How Long Do Collections Stay On Your Credit Reports

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

The long answer: Once the original creditor determines your debt is delinquent and sells it to a collection agency, the collection account can be reported as a separate account on your credit reports.

Assuming the collection information is accurate, the collection account can stay on your reports for up to seven years plus 180 days from the date the account first became past due.

Confused? Lets look at an example:

- Your account becomes late on

- After 180 days of nonpayment, your creditor charges it off on

- The original delinquency date is Jan. 1, 2018, but the account appeared on your credit report 180 days after that date. So the account should fall off your credit report by

Find Out How Long Credit Reporting Agencies Can Report Negative Items On Your Credit Report

By Carron Nicks

The federal Fair Credit Reporting Act dictates how long a negative item will remain your report. Some states have additional laws that limit reporting even further for their residents. Those laws won’t’ override the FCRA. Although, they can put more restrictions on the length of time the can report negative information.

The length of time information stays on your credit report depends on what’s being reported and whether the information is positive, neutral, or negative. The good news is, positive and neutral information can stay on indefinitely and might help improve your . Most negative information will drop off your reports after seven to ten years, but in rare cases, the info will appear longer than ten years.

Here are some common items and when you can expect them to drop off your reports.

How Will Collections Accounts Affect Your Credit

When a collection is added to your credit report, it can affect your score by as much as 110 points and take your credit score from fair to poor. The higher your score, the more points you can lose.

Collections tell potential lenders that you failed to pay back a debt and that you pose the same risk to them if they decide to lend you money.

Read Also: Remove Repossession From Credit Report

How Long Does Information Stay On My Credit Report In 2021

Rachel Surman

â¢7 min read

Article Contents

We get asked this question all the time: âHow long does information stay on my credit report?â

Itâs an understandable question, considering how important credit is to almost all of your financial decisions. Your credit report includes financial information about your credit history. Lenders report your bill payments to Canada’s credit bureaus, who update your credit report on a monthly basis. Missed or late payments are also reported, and this negative information is added to your credit report. Every time your credit report is updated, your credit score is likely to change as well.

You might be concerned about how long information stays on your report and how it will affect your credit score. You might wonder if lenders will see this information when they review your loan application, or if negative information on your credit report will impact your ability to find a rental apartment .

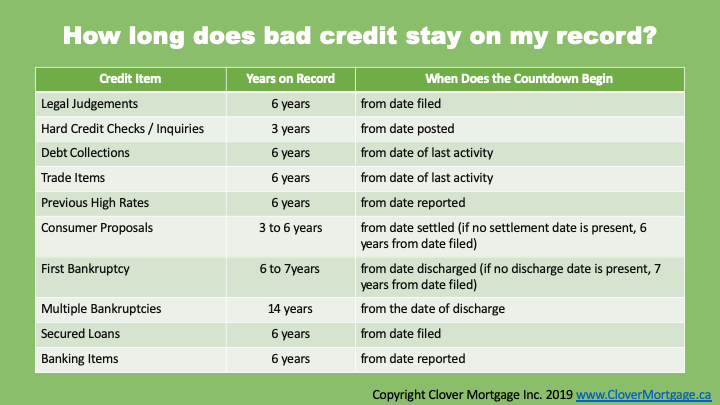

If youâre wondering when something will come off of your report, there are set time frames for items like bankruptcies and collections that Equifax has put in place. In general, most negative information is deleted from your file 6 years from the date of last activity.

Want to see your Equifax Credit Report?

How Long Can Student Loans Hurt Your Credit

We get questions and comments from distressed student borrowers wondering exactly how long missteps in repaying their student loans are likely to continue to hurt their credit. It can feel like student loans cast a very long shadow that is hard to escape.

How long student loan problems can affect your credit isnt always clear, because they dont all work the same way.

One thing is clear: If you have private student loans, they should be treated like any other negative event, cycling off your credit report after seven years from the date of the late payment. So a negative mark on your private loan will cease to hurt your credit after that time frame.

