How Mortgage Lenders View Your Credit Score

When you apply for a mortgage, lenders check your credit score, along with your employment history, debt to income ratio and other factors, to determine their potential risk. A high credit score may help you qualify for lower interest rates than someone with low or no credit.

Credit scores can range between 400 and 900 . The two credit bureaus in Canada are TransUnion Canada and Equifax and these bureaus track the credit histories of millions of Canadians.

A strong credit score is especially important if youre applying for an insured mortgage where youre borrowing more than 80 percent of the homes value. Some banks will overlook a lower credit score to some degree if its an uninsured mortgage, meaning youve put down 20 percent or more.

For insured mortgages and best rates, most lenders want to see a minimum credit score of 680. If your score is at 680, the lender may want an explanation of why the credit score isnt higher . A few lenders will grant mortgages to those with low credit scores, but they will do so at a rate premium and a fee to cover their enhanced risk. Coast Capital, for instance, can charge a .5 to 2 percent fee and increase their rates by 1 to 3 percent under their specialty program for buyers with credit issues.

Here are a few tips for raising your credit score before you apply for a mortgage:

Don’t Overthink Your Credit Scores

While your credit scores can be important, there are three reasons that it makes more sense to focus on general healthy credit habits rather than a specific score:

Building a positive credit history can help increase all your credit scores, and you won’t need to worry about which score the lender uses.

Does Paying For Rent Build Credit

There is no definitive answer to this question as it depends on a number of factors, including the landlords policies and the credit reporting agencys guidelines. However, in general, paying rent on time can help build credit, as it is typically reported to credit agencies. Therefore, if youre looking to build credit, paying your rent in full and on time is a good place to start.

Rent payments do not typically build credit, but they can be reported to the credit bureaus on a regular basis to help build credit. Credit score calculations are based on the information contained in your credit reports. Rent payments are typically not reported to Experian, Equifax, or TransUnion. If you pay your rent on time, your rental payment information may be included in your credit report, which may help you establish or strengthen your credit. In general, utility bills are only reported to the bureaus if they are late or in collections. In order to avoid harming your credit score, you must ensure that utility bills are paid on time. If the owner reports the information, it will assist.

If you are late on your payments or are evicted from your home, they may still affect your credit score if they do not. You should not rely on information provided on WalletHub Answers for financial, legal, or investment advice. This site may display ads from third parties, in addition to those of paid advertisers.

You May Like: Which Credit Score Is Used For Home Loans

Grow Credit With Good Habits

Good credit habits include:

-

Paying your bills on time is crucial to growing your scores. Nothing counts more.

-

Light but regular use of your credit accounts is also important. Know your credit limit on each card and charge no more than 30 percent of that limit.

-

Pay balances in full. Theres no need to carry debt when your goal is growing your scores. If you do carry balances, try to pay them down as quickly as possible.

-

Avoid closing accounts if youre trying to improve your credit. Once your scores are high over 760 or so you can shutter an account or two without major damage, but try to keep your highest-limit credit cards open.

The Minimum Required To Calculate A Credit Score

For a credit score to be calculated, your credit report must contain enough informationand enough recent informationon which to base a credit score.Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit bureau within the last six months. What are the minimum requirements to have a FICO Score?

Recommended Reading: How To Better Your Credit Score

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates youre offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrowers application.

Theyll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the homes location, your down payment and loan type can all play into whether youll be approved and your mortgages terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Recommended Reading: How To Print Credit Report On Experian

Benefits Of Having A Good Credit Score

The Balance / Chloe Giroux

You can survive with bad credit, but its not always easy and definitely not cheap. Establishing a good credit score will help you save money and make your financial life much easier. If youre looking for reasons to maintain your good credit, here are some great benefits to having a good credit score.

Read Also: Is 805 A Good Credit Score

Which Credit Score Is Used For Car Loans

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Lenders can choose which credit score they want to use when evaluating your auto loan application. Different lenders might use different scores, and even the same lender might test several credit scores. As a result, you likely won’t know exactly which credit score the lender will see when you apply for an auto loan.

Improve Your Credit Score Before Buying A Car

If you check your credit scores and think it might be best to work on your credit before taking out an auto loan, here are some suggestions for improving your credit:

These actions could improve all of your credit scores, which can make it easier to get approved for an auto loan with a favorable rate.

Don’t Miss: What Credit Report Does Usaa Use

How Are Credit Scores Generated

When someone refers to a “credit score,” they’re generally referring to a three-digit rating that represents a borrower’s history of repaying loans and lines of credit. The credit score is generated by applying credit rating company’s algorithm like VantageScore® and FICO® to a borrower’s credit report.

What Credit Score Do You Need For Approval

For the most part, the minimum credit score needed for a personal loan approval will depend on the lender. Some lenders will tell you upfront what their minimum requirements are. Payoff Personal Loan, for example, requires a FICO score of 640 or higher for approval.

