Capital One Cuts Credit Limits As Millions Struggle With Income Cliff

Capital One is cutting the credit limits on some credit cards, with some consumers reporting on social media that their credit limits have been cut in half by the card issuer. The company said it’s making the decision based on the customer’s account activity in the last year.;

Capital One, the third-largest card issuer, is trimming consumers’ credit lines just weeks after the extra $600 in weekly unemployment benefits expired, a benefit that more than 27 million out-of-work adults had relied upon. That income cliff “will depress consumer confidence and spending and weigh on the broader economic recovery,” even as consumer spending remains 5% below pre-pandemic levels, according to Oxford Economics.;

The result: Credit-card issuers are tightening the reins because they’re fearful that more households could face financial difficulties in the coming months, experts say.;

“Basically, if you haven’t been using a card to this point, banks sure don’t want you to start using it now because it might be a sign of financial trouble,” said Matt Schulz, chief industry analyst at CompareCards.com. “For card issuers, it’s 1,000% about managing risk.”

DISAPPOINTED IN CAPONE. Long time customer, both savings, checking, and Credit Card. Many years using my card for international travel. Last 2 years, unable to travel, Decided to reduce my line of credit by more than 1/2. GUESS LOYALTY MEANS NOTHING!

AnAmericanCitizen *

Does A Credit Limit Increase Affect Your Credit Score

Increasing your credit limit or getting a good high limit credit card can be a good way to increase your credit score, but it doesn’t always work that way. There are two factors at play here: your debt-to-credit ratio, and your recent inquiries.

Your debt-to-credit ratio, also known as your , is the ratio of debt you have to your available credit. This is calculated across all accounts and on each individual account. If you have a balance of $3,000 across all of your credit cards and a total available credit of $10,000, your credit utilization rate is 30%. This is a good credit utilization rate.

This number is a major factor in calculating your “Amounts Owed,” which makes up 30% of your FICO Score®. The general rule of thumb is to keep this number below 30%, although there are no official published guidelines. We do know that a lower credit utilization rate is always better. Keep in mind that this number is updated continually, so if you tend to bump up against your credit limit each month, using all of your available credit could still be hurting your score even if you pay off your balance in full each month.

Capital One Venture Rewards Credit Card

Highest reported credit limit: $50,000, according to a post on the myFICO Forums. This is another Visa Signature card, so the minimum credit limit is $5,000.

Sign-up bonus: Earn 60,000 bonus miles after you spend $3,000 on purchases within the first three months of account opening.

Rewards: Earn 2x miles on every purchase.

Benefits: Visa Signature travel benefits include travel accident insurance, lost luggage reimbursement and secondary auto rental coverage. Youll also get extended warranty protection and purchase security, which replaces, repairs, or reimburses you for purchases in the event of theft or damage within 90 days of the purchase date, up to $500 per claim and $50,000 per cardholder. Benefits only available to accounts approved for the Visa Signature card. Terms apply.

Annual fee: $95

Highest reported credit limit:;$50,000, according to a post on the myFICO Forums.

Welcome offer: Earn 40,000 bonus miles after you spend $1,000 in purchases on your new card in your first three months card membership. Plus, earn up to $50 back in statement credits for eligible purchases at US restaurants with your card within the first 3 months of membership.

Rewards: Earn 2 miles per dollar on Delta purchases, restaurants and U.S. supermarkets and 1 mile per dollar on other eligible purchases.

Annual fee: $0 introductory annual fee for the first year, then $99

Highest reported credit limit: $31,500, according to a post on the myFICO Forums.

Annual fee: $495

Read Also: How To Remove From Credit Report

Bottom Line: Should You Apply For The Capital One Secured Mastercard Credit Card

The Capital One® Secured Mastercard® is a great choice for people rebuilding their credit. The low security deposit and lack of annual fee should more than offset the cards high interest rate, so long as you pay your bill off regularly.

While the Capital One® Secured Mastercard® wont automatically upgrade to an unsecured card, Capital One is a good bank to establish a relationship with for when your credit has improved.

