Why Do Landlords Run Credit Checks For Tenants

Landlords want to ensure that they will be paid the rent they are owed when they let out a property. Acredit check can help give them information about the tenantâs previous history when it comes to payingbackdebts. If there are County Court Judgements or insolvency solutions on a tenantâs credit report,alandlord might decide that this indicates that the potential tenant will have trouble paying them in thefuture.

Once a tenant is living in a property, it can take time to get them out if they stop paying their rent. Alandlord will have to give the tenant written notice of eviction and then possibly get a court order calleda âpossession orderâ. Therefore, landlords will want to be as sure as possible that eviction can beavoidedand that tenants will not end up in arrears.

Canadians Can Now Use Rent Payments Toward Their Credit Scores

According to the Financial Consumer Agency of Canada, rent and household-related expenses should not exceed 35% of your income. Thirty-five percent of your income is not an insignificant amount of money, which is why it is baffling that such a large and regular expense has not counted toward renters credit scores until recently.

The Landlord Credit Bureau , a rent reporting agency, and Equifax, one of the two main credit bureaus in Canada, are teaming up to solve this problem and help renters build their credit scores.

To do this, landlords also known as the creditor report the rent payment history to the LCB to collect. They send the data to Equifax, who then files this information on the tenants consumer credit report.

However, it is important to note that Equifax is currently the only credit bureau collaborating with the LCB, which means rent may not apply to or credit monitoring sites.

When the landlord records past or present tenancy with the LCB, the tenant receives an email encouraging them to log in and review their record. This way, the renter can also ensure the landlord is reporting accurate information. They can check their history and leave comments.

Similarly, the LCB verifies identities to ensure information is correct and manages disputes.

This record can also help landlords avoid delinquent or destructive tenants, offering a win-win situation.

If You Don’t Have Any Documents

If you don’t have any documents because you’re waiting for an immigration decision from the Home Office, ask the landlord to request a ‘right to rent’ check from the Home Office. They should reply within 2 working days.

If youve lived in the UK since before 1988, for example if youre part of the Windrush generation, and you dont have any documents, youll need to tell the landlord how long youve lived in the UK. The landlord should contact the Landlord Checking Service, wholl let them know if you have the right to rent and give you the right documents.

If the landlord doesnt contact the Landlord Checking Service, you can get advice from the Home Offices Commonwealth Taskforce.

Home Office – Commonwealth TaskforceMonday to Saturday, 9am to 5pmSunday, 10am to 4pmEmail:

Recommended Reading: Credit Score Without Social Security Number

What Can A Landlord See On A Credit Report

Renting an apartment is a ritual a lot of young adults go through. You fill out an application and hand over a fee. The leaser, or landlord, checks you out or passes your information on to a tenant screening service. One thing you can count on: the landlord will pull your credit. Its a smart move to know what shes going to see on your credit report.

What Is A Credit Reference Check

In the UK there are three credit reference agencies Experian, TransUnion and Equifax. These agencies collect data on each person, especially financial data. This information is used to compile a credit report, which details how someone has used credit in the past and how much debt they might reasonably be able to afford. The report can also reveal whether someone has any CCJs or any fraud convictions.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Can Landlords Do Credit Checks

Most landlords will want to perform at least a basic credit check on applicant tenants before they commit to letting out their property to ensure that their new tenant will be able to keep up with their rent payments and avoid the hassle of debt collection or chasing late payments. While it is not a legal requirement to run a check on a tenants credit history before they move into a property, it is certainly a good idea and could help to avoid any nasty surprises further down the line.

Also Check: Cbcinnovis Credit Check

How Do I Get A Copy Of My Credit Report

- You can get a free copy of your credit reports from the big three nationwide consumer reporting agencies TransUnion, Experian, and Equifax – free every week until April 20, 2022 at annualcreditreport.com. You can do this any time, to check your credit information before you apply for new rental housing. If you find errors, you can dispute them.

- Find more information about consumer reporting companies and requesting your consumer reports.

Does Paying Rent Improve Your Credit Score

Although landlords and property management companies aren’t required to report payments to the credit bureaus, a perfect payment pattern is still something to strive for. Not only will that information be appealing to anyone reviewing your credit report, adding a well-managed lease to your reports can cause your credit scores to rise.

