How To Check Your Business Credit Score For Free Cnbc

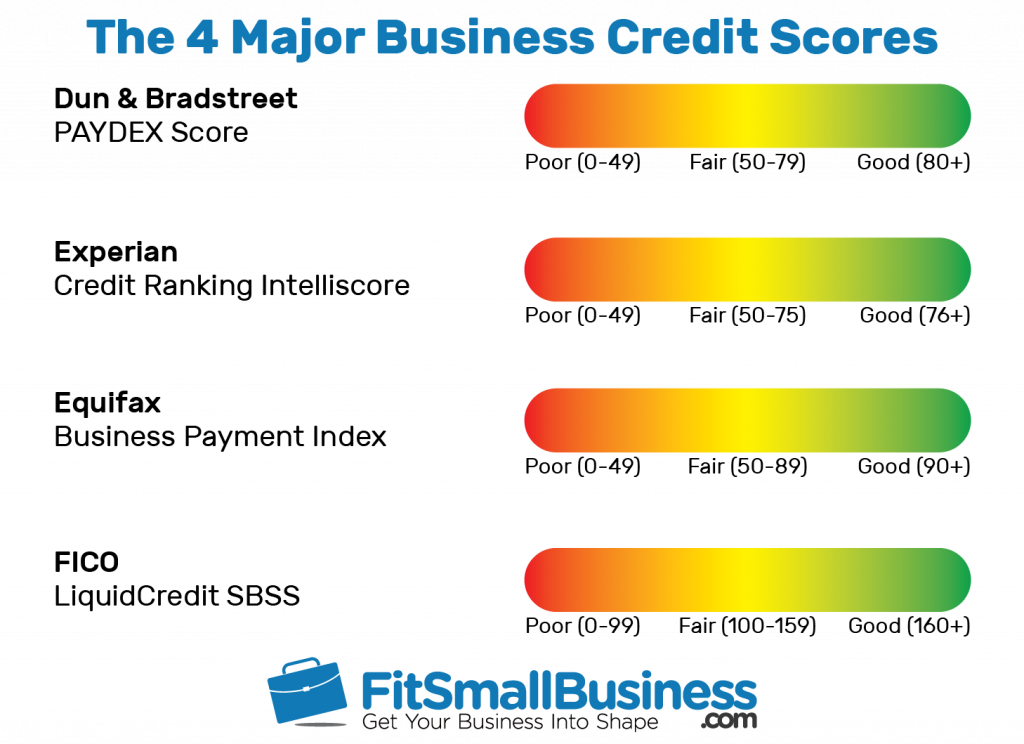

For two main types of business credit scores, Dun & Bradstreet PAYDEX Score and Experian Intelliscore Plus, scores range from 1 to 100, and the closer to 100,;

There is no guaranteed way to improve a business credit score, but there are a few steps you can take to ensure that your business credit report reflects the;

Learn How Experian Business Credit Scores Are Calculated. Collecting Information. We collect three types of information regarding your business: Credit;

Jan 20, 2021 What Is a Good Business Credit Score? The definition of a good business credit score varies with the different rating firms. Dun & Bradstreet;

31-80 Good Credit: This range constitutes good credit scores. Businesses falling in this range can typically expect most requests for financing to be approved;

How To See Information On The Credit Report

If you want to see what information is on your credit report, you can request it from one of the two Canadian credit bureaus â Equifax or TransUnion. You can either receive it online or in the mail.

The free credit report version that you get from these bureaus doesnât include your credit score. Itâs only a list of information. If you want your score, you would have to pay a fee. For more information, check out the Equifax Commercial Services page.

It Protects Your Personal Finances

With business credit, you can separate your personal and business financial obligations. Your;company debts will be reported on your small businesss credit reports,;saving your personal credit rating from being impacted from any financial woes your business may face, and vice versa.

Of course, its still important to review your personal credit report. When you apply for a loan, lenders may want to review your personal credit score in addition to your businesss credit report.

