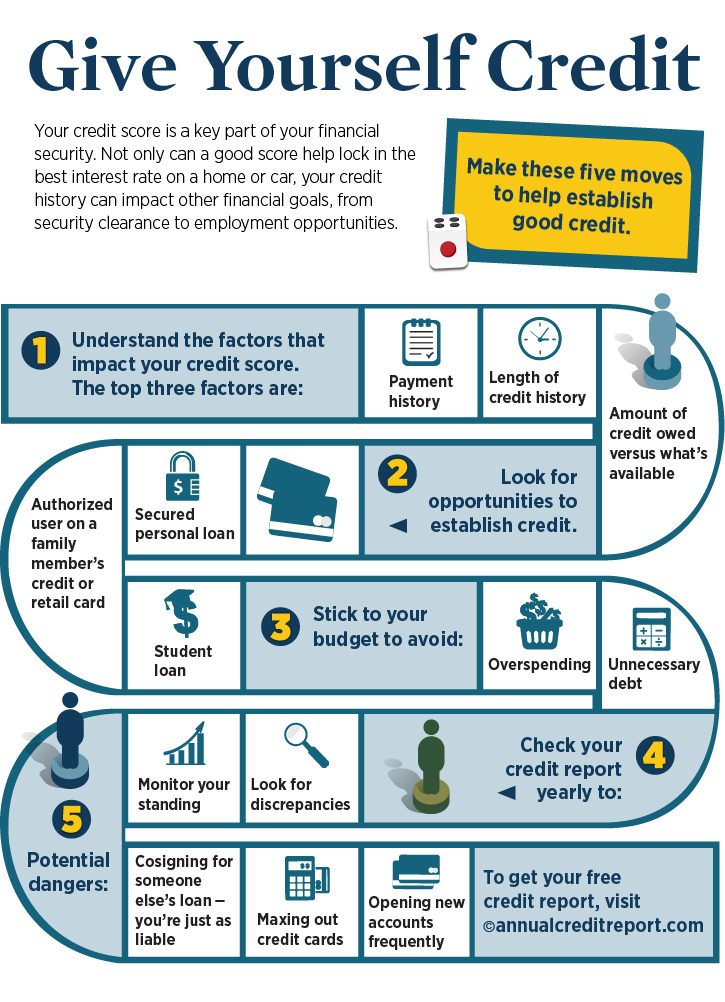

You Can Keep Your Credit Utilization Low

Your;the percent of your credit limit youre using at any given timecan also help establish a good credit history if you keep it low. Plus, your length of credit history will grow as you use the card over time.

Most credit cards report all of this information to the three national credit bureausExperian, Equifax and TransUnionat least once a month. The credit bureaus maintain these records in your;, which are then used to calculate your credit score.

Best Bank For Refinancing Your Usaa Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

You May Like: What Credit Report Does Paypal Pull

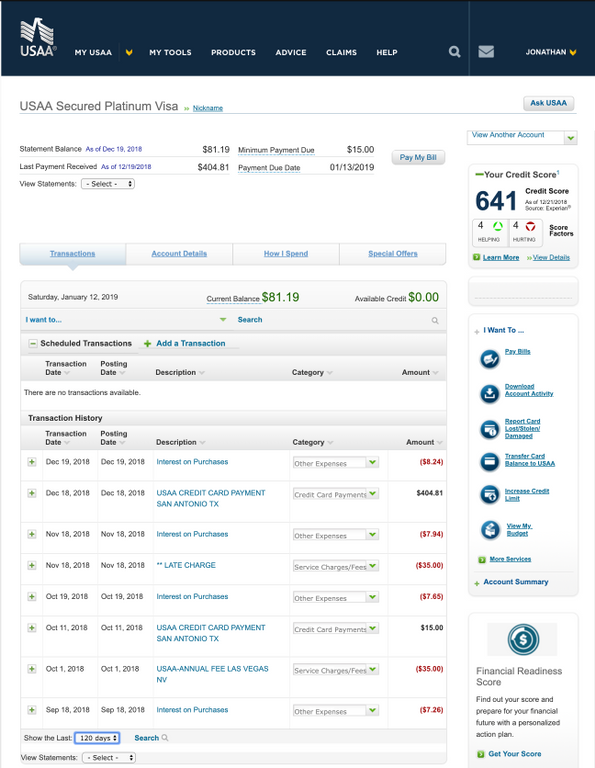

Compare Usaa Credit Cards

Generally speaking, USAAs card offerings are designed for those with good or excellent credit. A majority of them are rewards cards and those that dont offer rewards have other strong features, like an incredibly low purchase APR. If you have fair or bad credit, youll need to check out other providers for options.

