Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

Why You Should Not Pay A Collection Agency

Home » Blog » Why You Should Not Pay a Collection Agency

Reading time: 7 minutes

2021-04-15

If you dont pay your bank loan, credit card or other debt, the lender may decide to send your file to a collection agency.; A collection agents job is to phone you and take whatever measures they decide are necessary to collect the money.; They want to collect because thats how the collection agency gets paid. But its not always in your best interest to pay a collection agency. How you decide to pay off your outstanding debt will affect how long it will remain on your credit report.

Wait Until It Falls Off

When the debt in question is legitimate and you cant convince the debt collector to delete it from your report, your only remaining option is to wait. After seven years from the date the account first became delinquent, the collection should fall off of your credit report.

Although this means the collection will continue to impact your credit score; its impact will lessen as time passes.

Read Also: Can You Have A Bankruptcy Removed From Your Credit Report

Make A Settlement Offer

If you have a single old debt and want to stop the calls, consider negotiating a settlement with the collection agency.; You can offer to pay the collection agency a percentage of what you owe and ask that the unpaid debt be written off. Depending on what you can afford and how old the debt is, start at 20 cents on the dollar and see what they are willing to accept.

Be aware that your settlement payment will update the last activity date meaning the debt will remain for another six years on your report.; To avoid this, as part of your settlement arrangement, ask the collection agency to purge the debt from your credit report right away.

How To Get Something Removed From Your Credit Report

Categories

When it comes to the health of your finances, one of the most important things to have is a clean . After all, its often one of the first things that a bank, credit union, or alternative lender will examine when you apply for a new credit product, such as a personal loan, a line of credit, vehicle financing, or a mortgage.

Unfortunately, negative information on your report can lead to your application being denied, especially if you arent aware of it the information is wrong. To learn more about how credit report errors can affect your credit and how to get inaccurate information removed, keep reading.

Recommended Reading: Does Barclaycard Report To Credit Bureaus

Should I Pay Off My Collection Account

You may be wondering if its even worth it to pay a collection account. After all, the damage has already been done, right? There are, however, several reasons to take that step.

First, in one of the newer FICO scoring models, FICO 9, paid collection accounts no longer hurt your credit score. Unfortunately, many lenders are still using older FICO models. This means that it may take a while for that feature to work in your favor.

Even without the credit score aspect, though, there are several reasons to consider paying off the account. Most importantly, it keeps the collection agency from suing you. If this happens and the agency wins, the court may pass judgment allow them to garnish your wages and place liens against your property. Its also possible to have your bank account funds frozen or garnished to satisfy the debt.

When Do Debt Collections Fall Off Your Credit Report

Any type of financial account can be sent to a collection agency if you become delinquent on the payments.;When an account goes to collections, it will typically also be listed on your credit report and used to calculate your credit score. Unfortunately, debt collections bring down your credit score and can continue to affect it even after you pay off the balance.

Some newer versions of credit scoring calculations dont consider debt collections under $100 and dont ding you as much for medical debt collections. Even so, these blemishes can follow you around for years, hurting your ability to get approved for new credit cards, loans, and other credit-based services.

Thankfully, debt collections wont be on your credit report forever. The Fair Credit Reporting Act requires that debt collections fall off your credit report after seven years. In the past, court judgments against you for debt collection appeared on your credit report as long as an individual state’s statute of limitations. However, the major credit bureaus no longer include these civil judgments in your report.

Also Check: Is 586 A Good Credit Score

Removing Collections From Credit Report

Mar 4, 2021 To remove accurate collections from your credit report, you may be able to request a paid account be removed from your report with a goodwill;

So whether or not you pay your collections off is really a personal decision. Paying off a collection could cause the score to increase, decrease or have no;

Use Solosuit To Make Your Debt Validation Letter

SoloSuit can take care of all of this for you. Our Debt Validation Letter is the best way to respond to a collection letter. Many debt collectors will simply give up after receiving it. Just answer a few questions online, and well create your letter for you.

