How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

How Do I Get Access To Information On My Credit Reference File

You have the right to request a copy of the information held about your financial standing from any of the CRAs. Making this request is free of charge. You can make a request verbally or in writing. The CRAs also usually provide an online form you can use to apply. If you make your request verbally, we recommend you follow it up in writing to provide a clear trail of correspondence. It will also provide clear evidence of your actions.

If you make your request in writing, your letter should include:

- your full name

- any other names you have used or been known by in the last six years eg your maiden name

- your full address including postcode

- any other addresses you have lived at in the last six years and

- your date of birth.

You should keep a copy of your letter and you may want to send it by recorded delivery to demonstrate that your request has been sent and received. Unless the CRA needs more information, they have one month from receiving your request to respond. In certain circumstances they may need extra time to consider your request and can take up to an extra two months. If they are going to do this, the CRA should let you know within one month that it needs more time and why.

The addresses of the CRAs are:

Equifax Ltd

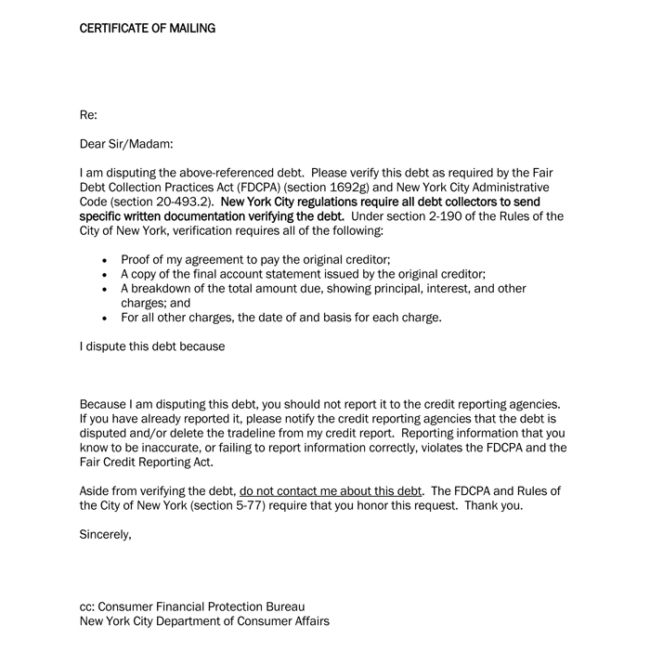

Review Your Credit Report For Errors

If you notice inaccurate information reporting on your credit report, it is important to dispute the inaccurate information with the Credit Reporting Agencies . Start your dispute .

If you are unsure how to read your credit report and you would like help in reviewing your credit report, please contact us at 1-877-FCRA-LAW , and we will be happy to assist you.