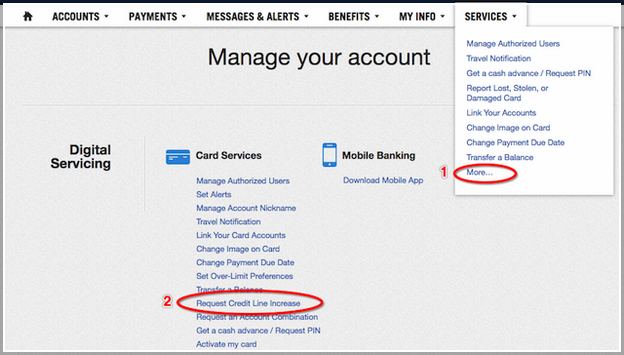

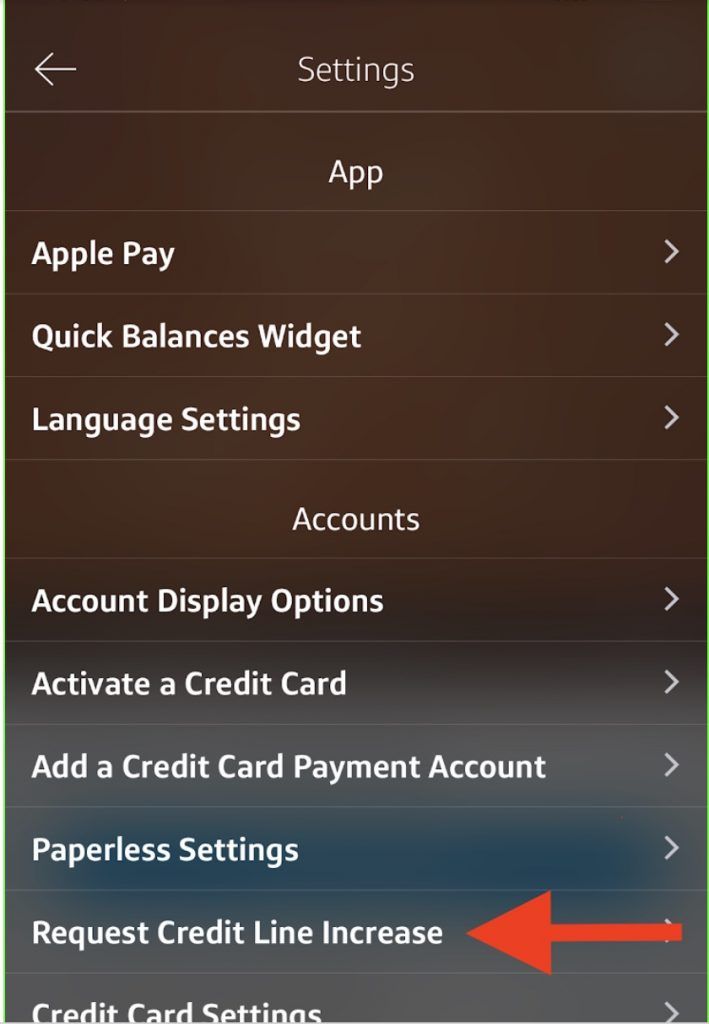

Receive An Automatic Credit Limit Increase

Frequently, Capital One will consequently increase your credit limit in the event that you utilize your credit card mindfully. Some Capital One cards, particularly those promoted toward purchasers setting up or assembling credit, offer the open door for an increase following five months of on-time payments.

Don’t Miss: Is 584 A Good Credit Score

Does Capital One Report Authorized Users To Credit Bureaus

Capital One notifies the three major credit bureaus that you are an authorized user for personal credit cards. This reporting applies to the Venture, Quicksilver, Savor, and Platinum card families, including some of the best Capital One credit cards for travel. Your Equifax, Experian, and TransUnion credit report usually update with your new credit account information in a few business days.

This is standard reporting practice for all of the large banks including Chase and American Express. Reports to all three can make sure your credit score is consistent across all three bureaus.

Your credit report will show the account age and credit utilization ratio for that card. This information will affect the primary cardholders credit score more because they are responsible for paying the monthly balance.

However, being an authorized user can either help or hurt your credit score. The answer depends on the age and how you manage your other credit accounts.

