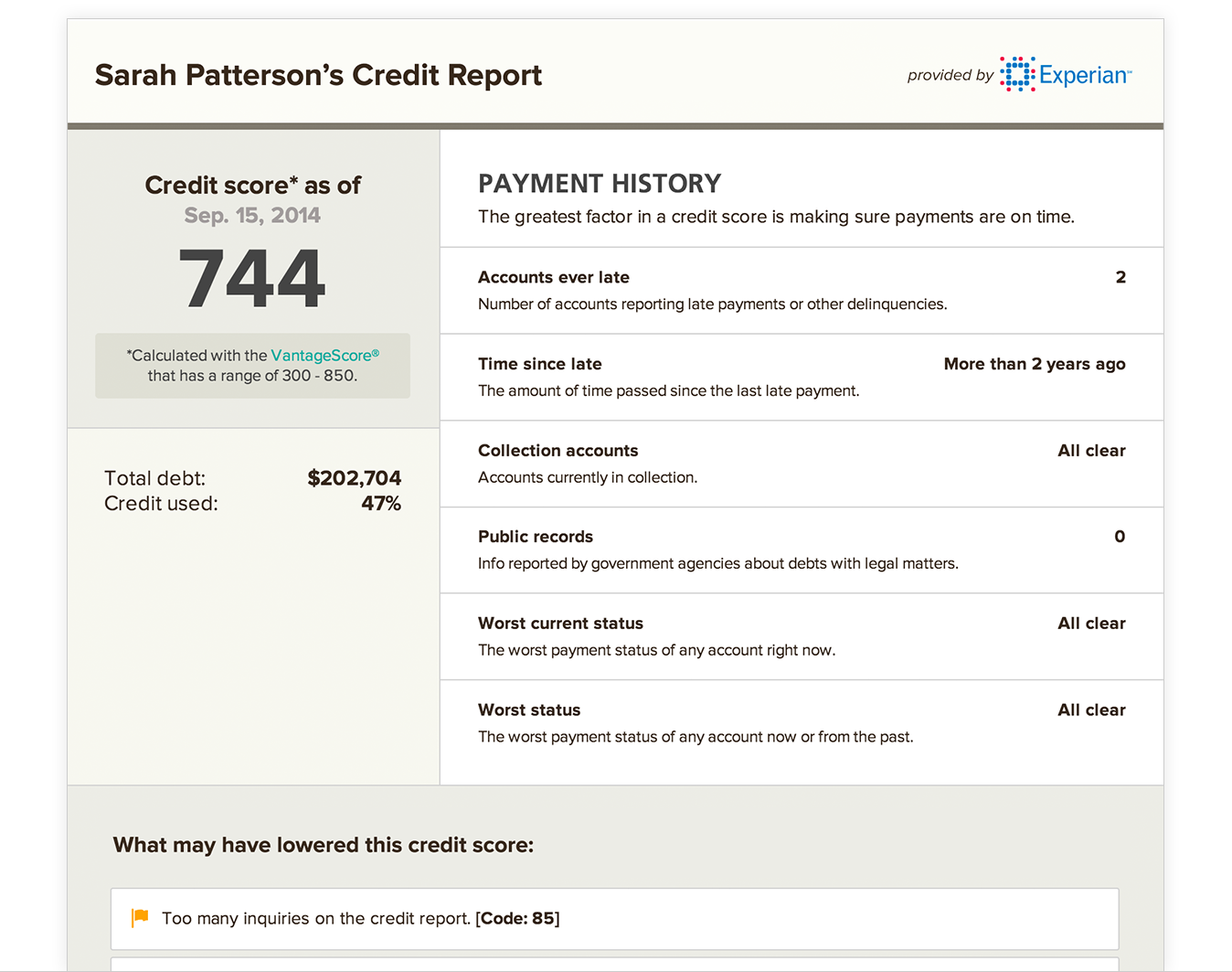

Credit reports are the raw material for credit scores. Calculating rent into your credit scores is an idea that is gaining traction. VantageScore considers it, and so do FICO 9 and FICO 10,;newer versions of the FICO score. The trouble is that earlier versions of FICO are in much wider use than the scores that factor in rent.

Its possible that having rental information in your files could improve your credit profile, particularly if you are still relatively new to credit.