While lenders might approve loans to consumers with a wide range of scores, the terms will likely be better for those with higher scores.

“If you have a 760 credit score, they’ll give you different terms versus if you have a 580 credit score,” Droske says. “If you have a 580 credit score, a lender may still give you a loan, but they’ll adjust the terms accordingly because you’ll be seen as a riskier borrower.”

Having a higher credit score usually means you can be approved for lower interest rates and more favorable loan terms.

But while your credit score is an important piece of the puzzle, keep in mind that you’ll also need to provide some other crucial pieces of information like your annual income, employment status, social security number and details on how you’d like to use the loan.

“Before you have a bunch of different lenders run your credit, ask if they have a credit score requirement and what it is,” Droske says. “You can also ask what scoring model they use so you can see for yourself if your credit score currently falls in their required range.”

You May Like: How To See My Credit Score

How Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person. But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game. The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

Length Of Credit History

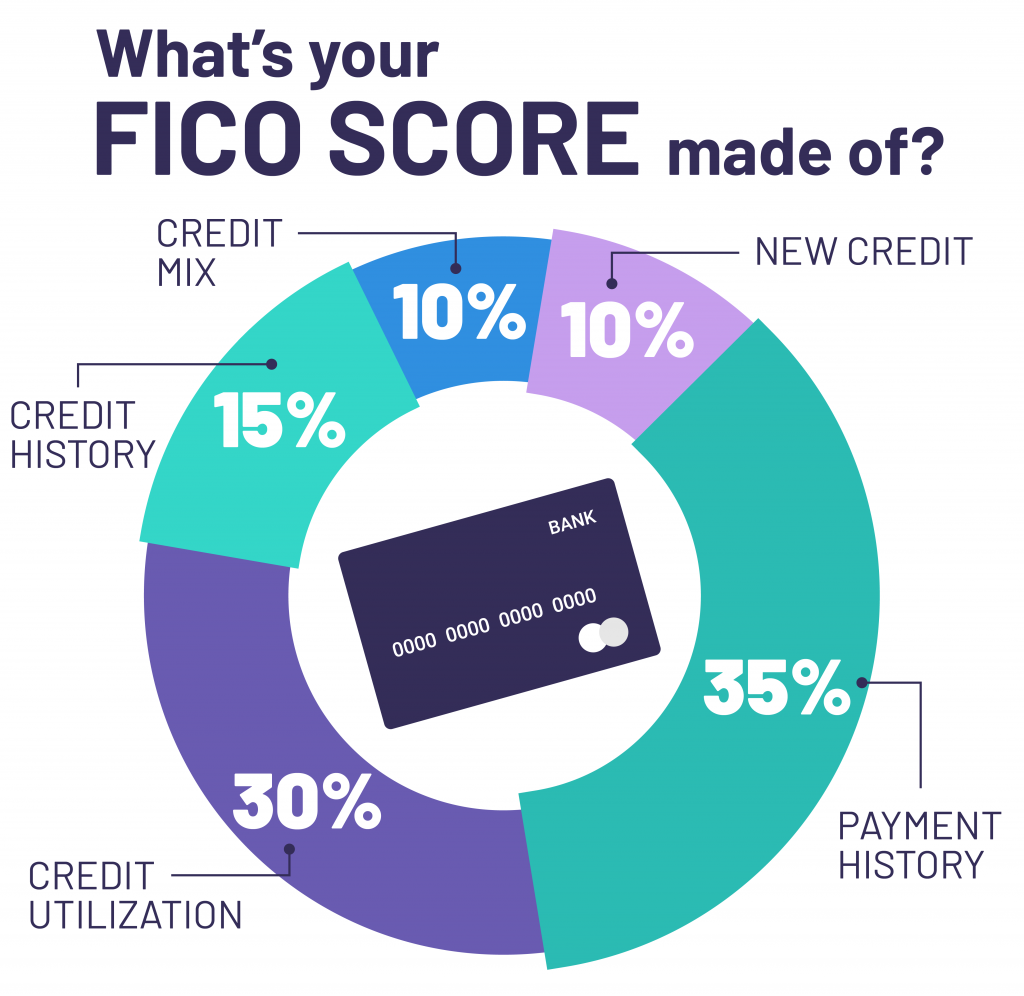

The length of your credit history makes up about 15% of your credit score. This takes into consideration how long accounts under your name have been open, including the average amount across all your accounts, as well as the length of your oldest open account. The older your accounts and your overall credit history, the larger time frame from which a company can accurately judge both your finances and behavior towards credit. A few years of data about a consumer is a better indicator for how they may act in the future than having only a few months’ worth of information.

