What Is A Good Fico Score

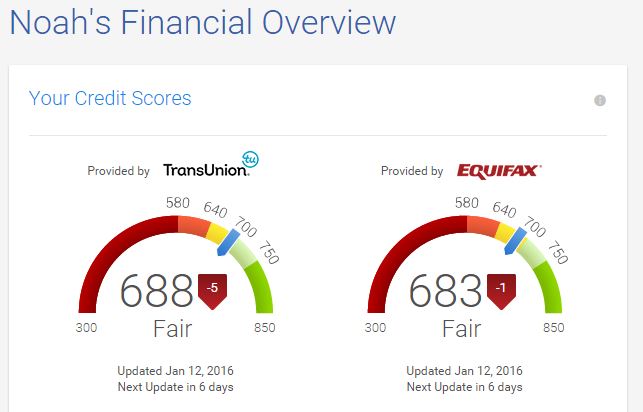

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores;typically express a consumer’s creditworthiness as a number between 300 and 850.

A good FICO score lies between 670 and 739, according to the company’s website.;FICO says scores between 580 and;669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

What Is A Good Vantagescore

FICO’s competitor, VantageScore;produces a similar score using the same credit report data;from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Recommended Reading: When Does Citi Card Report To Credit Bureaus

What Is A Good Credit Score To Buy A Car

You might think that getting an auto loan is almost impossible, but thats actually not the case! Most people find auto loan optionseven if they have truly dismal credit scores. Having said that, the better your credit score, the lower your auto loan interest rate will be and the less youll repay overall.

Intrigued? Lets take a look at VantageScores credit scoring model:

- Super prime: 781-850

- Subprime:;500-600

- Deep subprime: 300-499

The average amount people borrow doesnt change too much between the subprime and the super prime tiers. Borrowers tend to choose less expensive vehicles in the deep subprime market, however.

Featured Topics

How Long Does It Take To Get A 643 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Read Also: When Do Credit Cards Report Late Payments

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

How To Build Good Credit

Approximately 62 million Americans have no credit data to score or are considered thin files . When just starting your credit score journey, it can be difficult to access financial products to build credit if you dont even have a credit history established.

Some easy ways to establish a credit history include:

- Get a secured credit card. With a secured credit card, you put up a deposit and the issuer gives you a credit line based on your deposit. Then you use the credit card as normal, making payments and charging purchases on a rotating basis while the issuer reports to all three credit bureaus Equifax, Experian and TransUnion.

- Use non-bureau reporting information such as utility payments, rent payments or bank account history with a program like Experian Boost or UltraFICO to supplement the data in your file.

- Become an authorized user on a trusted persons credit card. If you have a strong enough personal relationship with someone like a family member, ask them if they could add you as an on their account. You dont even have to use the card, as long as the primary account holder uses the card and pays it on time, youll build credit history.

Don’t Miss: How To Help Credit Score

Why Good Credit Scores Matter

While credit scores help determine your availability of credit and the rate youll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. The greater the risk, the lower your score and the more youll pay to access credit if you can access any credit at all.

In August 2021, the average interest rate on a subprime credit card or a card for customers with subprime credit was 25.88%, while the APR on a low-interest card was 12.96%.

If you carry an average balance of $3,000 month to month on an average subprime credit card, expect to pay about $64 in interest charges. Compare that to $32 in interest charges for an average low-interest credit card, and youre paying twice as much in interest. Low-interest credit cards are typically only available to people with excellent credit scores, and this example demonstrates the importance of building good credit.

Heres How To Improve A 643 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

Read Also: What Credit Report Does Paypal Pull

Pay Attention To Your Credit Utilization Rate

Your is your total credit card balance divided by your total available credit. For instance, the average American has a credit limit of $22,589 on four cards and a $6,028 balance, according to Experian. That results in a CUR of about 27%. Experts typically recommend keeping your total CUR below 30%, and below 10% is even better.