Payment history is the weightiest scoring factor in both the FICO® Score and VantageScore® models, so the more evidence that you have been paying your bills on time, the better. Bear in mind that only the newest versions of the FICO® Score and VantageScore® models consider rental data, and some lenders still use older versions.

However, for the most current credit scoring systems that do take rental history into account, your on-time rental payments can give your scores a lift, especially if your credit history is young or you’ve had some credit problems in the past. According to Experian’s study, 75% of study participants who were scoreable before rental data was included on their credit files found that adding rental history increased their credit score. On average, those who saw an increase experienced a VantageScore 3.0 increase of 29 points.

Recommended Reading: Does Getting Married Affect Your Credit Score

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

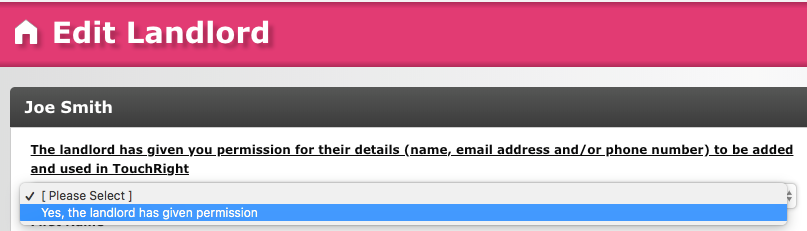

Information Landlords Need To Get A Tenant’s Credit Report

To run a credit check, you’ll need a prospective tenant’s name, address, and Social Security number or ITIN , which will typically be on the rental application or consent to background check forms you ask prospects to complete. The application is also the place for applicants to authorize you to run a credit report. Be sure to tell prospective tenants the amount of any credit fee you are charging .

Don’t Miss: Carmax Approve Bad Credit

What Other Information Might A Landlord Ask For

As well as a credit check, a landlord may also ask for references from previous landlords or fromemployers.They are also legally obliged to make sure that a tenant is allowed to live in the UK, so will ask forsome form of identification to confirm this.

They might also require proof of employment, such as payslips or a P60, in addition to the first monthâsrent in advance. In some cases, it might be necessary for a tenant to use a guarantor. This is someonewhoagrees to pay the rent in the event that the tenant cannot. This will often be a parent or relative whohasa better credit history or proof of a steady income.

Who Is Responsible For The Credit Check Fee

This depends on your landlord or property management company. But, for the most part, the credit and background check is a part of the application process and is the responsibility of the application. Usually, this comes in the form of an application fee that you pay when you submit your application.

Also Check: Does Paypal Credit Report To The Credit Bureaus

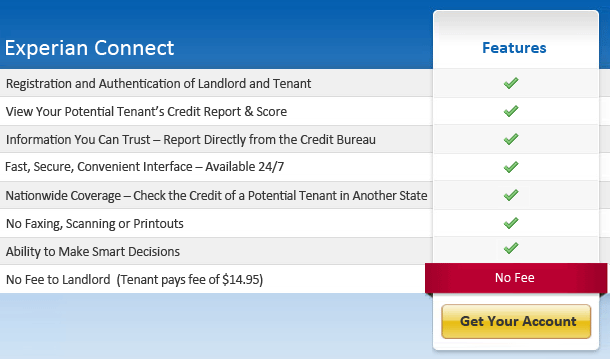

Where To Get A Tenant’s Credit Report

Three credit bureaus have cornered the market on credit reports:

- Experian .

As linked above, each of these credit bureaus offers tenant screening services that include credit checks. You can order the reports online and receive them immediately. Fees for the services vary, but usually are no more than $40.

Another popular option is to have a service request a credit and screening report from your tenant. Doing so avoids your having to collect a credit check fee and potentially sensitive information . Most of the time, you simply register an account online with the service, and it will send the applicant instructions for how to order the report and allow you to receive it. The service notifies you when the report is complete and tells you how to access it. Many of the credit bureaus provide this option, as do other landlord-oriented websites such as Cozy and TurboTenant.

How Do I Check For Errors In My Credit Or Tenant Screening Reports

First, check your report for common errors, like accounts or public records information, such as an eviction, belonging to another person with the same or similar name.

Second, check for protections that may apply to you if you experienced financial hardship due to the pandemic. Federal and state laws created programs and protections for renters and landlords related to evictions and past-due rental debt, which may affect your tenant screening report. For example:

- The federal CARES Act prohibited the charging of late fees by many types of landlords between March 27 and July 24, 2020.

