What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

A Good Credit Score Is In The Eye Of The Beholder

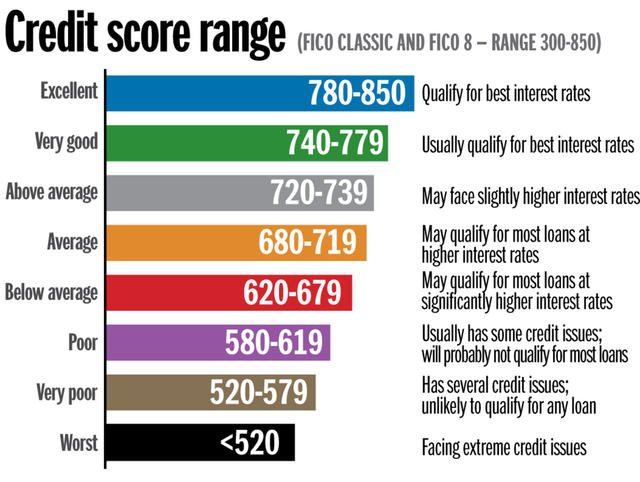

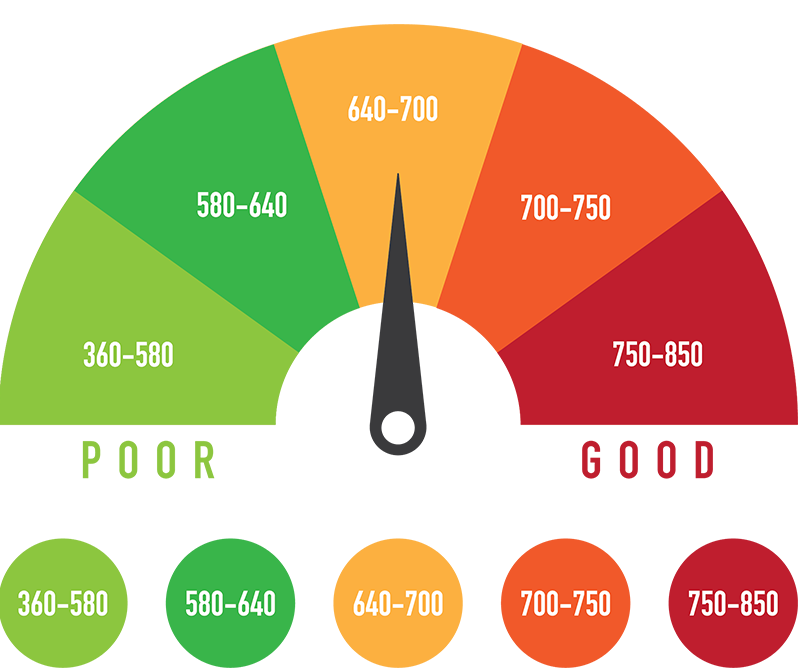

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

What Is The Difference Between Cibil Equifax Experian & High Mark

These are four credit information companies that function under the RBIs approval.They have various similarities and differences that are listed below.

1. CIBIL

-

It is the oldest and most popular in India today and also offers market insights and portfolio reviews for businesses apart CIBIL score and reports for individuals.

-

Its scoring system ranges from 300 to 900, with 900 being the highest and 300 being the minimum CIBIL score.

-

It offers businesses a Company Credit Report and a CIBIL Rank.

2. Equifax

-

It was granted its license in 2010.

-

Its scoring system is on a scale of 1 to 999, with 1 being the lowest and 999 being the highest score.

-

It also offers additional facilities like credit risk and fraud management, portfolio management and industry diagnostics.

3. Experian

-

It received its license for operation in India in 2010, but is an international company in existence since 2006.

-

The Experian score ranges from 300 to 900 with 300 being the lowest and 900 being the highest.

-

It offers several services for consumers and organisations like customer acquisition, collection and money recovery, customer management, data analytics, customer targeting and engagement.

