Should You Remove Closed Accounts From Your Credit Report

Asked by: Dr. Letha Haag IV

Should you remove closed accounts from your credit report? You should attempt to remove closed accounts that contain inaccurate information or negative items that are eligible for removal. Otherwise, there is generally no need to remove closed accounts from your credit report.

How A Closed Account Might Affect Your Credit

The effect of account closure on your credit depends on multiple factors, including the amount of available credit youre using, the length of your credit history, the status of the closed account and the accounts that are still open.

Here are a few things to watch out for when an account is closed.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Also Check: What Credit Report Does Discover Pull From

Situations When A Default May Be Removed

There are a small number of situations when a default listing can be removed from your credit report. These situations are limited to when the credit provider has made a mistake when listing the default, or the overdue payment happened because of something outside of your control .

In order to work out whether you can ask for the default to be removed, you should get a copy of your credit report from the . Its FREE to get a copy from each credit reporting body, or if youve applied for credit and been refused in the last 90 days.

Can Paid Collections Be Removed From A Credit Report

If you dont want to wait seven years for the paid collection to drop off your credit report, you may be wondering how to remove paid collections from a credit report.

When a debt is said to be sent to collection it means that the lender has given up on trying to get that money from you. Instead, they have employed a debt collections company to pursue the debt. This is bad for your credit report because it reflects badly on you as a debtor.

Accounts that get to the collection stage are considered seriously delinquent. It means that someone lent you money but you didnt repay it even after they did everything in their power to get you to pay it back. They had to send a debt collections company to try to collect money from you. Lenders dont want to give money to someone that has a bad record of repaying their debts. A collection will have a significant, negative impact on your credit score.

The problem is that, even if you then pay off this debt through the debt collection company, the collection still remains on your credit report. So even if you no longer owe the lender money, your credit score will still be negatively affected.

Luckily, there are some strategies you can employ to get paid collections removed from your credit report.

Recommended Reading: How To Increase Credit Score With Credit Card Payments

Beware Of Debt Settlement Or Consolidation

In general, be very cautious when pursuing debt settlement or debt consolidation as there are risks involved with both options. Some of these may not even have any contact with your original creditor. Worst case scenario: you pay the company, never hear from them again, and the negative item is still on your report. If youre considering going with one of these companies, youll want to keep a few things in mind:

- Fees and rigid contracts: Most of the time, theyll charge you a fee for settling. Worse, if you miss a payment as part of your settlement or consolidation plan, you could lose all of your moneynone of it will go toward paying off your debt.

- Taxes: When you settle for a lower amount, that means a portion of your past debt is forgiven. And anytime your debt is forgiven, youll owe taxes on the amount forgiven if its over $600.

- Longer terms: You can actually pay more over time with debt consolidation. All it does is stretch out the length of your debt. Your monthly payments are smaller, but at the expense of paying more interest over time.

Theres also an important distinction to be made here: debt settlement and consolidation are not the same as credit counseling. The former options, along with the , promise to simply erase your delinquenciesand usually at quite a costwhile the latter helps you build better habits to improve your credit over time.

Why Should You Settle An Account

Its important to remember that having unpaid debts will affect your credit score in a negative way. Creditors will consider you a high-risk borrower, which means these lenders will assume that youre less likely to pay back the amount you borrow from them. Theres a good chance youll end up with a higher interest rate when you obtain the loan too. Lenders use this additional interest to account for the perceived risk of lending to you.

Settled accounts may harm your credit history but their effects are much less averse when compared to listing an unpaid debt on your credit report. Creditors will look at credit reports with settled debts more favorably than those with unpaid debts. Settling an account may lower your credit score in the short term but its negative effect will lessen as time goes by.

Settling an account, paying it in full and closing it may help your credit score. Your payment history on that particular account will still appear on your credit report, which lenders can use as a reference to determine your ability to pay back debts.

Recommended Reading: How To Dispute Items On Credit Report By Mail

When To Negotiate With A Creditor

This likely wont work if the charged-off account belongs to you and all the information being reported about it is accurate. In that scenario, you could try negotiating with the creditor or debt collector to update or remove the charge-off account from your credit file. This is called pay for delete, and essentially youre asking for the account to be removed from your credit reports in exchange for a fee.

Pay for delete arrangements are legal under the Fair Credit Reporting Act, but there are a few things to know. First, creditors arent obligated to honor your request and remove charge-offs from your credit. So while you can ask for a pay-for-delete, theres no guarantee that a creditor or debt collector will agree to it.

Second, if they do agree, youll likely need to pay the account in full. However, if an account has been delinquent for some time, the creditor may be willing to accept a settlement in which you pay less than the full amount. Either way, youll almost certainly have to pay something toward the debt.

