How To Read Credit Report Codes

Warning

Keep your credit reports in a safe place. Most of them contain identifying information that could be used for fraud or identity theft.

Tip

Save your credit reports so you have an accurate view of your total credit history. This will help you spot changes and errors from one year to the next.

It’s a good idea to get a copy of your credit report from each reporting agency once per year. This will give you valuable information on who has been accessing your report and why, whether there are errors on your report that negatively affect your credit score, and whether or not you are a victim of credit fraud. However, once you’ve received a copy of your credit report, it can be hard to figure out what all of those codes mean. Learn how to decipher what credit reporting agencies are saying about you.

How Do You Dispute A Credit Inquiry

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

Get Free Help From Consumer Protection Lawyers

Factual Data Ignore Your Dispute? If you have tried to dispute your Factual Data credit report and they have not made corrections after 30 days, it may be time to get legal help. Assert your rights. Do not let Factual Data credit report errors keep you from getting a home or the credit you deserve. Has your dispute with Factual Data been ignored? Did reports provided by Factual Data, AmRent, or DataVerify cause you to be denied housing? Did the Factual Data credit report cause you to be denied credit?

The consumer protection attorneys at Francis Mailman Soumilas, P.C. can help you.

We have been fighting for the rights of consumers for over 20 years against false credit reporting. We know how serious these reports are and the major impact errors can have on your life. The case review is free. If you have a case, there is not out of pocket cost to you. We only get paid when we win money for you.

If you need help call us at 1-877-735-8600 or fill out the form on this page and a representative from Francis Mailman Soumilas, P.C. will be in touch.

Factual Data Contact Information

Don’t Miss: Does Klarna Improve Credit Score

Factual Data Announces Integration With Lendingpad

LOVELAND, Colo.—-Oct 31, 2018–Factual Data, one of the nations premier providers of credit and data verification services to lenders nationwide, today announced an integration of its credit reporting capabilities with LendingPad , a leading provider of loan origination software headquartered in McLean, VA.

This integration allows clients to order tri-merged credit reports directly from Factual Data. Credit reports are merged in LendingPads document management system and liabilities data is updated in real time. The integration is available to all LendingPad users and will automatically populate credit information into the platform.

Factual Data is committed to providing our customers with innovative products and services to support their evolving business needs, said Factual Data President, Jay Giesen. This integration providing tier one credit reporting capabilities from Factual Data with LendingPads innovative loan origination system is another example of that commitment in action.

LendingPad is proud to be at the forefront of mortgage lending technologies working with industry leaders together to enhance origination process, said LendingPads Managing Director, Wes Yuan. Our mutual customers will immediately enjoy the convenience and benefits of Factual Data credit products inside of LendingPads platform.

About Factual Data

About LendingPad

View source version on businesswire.com:

Jones V Lexisnexis Risk Solutions Inc Et Al

Filed: August 7, 2020§ 2:20-cv-01180

A class action alleges LexisNexis and Kroll Factual Data have failed to take reasonable steps to ensure the consumer reports they furnish and sell are accurate.

Pennsylvania

New to ClassAction.org? Read our Newswire Disclaimer

A proposed class action alleges LexisNexis Risk Solutions, Inc. and Kroll Factual Data, Inc. have failed to take reasonable steps to ensure the consumer reports they furnish and sell are accurate.

LexisNexis, which prepares and furnishes consumer reports that include civil judgments and tax liens, diligently collects the initial entry of such derogatory consumer information yet fails to report when the judgments and liens are satisfied, withdrawn, or released, the case alleges.

The plaintiff claims Kroll purchases consumer records from LexisNexis to include in credit reports for mortgage loan applicants despite knowing of the problems and failures of the LexisNexis record collection procedures and without taking adequate steps to verify the accuracy of the reports.

The inaccuracies in the reporting of tax liens and civil judgments have been the subject of multiple lawsuits, the case relays, with the credit bureaus entering into a;multi-state settlement;in 2015 in which they agreed to only report public records if the information was updated every 90 days.