4. High Mark

You can choose any one from these companies to calculate your credit score and so can lenders and other parties.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Will The Credit Deals Be Less Exciting If You Have A Credit Score Of 700

Firstly, the credit score of 700-750 is considered good by the lenders and they give approvals based on the same. Yes, the credit deals may not be as good as when you have a score of more than 750 or beyond 800. But they will still be attractive for borrowers. Like you can get all types of loans, be it unsecured and secured, even if the credit score is below 750 but above 700. Maybe, if you keep paying your dues on time, your score will most likely be more than 750 and could go even beyond 800. Yes, that will require patience and perseverance while handing debts. So, display that and get rewarded.

Are Credit Karmas Credit Scores Accurate

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

You May Like: What Is Cbcinnovis On My Credit Report

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Also Check: How To Remove Repos From Credit Report

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Read Also: Paypal Credit Report

Effects Of Excellent Credit

When you ask to borrow money and you can show such a strong credit score, lenders already trust you before they get details of your loan or about your background. For this reason, you will have no difficulty finding loans when you need them, such as when you buy a car, purchase real estate or lose your job.

Such good credit also means youll be eligible for larger loans if you need to cover more expenses or you want to borrow to make an investment. When you do take out loans or take on other types of debt, lenders will charge you their lowest interest rates. For large debts or long-term loans, lower interest rates can mean huge savings.

For example, say you take out a mortgage of $300,000 that you aim to repay in 15 years. Your excellent credit score could make you eligible for an interest rate of 3 percent, whereas someone with a lower score might receive an interest rate of 4 percent or more for a comparable loan.

The difference is larger than it seems. Over the course of your loan, youll pay $72,914 in interest. Someone with the 4 percent interest rate will pay $99,431 in interest. In this example, your excellent credit score equates to more than $26,500 in savings over the life of your mortgage.

These are the perks of being diligent about paying your bills on time and being responsible in other areas of your financial life.

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Read Also: Does Paypal Credit Report To Credit Bureaus

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Read Also: How Long Does It Take For Opensky To Report

You’ll Get The Best Rates On Car And Homeowners Insurance

According to McClary, having a good credit score can help you save money on your car and/or homeowners insurance.

Most U.S. states allow , where insurance companies assess your risk based on how well you handle your money.

A variety of other factors go into evaluating your rates, and insurance companies don’t rely solely on your credit score in the underwriting process. They cannot penalize you for a bad score by raising premiums, denying coverage or canceling your policy.

But according to the insurance company Nationwide, credit-based scoring results in the most fair assessment of a driver’s risk and the company reports that it actually lowers premiums for about half of its customers.

Getting a free quote from an insurance carrier is the most accurate way to see whether your credit score might bring you savings. You can also view your credit-based insurance score through LexisNexis.

What Does A Low Credit Score Mean

A low credit score doesnt mean youll never be able to borrow. Some places might still lend you money, although at a higher interest rate. This is one of the ways youll find your credit score really matters: the better your score, the less you pay on interest.

In other words, a good credit score helps you save money.

Recommended Reading: Ccb/mprcc

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Your Score Range: 550

A score between 550 and 649 sits below the national average, which is around 660. Credit scores in this range are considered a problem, and they indicate that you had some significant missteps in your financial history as a consumer.

With such an iffy credit score, you have plenty of room for improvement. That said, you are far from the bottom of the credit score spectrum, which is 300.

Youll have to work to regain the trust of creditors and lenders, and youll face high interest rates in the meantime. About one in five Americans falls into this problem range.

You Can Access Perks And Enjoy The Best Rewards

It’s no secret that the best rewards credit cards require at least good credit. And McClary says there are other perks, as well.

With a good credit score, “you can also take full advantage of the best introductory offers and reward incentives on new credit cards,” says McClary. “Some higher tier credit cardholders are able to receive special invitations to exclusive events, free access to online streaming services and even free swag.”

One of CNBC Select’s best credit cards for sports fans, movie buffs and adventure seekers is the Capital One® Savor® Cash Rewards Credit Card, which delivers a competitive 4% cash back on dining and entertainment, 3% at grocery stores and 1% on all other purchases. Currently, new cardholders can also earn a one-time $300 cash bonus once they spend $3,000 on purchases within the first three months from account opening.

Don’t Miss: Is 575 A Good Credit Score