Usaa Not Reporting To Tu For Past Two Months

HI all,

In April I accidently let a large purchase report that took my USAA Signature Visa to 90% untilization, I paid it off a day after it reported and thought oh well will post in May. Well in May and now June USAA did not report to TU they did report to EQ and EXboth months with the balance gone.;USAA has;reported to TU every other month in the 3+ years that I have had the card and my spouses card was reported to TU in May and June. Is this something I can call them on and have them report or will they not care. It’s lowering my TU score by about 20 points as the very large balance that only exsisted for two weeks is still reporting 2.5 months after being paid in full on TU.

Recommended Reading: Removing Hard Inquiries From Your Credit Report

Why Is It Important To Know When Credit Companies Report

Some confusion can be cleared up by knowing when credit-card companies report to the CRAs. Its usually at your statement closing date.

Dont be alarmed if you check your credit report and see a balance when you know your card is paid off in full each month. At the end of your billing cycle, theres a great fluctuation, sometimes causing as much as a 30% shift in the credit score for most consumers. But when the payment is accounted for, it shifts back into form.

Billing cycles can vary. Some credit-card companies might do it at mid-month and others at the end of the month.

Credit-card companies probably are providing a snapshot of your current balance when they report to the CRAs. If this is a concern, keep track of your spending by your statement closing date. Making a payment before your statement closing date will keep the balance lower when its reported, helping your overall credit.

This also helps your credit utilization rate, an important factor when it comes to your credit score. Your credit utilization rate is your total credit-card balance divided by your total credit-card limit. Experts advise consumers to keep that ratio under 30%. Paying down your revolving debt and carrying a lower balance is a possible way to help your credit score, although it is influenced by several factors.

The bottom line is if you pay your bills on time and you keep a low credit-card balance, your credit score will take care of itself.

All that being said, here are some tricks:

What Credit Bureau Does Usaa Check

No chexsystems banks open a new account today. 7 related questions.

loose credit reports & ratings creditland. Find out your credit score at no cost at creditland. Credit score reports from 3 primary bureaus transunion, experian, equifax. Usaa rewards american specific® card reviews credit score karma. Usaa rewards american all you want to do is find playing cards you like and take a look at the credit score karma appears at how your credit score profile compares to other credit score karma. Usaa rewards visa signature reviews wallethub. Associated credit playing cards. If you are interested in the usaa rewards visa signature®, take a look at out the following credit score playing cards as properly. The fine secured credit cards smart bread. Get accredited for a secured credit card if you have a horrific or no credit score records. Build or rebuild your credit score rating. What credit bureau does usaa take a look at yahoo answers effects. Contrary to what a whole lot of humans suppose , a few pupil credit cards can be pretty smooth to get in case you’re a college scholar and at. Usaa rewards visa signature reviews wallethub free credit. Related credit cards. If you are interested by the usaa rewards visa signature®, test out the subsequent credit playing cards as properly.

You May Like: Credit Score Without Social Security Number

Get Your Collections Removed Today

If youre looking for a reputable company to help you with collection accounts and repair your credit, we HIGHLY recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

- Top Trending Debt Collection Agencies

-

Heres a list of some of the nations most popular debt collectors that cause damage to your credit.

Is A Social Security Number Required

Some banks may ask for an authorized users Social Security number. If so, the payment activity and being added as an authorized user will most likely report to the credit bureaus.

When the bank only requests the secondary users name and home address, there is a chance the account will not list on a credit bureaus credit report. In most cases, the information will report if the home address matches the address on record with the credit bureau.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Things To Consider Before Refinancing

Raise Your Fico Score Instantly

Get credit for your phone and utility bills.

Add positive payments to your Experian credit file with Experian BoostTM. Missed payments will not affect your boosted score.

*Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian BoostTM.