Can Build Your Credit Score

Payment history, average account age, and the credit utilization ratio help determine your credit score. These three factors combined influence 80% of your credit score. You want to look for someone who can add you to a credit card that is older than yours and has a positive payment history.

The primary users good credit can help build your credit score. Ideally, they will have a 750 credit score and at least one credit card account thats been open for more than 10 years. They will also have a credit utilization ratio below 30%.

For example, one person saw their score increase 20 points because they were added to an account that was 20 years old. It might not be a large jump, but its better than a drop. They explained, I can tell you I had mine add me to a card she has, it is 20 yrs old, had a very high credit limit and owing about 25% of that limitit boosted me 15-20 points per report.

Remember that being added to an account thats the same or newer than your current accounts or has a negative credit history can lower your score. While it may only be a small decrease, note that it is something to look for.

Recommended Reading: How To Raise My Credit Score 100 Points

Why You Should Check Your Credit Score First

The reason for this is simple the bank may do a hard-pull on your credit to see if your eligible for a credit limit increase. You want to verify that your credit scores are above 700 for the best chance of approval. Also, make sure that you do not have high credit utilization as this can be a red flag and make it look like you are desperate for more credit.If your scores are below 700 or you are using over 30% of your available credit it may be best to hold off on requesting an increase.

Why Credit Utilization Is Important

The credit utilization rate is simply the amount of your available credit currently being used. So, for example, if you have the following balances and limits on a portfolio of four cards

| $24,000 |

your comprehensive utilization rate would be 25% — $6,000 divided by $24,000.

Credit utilization indicates how much room you have for more borrowing. Less than 30% to 35% is generally considered good and safe; a figure above this could negatively affect your credit score.

That’s because credit utilization matters, as you can see by the five main factors that go into a credit score. We’ve sorted them according to their weighting, most to least:

Payment history — 35%

Length of credit history — 15%

New credit accounts — 10%

— 10%

Utilization is the second-most critical component of the score, next to payment history, and its weight is nearly equal.

Read Also: When Does Citi Card Report To Credit Bureaus

Why You Might Want The Secured Mastercard From Capital One

FLEXIBLE SECURITY DEPOSIT

Like all secured credit cards, the Secured Mastercard® from Capital One requires a refundable security deposit.;With;most secured cards, your credit limit will be equal to your deposit, but the Secured Mastercard® from Capital One allows for a lower deposit for those who qualify. Your deposit may be $49, $99 or $200 for a starter credit line of $200. You can increase your limit up to $1,000 by making more than the minimum deposit before activating your account.

Best of all, if you cant pay your security deposit upfront, Capital One will let you pay it in installments of at least $20, as long as you provide the full amount within 35 days;of approval. This is a great benefit for those on a fixed income.

Access to A higher credit line

Make your monthly payments on time, and you could get access to a higher credit limit in as little as six months without having to deposit more money. A higher credit limit gives you;increased;flexibility, but more important, it can help your credit by reducing your , a key factor in your credit score. The lower your utilization, the better. If you have a $200 credit limit and a balance of $60, your credit utilization is 30%, which is;about as high as you want it to go. If your credit line gets bumped up to, say, $500, your utilization drops to 12%.

» MORE:;How do secured credit cards work?

Freedom from fees

Upgrade potential

What To Do If Your Credit Limit Increase Is Denied

While the cycle for mentioning a higher acknowledge limit for Capital One is simple, you are not guaranteed an increase. In case you are denied, do not feel pressure. Ask the client support delegate for what reason you werent affirmed, and spotlight on improving your odds for next time.

- Work to improve your record by making reliable, on-time installments.

- Pay down equilibriums on your charge card accounts with Capital One and some other backers.

- Utilize the card all the more routinely. Capital One may be less disposed to offer more credit on a card you do nOt utilize as often as possible.

- Update your pay and other individual data on your Capital One record consistently. This can more readily show your financial soundness as your circumstance changes.

- Think about asking during an alternate season. A TransUnion study demonstrated that credit limit increments are more normal among January and May.

