Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

How Can The Differences Between My Files At Transunion And Equifax Impact Me

If both files contain no errors, their differences do not present significant issues for the vast majority of people. People who are starting to build their credit history, and also those who are trying to rebuild it after financial troubles, may encounter difficulties, however.

As an example, young Mary furnishes her first apartment through a furniture store that offers her 24-month financing. She signs up for it because it will enable her to start building her credit history. In turn, the merchant submits financing repayment information to Equifax only. If Mary applies for credit the following year and the financial institution checks only with TransUnion, she may be denied the loan due to non-existent credit history.

Most large companies submit customer information to both agencies, but if you are obtaining financing in order to build or rebuild your credit history, be sure to verify that this is the case.

To start building or improving your credit history, our credit card will help you find the best option.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Consumer Statement And Public Notices

This final section of your report will document any consumer proposals, bankruptcies and other judgments against you on your accounts in the past six years. After the time is up, your job is to make sure the debts are removed from your report and you have a clean slate again.

Consumer statements are any messages youd like to convey on your credit report. You could explain why theres a mark on your report. Your explanations could vary: maybe youve been a victim of fraud, you had a family emergency thats caused your payments to go into arrears a few years ago, or youre in the process of correcting an error, for example.

You could even note that youre in a debt repayment plan and getting back on track with your finances to communicate to them that youre a responsible consumer.

Worried about your credit?;

Get answers from an expert.

Whether its about keeping, building, or rebuilding your credit, we can help if youre feeling overwhelmed or have questions. One of our professional credit counsellors would be happy to review your financial situation with you and help you find the right solution to overcome your financial challenges. Speaking with our certified counsellors is always free, confidential and without obligation.

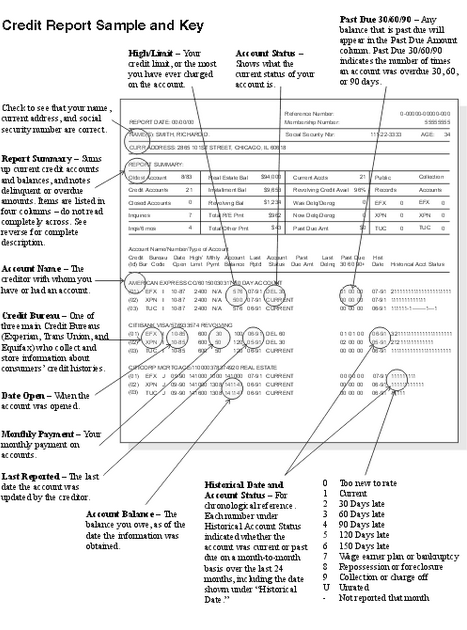

What Is A Credit Report

A credit report is kind of like a report card for your credit history. It can be used by potential lenders to determine your risk, which is basically just how likely you are to pay your monthly payments on time. A credit report all about you can tell them:

-

The date you opened any credit accounts or took out any loans

-

The current balance on each account

-

Your payment history

-

The credit limits and total loan amounts

-

Any bankruptcies or tax liens

-

Your identifying information

A credit bureau or credit-reporting company like Equifax, Experian or TransUnion will provide your information to whatever company may be considering giving a loan or credit account. These bureaus all operate independently, so their reports on you may contain slightly different information depending on the credit-reporting company they used.

Recommended Reading: How To Get Charge Offs Off Of Your Credit Report

Why Isnt My Credit Card On My Credit Reports

If youve checked your credit reports and found that a credit card or other account is missing, it could either be an error or your lender may not report to the credit bureaus. With the major card issuers, if your card isnt showing up on your reports its more likely an error than a reporting policy.

Every lender and creditor has its own reporting policies, but most include some sort of regularly scheduled automatic update that transmits your account information electronically to the credit agencies every 30 days.

Based on the individual lenders policies, it may report to all three major credit reporting agencies, or it may only report to one or two. This is one reason why credit reports and credit scores can vary from bureau to bureau.

Smaller credit unions and financial institutions may not report to all three bureaus, but you wont run into this problem when youre dealing with major lenders and card issuers, like American Express, Chase, Citi, and others. If youre not sure, you can simply call customer support and ask.

If your lender isnt reporting an account, you can contact it directly to request that it begins doing so.

Legally, however, you cant force your lender to report an account. Credit reporting is completely voluntary, although theres legislation that governs information once its reported. Unfortunately, if the lender wont honor your request, theres really not much you can do other than find a different company to do business with.

Why Arent My Credit Scores On My Credit Reports

Thanks to the Fair Credit Reporting Act , were entitled to one free copy of each of our credit reports every 12 months from the three national credit reporting agencies: Equifax, Experian and TransUnion.

But credit scores arent a part of credit reports theyre calculated separately, based on the information in those reports.

Since credit scores arent a component of credit reports, they arent required by law to be given for free . There are also hundreds of different credit scoring models so which should be the free score that everyone can see?

As part of the credit report ordering process, each of the three credit bureaus will offer you the option to add a credit score when requesting your free annual credit reports for a fee.