You May Like: Credit Report With Itin

How To Get Your Free Credit Report & Check Your Credit Score

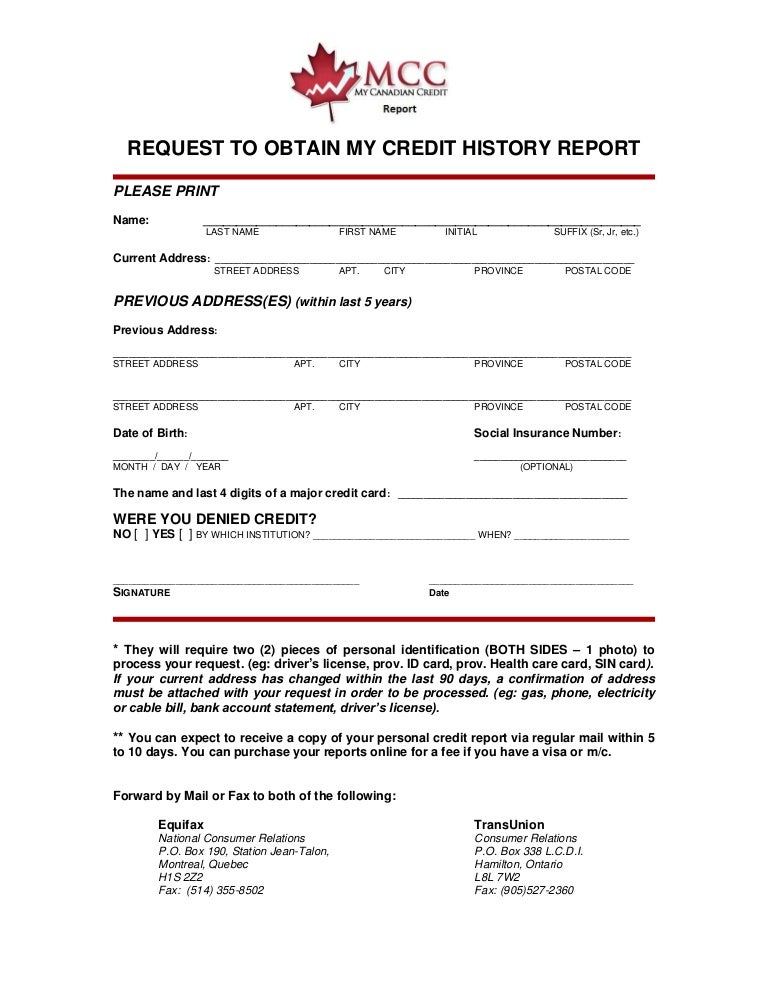

3 Ways to Get Your Credit Report in Canada

In Canada, there are a number of ways you can check your credit report for free. The first options listed below are free but the last one option costs money. You can obtain a free credit report from each of the two credit reporting agencies, Equifax and TransUnion, once a year for no charge.

Historically, if you wanted your free credit report it was sent to you in the mail and did not contain your credit score. The credit reporting agencies required you to pay to find out your credit score. However, things are changing. Both companies now allow you to try and obtain your credit report for free online, and Equifax is currently allowing people to see their credit score for free. The online method doesn’t work for everyone, though, and for this reason, we have many more methods listed below. We should also mention, that you can also ask your banker for your credit score when you apply for credit or when you open a new bank account. You can also use a free credit score estimator calculator to get a rough idea of your score. We recommend that you get a copy of your credit report from both Equifax and TransUnion as the information on each report may be different.

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Don’t Miss: Cricket Affirm

You Need Irs Letter 6419 For The Rest Of Your Child Tax Credit Money

Ensure you get your full expanded child tax credit money by keeping this important letter from the IRS.

The IRS started sending Letter 6419 in December and will continue to mail it through January.

Tax season starts Monday, Jan. 24. That means it’s almost time for you to get the rest of your child tax credit money. Parents who didn’t opt out of advance payments received half of their money in 2021. Those parents and those who unenrolled from advance payments can both receive their remaining expanded child tax credit money after filing their 2021 taxes.

To ensure you get that money, you’ll need to be on the lookout for a specific letter from the IRS with important information about your child tax credit. The IRS started mailing copies of Letter 6419 in late December and will continue to send more letters throughout January. The agency is urging you to hold on to the notice as you’ll need it when you file your 2021 taxes.

We’ll tell you what the letter contains and why you shouldn’t throw it away. For more information, here’s everything to know about the upcoming child tax credit payment. Also, here’s what to do if you’re having issues with a missing payment.

Request Your Free Credit Report From Other Consumer Reporting Agencies

There are many other consumer reporting agencies aside from TransUnion, Equifax, and Experian. You have a right to a free annual credit report from each of these agencies as well. Each should provide information on their website regarding how you can request a free copy of your report. If you have trouble requesting your report from another consumer reporting agencies, feel free to contact us.

Read Also: Chase Sapphire Preferred Credit Score Requirement

I Received A Copy Of My Credit File And There Is No Electoral Roll Information On There I Am Definitely Registered To Vote And This Has Caused My Credit Score To Drop What Can I Do About This

If you find that your electoral roll information is inaccurate, or missing, from your credit file the first thing you should do is raise this as a dispute with the CRA that you obtained your credit file from. They can, in the first instance, try and match you to the correct information. There are easy mistakes to identify such as an obvious mis-keying of a house number or misspelling of a name and in these cases the correct information can be merged, or separated as appropriate. The CRA should reply to let you know that they have resolved the issue or, if they are unable to, explaining why.

If, after raising a dispute with the CRA they have failed to resolve the issue you may want to make a complaint to the ICO. You can find more information about how to make a complaint and the evidence we require in section 5 of our guidance.

You may also wish to contact your local authority as well to ensure that the information regarding your address is correct, for example, the right postcode, flat number, etc.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Read Also: Is A 524 Credit Score Good

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

How Lenders Use Credit Reports

Be aware that different lenders look for different things when reviewing your credit report and deciding whether to lend to you. They can also take other factors into account.

For example, you might have been furloughed and taken a payment holiday during the coronavirus pandemic. While this won’t directly affect your credit score, it may affect your ability to borrow in the future.

Also Check: 766 Fico Score

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Also Check: How Long Do Repos Stay On Your Credit