Recommended Reading: Why Has My Credit Score Dropped

Your Business Credit Score: What It Is & Why It Matters

There are multiple factors that can influence your score, including the industry your business is in.

Much like individuals have personal credit scores, so do businesses. However, a business credit score is different than a personal score in small but important ways. There are multiple factors that can influence your score, including the industry your business is in.

In this article, well learn about what a business credit score is and why its important for the expansion of your business. Well also take a look at what contributes to your credit score and how you can find your businesss credit score. Lets start by learning what a business credit score is, and what makes a good score.

How Is The Tillful Business Credit Score Different

The Tillful Business Credit Score is based on real-time transaction data from bank and credit card accounts. We apply our machine learning based credit model to find patterns from cash flow data in order to accurately assess business credit scores. In addition to traditional factors, such as payment history, these cash flow patterns could include:

- Increasing or decreasing trend in your cash balance

- Irregularities in inflow and outflow

You May Like: Does Credit Limit Increase Hurt Score

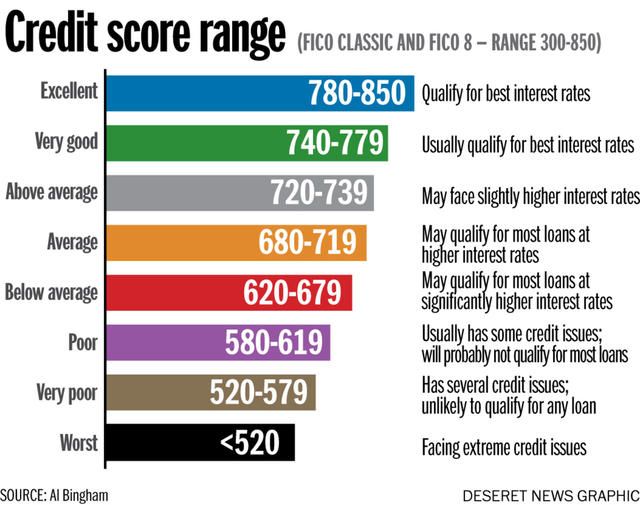

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Equifax Business Credit Reports

Equifax is unique in that it assigns your company 3 different scores, inside of a single report. The first is a traditional credit risk score , which analyzes your companys credit history credit utilization, past delinquencies, length of credit history, and the like. Secondly, the Equifax report contains a “Payment Index” . This is a measure of your payment history to past creditors. A score of 90+ indicates that, on average, the company paid its bills on time.

Finally, Equifax issues a “Business Failure Score” , which asses the risk of a company going under and dissolving. In order to maintain a good score, your company should have an old financial account opened, suggesting it has been around for a long time.

Read Also: Does Afterpay Affect Credit Score

How To Get A Good Business Credit Score

Apr 8, 2019 Your business credit score is a measurement of your businesss financial stability and creditworthiness. A good business credit score is;

What should companies do to ensure they have the highest FICO® SBSS Credit Score to gain the best advantage for better pricing and approvals on financing? The;

Jun 4, 2021 The scale for most consumer credit scores runs from 300 to 850, with 850 being the best score you can get. With business credit scores,;

So What Is A Good Credit For A Small Business Loan

The answer is not as simple as stating a number, but that is a good thing! A program that will examine the entire picture is better than an automated program that uses a minimum cut-off in terms of credit score, either business or consumer. A small business loan program understands that complex decisions are made daily when operating a business. Many times, these decisions are related to finance and credit.

Often a business owner will sacrifice their personal financial situation to keep funding their business, but its important to try and balance these two to ones best ability. Its alright if both scores are okay, but its risky if one is somewhat poor and one is good.

The faster a company grows, so does its bills. The first issue, on a micro-level, is that growth will outpace the speed at which receivables are being collected. The second issue, on a macro level, is that a growing economy will have a trickle-down effect on every level where terms were extended. If the slow payment of financial obligations is a result of a growing business in a growing economy, there is much less concern for the risk of issuing a small business loan.