The lawsuit looks to represent the following two proposed classes:

Also Check: How Long Does Repossession Stay On Credit Report

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Get Your Inquiries Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Don’t Miss: How To Get Credit Report Without Social Security Number

Does A Credit Report Show The Full Picture

Critical thinking is important when looking at a credit report.

Whether a persons credit score is exceptionally high or low, you need to figure out the why. For instance, lets consider the credit scores of Applicant A and B.

Applicant A

This person has a credit score of 580.

They lost their job last year and couldnt pay their student loans, which sabotaged their credit history. However, during their loss of income, they chose to continue paying their rent. In other words, they prioritized their payments to their landlord over their other obligations, even to the detriment of their credit score.

They recently got a new job and are current on their payments again, but it will take time to fix their credit score.

Applicant B

This person has a credit score of 780.

Their credit score appears to be very good because they owe money on several loans, and theyve always paid on time. However, they also have $20,000 in credit card debt and no history of making rent payments. Their borrowing capacity is already highly leveraged, and we arent sure which payments they would prioritize if they lost their job tomorrow.

When you compare both applicants and understand the FULL picture of why their credit scores are high or low , you may start to see how a low credit score doesnt necessarily mean someone will be a bad tenant. Conversely,;a high credit score doesnt necessarily mean their payments will come with a stronger guarantee.

Get Help From A Credit Repair Company

With the tools and resources provided by the FCRA, you are fully equipped to dispute an inaccurate entry on your credit report, but you dont have to go it alone.

Sometimes, it can be easier to leave disputing entries to the experts.

A good credit repair company can help to straighten out reporting errors, break down your credit report, and come up with a gameplan to tackle your biggest credit issues to improve your score quickly.

To give you an idea, here are some of the types of problems credit repair companies deal with:

Heres contact information on Factual Data:

- Address: 5100 Hahns Peak Drive Loveland, Colorado, 80538

- Phone Number: 663-5700

- Website: http://www.factualdata.com

You May Like: Removing Hard Inquiries From Your Credit Report

Where To Order A Credit Report

There are many different websites and services you can use to generate credit reports.

In the United States, three giant credit reporting agencies collect the financial data used in most credit reports:

Personally, I use Cozy. It has a downright idiot-proof way of requesting reports from tenants and borrowers .

The best part is that the system actually requires;the applicant to pay for the report, so it doesnt cost me anything to do this essential piece of homework on the people Im considering working with.

Experian provides the credit reports from Cozy. Luckily,theyre some of the most user-friendly credit reports Ive ever seen. And Ive seen a lot of them in my time.

That said, I think the average person could still benefit from a little bit of hand-holding. I put together this short video to walk you through one example.

Note:;Some of the links throughout this blog post are affiliate links that will generate a small commission for the REtipster Blog at no additional cost to you. If you feel Cozy will help achieve your goals and you decide to use these links, your support is very much appreciated!