Recommended Reading: Credit Report Without Ssn Or Itin

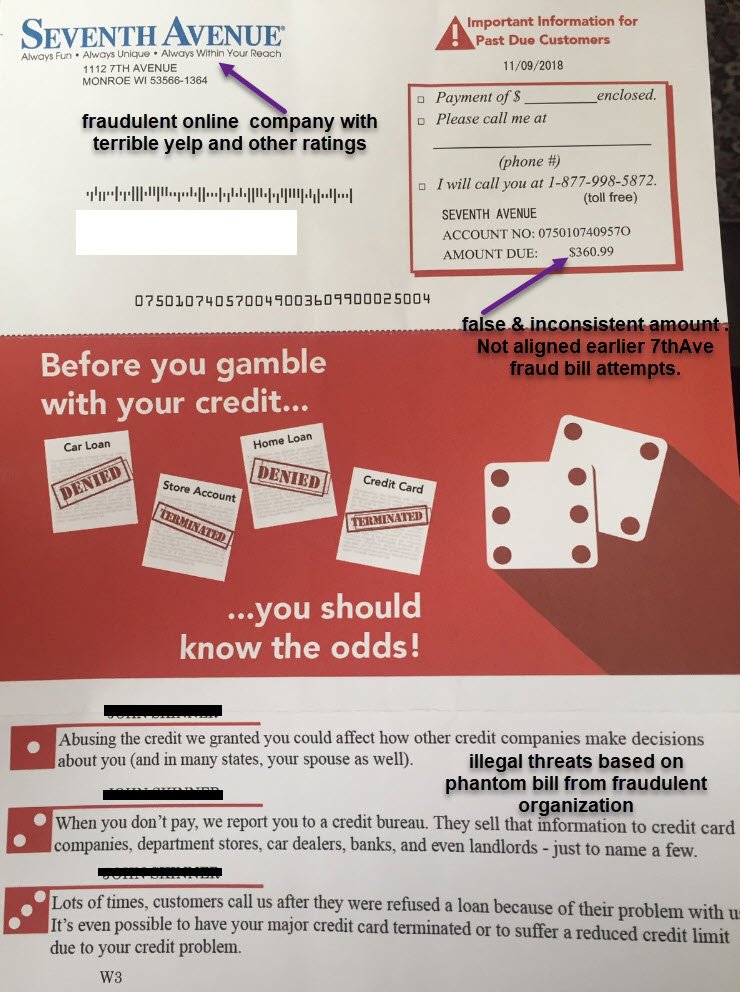

Remove Usaa Collections From Your Report Today

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Who Can Join Usaa

USAA serves current and former military members and their families, including:

- Active military members

- Cadets and midshipmen

- Family members, including widows, widowers, un-remarried former spouses of USAA members and individuals whose parents joined USAA

- Former military, individuals retired or separated with an honorable discharge

Read Also: Does Klarna Report To Credit

How To Refinance Your Usaa Auto Loan

- Pennsylvania State Employees Credit Union

- and a few more.

Removing Usaa Collections From Your Credit Report

USAA collections can hurt your credit score and remain on your credit report for up to 7 years regardless of whether you pay it or not. Unfortunately, paying the collection could even lower your credit score.

However, it is possible to have it removed before 7 years, and you may not even have to pay it.

Phone number: 531-8722

Don’t Miss: Does Zzounds Report To Credit Bureau

How Long Until A New Credit Card Shows Up On Your Credit Reports

Nervous about a newer credit card that hasnt shown up on your credit reports? Fear not it may simply be too soon. Credit cards dont pop up on your reports the moment youre approved. It can take anywhere from 30 to 60 days for your new accounts credit activity to be reported to the credit bureaus. Itll usually happen after the first billing cycle comes to a close.

Why You Should Use This Program

If you are a USAA member, I can’t imagine any reason why you wouldn’t want to sign up for this great free service. ;Keeping tabs on your credit scores and report is always a good idea, and this is a super-easy way to track the information being reported by Experian and the Vantage Score, one of the major credit scores used by lenders and other organizations. ;I love that it is both free and easy-too-use!

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Average Age Of Accounts

Probably the best advantage of being an authorized user is being added to an old account. Even if you have no credit history, most banks give you credit for the credit cards total age.

For example, being added to a card open for at least 10 years implies that you have been on that tradeline for 10 years. One exception to this rule is American Express credit cards which reports the actual day you were added as an authorized user.

