Use Experian Boost And Ecredable Lift

Experian Boost and TransUnions eCredable Lift can help you improve your credit score by giving you credit for paying utilities and other bills on time. Anyone who regularly pays for utilities or streaming services can use Experian Boost and eCredable Lift to boost their credit score, even if it is already good. Both services are free!

Comenity Banks Most Popular Credit Cards

Now that weve highlighted the top 3 credit cards from Comenity Bank, lets take a look at some of the other popular cards;they offer to see if your favorite store made the list.

Ann Taylor is a womens retail store under the Ann Inc. umbrella of stores, which includes LOFT, Ann Taylor Factory Store, LOFT Outlet, and Lou & Grey.

The Ann Taylor Mastercard earns 5 rewards points per dollar spent with Ann Inc. stores. For every 2,000 rewards points or $400 spent online or in-store, youll get rewarded with a $20 rewards card .

Your first purchase made outside the Ann Inc. family will also trigger a $20 rewards;card. Use this card at grocery stores and gas stations to earn 2 rewards points per dollar spent.

You will earn 15% off your first purchase if you open your account in-store or online at any Ann Taylor or LOFT store and 15% off purchases made on the first Tuesday of the month at those same locations. To top it off, youll receive a $15 birthday gift each year.

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then review each report to see whats helping or hurting your score.

