What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Credit Score Mortgage Rate: What Kind Of Rates Can You Get

An 800 credit score usually comes with low mortgage rates and can help you save thousands of dollars over the life of your loan.

Kim PorterUpdated April 28, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youve managed to earn a credit score of 800 or higher, congratulations! Youve achieved one of the highest scores out there. Credit scores stretch from 300 to 850, and the average Americans score sits at 711 as of October 2020.

Generally, a high credit score shows youve managed debt responsibly in the past and it comes with benefits. Aside from bragging rights, an exceptional credit score makes you an attractive borrower for mortgage lenders and puts the best interest rates within your reach.

Heres what you need to know about credit scores of 800 or higher:

Perfect Score Vs Average Score: Credit Profiles

People with perfect FICO® Scores carry debtthey just do it differently from those further down the scoring scale. U.S. consumers with perfect scores have more tradelines, or credit products, but less average debt than those with the average FICO® Score, which in the fourth quarter of 2018 was 701.

People with FICO® Scores of 850 carried an average 6.4 credit cards compared with the national average of 3.8 credit cards. When it came to credit card debt, however, Americans with perfect FICO® Scores owed less than half the U.S. average: an average $3,025 compared with the national average of $6,445.

In every other debt category except mortgage and personal loan, people with perfect scores had more open tradelines but less debt than their counterparts with average scoresunderscoring the value of being able to manage debt while having numerous credit accounts.

You May Like: Why Is There Aargon Agency On My Credit Report

How To Calculate A Credit Score

These 5 points are very important when your credit score is calculated, but its not an exhaustive list of criteria. Lenders take more things into account, such as the ratio between your income and debt, to determine creditworthiness.

However, if you pay your bills on time, start a credit history as soon as possible, and diversify your debt, you have good chances of fixing bad credit score. The average of 703 might not be that unattainable.

So does paying a mortgage improve your credit score? What about paying off a student loan?

Yes, it helps.

Whats interesting is that the average credit score has seen continuously growing in the past 10 years.

5. In 2019 the average credit score higher by 14 points compared to 2010

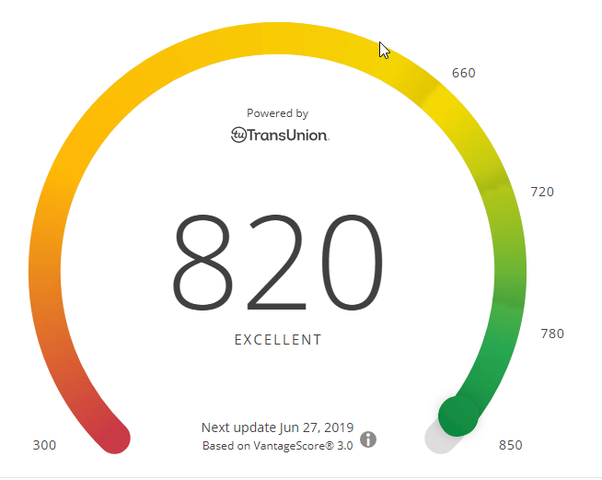

How To Improve An 820 Credit Score

Increasing an 820 credit score to 850 wont change your loan options. Lenders see scores above 820 as relatively the same score and dont break down mortgage and loan rates further.

However, if you want to increase your 820 credit score to 850 to allow for more breathing room within the Exceptional credit range, heres how you can do it.

Read Also: Does Paypal Credit Report To Credit Bureaus

Getting Mortgages With 820 Credit Score

820 FICO credit score qualifies you for the best mortgage terms available, which can mean saving up to 1% on your mortgage interest overall. Over the course of your loan, this means thousands of dollars in savings. Interest rates should hover around 4%. While improving your credit wont make much of a difference at this point, you can decrease your interest rates further in a variety of ways, such as making your home environmentally friendly or making a larger down payment.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 820 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 820 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

What Is The Average Credit Score By Age

Understandably, seniors have the highest credit scores.