Being listed on a personal account thats less than 24 months old can hurt your approval odds for near-future credit card applications. For example, Chase credit cards is known for only approving applications when you have added 4 or less credit card accounts to your report in the most recent 24 months.

Special Services And Benefits

If youve ever dealt with bad customer service, you know it can make or break a service no matter what theyre offering. USAA consistently collects top customer services rankings and praise. Their online banking systems are even brag-worthy, being known as an organization that consistently keeps up on advancing technology.

Its truly a business built by the people who needed it and running for the people it serves. But customer service is just one of the special services and benefits that USAA offers its members, others include:

- ADT home security and monitoring discounts

- Car buying discounts on new and used vehicles

- Exclusive discounts on shipping, moving, and storage

- Rental car discounts and savings

- Shopping rewards for hundreds of online stores

- Travel deals including price match and travel insurance

USAA is a bank for military members and their families, offering products and services to care for all your financial needs. If you qualify, be sure to get your membership today.

Read Also: Does Paypal Credit Report To Credit Bureaus

Usaa Now Offering Free Credit Scores And Reports For All Members

USAA has announced that it will now be offering free credit scores and credit reports information to all its members, not just those with credit card accounts. ;This is great news, because it will add another free way to keep tabs on your credit report and credit score. ;USAA members do have to opt-in for this free service, and there are paid upgrades available.

Which Credit Cards Help Authorized Users Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Adding someone to your credit card as an is a simple way to potentially buoy their credit scores, assuming youve paid the account on time and havent used too much of your available credit. But to make this strategy actually work, youll want to be sure that information about that account is included on their credit reports. Otherwise, adding someone to your card whether its a child, partner or parent wont do a thing for their scores.

Getting that same account to appear as a “tradeline” on your authorized users credit reports will depend on two major factors:

Ultimately, if you want to help someone establish a credit history by adding them to your account, you can save time and energy by knowing beforehand about how issuers and bureaus handle this information. After all, you dont want to add someone to an account in an effort to help their scores, only to find out months later that it had no effect.

» MORE:;View authorized user purchases with these credit cards

Recommended Reading: Aargon Agency

Re: How Often Does Your Usaa Cc Report

Thank you. I’ll be receiving my card in about 8 days, decided not to have it overnighted. Hasn’t showed up on any alerts yet.

Just curious how often peoples’ USAA credit cards report to the CRAs?

EVery month.

I also asked when USAA reports to the CRAs and I was told every 60 days.

USAA’s CSR’s are generally good in my experience but the usual caveats with CSR’s apply.

Re: Usaa Not Reporting To Tu For Past Two Months

2 thoughts here. The first is maybe you should let a small balance report. Second this reminds me of something similar that happened to my DW. Big balance that hurt utilization that got paid instantly and didn’t report the zero balance for months. Score tanked for months. We even went so far as to file a dispute. Here’s what happened: We totally forgot we changed our due date and it took a few cycles to process and report! It was completely our fault.

TU 778 – EX 785 – EQ 779First Tradeline800 Credit ScoreHomeowner

Recommended Reading: What Credit Report Does Paypal Pull

Usaa Free Credit Scores And Credit Monitoring Have Transitioned To Experian

Advertiser Disclosure: Opinions, reviews, analyses & recommendations are the authors alone. This article may contain links from our advertisers. For more information, please see our .

Note Regarding USAA Credit Monitoring Service: All Credit Monitoring & ID Protection plans moved to Experian®. You can still monitor your credit score for free through several different services. We explain the importance of this and show you how in this article.

Do you keep track of your credit score? If not, you probably should. It is used by many agencies as an indicator of your trustworthiness. This includes banks and lending institutions, but it can also be used by landlords, cell phone companies, by potential employers, and even for your security clearance.

Your credit score also determines whether or not a bank will extend a loan, and the terms they will offer. Generally the better your score, the lower your risk, and the lower the interest rate you may qualify for.

Thankfully, there are many ways you can monitor your credit history and credit score for free. You can visit annualcreditreport.com to get your credit history, but they dont offer your credit score. But you can monitor your credit for free through several different websites, such as Credit Karma, Credit Sesame, Experian, and even through many banking and credit card websites. In fact, several banks recently began offering a free credit monitoring service for their customers.