- You or your landlord may have received emergency rental assistance funds that reduced or eliminated your rental debt.

- You might live in a state that allowed for sealing or expunging of eviction filings or prohibited certain types of fees or debt collection activities related to rental debt due to the pandemic.

Check to make sure your tenant screening report reflects these protections. If you find errors or incomplete or outdated information in your tenant screening report, dispute the information with the company that generated the report as well as with the person or company that provided, or furnished, the information. We have detailed information on how to dispute an error on your reports and how to add a statement explaining your dispute to your consumer reporting file.

Also Check: Does Paypal Credit Report To Credit Bureaus

Why Is A Credit Report Important

The truth is that an eviction is difficult and often results in your tenant living in your rental for the remainder of the term for free. Seasoned landlords and property managers know to avoid evictions at all costs.

Just the act of requiring a tenant to authorize a credit report not even actually pulling the report will scare away tenants that know they have a bad credit history. This is especially true if you charge the tenant a fee for the application and credit report .

We still recommend you actually pull the report. Youre essentially providing credit because youre allowing someone to live in your property before you receive all payments. You need to know that theyre capable of making payments going forward.

How Do I Check My Credit Score

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Landlord Credit Check: What To Expect

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Because many landlords check applicants’ credit, your credit history could make a big difference in your next apartment search.

For would-be renters, the credit-check process may seem mysterious. If you’re wondering what landlords scrutinize when they check your credit, here’s an insider’s look, along with strategies for landing a place to live.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: What Credit Score Does Carmax Use

What Information Is Included In A Credit Report

Because landlords and property management companies aren’t considered creditors, they do not automatically report your payment history to the three major consumer Experian, TransUnion and Equifax. Nor will they report evictions, bounced checks, broken leases or property damage. You might, however, end up with a collection account on your credit report if you leave behind unpaid debt after you move out.

Most of the information that appears on consumer credit reports comes from lenders, banks, credit unions and, in some cases, the courts. These entities regularly furnish the three credit reporting bureaus with data regarding your credit application and usage activity. Each :

- Personal information: Your name, birth date, current and past home addresses, phone numbers and employers you’ve listed on credit applications will be here.

- Accounts: This lists your tradelines, such as credit cards, loans, lines of credit and collection accounts. It will include partial account numbers, last-reported balances, payment history and account status .

- Public records: If you’ve filed for bankruptcy, details about it will appear in this section.

- Inquiries: If a company requests your credit report for business purposes or if you check your own, a soft inquiry will appear. When you apply for credit, such as a loan or credit card, it will be noted as a hard inquiry. Both types of inquiries vanish after two years and only hard inquiries can affect your credit score.

What To Do If I Have A Criminal Past

Nobodys perfect. If you have past criminal convictions, or have been to prison, it doesnt mean that you dont have a right to rent a property.

Its true that a lot of landlords will automatically reject people with recent criminal convictions or with any serious offence throughout the years.

The way you play your cards will determine if you can negotiate about your DBS check. If your landlord or letting agent never requests one, you can safely keep quiet about it, if not asked.

If you get asked about it during the interview, or you know your landlord is about to do a screening service on you, its best to go for full disclosure. If you preemptively talk about your criminal past and give reasonable explanations for why this will not affect you as a tenant, there is a bigger chance that your landlord will not consider it against you.

Don’t Miss: Capital One Authorized User Policy

Collecting Credit Check Fees From Tenants

It’s legal in most states to charge prospective tenants a fee for the cost of the credit report itself and your time and trouble. Any credit check fee should be reasonably related to the cost of the credit check $30 to $50 is common. California sets a maximum screening fee and requires landlords to provide an itemized receipt when accepting a credit check fee.

Be sure prospective tenants know the amount and purpose of a credit check fee and understand that this fee is not a holding deposit and does not guarantee the rental unit.

Also, if you expect a large number of applicants, you’d be wise not to accept fees from everyone. Instead, read over the applications first and do a credit check only on those who are genuine contenders . That way, you won’t waste your time collecting fees from unqualified applicants.

Keep in mind that it is illegal to charge a credit check fee if you do not use it for the stated purpose and pocket it instead. Return any credit check fees you don’t use for that purpose.