Recommended Reading: Is 682 A Good Credit Score

Definition And Example Of Credit

For example, good credit signals to lenders that you are “creditworthy” or likely to be able to repay money you borrow. It instills confidence in lenders that they will get the loan principal plus any interest back from you, which makes you more likely to get approved for new credit with favorable terms, such as low interest rates or higher limits.

In contrast, if your credit history suggests to lenders that you cannot repay your debts, you are said to have poor credit, which can hurt you when you apply for a loan, because lenders will have less confidence that you can repay it.

How Credit Scores Work

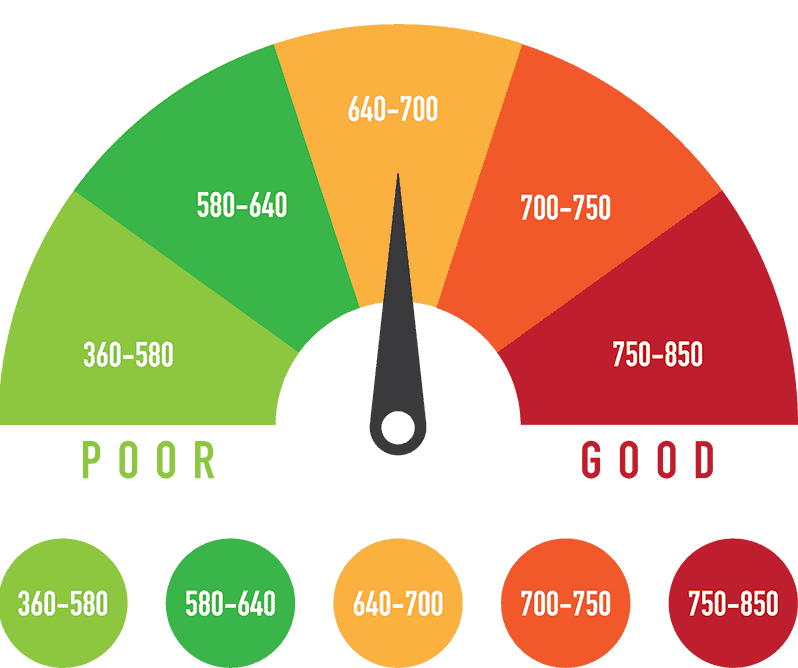

A credit score can significantly affect your financial life. It plays a key role in a lenders decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used.

- Excellent: 800850

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit that you take out.

A persons credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers scores, especially when deciding whether to change an interest rate or on a credit card.

What Is A Credit Score?

Read Also: How To Write A Credit Report Dispute Letter

Why Your Credit Score Matters

Your credit score affects:

The higher your FICO Score the more likely you are to get approved for a or loan plus, itll usually reduce the interest rate associated with that particular loan or card. Lower scores can raise your interest rates significantly, or may even disqualify you for a product or service completely.

Loans

For many credit cards, especially the most lucrative rewards cards, the cards are only offered to consumers that meet a minimum credit quality. Many of the best cards are exclusively marketed to consumers with excellent credit scores. And when it comes to credit cards, your credit score can determine the breadth of options you can choose from. Most cards are also marketed with a range of interest rates and APRs. The actual interest rate on your specific card will be inversely related to your credit score with higher creditworthiness receiving lower interest rates and vice versa.

Loans

With mortgages and auto loans, lenders behave similarly. Your credit score is used as a component of whether or not a bank will choose to approve a loan or may force you to make additional concessions for approval. It can and generally will move the interest rate you pay on the loan as well.

How Are Credit Scores Calculated

Your credit score is calculated using a points system, based on whats in your also known as your credit file which reflects how youve managed your debts and bills in the past.

For example, if youve always paid your bills on time, this would have had a positive impact on your score. But a history of missed or late payments would have had a negative impact.

If youve never borrowed money before, it’s difficult for lenders to assess the risk of lending to you and your credit score will reflect that.

Recommended Reading: Does Credit Karma Hurt Your Score

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

How Your Credit Score Is Calculated

Learn what your credit score is based on and the many ways you can improve it.

