Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Experian Credit Report And Credit Score

Experian Credit Report and Credit Score – How is it Beneficial? & FAQs

08 min read

Experian is one among the SEBI and RBI approved . Similar to the other credit rating agencies, Experian stores consumer information in its repository and retrieves them into a report whenever an enquiry arises. Know more about the agency here:

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: Is Chase Credit Score Accurate

Csc Partners With Transunion To Provide Cibil Score

The Common Service Centre has partnered with TransUnion CIBIL Ltd. to provide the CIBIL score. The new partnership will provide access to individuals in rural areas, where over 2.5 lakh CSCs are present. CSCs allow individuals to avail bank loans quickly for their personal and entrepreneurial needs. Lenders access the CIBIL score to check the individuals financial health and credit worthiness. Lenders use this data before loans are provided. Individuals will have to go through the authentication process in order to get the CIBIL score via CSCs. The report can also be downloaded. According to the Chief Executive Officer of the CSC, Dinesh Tyagi, individuals in rural areas lack awareness about the CIBIL score. Customers who have a good credit score can negotiate for better interest rates.

14 July 2020

What Can Lenders See On Your Credit Report

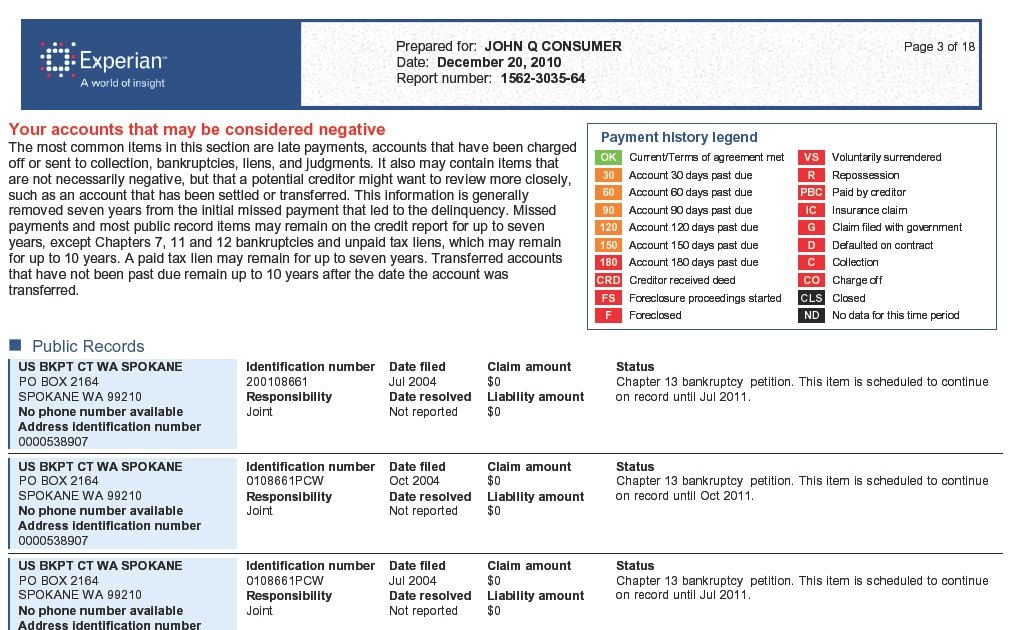

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Recommended Reading: What Credit Score Does Carmax Use

What Information Is In A Credit Report

A typical credit report includes:

-

Personal details about you for example, your name and address

-

Details about all your credit accounts that is to say bank accounts, credit cards, utility bills, phone accounts, store cards and mortgages

-

Payment status for example, do you pay your bills on time

-

History of paying things back for example, have you missed payments in the past

-

Your outstanding balance how much you have borrowed in total, by type

-

How much spare credit do you have for example, you have a £1,000 credit card limit , but are only £50 into it

-

How long have you had these accounts the longer, the better your score in many cases

-

How often you’re asking for new accounts if you’ve just applied for 20 new credit cards, that will show up to anyone looking at the report

-

Are you on the electoral roll

-

Have you had any CCJs, IVAs or been declared bankrupt in the past 6 years

-

Do you have debts at a previous address

-

Have you been a victim of ID theft

-

How many addresses are you linked to ie do you have credit accounts where the payment address is not current, or different from your main address

-

Past names

Cons Boost Your Credit Score Experian

Right here are some disadvantages of Experian Boost that we need to consider to derive at a meaningful analysis of Boost Your Credit Score Experian.

Not Offered In All Places

Experian Boost is not offered in all states. Experian, among the 3 significant credit rating bureaus, does not provide its solutions to every U.S state. There are 17 states where Experian can not assist boost your FICO rating which might lead you to think about other options for enhancing a bad credit report and even surrender on Experian Boost entirely if it cant be made use of at all in your state.