You May Like: Will Increasing Credit Limit Hurt Score

Youll Receive Better Terms From Suppliers

Once youve established great business credit, not only will this help you when you apply for business financing, but it also bodes well for the credit terms provided by suppliers.

When its time to purchase additional equipment and inventory, consider purchasing on credit. If your suppliers can trust that your business is financially stable and capable of repaying debts in a timely manner, theyll be more comfortable in forgoing prepayment and allowing you to purchase on credit.

How Business Credit Scores Are Used

Much like personal credit scores, business credit scores are an important representation of your companys financial performance and payment history. Vendors, creditors, and lenders alike use these scores to assess the risk and overall creditworthiness of your company. This also applies to potential partners interested in working with you or joining your company because anyone can view your business credit scores.

The better your business credit rating, the more likely you are to qualify for business financing. Youre also more likely to receive favorable terms like lower interest rates and larger loan amounts because creditors see your business as a lower risk. If your company doesnt have good credit scores, its crucial to focus on improving and building your business credit.

Don’t Miss: How To Remove Chapter 7 From Credit Report

Whats A Good Business Credit Score

Business credit scores range from zero to 100, with most lenders requiring a minimum business credit score of 75. The Small Business Administration , potential lenders, and your suppliers rely heavily on your business credit score when extending lines of credit and determining payment terms. Having a strong and healthy business credit score can help you in obtaining financing and on more favorable terms.

How Can I Check My Business Credit Score

To check your business credit score, choose the reporting agency whose report you want to view or choose a third-party service to order from. Some agencies allow you to check your own business credit report for free. And a few even let you claim and update the credit information of your business so you can correct errors and gain more control over what appears on your credit report.

There are also third-party services and websites that small businesses can use to check their business credit reports. Some services offer alerts and help managers monitor events that may impact your score and business credit report. Here are some of the top options for checking your business credit reports:

- Nav.com Nav offers a free service with some limitations and sells an upgrade. It includes information from Experian, Dun & Bradstreet, and Equifax. To access your free business credit report, just sign up for an online account. Or you can upgrade to a paid account to receive your updated business credit reports and information each month.

- Dun & Bradstreet Report Dun & Bradstreet gives you the option to purchase a business credit report or access your own information for free. You can also sign up for free alerts to find out when information that impacts your D&B score has changed.

Read Also: How To Get Free Credit Report From Transunion

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Is A Fico Sbbs Credit Score

Unlike Dun & Bradstreet, Experian or Equifax, FICCO technically isnt a credit bureau. Instead, the FICO credit score comes from information that the three major credit bureaus have already gathered.

The FICO score is also known as the LiquidCredit Small Business Scoring Service . Banks and lenders typically use it when making decisions on the approval of Small Business Administration loans and other similar credit applications for amounts up to $1 million.

The FICO score comes from data on the business and owners personal credit history alongside other information such as the revenue, assets and age of the company. FICO will assign a score of between 0 to 300. The higher the score, the lower the financial risk the business poses. Many lenders set a minimum FICO SBBS credit score of 160 to pass the SBAs pre-screen process.