Fight Back with SoloSuit

“You’d be silly not to drop a few bucks and possibly save yourself thousands in the process. I can’t thank you all enough for making an overwhelming situation something handleable.” Daniel

Don’t Miss: Will Paying Off Collections Help My Credit Score

Can You Dispute A Collection With The Credit Bureaus

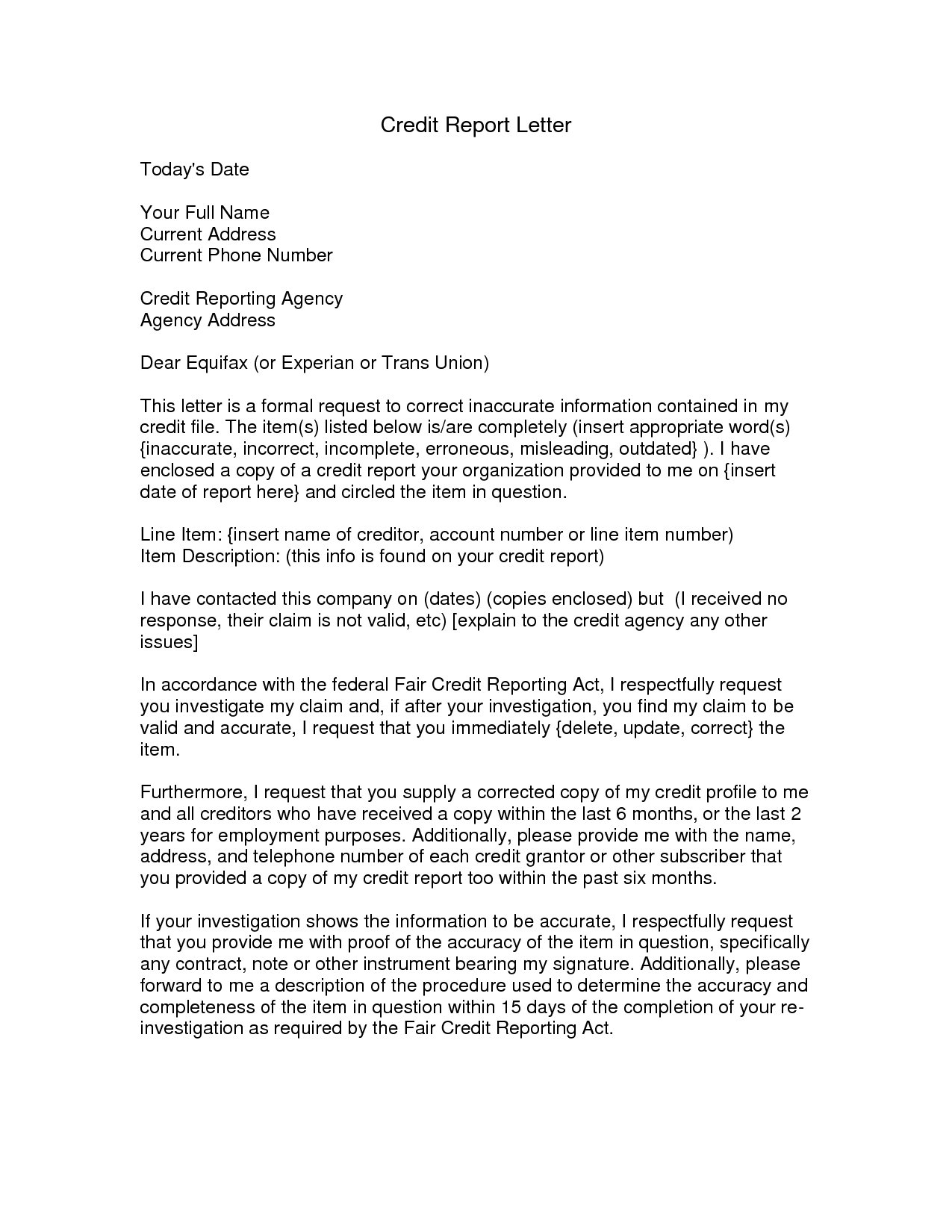

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

Debts Not Included In Limitation Period

The description above applies to standard debts like credit cards and bank loans. Government enforced debts are not subject to the two year limitation period. In most cases government debts do not appear on your credit report, so there is nothing to purge after the six year time frame.