Read Also: How To Get Repossession Off Credit Report

Q What Are Account Review Inquiries

A. After establishing a relationship with you, companies may periodically review your credit file for account renewals, limit increases and pre-approved offerings. Since these inquiries are for account review purposes only, they are not disclosed to any other companies viewing your credit file and have no impact on your credit rating. These inquiries are posted for your information.

Don’t Miss: What Is The Best Credit Rating Agency

What Is A Default Notice

A Notice of Default letter is a warning from a creditor that you have missed payments on your credit agreement. They typically send the default notice when you have not been paying for three to six months.

They will contact you and ask for full payment, giving you at least two weeks to catch up. If you do not pay the money owed, the account will default and you may:

These notices can only be sent on credit covered by the Consumer Credit Act, such as credit cards, personal loans and mobile phone contracts. If you have paid within the time given, no further action will be taken but you should avoid missing further payments or you will get another letter.

Read Also: How Often Does Capital One Report To Credit Bureaus

Your Credit Utilization May Increase

Your credit utilization rate is the portion of revolving credit youre using compared to how much you have available generally expressed as a percentage. If you close a revolving account, such as a credit card, the total amount available decreases.

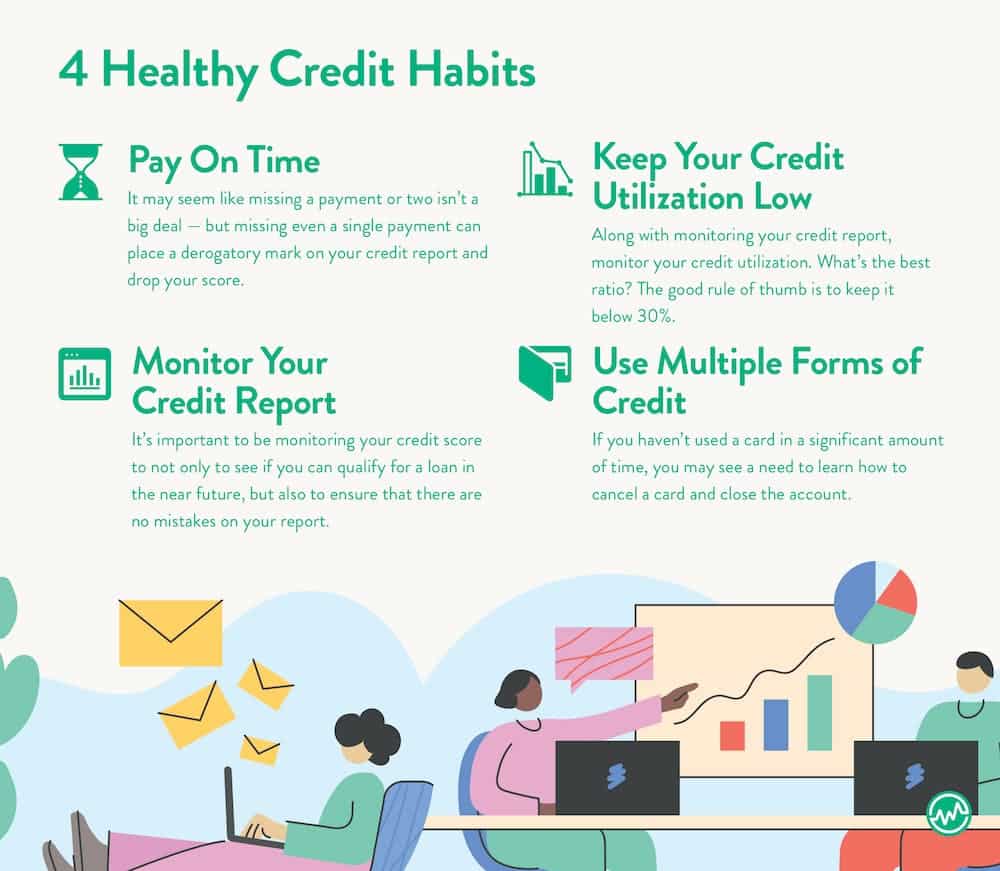

When that happens, your credit utilization could increase, which may lower your credit scores. In general, most experts recommend keeping your rate below 30%.

Read Also: Is Fico And Credit Score The Same

When It Comes To Your Credit Score Dont Sweat The Small Stuff

Remember that credit bureaus consider the entirety of your situation when determining your score, and not just which old accounts are still listed on your reports.