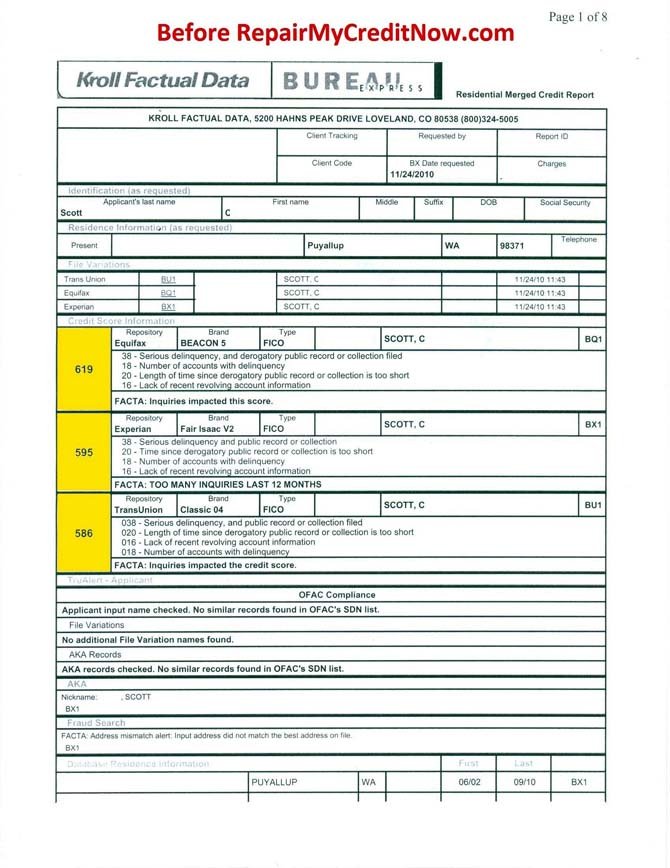

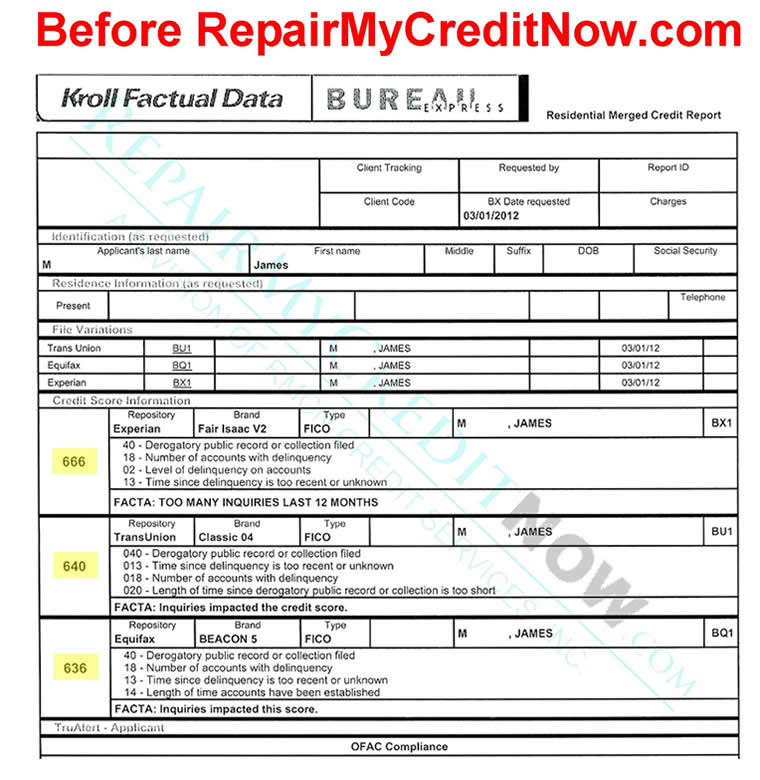

Kroll Factual Data Repair My Credit Now

What’s kroll factual data credit report?

Fellas! Are you currently Doing the job for a secretary in an organization or Firm? Absolutely sure, you may choose in charge in all letters concerns. And Sure, a kroll factual data credit report issue is among a issue try to be master in. Even You’re not an worker, a kroll factual data credit report is crucial for just about any purposes in order to ship a proposal to other Corporation, company or perhaps your teacher. Figuring out how crucial kroll factual data credit report functions are, we have an interest to debate it right now. Remember to remain tuned and luxuriate in looking at!A kroll factual data credit report is a proper and Skilled doc that is published by personalized, Corporation or company to its purchasers, stakeholder, company, Group and several more. This letter functions to provide any data, ask for, permission and several much more skillfully with The fundamental and customary templates among the people everywhere in the environment. Each a personal correspondent and firm will need to make the Make high-quality via your kroll factual data credit report in sake of showing your Specialist small business. Then how to make it? Right here we go.

What Should Contain in kroll factual data credit report?Nicely, it is the crucial elements you should point out within your kroll factual data credit report. And, below the pieces are:

| Title |

|---|

Read Also: Is 739 A Good Credit Score

Factual Data Credit Inquiry

Factual Data Corp, or FDC, is a credit reporting agency employed by lenders to obtain potential borrowers credit reports from Experian, Equifax, and TransUnion.

They may show up on your credit history as Kroll Factual Data, Inc or Kroll Factual Data.

Factual Data most commonly provide mortgage lenders with merged credit reports, which combine the information from all three bureaus into one comprehensive report.

In fact, their website claims they provide risk mitigation, credit reporting, and independent verification services using items such as public records, verification through your social security number, as well as looking at credit information using FICO scoring models .