But there is one type of federal loan a Perkins loan that can stay on your credit report until the loan has been paid in full, even if it is longer than seven years. This is not true for other types of student loans. The special treatment of a Perkins loan was a provision of the Higher Education Act. Perkins loans are distributed by colleges, and they are a need-based type of loan, with interest deferred while the student is still in school. No other type of student loan delinquency stays on your credit report until the loan is paid off.

Featured Topics

Delinquencies and defaults are reported for seven years, though Yu notes that those can happen more than once, and if that happens, there will be a new negative item that will be on the credit report for seven years.

Get Your Free Credit Score & Monitoring

Recommended Reading: Mprcc On Credit Report

If You’ve Been Contacted About Child Maintenance Arrears

If you get a bill for child maintenance you should:

- ask for a detailed statement and check this against what you think youve paid

- check how much child maintenance youre paying – use the child maintenance calculator on GOV.UK to check youre paying the right amount

- check if youve told the Child Maintenance Service about any changes in your circumstances – this can affect the amount you should pay

If you think the amount is wrong, you might be able to appeal or ask for a review. You should contact the Child Maintenance Service. Check how to contact the CMS on GOV.UK

If you dont pay your child maintenance the action that can be taken depends on the kind of arrangement you have. Check what to do if you owe child maintenance.

If your child maintenance arrears are because of payments you missed a long time ago, you might be able to get them written off. This will depend on what type of child maintenance agreement you had. You wont be able to get the arrears written off if you should still be paying child maintenance.

If you think your child maintenance arrears are old and youre not sure if you have to pay, get help from your nearest Citizens Advice.

How Long Does A Collection Entry Remain On Your Credit Bureau

Regardless of whether you paid the collection amount owing or not, the collection entry will stay on your credit report for seven years. As a result of this, for seven years, the collection entry will impact your chances of applying for new credit.

The unfortunate part is that even if they approve your credit, youre almost always going to pay a higher interest rate. As the collection entry gets older, it will affect your credit score less and less.

You May Like: Does Paypal Credit Report

Check If The Time Limit On A Debt Has Passed

For most debts, if youre liable your creditor has to take action against you within a certain time limit. Taking action means they send you court papers telling you theyre going to take you to court.

The time limit is sometimes called the limitation period.

For most debts, the time limit is 6 years since you last wrote to them or made a payment.

The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

If youve already been given a court order for a debt, theres no time limit for the creditor to enforce the order.

If the court order was made more than 6 years ago, the creditor has to get court permission before they can use bailiffs.

After the time limit has passed, the debt might be statute barred this means you dont have to pay it.

Your debt could be statute barred if, during the time limit:

- you , havent made any payments towards the debt

- you, or someone representing you, havent written to the creditor saying the debts yours

- the creditor hasnt gone to court for the debt

Check the date that you last made a payment to find out if your debt is within the time limit.

If you know your debt is still well within the time limit and isnt statute barred, you should make sure you’ve collected information about all of your debts.

You can find out more about what to do if you’re being taken to court for debt.

Why Do Closed Accounts Stay On Your Credit Report

A credit report is a detailed document listing information about how you’ve handled borrowed money. You have a credit report from each of the three major credit bureaus Equifax, Experian and TransUnion which get data about your accounts from lenders and compile it. That data is then used to calculate your credit scores.

Your reports list both positive and negative information about how you manage credit. For instance, if you always pay your car loan on time, it will be listed as in good standing. On the other hand, if youve paid late, that will be noted.

Including both open and closed accounts gives more data about your use of credit, which helps credit scores more accurately portray what type of customer you are.

Its a common misconception that your credit report includes only information about your active accounts. Unless you have a very limited credit history, your credit report is probably full of data about closed accounts, like loans and credit cards you paid off years ago.