Not ideal For Mortgage

You ought to not utilize Experian Boost if you are going to apply for a mortgage loan. Experian discloses that its Experian Boost item is designed just as an instructional tool.

The credit score it offers might change depending on which credit rating report information is made use of, whether your FICO Rating has actually been adjusted recently due to adjustments in the scoring model, the number of times your information has altered when given that last time Experian opted-in updated your documents with new ratings.

Blunders On Credit Rating

If there is any sort of mistake on the credit reports provided by creditors Experian Boost is unable to take any type of action on it. Experian does not manage the details in your credit rating reports. And Experians products are unable to make corrections or avoid errors from appearing on your credit score record.

Also Check: What Credit Score Does Carmax Use

Can You Improve Your Experian Credit Score

You can see from the points above that it is important to have a good credit score. Luckily, it is fairly easy to improve your Experian credit score by taking a few necessary steps as follows:

- Pay your bills on time, as even one or two missed payments can negatively affect your score.

- Keep your credit utilization ratio low.

- Maintain a good mix of credit to show that you are able to handle new credit responsibly.

- Keep old accounts and credit cards open, as a long credit history can reassure lenders that you have displayed responsible behaviour.

- Only apply for new credit accounts when necessary

- Check your credit report regularly to make sure they dont contain any inaccuracies that can potentially hurt your score.

An Experian Credit Information Report compiles a persons credit history and based on this information, your credit score is generated. This score is used by banks and lending institutions to decide whether the individual would qualify or be denied for a loan or other credit.

Generally, the higher a persons Experian credit score, the more favourably they are viewed by banks and financial institutions, as they are said to be at a lower risk of defaulting on the loans.

So, having a good credit score can make achieving financial goals easier, like getting approved for credit cards and loans, or paying lower interest once they are approved.

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

Also Check: Speedy Cash Change Due Date

Where Do I Find My Routing Number And Account Number

If you don’t have access to a debit card but still need to withdraw money from the account it’s linked to, you may need to know the routing and account numbers associated with the account. There are a few ways you can find this information.

- Checkbook: If you have a physical book of checks, you can find the routing and account numbers at the bottom of the check. You’ll see three groups of numbers: On the far left is your routing number, in the middle is your account number and on the right is your check number.

- Online banking: You can access your bank account online and look for the account and routing numbers there. If you have trouble finding them, search the help section of the site or contact a service rep.

- Mobile app: You can usually find your account and routing numbers on your bank’s mobile app.

- Bank: If you go to a bank branch with appropriate identification, a teller or bank representative can give you your routing and account number.

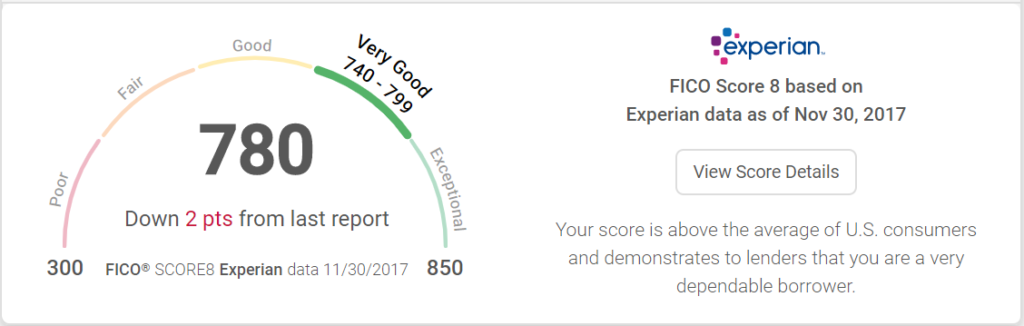

What Is A Good Experian Fico Score

A good Experian FICO score is considered to be 670 or better when looking at the FICO 8 scoring model. The chart below shows the ranges of credit scores from poor to excellent.

Its important to know your credit score and what a good credit score is because having a poor or fair Experian credit score could cost you lenders may be reluctant to give you a loan or approve you for a credit card, or you may pay a higher interest rate than a borrower with a good credit score.

Also Check: Does Speedy Cash Do Credit Checks

What Is A Credit Score

Checking your credit report is an important part of maintaining your financial health. It’ll allow you to pick up on any mistakes – or even fraudulent applications – that could hinder your chances of getting credit.

There’s no such thing as a universal credit score. Each lender has its own system in place to decide whether or not to accept you as a customer, meaning you could be turned down by one, but successful with another.

To give you a better idea of how your application might be viewed by lenders, credit reference agencies produce their own version of your credit score.

The higher this number, the higher your chances of getting the best credit deals – but a good score from a credit reference agency is no guarantee that your application will be successful.

And confusingly, each credit reference agency uses a slightly different scale. For example, a score of less than 560 is ‘very poor’ with Experian, but ‘excellent’ with Equifax.