Recommended Reading: Do Medical Bills Show Up On Credit Report

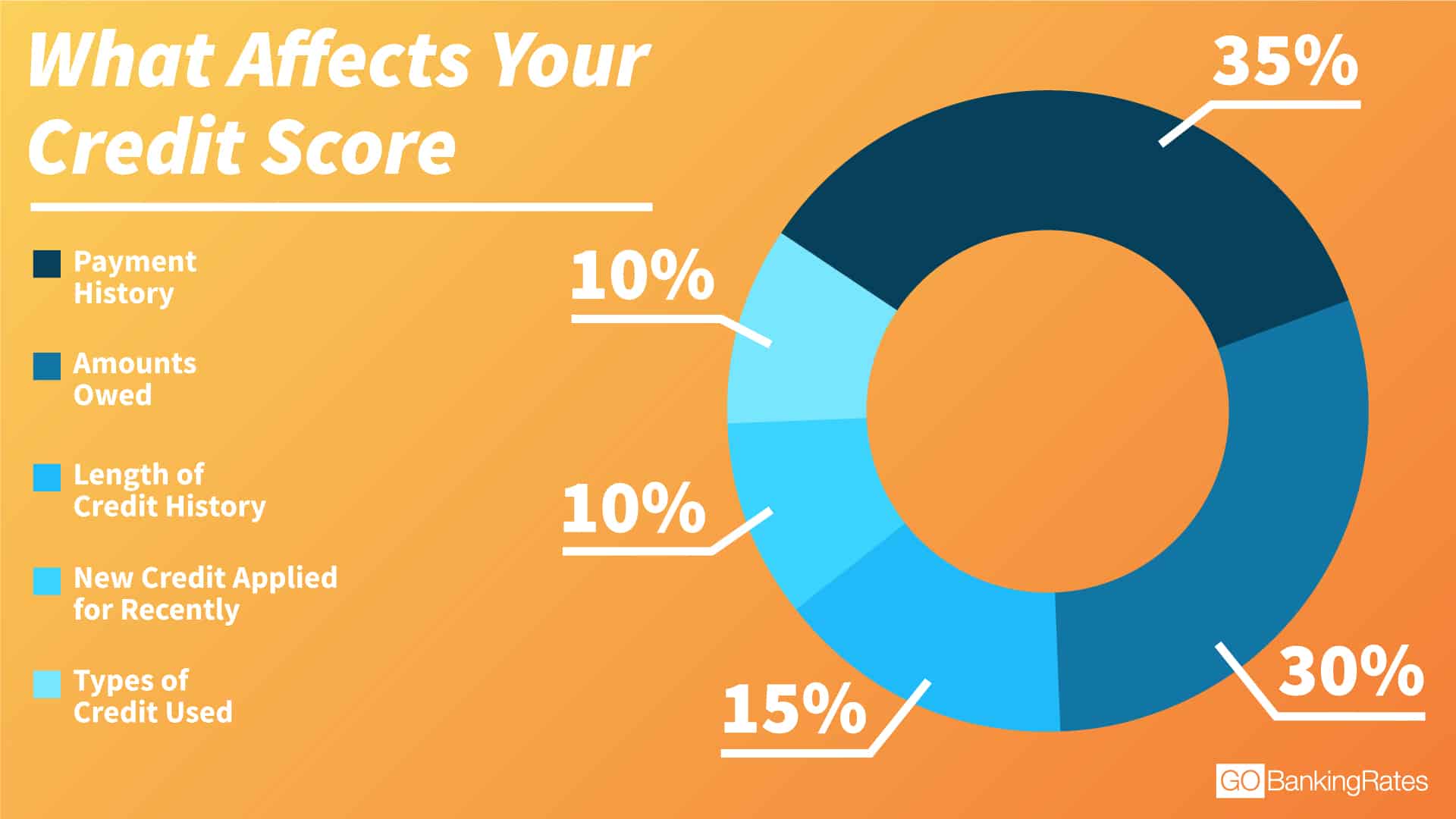

How Are Business Credit Scores Calculated

Like your personal credit score, the most important factor that makes up your business credit score is your payment historywhether you make sufficient on-time payments on your debts. Business credit scores also consider the age of your company, and you may achieve a higher score the longer youve been around. Debt and debt usage are also considered when figuring out a business credit score, as well as the type of industry youre in and the size of your firm.

Keep in mind that, unlike personal credit scores that can consider multiple factors, some business credit scores only consider one. With the Dun & Bradstreet PAYDEX business credit score, for example, the only factor they consider is your payment history.