14. Americans aged 60 and above have an average credit score of 749

It takes time to build up your credit score, and the more time passes the more financially stable you usually are. That shows in credit risk evaluations.So, anyone below the age of 20 will not have a good credit score because theyre yet to enter the labor market and qualify for credit cards and loans.

Millennials credit score at the moment is right below the average for the country with 673 points, which are considered fair.

You May Like: Does Barclaycard Report To Credit Bureaus

Age Of Your Credit History

Another factor weighed in your credit scores is the age of your credit history, or how long your active accounts have been open.

Canceling a credit card can affect the age of your credit history, especially if its a card youve had for a while, so weigh that potential impact when youre deciding whether to close a card. Only time can offset the impact of closing an older account, but youll also lose the credit limit amount on a closed card, which can negatively affect your credit utilization rate.

Heads up that card issuers may decide to close your accounts if youre not actively using them, so make sure you keep any accounts you dont want closed active with at least an occasional minimal purchase.

The Three Credit Reporting Agencies And Different Types Of Credit Scores

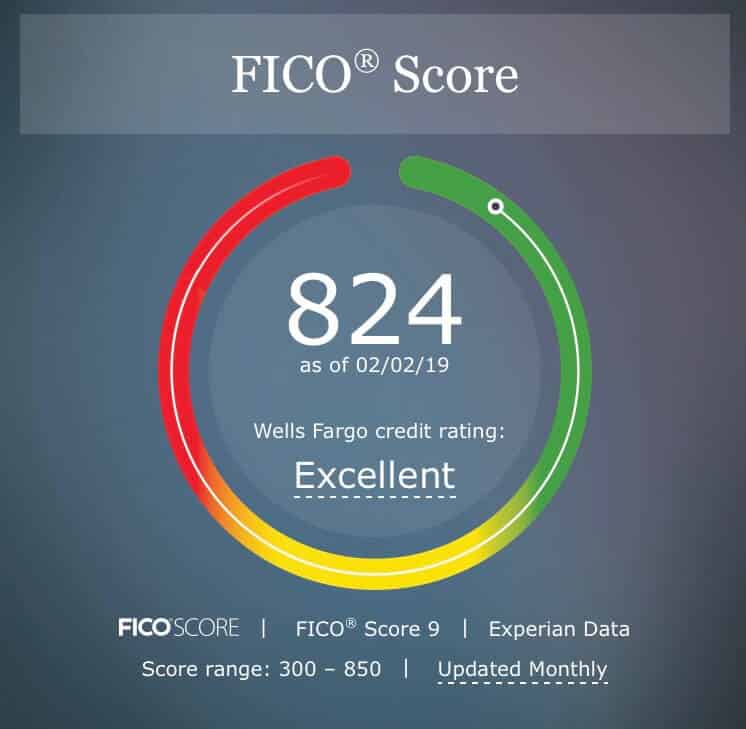

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 820 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

Do You Need An 850 Credit Score

Nothing magical will happen if your credit score of 820 ticks up to 850. And most importantly, you probably wont save more money. You dont need to take our word for it, though. We consulted a panel of financial experts, all of whom said the same thing.

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

Don’t Miss: Paypal Credit Hard Pull

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

Don’t Miss: How Accurate Is Creditwise

What Are The Highest Fico Scores Ever Reported On This Forum

In my files today, I came across some FICO scores I ordered back in 2008 when you could still buy all three agency FICOs thru MyFICO.com. My Experian FICO was 837. At the time, I didn’t understand how unusual it was to be just 13 points from the maximum 850.

I came across this article saying the highest FICO score of anyone in the U.S. as of August 2011 is 834. It was written by John Ulzheimer, who formerly worked at FICO and is an expert on credit score issues. But he doesn’t say where he got this info from.

This got me to thinking: what are the highest FICO scores ever reported here?