Also Check: Is Credit Wise Accurate

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

How Do I Build A Good Credit History

Establishing a good credit history takes time. If you have steady income and have used the same mailing address for at least one year, you may wish to apply for credit with a local business or department store, or for a secured loan or credit card through a financial institution. Paying credit obligations on time will help you develop a good credit history and may enable you to obtain additional credit in the future.

When filling out credit applications, it is important to use complete and accurate personal information, including your formal or legal name. You may also wish to see if the company reports account information to a credit reporting company. Companies are not required to report account information, but most do.

Each creditor has different requirements for issuing credit. If you are denied credit, contact the creditor to find out why. You may be denied credit for various reasons, including not meeting the creditor’s minimum income requirement or not being at your address or job for the required amount of time. You can overcome these obstacles with time.

Also Check: Does Speedy Cash Report To Credit Bureaus

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

What If The Collection Agency Sues Me

If the collection agency sues you, stick to your guns: you can win. This flowchart shows you the path to victory in a debt collection lawsuit. Pre-lawsuit, make sure to send the collector a Debt Validation Letter telling them you dispute the debt and requesting validation of the debt.

If they sue you, be sure to file an Answer in court. This will make it more likely they give up and the case gets dismissed. If not, you can angle for a settlement with a Debt Lawsuit Settlement Offer Letter.

Don’t Miss: When Do Companies Report To Credit Bureaus

What You Can’t Change Or Remove

You can’t change or remove any information on your credit report that is correct even if it’s negative information.

For example:

- All payments you’ve made during the last two years on credit cards, loans or bills, whether you paid on time or not.

- Payments of $150 or more that are overdue by 60 days or more these stay on your report for five years, even after you’ve paid them off.

- All applications for credit cards, store cards, home loans, personal loans and business loans these stay on your report for five years.

For a full list, see what’s in your credit report.

Avoid credit repair companies that claim they can clean up this sort of thing or fix your debt. They may not be able to do what they say. They may also charge you high fees for things you can do by yourself for free.

Paying a credit repair company is unlikely to improve your credit score.

What To Know About Old Debts

What if my debt is old?

Debt doesnt usually go away, but debt collectors do have a limited amount of time to sue you to collect on a debt. This time period is called the statute of limitations, and it usually starts when you miss a payment on a debt. After the statute of limitations runs out, your unpaid debt is considered to be time-barred.

If a debt is time-barred, a debt collector can no longer sue you to collect it. In fact, its against the law for a debt collector to sue you for not paying a debt thats time-barred. If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out.

How long the statute of limitations lasts depends on what kind of debt it is and the law in your state or the state specified in your credit contract or agreement creating the debt.

Also, under the laws of some states, if you make a payment or even acknowledge in writing that you owe the debt, the clock resets and a new statute of limitations period begins. In that case, your debt isnt time-barred anymore.

Can a debt collector contact me about a time-barred debt?

Sometimes. It depends on which state you live in. Some state laws say its illegal for a debt collector to contact you about a time-barred debt. But even if you live in a state where a collector may still contact you, they cannot sue or threaten to sue you over a time-barred debt.

What if Im not sure if my debt is time-barred?

Does a time-barred debt stay on my credit report?

Recommended Reading: How Accurate Is Creditwise Credit Score

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

Should I Try To Get Rid Of Closed Accounts On My Credit Report

Don’t try to remove a paid-off mortgage, car loan, credit card or other accounts from your credit report if they show a positive payment record. That good record will continue to help your credit scores.

If you have negative marks on the account, however, you want it off as soon as possible. You can use AnnualCreditReport.com to get free reports from the bureaus every 12 months to verify negative information has been removed as required by law. If a negative mark is lingering, you can file a dispute.

Many credit scoring models now exclude paid-up collections accounts. But because some lenders still use older scoring models, you may want to try removing collections from your reports.

Read Also: Does Opensky Report To Credit Bureaus

How Long Will A Paid

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. Thats because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score.

You can check your free credit report on NerdWallet to see when an account is reported as being closed.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more