The right to access your credit reports for free wasnt granted until 2003, with the Fair and Accurate Credit Transactions Act FACTA for short which officially amended the FCRA to give us the rights we know today. Still, the New York Times reported in 2018 that only 36% of consumers were checking their credit reports. But that was better than in 2014, which saw only 29%.

Before you cry foul at the unfairness of it all, things are getting better for the consumer. Thanks to amendments to the FCRA from the Dodd-Frank Act, consumers are entitled to see certain credit scores for free, but only when theyve been denied credit or received less attractive loan terms as a result of those scores. This is known as an adverse action notice.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

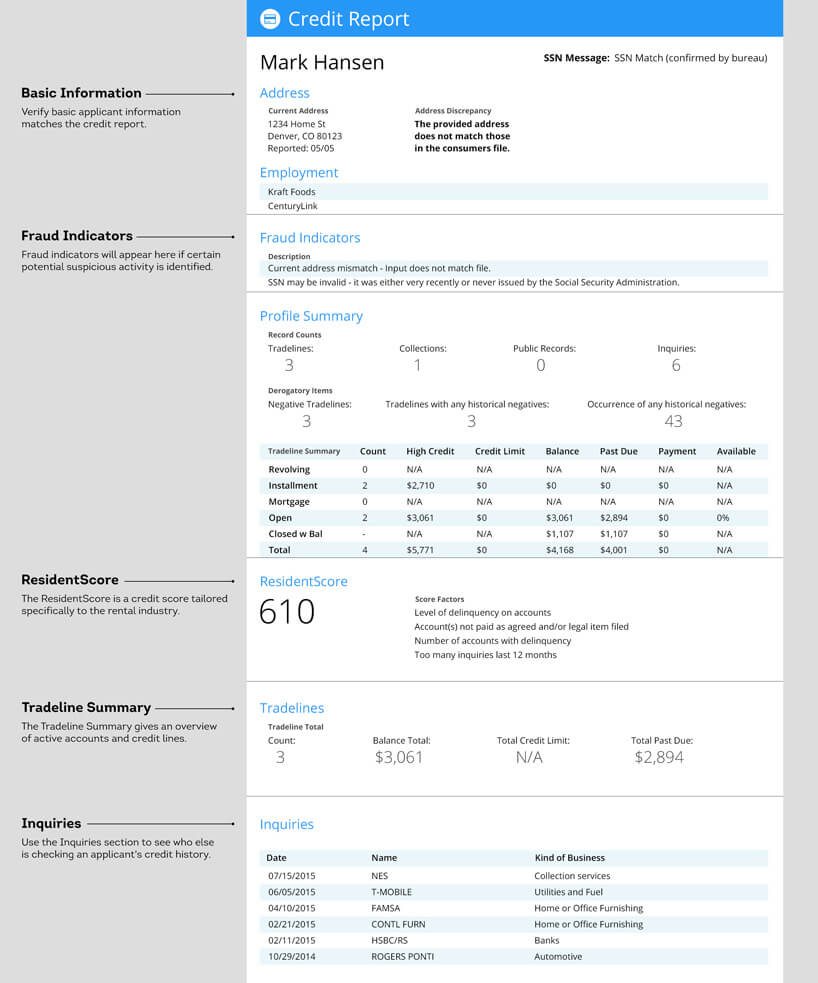

Learning Your Credit Scores Shouldnt Be The End Of Your Credit Evaluation

Your credit reports from the three major consumer credit bureaus can help shed light on your credit history by showing information like why you may have been turned down for credit, how negative information may affect your credit, and whether someone tried to fraudulently apply for credit under your name.

Equifax, Experian and TransUnion issue separate credit reports, which may contain information about your credit activity, payment history and the status of your credit accounts based on reporting from creditors and other sources.

So why are these reports important? Because credit card issuers and lenders pull and review them to help determine things like whether youre a credit risk, what interest rate theyll offer you, and the amount of your credit limit. Your credit reports may also be reviewed when youre renting an apartment or purchasing insurance.

With so much information, where do you even start when it comes to reading your credit reports? Lets take a look.

- Address

- Phone number

If you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. You can also notify the creditor that reported the information and request that it send an update to the credit bureau.

Check Your Credit Report

You should get into the habit of checking your credit report for errors that could hurt your credit score or indicate identity theft. Potential errors include:

- Unfamiliar accounts and account numbers you dont recognize

- Addresses youve never lived at

- Former spouses listed on credit cards, loans and bank accounts

- Incorrect reporting of account status, such as accounts incorrectly reported as late or delinquent

- Gather relevant documents to dispute credit report errors

Since disputes are reviewed on a case-by-case basis, youll need to provide documentation to support your claim. You will need to provide proof of your identity, including your Social Security number, date of birth and a copy of your ID . Depending on the specific error, you may need to submit copies of documents to support your case, which could include bank and credit card statements, loans or death certificates.