Recommended Reading: Why Does Credit Score Drop When You Pay Off Debt

Also Check: What Does Charge Off Mean On Credit Report

How To Start Reporting Your Rent Payments

Chat with your landlord to find out if they have a system in place for reporting rent payments. Some landlords might already offer the option to report rent to the credit bureaus and help you improve your credit.

If they dont, you can for a third-party reporting platform like CreditBoost and invite your landlord to collect rent online. Avail lets renters pay their rent with a bank account, debit card, or credit card, and once enabled, CreditBoost will automatically report all on-time rent payments that are made through Avail.

Find out more about paying rent through Avail and how reporting rent payments with CreditBoost can help build your credit*.

Rentreporters At A Glance

To review RentReporters, NerdWallet collected pricing and other information, reviewed the online application process, interviewed company representatives and compared the company with others that target the same customers.

RentReporters might be a good fit for you if:

-

The credit bureaus have little or no credit data on you, and you have been paying your rent on time

-

You have been at your current address for several months and wont have to pay extra to include previous landlords in order to build length of credit history

-

You have a credit score thats in the mid-600s or lower

RentReporters may be less valuable if:

-

Youve had rent payments that were 30 or more days late

-

You already have a loan or credit card; thats a very effective route to credit-building, if you pay on time and keep low

-

You havent been at your current address for long and would have to pay more to include previous landlords

Recommended Reading: Does Capital One Report Credit Limit

The Positive: Reporting On

When you regularly report rental payments to the credit bureau, most of these payments will be standard, on-time payments. When the credit bureaus receive this information, it shows that a positive tradeline is active on the account.

If credit reporting is something that you are thinking about doing, its important to learn about the benefits for yourself and for your tenants. With this information, you can build stronger relationships with all of your tenants.

Tenants Have An Incentive To Pay On

Reporting rent payments to credit bureaus will reduce stress on landlords because tenants who know their payments are helping their credit score will be more motivated to pay on time. Tenants wont want the negative consequence of having a mark against their credit score and will make fewer late or missed payments.

In addition, the right tenants will view rent payment reporting as a great way to boost their score, which will help attract trustworthy, reliable tenants. This will allow landlords to find the best renters for their properties.;

Related: Why Landlords Should Use An Online Rent Payment Service

Don’t Miss: Does Afterpay Affect Credit Score

Ways Your Credit History May Affect Everyday Life

Reading time: 4;minutes

- Your credit history and credit scores may impact you more than you think

- If youre applying for a job or apartment, your credit may be checked

- Your credit may impact your utility services, for better or worse

You already know your credit scores matter when you apply for a credit card, make a major purchase like a home or car, or apply for a loan. But did you know your credit history may impact your application for an apartment or a job? Here are 4;ways;your credit history and credit scores can play a role;in everyday life.