I found this Nov 2011 post from psychic on this forum where his signature shows an Experian FICO of 842. Maybe we should tell John Ulzheimer that we have a new national FICO champion on this board.

Sadly, my FICO is much lower today. But it was a pleasant surprise to come across those old reports.

——————————————————-

Below is a summary of my 2008 Experian credit report. My other 2008 scores were EQ 809 and TU 796.

FICO score: 837

Average age of accounts: 17 years

Total credit line of open accounts: $39,100

Accounts with current balance: 2___$488 on card with 10,300 credit line ___$627 on card with 14,300 credit line

Accounts opened in past year: 0

Inquiries in past year: 0

Youll Qualify For Lower Interest Rates And Higher Credit Limits

With an 800-plus credit score, you are considered very likely to repay your debts, so lenders can offer you better deals. This is true whether youre getting a mortgage, an auto loan, or trying to score a better interest rate on your credit card.

In general, youll automatically be offered better terms on a mortgage or car loan if you have an exceptional credit score . If you have an existing loan, you might be able to refinance at a better rate now that you have a high credit score. Like any refi, crunch the numbers first to make sure the move makes financial sense.

Credit cards are different, and you might have to ask to get a better deal, especially if youve had the card for a while. If your credit score recently hit the 800-plus rangeor if youve never taken a close look at your terms beforecall your existing credit issuers, let them know your credit score, and ask if they can drop the interest rate or increase your credit line. Even if you dont need a higher limit, it can make it easier to maintain a good .

Recommended Reading: Zzounds Credit Approval

Best Used Car Rates 820 To 829 Credit Score

According to a Federally funded study on used auto loans, people with a credit score of 825 were likely to save over $4,000 as compared to a prime borrower.

Grandpa always said that as soon as you buy a new car and drive it off the lot, it loses thousands of dollars in value.

Stands to reason, that getting the best used car rates should further help save you potentially thousands of dollars by choosing to purchase a used car over a new one.

But heres the thing

If your credit score is in the 820s, you should qualify for a super prime APR rate, which should be the best rates available.

| Used Auto Loan Amount | |

|---|---|

| $557 | $415 |

*Sample Quote For Credit Scores Of 821, 822, to 826, & 827: Assumes $2,000 down payment. Scores sourced from Nerd Wallet site and are accurate as of 10/11/19. All loan payment amounts are based on a used car loan APR interest rate of 4.34% for prime borrowers with a credit score of 780 to 850. The loan terms included in this chart are for 3 years , 5 years , and 7 years . However, speak to your lender about additional loan options, including mortgage loan terms that cover 1 year , 2 years , 4 years , 6 years , 8 years , 9 years , and 10 years . This is not an offer for a loan or a loan approval. Rates and stipulations change by state, income, credit score, and a variety of other factors. For informational purposes only.

Say you have a credit score of 823 or 825

You can definitely refinance with this score!

| Refinance Auto Loan Amount | |

|---|---|

| $657 | $449 |

What Is A Credit Score

A credit score represents the creditworthiness of an individual or the likelihood that this person will pay their debts to a lender. The higher the credit score, the more trustworthy the person is in the eyes of the bank.

In order to get to the final score, a credit score agency collects and evaluates account data from various creditors. In the United States, the agency that gathers credit score information is the FICO .

1. FICO data analytics company was founded in 1956

The company was founded by Bill Fair and Earl Isaacs with the purpose of evaluating credit risk. Since its establishment, it has become a driving force of the credit risk evaluation in the United States.The FICO score is used by the majority of the banks and other lenders to evaluate potential borrowers. The score relies on consumer credit files from the three national credit bureaus Experian, Equifax, and TransUnion.For a long time, FICO was the primary source of credit score statistics but in recent years a new competitor has emerged.VantageScore is another consumer credit-scoring model, and its a creation of the national credit bureaus.

2. VantageScore was formed in 2006 and is jointly owned by Equifax, Experian, and TransUnion

Also Check: Does Zebit Report To Credit