Recommended Reading: How Much Does Transunion Charge For Credit Report

Should You Subscribe To Equifax And Transunion

Unless there is a case of force majeure, paying $20 to get your file directly from Equifax and TransUnion isnt worth it. Especially since the two agencies must provide you with a free copy once a year, if you request it.

Entrepreneurs, especially real estate investors, who frequently need to finance their projects, could benefit from full access to their credit report at all times. This will give them an opportunity to make the necessary changes to improve their score before applying for their next loan. If this is your case, I recommend Equifaxs services at $19.95 per month.

What you need to remember is that the differences between TransUnion and Equifax will probably never have an impact on you. What really matters is paying your bills on time and using credit efficiently and wisely. If you follow these two golden rules, youll probably never have to worry about what’s on your credit reports.

How Long Does Negative Information Stay On My Credit Report

Typically, negative information falls off your credit report 7 years after the date of first account delinquency. Bankruptcy information stays on your report for up to 10 years from the date filed, but it can be less depending on the type of bankruptcy.

Positive information remains on your report for up to 10 years from the date of last activity on the account. This information applies to installment accounts like mortgages and car loans, which are the types of agreements that have fixed terms on the number of years for repayment. For revolving accounts, such as credit cards, your positive history will stay on your report for as long as the account is active.;

Recommended Reading: How To Get Credit Report With Itin Number

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from;Equifax, Experian and TransUnion;by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at;AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

Take Any Advice Or Pointers

Your credit report, right below your credit score, will outline precisely whats dragging your score down. It will list three factors in order of importance to guide you on what you can do to improve your ranking. Read this section carefully.

Some examples of pointers include: Missed payments in the past two years, accounts going into collections, abusing your credit utilization ratio, opening too many accounts, or even not opening enough. There are hundreds of potential reasons that the report could generate.

Dont be too discouraged if your credit score isnt perfect. Keep in mind, your financial institution and creditors arent focusing solely on the number. They work in other internal factors, too, such as your client history and their own risk algorithms.

Recommended Reading: How To Boost Credit Score 100 Points

Should I Be Concerned About Both Credit Reports Equifax’s And Transunion’s

Since each lender can view your file from either credit bureau, it’s important that both are up to date and at their best.

Regardless of the agency, your file is your financial report card as a consumer and borrower. Financial institutions, merchants, employers, and landlords use it to assess your ability to meet your financial commitments. It’s not rocket science; theyre trying to find out if you are trustworthy. Your credit score is obviously not a perfect reflection of your reliability in everyday life. However, that’s the system in place, so you better know how to go about optimizing it.

If youre having difficulty obtaining financing, getting one of these credit cards could help improve your credit score.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Recommended Reading: When Does Citi Card Report To Credit Bureaus

Where Can I Get My Credit Report

Your credit report is available in a few different places and formats. The federal FACT Act entitles you to one free copy of your credit report from each of the three major credit reporting agencies TransUnion, Equifax and Experian every 12 months. It also entitles you to additional free credit reports if you were recently denied credit, employment or insurance or if youre a victim of fraud, unemployed or on public welfare assistance.

As part of TransUnions commitment to supporting all Americans during and after the COVID-19 health crisis, were pleased to offer you free weekly credit reports through April 20th, 2022 at the same place you would go for your free annual reports: annualcreditreport.com.

Another way to access your credit report information is through a subscription based credit monitoring product such as TransUnion Credit Monitoring. and become a member to get instant online access to your credit report and score with updates available daily. Youll also get interactive tools, key information and alerts to help you understand and stay on top of critical credit report changes and protect your report with just a click.

How To Read And Understand A Trans Union Credit From The Top

1. The Heading is at the very top right of the report. It contains the Credit Bureau’s information. The Credit Agency, their address, their phone number, and the date the report was inquired upon.

TRANS UNION Credit Profile ReportTRANS UNION2 BALDWIN PLACE, P. O. BOX 1000CHESTER, PA. 19022Date Reported: 7/30/2003

Recommended Reading: Will A Sim Only Contract Improve Credit Rating

Triple Check Your Personal Information

It may be simple, but scanning through the personal information section is crucial. Make sure your full name, address, and date of birth is accurate, along with your social insurance number.

There may be a risk that your information could be linked to another person, especially if you share an identical name or a common name.

There could be two reports out there tied to you and you dont know which one is making its way into your bankers hands.

Your employment is listed, too. Anytime you apply for a credit product, youre asked about your employment and income.

Dispute Credit Report Errors

Experian, TransUnion and Equifax all accept online disputes. You can easily fill in your information online or dispute by mail or over the phone.

- Equifax:;You can dispute online or by mail to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256. Dispute over the phone at 349-5191.

- Experian:;You can dispute information online or over the phone using the toll-free number included on your credit report. Dispute by mail at Experian, P.O. Box 4500, Allen, TX 75013.

- TransUnion:;Call the toll-free number 916-8800, dispute online or by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016-2000. Make sure to complete and include the request form on the website.

Read Also: Does Opensky Report To Credit Bureaus