Advertisement

Don’t Miss: How Are Account Numbers Displayed In A Credit Report

Dispute Or Remove Any Errors

Having errors on your credit report is more common than youd think. Removing them is one of the best ways to improve your credit score. Look for missed payments that you didnt miss, accounts you didnt open, and things like that.

Each bureau has different instructions for disputing errors, and you should certainly take the time to do so.

Fees To Watch Out For

For the most part, the cards fees are on par with industry standards. However, it’s worth noting that the Capital One Spark Classic not only charges a penalty APR, which isnt common, but sets the rate at 29.40%, which is a little higher than that of many cards. This ratewhich can kick in for some time if you miss making a paymentfurther underlines the value of making special efforts with this card to ensure you pay its bills in a timely manner.;

Don’t Miss: Is 779 A Good Credit Score

How To Redeem Capital One Rewards

Capital One Rewards are unlimited and donât expire as long as you hold the card.Â; Redemption will depend on the type of card.Â; A miles card such as the Venture Rewards card can act as an eraser for travel purchases or miles can be transferred to a number of airline partners.Â; A cash back cardâs rewards can be redeemed for cash back or statement credit.Â; Capital One will even redeem rewards automatically when you reach an amount that you designate.

What Happens If You Have A Card That Doesnt Report To All Three

If you have a card that doesnt report your activity to any of the three credit bureaus, youll get no benefit from using it responsibly. And if it reports to only one or two, the credit benefit of using the card will be limited.

For example, lets say you have a credit card that reports to Experian and TransUnion, but not to Equifax. Over time, youve used your card responsibly and established a good history on your credit reports with those bureaus.

But if you go to apply for a loan or a new credit card and the lender calculates your credit score based on your Equifax credit report, it will be as if you never had the credit card. Again, youll get no benefit.

Read Also: Does Checking Your Credit Score Affect Your Credit Rating

Try A Balance Transfer

If you were considering a credit limit increase because youve gotten too close to the credit limit on your card, you might want to look into a balance transfer.

With a;balance transfer credit card, you can transfer balances from existing cards and not pay anything in interest for a few months. Zero percent APR periods offered by balance transfer cards can range from six to 18 months.

Have A Good Reason For Requesting A Higher Limit

Although it is not always necessarily required for you to have a legitimate reason for requesting a credit limit increase it wont ever hurt your odds to have a good reason. A common reason for wanting a higher credit limit is if you have a major purchase coming such as a:

- Honeymoon

- Wedding

- Family vacation, etc.;

This just helps to get the bank added confidence and assurance that this is a planned out move and that you have thought out your request. You could also just tell the bank youre trying to improve your credit score, since thats a pretty reasonable reason for wanting more credit.;

Don’t Miss: How To Read A Transunion Credit Report

Your Limit Is More Likely To Be Lowered If Your Card Is Inactive

“Card issuers are closing cards and slashing credit limits on inactive cards to further prevent risk when lending,” says Tayne. This even goes for customers with good credit.

“Tighter underwriting on applications means that lenders are looking to minimize the amount of risk faced when lending money,” says Tayne.So while card companies look with more scrutiny at high credit utilization rates and missed payments, they are also more likely to reduce your access to their credit if you’re not already demonstrating that you can borrow and pay off large amounts with regularity. If you currently have an unused line of credit, your card issuer might decide that it’s easier to reduce your limit now before you could theoretically max it out in the future.;

“American Express has also implemented a new policy limiting cardholders to four consumer or business lending cards and ten charge cards, so consumers who are currently at this limit or over it won’t get approved for another card from Amex,” says Tayne.

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

Read Also: How To Get Free Credit Report From Transunion

How To Sign Up For Creditwise

CreditWise signup is simple, especially if you already have a Capital One account customers can log in without signing up separately. To , youll need to provide your:

- First and last name

- Email address

- Home address

You must be at least 18 and a resident of the U.S. or Puerto Rico to use the app. You must also have a valid Social Security number.

You can use the CreditWise login to check your credit score as often as youd like without it being negatively affected.

To cancel your account, you simply go into the apps settings and select Cancel My Account. Keep in mind that although you can cancel your account anytime, it could take up to 45 days.