They provide risk mitigation by automating the underwriting process in the United States.

Lenders use this information and the Factual Data Credit Report to decide whether or not to provide you with a loan. If you are approved with a loan, the data also helps determine what interest rate youre awarded.

Factual Data also runs soft credit inquiries for prospective employers and landlords to verify ones identity, background, and credit score.

Next, well take a closer look at the difference between a soft and hard inquiry.

If you are overwhelmed by dealing with negative entries on your credit report,we suggest you ask a professional credit repair company for help.

Kroll Factual Data Credit Report Video Tutorial

For our lovely reader, we provide a useful movie to give you a straightforward tutorial how to write a superb kroll factual data credit report. The sample beneath could a merely information while you are totally free to vary it depending on your issues. So, get pleasure from observing!

Very well, it is centered on kroll factual data credit report. We hope it can be practical for virtually any business purposes you might have. Thanks for looking through and find out you before long!

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Does A Hard Credit Check Affect Your Report

There are two kinds of credit inquiries: hard and soft.

Soft inquiries, as described above, simply verify your score. They can be run when you apply for a job or apartment, but also when you get pre-qualified for a loan or check your credit score yourself.

A soft inquiry doesnt hurt your credit, while a hard inquiry may.

Whenever you apply for a loan, a more invasive credit check is required. Lenders use your history with credit to determine how reliable of a borrower you are.

As such, they may obtain one or all of your credit reports in the screening process or a merged Factual Data credit report.

This type of inquiry is added to your report, where it will stay for two years. Hard inquiries typically drop your score by a couple of points, but they can be more detrimental if you have several of them on your report.

Having a slew of credit applications suggests that youre financially unstable, lowering your score more significantly than a single entry.

There are a few exceptions, like when youre comparison shopping for a mortgage.

You have a 14-day window to apply for loans, during which time your score shouldnt be lowered by each individual application.

Factual Data Credit Report Errors

Your credit report and credit score are crucial when applying for a mortgage or rental property. They can be the deciding factor of whether or not you are able to rent, or refinance. They will also play a large role in whether or not you qualify for a loan or what your interest rate will be.

Your Rights Under the FCRA

- Under the Fair Credit Reporting Act , credit reporting agencies like Factual Data must be sure that the information they report is accurate and up-to-date.

- Errors on your Factual Data reports cause you to be denied housing.

- If a credit report provided by Factual Data is used against you, you have the right to a free copy of the Factual Data Credit Report.

- You have the right to dispute errors on your consumer reports.

- When there are mistakes on your credit report or background check, it is important to dispute them right away.

- You have the right to sue credit reporting agencies that report false information.

How to Dispute Factual Data Credit Report Errors

To dispute errors on your Factual Data Credit Report visit the Factual Data consumer assistance webpage. Here you can download the consumer request form. Fill out the form and send it either by mail or by fax.

Factual Data Dispute Mailing Address: Factual Data Consumer Assistance

Factual Data will have 30 days to investigate your dispute and make any corrections.

You May Like: How Long Does A Repossession Stay On Your Credit Report

What Should Contain In Kroll Factual Data Credit Report

Nicely, it is the crucial elements you should point out within your kroll factual data credit report. And, below the pieces are:

Whats the Format for any kroll factual data credit report?

A kroll factual data credit report is a proper letter which has the apparent rule for men and women in everywhere in the planet. To make sure thats why, you must concentrate with its structure and font. But once again, Each individual Group can have various structure and style for his or her Expert interaction. And weve been in this article to share the prevalent varieties of the basic kroll factual data credit report structure. In this article some facts about this:

- Block Structure

- Modified Block

- Semi-Block

- Font

- Punctuation

Factual Data Complaints And Lawsuits

The following are recent cases that we settled in Federal court for our clients.

Comer, W. v. Factual Data. Pre-filed. Factual Data mixed our clients information with another individual. The Factual Data report contained a civil judgment that belonged to another individual. The court documents for the civil judgement being reported by Factual Data had a different address and a different middle initial that that of our client. The case settled.

Read Also: What Credit Report Does Paypal Pull