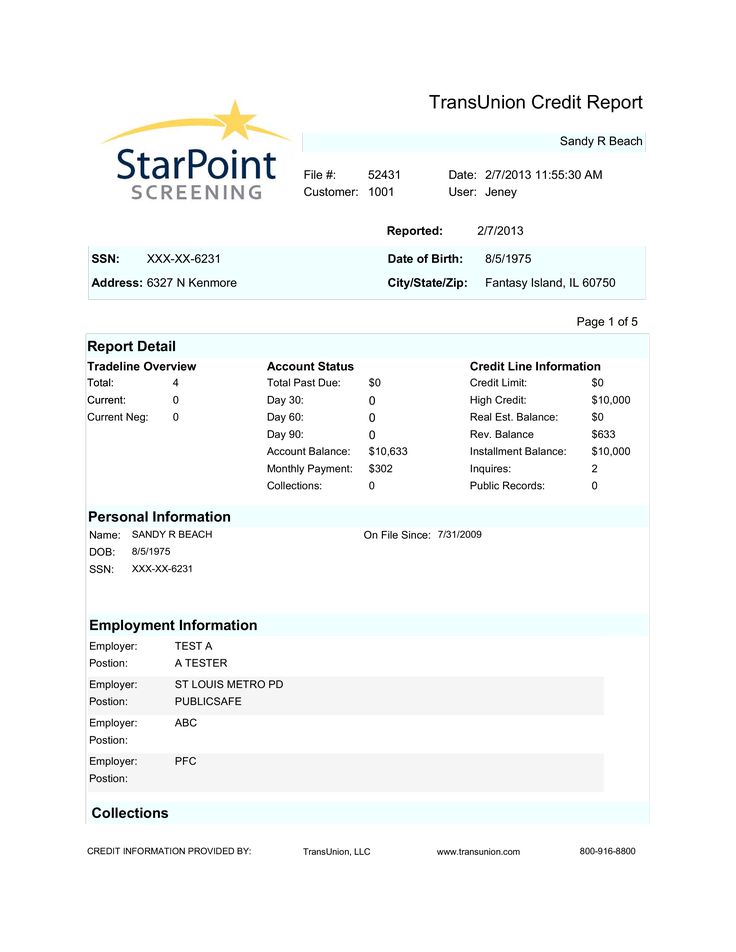

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

Read Also: How To Report To Credit Bureau As Landlord

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Why Did I Receive Irs Letter 6419

Letter 6419, “2021 Advance Child Tax Credit”, includes information such as the total amount of advance tax credit payments your family received in 2021, and how many qualifying children the advance payments were based on.

If you received advance payments of the child tax credit, you will need to file a 2021 tax return and compare the payments with the amount you were eligible for.

Recommended Reading: Remove Eviction From Credit

How Often Should I Check My Credit Report

Its generally recommended that you check your credit reports a minimum of one time a year, but you can check them as often as you like. Before you apply for credit, it can be a good idea to review your reports for errors to increase your chances of securing more favorable terms, such as lower interest rates.

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

You May Like: Usaa Credit Card Credit Score

Why Your Credit History Is Important

When you apply for a loan or other type of credit, such as a credit card,overdraft, HP or personal contract plan , the lender has to decide whetheror not to lend to you.

The information on your credit report can be used to decide:

- Whether to lend to you

- How much to allow you to borrow

- How much interest to charge you

Under EUlaw, lenders must assess your creditworthiness before agreeing to give youa loan. Creditworthiness means your ability to repay the loan. This assessmentmust be based on the information you provide as part of your loan application,and also on the information in your credit report.

Information in your credit report may mean that lenders could decide not tolend to you, even if you have the income to repay the loan. They could refuseyour loan if they believe they might be taking a high risk in lending toyou.

If you are applying for an overdraft, mortgage, credit card or other type ofloan, it is a good idea to check your credit report before you apply. It canhelp you spot any missed payments you did not realise were missed, or mistakesin your credit report.

Importantly, you can get incorrect information corrected. You also have theright to add a statement to your credit report to explain any specialcircumstance see Rules below.

What Are Credit Reference Agencies

The three main consumer CRAs in the UK are Equifax, Experian and TransUnion.

Most of the information held by the CRAs relates to how you have maintained your credit and service/utility accounts. It also includes details of your previous addresses and information from public sources such as the electoral roll, public records including county court judgments, and bankruptcy and insolvency data.

The information held by the CRAs is also used to verify the identity, age and residency of individuals, to identify and track fraud, to combat money laundering and to help recover payment of debts. Government bodies may also access this credit data to check that individuals are entitled to certain benefits and to recover unpaid taxes and similar debts.

CRAs are licensed by the Financial Conduct Authority.

Also Check: Qvc Card Approval

There Is A Ccj On My Credit File That Has Nothing To Do With Me What Can I Do

Because information relating to county court judgments is often received from the courts without the individuals date of birth this can sometimes lead to mix ups particularly where people with the same name live at the same address.

If this has happened to you, you should raise this as a dispute with the CRA who you obtained your credit file from. They can, in the first instance, try and match you to the correct information. There are easy mistakes to identify such as an obvious mis-keying of a house number or misspelling of a name and in these cases the correct information can be merged, or separated as appropriate. The CRA should reply to let you know that they have resolved the issue or, if they are unable to, explaining why.

If, after raising a dispute with the CRA they have failed to resolve the issue you may want to make a complaint to the ICO. You can find more information about how to make a complaint and the evidence we require can be found in Section 5 of our guidance.