#1: When you’re renting a home or apartment

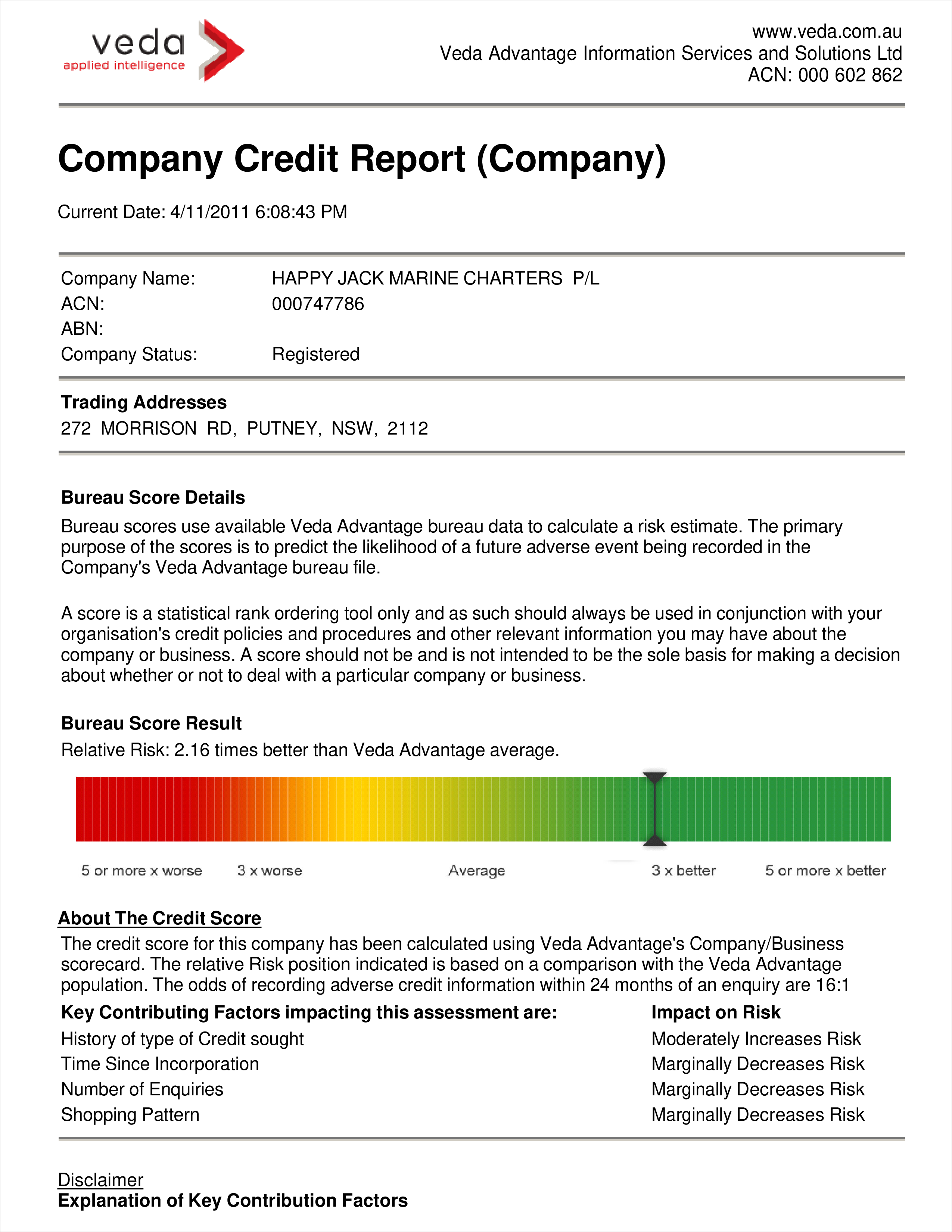

Depending on the apartment or leasing company, credit report and credit score checks may be part of the rental application process.;Like any potential lender or creditor, landlords and leasing companies want to know: what is the likelihood that you will honor your financial commitments? They may look at your credit history to find out if you have a history of missed payments or have delinquent accounts.

If your credit application is rejected because of information on your credit reports, lenders and creditors are required to tell you the reason your application was denied through whats called an adverse action notice. This notice includes the name and contact information of the credit bureau which furnished the credit report. If you receive an adverse action notice, you are entitled to a free copy of your credit report from that credit bureau. ;

#4: When you’re applying for a job

In Fact Landlords That Report Rent Payments Through The Landlord Credit Bureau Have Reduced Late Payments And Defaults By 36%

Landlords typically spend the majority of their time chasing after a minority of tenants who dont pay on time, instead of focusing on rewarding good tenants. By reporting rent payments, landlords can start fostering tenant retention, which adds value to the rental property business, and stop spending the bulk of their time weeding out problem tenants, which does nothing to improve profitability.

As is always the case with credit reporting, the rent payment history must come from the creditor the landlord. Landlord Credit Bureau is a credit reporting agency and the only agency of its kind in Canada that provides rent reporting services to landlords. This service already is used by more than 30,000 landlords and property managers representing all sizes of rental property businesses. Even the smallest landlord businesses can profit from reporting rent payments.

Ready to make renting easier?

Recommended Reading: Can You Have A Bankruptcy Removed From Your Credit Report

How Much Will My Credit Score Increase

As with most credit building tools,people with athin credit file or limited to no credit will see the most significant credit score increase because they have no credit history.;

People with thin credit files report seeing their credit score increase by hundreds of points.;

I enrolled for rent reporting with Credit Rent Boost in March and saw about a 15 point credit increase at TransUnion when they reported my previous 24 months of rental payments.;

This is because I have a thick credit file, full of good and bad credit history.;

If you have bad credit with a lot of credit history, rent reporting will be good for the long-term credit building game, but you wont see as big of a boost as someone with a thin credit file.;

The less information you have in your credit report, the more impact each item has on your score.

Be Careful!People with thin credit files will see the largest credit score gains. If you have bad credit with a thick file dont expect much more than a 25 point gain from the 24 months of back reporting.;

Most of the credit reporting services track their customers credit score gains, and we have provided you with their claims in each of the companies highlights above.;