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

Read Also: Does Opensky Report To Credit Bureaus

How Do You Check Your Credit Score

You can check your credit score from many sources, including Experian. Learning what your credit scores mean and what affects them can help you when you’re getting ready to apply for new credit.

Lenders use credit scores to decide how likely it is you will repay your debts on time. There are hundreds of credit scoring models in existence, though the FICO® Score is the most common. The higher your credit scores, the better offers you are likely to receive from lenders in the form of lower interest rates and other favorable terms.

What Factors Make Up My Credit Scores

There are a few factors that make up your credit scores, whether youre looking at FICO or VantageScore scores. Its worth briefly covering these to help you better understand your credit scores.

- Payment history Having a history of on-time payments is most important for credit scores and gives lenders an indication of how likely you are to pay back a loan.

- is how much of your total credit youre using compared to the amount youve borrowed. Lenders might view a higher credit utilization rate as a sign you have too much debt to pay back a new loan or credit card balance.

- Length of credit history A longer credit history may help your credit scores by demonstrating a history of more on-time payments.

- Having a mix of different types of credit can help show lenders you have experience with different types of loans.

- Recent credit The number of hard inquiries on your credit reports can signal to lenders that youve been actively seeking credit and might be a riskier borrower.

Also Check: What Is Syncb/ppc

Your Transunion Credit Score

TransUnion is the second largest credit reference agency in the UK. It used to be known as Callcredit. You can check your TransUnion credit score by going to Noddle. You can also access your TransUnion and Equifax credit reports at the same time by registering for a 30-day free trial of CheckMyFile. Just make sure you have a look at their terms and conditions before you register. And if you want to continue with their service beyond the 30 days, a monthly fee would apply.

Whats A Good Or Average Credit Score

We consider a âgoodâ score to be between 881 and 960, with âfairâ between 721 and 880. However, thereâs no âmagicâ number that will guarantee lenders will approve an application if you apply.

If your credit score is poor, youâll probably find it harder to borrow money or access certain services. We consider a âpoorâ score to be between 561 and 720, with âvery poorâ between 0-560. But remember, lenders may have different views of what an ideal customer looks like to them, which will be reflected in how they calculate your credit score.

Your free Experian Credit Score is intended as a useful guide to give you an idea of how lenders may view your credit history. Knowing your score can help you make more informed choices when it comes to credit.

You May Like: Which Business Credit Cards Do Not Report Personal Credit

Rbi Rate Cut Followed By Increased Credit Growth By 100 Bps

The credit growth of all commercial banks had grown around 7% on 10 April to Rs.102.85 trillion. This was the data that had been gathered from the Reserve Bank of India . On 27 March, the RBI had reduced the repo rate by 75 bps for stimulating growth, after which the banks also lowered their deposit rates and lending rates.

This is an improvement from the 6% credit growth that had been seen in the previous fortnight ended 27 March. Credit growth has been reducing for the past few quarters and has been expected to reduce further because of the coronavirus that has disrupted all credit disbursals. The lenders from the public sector are now trying their best to push the covid-19 emergency credit lines to all their borrowers. It had been reported n 26 April that all branch-level officials in public sector banks are now having difficulty in managing the superiors expectations on higher credit growth. In a few cases, the branch officials have also learned that the demand for fresh credit has reduced drastically and this has brought almost all loan disbursals to a standstill.

28 April 2020

Checking Your Experian Credit Score Online

- Step 1: Visit the Experian website and click on the Free Credit Report button

- Step 2: Enter your details to log in, such as your name, mobile number, and email address.

- Step 3: You will receive an OTP to the mobile number shared above. Once it has been entered, you can click on the Get Credit Report option

- Step 4: Once you have logged in, you will be asked to verify your identity using your date of birth, residential address, and any government approved ID card number

- Step 5: Once this information is verified, you may be asked some further questions about your loans and credit history.

- Step 6: After this has been completed, you will be redirected to a page where your credit score will be generated.

- Step 7: You will also be able to download your credit report.

You May Like: Does Paypal Credit Report To Credit Bureaus

How Much Money Can I Withdraw From A Checking Account

When you have to put in the extra effort to withdraw money because you don’t have a debit card, it may make sense to take out a little more cash than you need at the time. However, there might be some limits on how much money you can take out depending on the method you use.

If you make a trip to a physical branch of your bank and connect with a teller, you can usually take out more than you could from an ATM . If you opt to withdraw money at an ATM, you will likely have a maximum amount you can withdraw. ATM withdrawal limits depend on which bank you use and what type or “level” account you have. Some banks allow withdrawals as high as $2,000, but most banks set a limit of around $300 to $1,000. You can always check with your bank to see what your limit is.

Not having a debit card can present some challenges when you need to get cash, but thankfully, there are plenty of options to help as long as you know where to look.