In other words, government debts dont go away.

Debts not subject to a limitation period, and that are not automatically discharged in a bankruptcy are:

- Large tax debts owed to the CRA

- Student loans

- Alimony or child support

- Parking tickets

Other debts like 407 ETR debts and a CMHC mortgage shortfalls can get complicated. Listen to the podcast to hear more.

Just because a debt is old does not mean that it goes away. If you have old debts, dont assume you can just do nothing. If its less than two years old, the limitations act doesnt apply and your creditor can sue you. If its more than six years old, its not on your credit report, but your chances of getting another loan at your former creditor is slim, or will come at the cost of extreme interest rates. If you owe the government money, you owe the government money. Theres no way around that.

The experts at Hoyes Michalos are here to review your debts and advise you on which actions you should take to deal with your debt. Whether theyre old or not. Book your free consultation today so we can help you make a plan to deal with your debts.

Resources mentioned in todays show:

Read Also: What Is A Good Credit Score For My Age

How Long Before A Collection Is Reported To The Credit Bureau

Once an account goes about 150 days past due, a creditor will turn the account over to collections. They will either pass it on to their in-house collections department or sell the debt to a collection agency for pennies on the dollar.

The collection agency will attempt to collect the debt from you. Usually, you are given a few weeks to settle the debt before reporting to the Credit Bureaus. However, they may also report it immediately.

If at all possible, it is best to work out a settlement arrangement with the collection company before it is listed on your report. They will work out a payment arrangement with you. This way, you can avoid the account from hurting your credit history.

How Long Does Negative Info Stay On Your Credit Report

Missing a payment, defaulting on a student loan or going into foreclosure can all negatively impact your credit report. Heres for how long.

Jun 4, 2021 If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists;

Find out how long these stay on your credit report at myFICO.com. For all of these negative items, the older they are the less impact they are going to;

Jun 25, 2020 Your late payment or collection account can mess up your credit score, Know when the negative items should come off your report.

You May Like: How To Make My Credit Score Go Up

Dispute The Collection If You Found An Error

If the goodwill letter falls flat and the debt collection remains on your credit report, its time for a more advanced method.

For this, you will need a current copy of your credit report. TransUnion, Experian, and Equifax provide you with a free credit report once a year.

Once you have your credit reports in hand , find the negative item youd like removed and check it out closely.

Confirm all the details and if you see anything inaccurate, report the inaccurate information to the major credit reporting agencies.

The Fair Credit Reporting Act or FCRA requires credit reporting agencies to show only accurate information in your credit history.

If you can find inaccurate information, the credit bureau will have to fix the information. Though, if it cant fix the errors, the bureau should remove the collections from your credit report.

This method can work because, rather than simply disputing the entire entry, you are going to write an advanced dispute letter that lists especially what is inaccurate.

Using this letter, you will insist that each piece of information is corrected or that the collection be removed.

This makes it more difficult for the credit agencies to verify the collection and hopefully result in them simply removing the collection altogether.

ITEMS ON THE COLLECTION ENTRY TO CHECK FOR INACCURACIES:

- Balance

- Anything else that appears to be inaccurate

What Can Do To Repair Your Credit History While You Wait

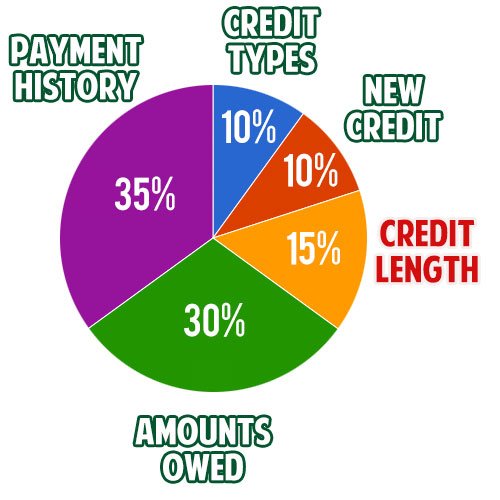

The golden rule to a good credit score is to make sure all your credit accounts are paid on time and any past due accounts have been brought up-to-date. Try to reduce your credit balance where possible and keep the balances on revolving accounts low.