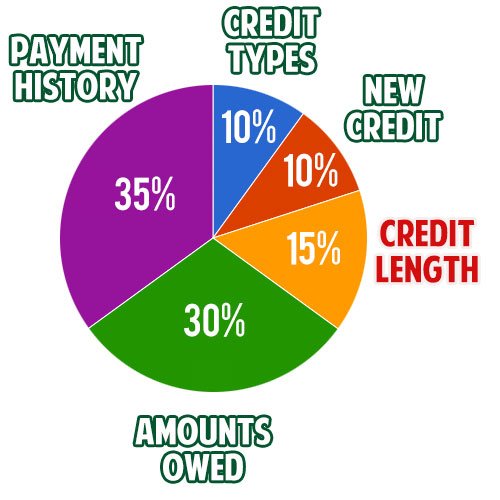

Further, the most important factors of your FICO score are your payment history and how much debt you owe. For that reason, you should focus most of your efforts on making sure your bills are paid on time and maintaining a credit utilization rate thats on the lower end of the spectrum, and preferably under 30%. Other ways to improve your credit score include refraining from opening or closing too many accounts and having a few different types of accounts on your reports on any given time.

Good credit is built slowly over the years, and youll have the best results if you focus on areas where you can have significant impact. Old accounts on your report may be inconsequential, but how you treat your credit now can impact your score for years to come.

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Also Check: Is 691 A Good Credit Score

How Long Do Paid Off Credit Accounts In Good Standing Stay On My Report

A credit account that was paid off on time and is in good standing will remain on your credit account for 20 years after the last day it was active. Often, people mistakenly believe that old credit accounts are bad information and do not want then on their reports. In fact, this is the exact type of information that you want to appear on your credit report. Old accounts, which were paid off on time, show potential future lenders that you can responsibly handle credit. A long and positive credit history is created by using credit and taking on loans.

When Should You Remove An Account From Your Credit Report

Don’t try to remove an account that illustrates positive payment habits. Ventures that generate good credit are highly impactful, as they symbolize responsible credit habits.

You may wish to cancel the account because of high fees or poor service. It might be closed by the lender due to too many late payments, inactivity over a substantial period, or if the account is defaulted, meaning that you have broken agreed-upon terms regarding credit utilization and maintenance.

Always double-check your report before deciding to do anything. Fortunately, youâre entitled to a free credit report from either of the three bureaus once a year. Afterward, you can submit a dispute if any negative information is still present.

Additionally, your report will also indicate whether you or an external party closed the account.

Recommended Reading: Do Late Payments Affect Credit Rating

Late Payments And Defaults

Late payments can be notified to a credit agency when they are more than thirty days in default. Most late payments notified to the credit agencies are from either the credit card companies or the utility providers.

Not all utility companies report payments to credit reference agencies but the number that do is increasing. More and more lenders are starting to pass their data onto these agencies and you may soon see all your personal and household bill payments recorded on your credit file.

Open accounts stay on your report indefinitely and settled or closed accounts can remain on your credit file and available for future lenders to see for six years.

Can Settled Accounts Be Removed

The short answer is no. Settled accounts arent always be removed from your credit. There are several reasons why they cant be removed.

Paying off a settled account without a pay-to-delete letter. Using this method doesnt put into motion the steps necessary to remove the settled account. As such, your lender has no incentive to remove the account. Legally, your lender doesnt have to remove the account unless theyve signed a letter saying otherwise. Or, you havent paid off the settled amount. In a case where you havent given the lender or collections agency the reduced amount you agreed to pay, they wont take the settled account off your credit report.

Don’t Miss: How To Remove Disputes From Credit Report

Contact The Credit Reporting Agency To Remove The Defaults

If you believe you have an illegitimate default in your account, then you should contact the credit reporting agency in charge of your credit report to have these defaults removed. Defaults should not be ignored, and as soon as you realise you have a default on your credit report, you need to contact the appropriate agencies to sort it out. If left to fester, credit report problems can cause big headaches for you in the long run.

In order to repair credit, you must contact the credit reporting agency. If this does not work and you still feel you have a legitimate claim to clearance of defaults, you can contact lawyers specialised in the field of credit defaults.

Dont Miss: What Causes Credit Score To Go Down

Review Your Credit Report For Answers

If you’re wondering when a specific collection account will fall off your credit report, pull a copy to review. You can get a free one from AnnualCreditReport.com once a year. Review the history for the original account to check the date of delinquency and add seven years to that date. That’s about when you can expect the collection account to drop off.

Read Also: Do Utility Bills Show On Credit Report

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Closing A Credit Card Can Raise Your Credit Utilization Ratio

When an installment loan, for say a car or furniture, gets paid off that account is closed. However, I want you to think twice before closing a revolving account just because you havent used it in a while.

Dont get me wrong there are good reasons to close revolving accounts, like a high annual fee or poor customer service but generally speaking, I recommend not closing accounts especially for someone with a limited credit history.

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Closing an account reduces your overall available credit, which is used in the utilization calculation. Utilization is figured two ways. First, the ratio of balance to credit unit is used, and second, the ratio of all your credit limits on all your cards to all your balances is factored in. Closing an account reduces the value of the second ratio.

Don’t Miss: How Good Is My Credit Score