Dealing With Credit Scores Can Be Challenging Because:

-

It often takes at least a year or two to establish or improve your business credit history or personal credit history

-

You can influence and improve your credit scores with effort, but you cannot directly change them since they are given to you by external rating agencies

-

Internal record keeping and monitoring small business credit scores can be time consuming

Recommended Reading: Is Settled Good On A Credit Report

Common Business Credit Scores

There are five business credit scores that carry the most weight for businesses. While two credit scores from D&B and Experian range from 0 to 100, Equifaxs Business Credit Risk and Business Failure scores range from 101 to 992 and 1,000 to 1,610, respectively. The FICO SBSS score is also a bit different, with its scores ranging from 0 to 300. A higher rating represents a lower risk of delinquency or failure for each business score.

| Visit NAV |

Although there are the five most commonly used scores, each credit scoring agency offers a variety of additional ratings and business indicators. We focus on the principal business risk scores in this article because these scores are most likely to be reviewed by business creditors and lenders.

Are You Clued Up When It Comes To Business Credit Scores

If youve answered no to this, dont worry, youre not alone. According to a recent Experian survey1, as many as 19% of businesses said they had limited or no understanding of business credit scores and how they work. In addition, 37% of those surveyed also admitted that they didnt know or werent sure of their own business credit score.

Given that over 73% of respondents highlighted increasing sales and profitability, and cutting costs, as their main business priority for the next 12 months, the time is ripe to get in the know about how your business credit score, along with your customers and suppliers, could help steer your company to success.Starting with the basics, knowing your business credit score is an important step in ensuring your business finances are in order. Experians My Business Profile lets you see what creditors see before deciding whether to offer you credit. The higher your business credit score, the more chance your business has of being accepted for credit.

Cash flow will always be one of the main concerns of any business, and with so many factors to juggle, it can be hard to see whether your business finances are healthy. However, something as simple as knowing your business credit score, and also that of suppliers and customers, is a great way to ensure youre not caught out.

1 ;Experian survey was conducted between December 2017 and January 2018. In total, 115 small and medium sized businesses took part in the survey.

You May Like: Is 643 A Good Credit Score

What If I Find A Mistake On My Business Credit Report

You can contact the various business credit score rating agencies directly if you ever find an error in your business credit score or FICO score reports.

We suggest that you keep an eye on the publicly available financial information about your business including business credit scores & business FICO scores. Because these scores are dynamic and change on a regular basis, business owners should make it a habit to check your business credit score and FICO score at least a few times per year, or once per quarter.

Even if your business credit score is high, you should monitor changes because it definitely affects the creditworthiness of your business. If you do find and report an error, it may take several weeks or even months before the various reporting agencies completely remove those errors from your record.

Paying bills on time and maintaining a good credit utilization record is prudent for many reasons and especially so when it comes to maintaining good business credit scores. Besides the small business financing companies, suppliers and even prospective customers look at business credit scores and FICO scores before entering into relationships or conducting large transactions with prospective business partners.

Where To Check Your Business Credit Score

There are four main business credit scores and reporting agencies. Dun & Bradstreet Credit Score for Businesses is most commonly employed in a credit check. There are also the Experian Business Payment and the Equifax Business Credit Scores. These are typically used by banks and lenders when assessing credit applications.

Finally, there is the FICO LiquidCredit Small Business Scoring Service. Unlike the above examples, FICO is not a credit bureau. It instead uses information from Dun & Bradstreet, Equifax, and Experian to generate a credit score. That score is then commonly used when making approval decisions on Small Business Administration loans.

These four credit reporting agencies can all hold different information on the same company and, as a result, there can be variation in these business credit scores. They also use different credit ranking scales, meaning what is considered a good score by one reporting agency may not be by another.

Also Check: How To Check Credit Score For Free

Whats A Business Credit Score And Why Is It Important

A good business credit score does more than just determine whether or not you receive financing from a lender or creditor, but also how much money you can;

Jul 14, 2021 Your business has a business credit score. As the gatekeeper to affordable financing, a good personal credit score is extremely;

Business Credit Score 101

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you have a business credit card for your company, you probably have business credit scores, too whether you know it or not. These scores may help you secure better terms the next time you apply for a small-business loan or get an insurance policy for your business.

Heres what you need to know about business credit scores, including where to find them and how to;build and protect them.

Don’t Miss: Can You Self Report To Credit Bureaus