If your CUR is above 30% and you have no problem paying your bills on time and in full, you can call your card issuer and ask for a credit increase. If you’re struggling to pay off your bills and you have a high CUR, it’s smarter to figure out some areas where you can cut back your spending.

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that you have undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Read Also: How Long Do Late Payments Stay On Your Credit Report

Personal Loans With A 643 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Make Your Payments On Time

Paying your bills on time is the most important thing you can do to help raise your score. FICO and VantageScore, which are two of the main credit card scoring models, both view payment history as the most influential factors when determining a person’s credit score. For lenders, a person’s ability to keep up with their credit card payments indicates that they are capable of taking out a loan and paying it back.

But your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt and any medical bills you might have.

Also Check: Can You Have A Bankruptcy Removed From Your Credit Report

Fico Credit Score Of 643

The Fico score of 643 ranges from 580 to 669. So, according to Fico score range its fair. However, this score is below the average Fico score range. A recent study showed 17% of all consumers have Fico scores in the Fair range. Some lenders consider Fair range as unfavorable to give and might decline the applications. However, there are other lenders who are happy to work with consumers with fair range but they are more likely to charge relatively high interest rates and fees.

How We Came Up With This List

We started by isolating the cards known to be available to those in the 600 to 649 credit score range. From there, we considered the features that would make it most valuable to people in that credit score range, based on different credit factors.

Those factors include:

- The issuer reports to all three major credit bureaus TransUnion, Experian and Equifax giving you an opportunity raise your credit score with all three

- Secured or unsecured credit cards secured may be necessary for those at the lower end of the fair credit score range

- Low or no annual fee

- Offering the ability to increase your credit line as your payment history warrants.

- Card features, like rewards and other benefits, if offered

Also Check: How Much Does Transunion Charge For Credit Report

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent;.

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710.; A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent;.

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Understand The Benefits Of A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 36% of people with FICO® Scores of 673.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How To Compensate For A Fair Credit Score

If you dont want to wait until your FICO score improves, you can make your application more attractive to lenders in several ways:

Make a bigger down payment.

A;down payment of 20 percent or more makes you a stronger candidate for a loan, because you already have built-in home equity.;In addition, a bigger down payment gets you;smaller mortgage payments.

Increase;cash reserves.

If you can document that you have several;months of mortgage payments in the bank, lenders have;more confidence that you can repay your loan if you have a cash crunch.

Eliminate;payment shock.

Payment shock happens when;your new housing payment is much higher than your old one. Your approval chances increase if youve been comfortably paying rent or a previous mortgage in an amount similar to your new payment.

Reduce your debt-to-income ratio.

Your debt-to-income ratio compares the minimum monthly payment on all your current debt, including your mortgage,;to your gross monthly income.;Anything over 41 percent is considered high by many lenders, so lower is better.

If you apply and get turned down for a mortgage, its not the end of the world. Ask your lender what youd need to do to change your denial to an approval. Or simply find another lender with more forgiving guidelines theyre out there.

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set;their own standards on what “good credit” means as they decide;whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Don’t Miss: Does Credit Limit Increase Hurt Score

Is 700 Really A Good Credit Score

Your credit score has more impact on your everyday life than you may think. Not only is it what lenders look at to determine your credit health for interest rates it can impact your ability to get a new apartment, a cell phone contract with no down payment, and in some states, even your opportunity to get a job.

Somewhere along the line, youve probably heard that a 700 credit score is a good standard of the division between a Good credit score and a bad one. But is this true?

Theres certainly some truth to that. FICO is the standard for credit scores, with each credit score agency having their own, at times slightly different, scoring models. FICO Scores range from 300 to 850. The higher the score, the better you look to potential lenders. So, generally speaking, a 700 score is good but, well dive deeper than that.

As you can see from the chart below, the average American is struggling to get over that 700 score hurdle.

| 695 |

If youre like most Americans and are looking for ways to earn a credit score over 700, keep reading. Well dive into whether or not thats really a good score, what a 700 score can get you, how its derived and what you can do to achieve it.