Avoid applying for credit if you think there is any chance you may be declined, by checking your credit score and running pre-approved applications you can get a good idea if it will be successful and this reduces the number of checks on your file. Fewer checks mean an improved score.

If any negative information has been put on your file by mistake you can contact the credit agency and ask them to remove it, this is called a notice of correction. When they receive your query they will contact the company who provided the data you are querying and let you know the outcome within 28 days. The credit agency is not legally allowed to change the information on your credit report without permission from the company who originally provided it to them.

Having a low credit score doesnt mean you cant get credit. There are some lenders that specialise in approving loans for borrowers with poor credit. However, those loans typically come with higher interest rates and less favourable terms.

You May Like: Which Information Can Be Found On A Person’s Credit Report

Do I Need To Notify Credit Bureaus Of Paid Collections

If you pay off or settle a debt with a collection agency, the status of the collection account on your credit report should update to “paid” or “settled” within a month or two. You do not need to do anything to make that happen; the collection agency should notify the three national credit bureaus to update their records.

If that doesn’t occur, you can file a dispute with each of the bureaus to have the records corrected. You’ll likely need to provide proof of payment, such as a cancelled check.

Know Your Rights With Debt In Collections

Having a debt in collections doesn’t mean you don’t have rights. You shouldn’t suffer harassment as a result of being unable to pay your bill.

The Fair Debt Collection Practices Act outlines your rights, including the following:

- A collection agency cannot contact you at work if you have specifically informed them that your employer will not allow you to receive their calls in the workplace.

- They cannot contact you before 8 a.m. or after 9 p.m.

- Debt collection agencies are strictly prohibited from deceiving you. For example, it would be illegal for them to claim they are a law enforcement agency in order to scare consumers into paying.

Having a debt in collections is overwhelming for anyone, but you should remember that you still have rights. If a debt collection agency violates these rights, you can report them to the Attorney Generals office in your state or the Federal Trade Commission .

Don’t Miss: How Accurate Is Credit Karma Score

Can You Remove A Collection From Your Credit Reports Without Paying

Technically, the answer is yes. Its unlikely, though.

There are a few ways you could try. Theyre essentially the same steps youd take to request a paid account be removed:

- File a dispute with the credit bureau and/or ask the collection agency to validate the debt if you believe the collection account is inaccurate.

- If the account is legitimate but youve paid some of it and/or have exhibited responsible behavior otherwise, send the collection agency a goodwill letter requesting the unpaid collection be removed from your reports.

If the above routes fail, youre probably out of luck. And remember that even if a collection account is removed from your credit reports, youre still liable for the debt.

Who A Debt Collector Can Contact

A debt collector can only contact your friends, employer, relatives or neighbours to get your telephone number or address.

This does not apply in the following cases:

- the person being contacted has guaranteed your loan

- your employer is contacted to confirm your employment

- you’ve given your consent to the financial institution that they can contact the person

If you gave consent orally to your financial institution, you must receive written confirmation of your consent either on paper or electronically.

Recommended Reading: Does Joint Account Affect Credit Rating

How Do I Contact The Other Two Credit Reporting Companies Experian And Equifax

TransUnion does not share credit information with any other credit reporting company. To obtain your Experian or Equifax credit report, you must contact them directly. For your convenience we have provided their addresses and telephone numbers below.

Equifax Credit Information Services, Inc

P.O. Box 740241

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Also Check: When Do Credit Cards Report Late Payments

You Can Negotiate With Debt Collection Agencies To Remove Negative Information From Your Credit Report

By , Attorney

If you’re negotiating with a collection agency on payment of a debt, consider making your part of the negotiations. You can ask the collector to agree to report your debt a certain way on your credit reports. Here’s how: The three major credit reporting bureausExperian, Equifax, and TransUnionproduce credit reports. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. The collector might not agree, it might have to get the creditor’s approval first, or you might have to pay a bit more on the debt; but it doesn’t hurt to ask.

And if you get the collector to agree to accept less than the full amount to settle the debt, be sure the collector also agrees to report the debt as “paid in full” on your report.