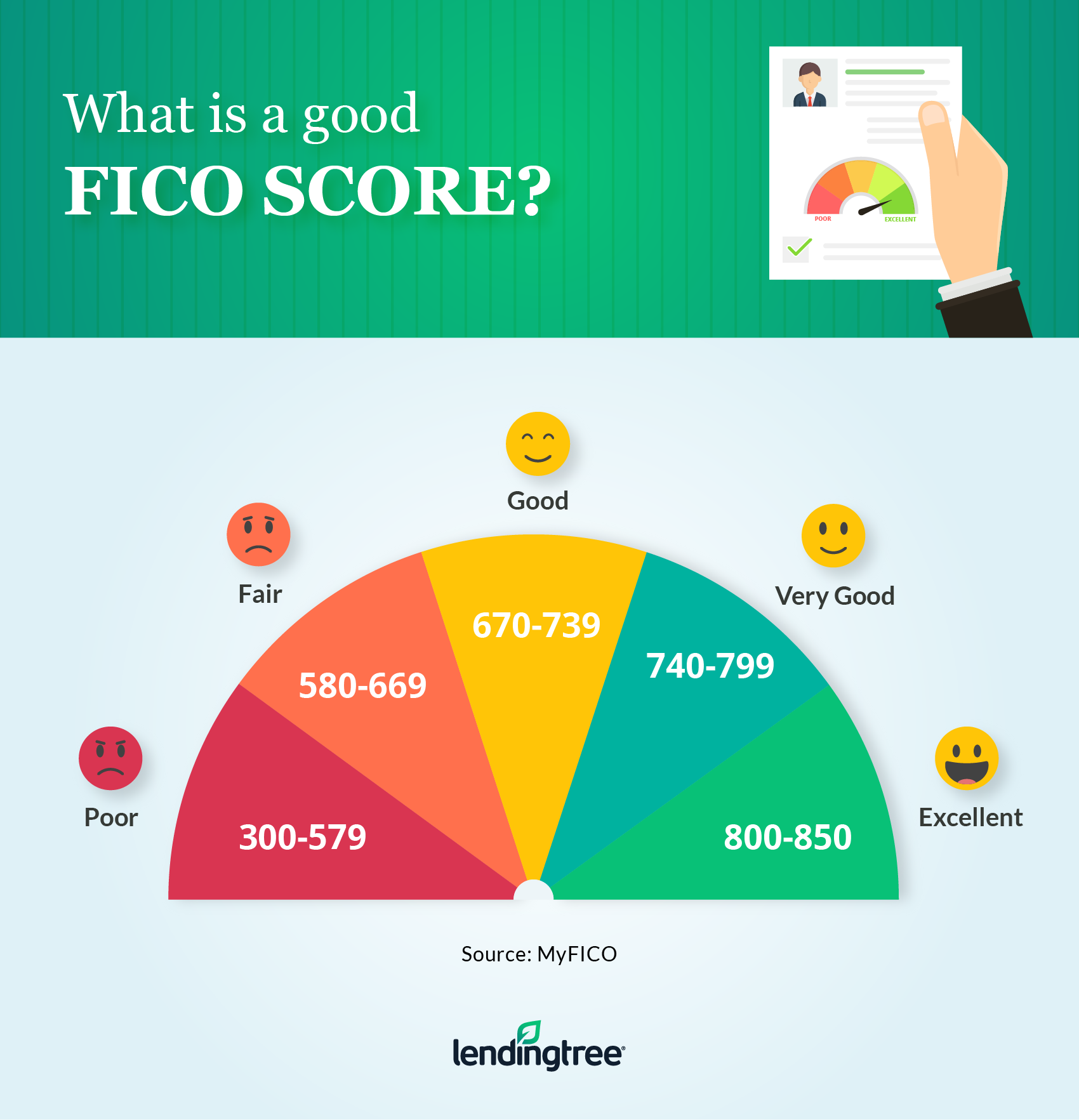

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Score, it’s a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. By understanding what impacts your credit score, you can take steps to improve it.

You May Like: What Is Thd Cbna On Credit Report

Whose Score Will Lenders Use

When you make a joint mortgage application, lenders could be evaluating as many as six credit scores three for each of you. While most lenders consider the applicant with the highest monthly income as the primary borrower, they often take the lowest middle credit score of both borrowers as their benchmark. While frustrating, this is just another example of conservative lending policy.

Recommended Reading: Do Utilities Affect Credit Score

The Fico Credit Score Model

The FICO® credit score model is calculated with software from Fair Isaac Corporation and is used in the majority of lending decisions. Lenders take your FICO® score into account to help make accurate, reliable and quick decisions regarding credit risk. FICO® scores range between 300 and 850 and are calculated using only information in a consumer’s credit report maintained by the credit bureaus. You must have a credit account at least six months old and activity during the past six months.

Generally, scores in the 670 to 739 range indicate that you have a good” credit history, which is considered favorable to most lenders. Borrowers in the 580-669 range may have a harder time obtaining financing at a desirable rate. This may be because of several factors including an insufficient credit history, a pattern of late payments, a default on a loan, a bankruptcy filing or other factors.

FICO® scores can be broken up into five ranges:

- Exceptional: 800+

- Fair: 580 to 699

- Poor: 579 and below

FICO® has more than a dozen credit scoring versions broken up into base scores and industry-specific scores. Base scores show your likeliness to repay things like your credit card bill or loans. Industry-specific scores represent the likeliness to repay things like auto loans or mortgages.

How is a FICO® score calculated?

FICO® breaks its scoring criteria down into five categories, with a percentage value based on how important the category is, which may vary for individuals.

Read Also: What Is A Credit Score Definition