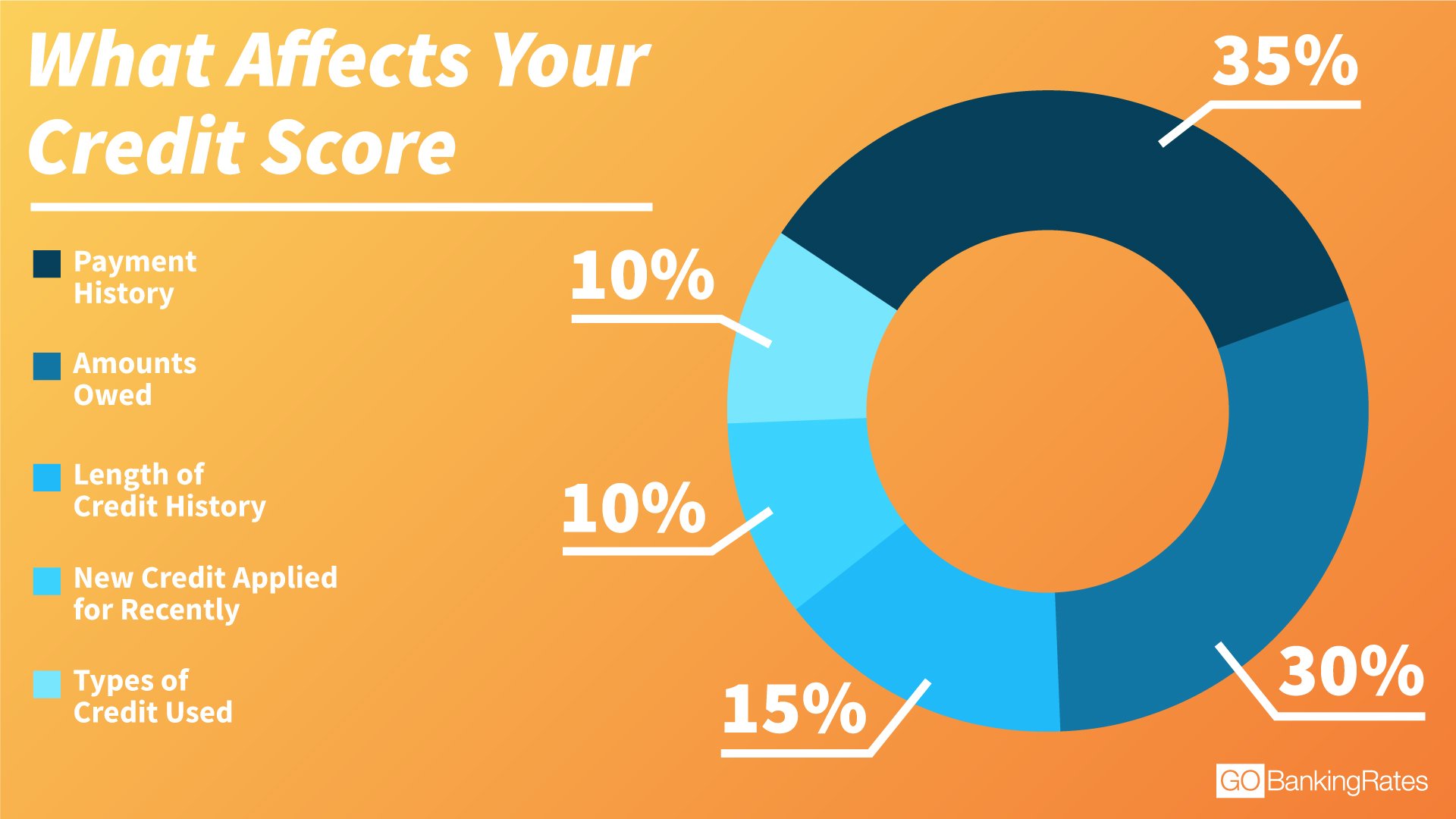

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Check your credit report for errors that could drag down your score and dispute any you spot so they can be corrected or removed from your file.

Read Also: Does Having More Credit Cards Help Your Credit Score

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Read Also: Does Bluebird Report To Credit Bureaus

Where Can I Check My Credit Score

When it comes to credit scores, there are three main credit reference agencies in the United Kingdom: Experian, Equifax and TransUnion . Each uses a slightly different scoring system. But dont let that scare you. Because they all base their scores on similar criteria. So if you have one credit score, youll have a pretty good idea of how you rate with the other credit reference agencies. Heres how to access your credit score and credit history for free with the top three CRAs.

What Credit Score Do I Need To Refinance My Car Loan

Aug 3, 2021 Beyond simply getting approved, a good credit score can help you receive a better interest rate and more favorable terms. If you have bad credit;

Financing without excellent credit can be challenging, but not impossible. Learn more about what credit score is needed to finance a car with Mercedes-Benz;

Don’t Miss: How Long Do Late Payments Stay On Your Credit Report

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: ;www.equifax.ca

Also Check: What Is The Highest Credit Score You Can Get

What Not To Do

Many people who are eager to improve their credit embrace methods that are risky or ineffective. Some even fall victim to .

If anyone promises that they can improve your score instantly or remove legitimate items from your credit report, be careful. Its easy to make promises but hard to deliver on them, and you may end up spending money for nothing.

There are legitimate credit repair companies but also many that are less legitimate. do your research carefully before hiring someone to improve your credit, purchasing tradelines from someone else, or using other shortcuts.

In general, its not a good idea to spend money to improve your credit score. If you open a new credit line, only use it to buy things that you need and would have bought anyway. If you get a new credit card or keep an old one just to help your credit, be sure youre not paying annual fees for those cards. Getting a credit line at an online store that sells overpriced goods is a poor way to build credit.

You want your spending to work for you, not against you!

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Don’t Miss: What Does Bankruptcy Petition Mean On Credit Report

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.;

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Why Your Free Credit Scores From Equifax And Transunion May Be Different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be the same, but thats not always the case.

Remember, VantageScore 3.0 is ultimately just a scoring model. The three-digit number it produces depends largely on the information that lenders report to each credit bureau.

When credit scores that use the same model differ between credit reporting bureaus, its typically because they dont have the same information. Here are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. Its up to lenders to decide which credit bureaus they report your information two. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesnt , your scores may differ.

- Your credit reports contain incorrect information. Its possible that one or several of your credit reports contain errors. Thats why we recommend regularly checking your credit reports for errors that may affect your scores anddisputing those errors, if need be.

Also Check: What Credit Score Does Carmax Use

What Do Credit Card Users Say

Melinda Opperman, president and chief relationship officer at Credit.org, a nonprofit agency that provides credit counseling and related services, says her organizations review of online forums and discussion boards indicates American Express, Discover and U.S. Bank rely mostly or solely on Experian, whereas Barclays and Goldman Sachs depend primarily or only on TransUnion.

Heres how the credit-reporting landscape looks for other card issuers, according to Credit.org:

- Bank of America: Experian or TransUnion

- Capital One: Equifax, Experian and TransUnion

- Chase: Equifax, Experian and TransUnion

- Citi: Equifax and Experian

- Wells Fargo: Equifax, Experian and TransUnion

Opperman warned that this information only represents a quick survey of what users report. So it could differ from what you experience when applying for a credit card.

Nonetheless, visiting online credit card forums and discussion boards can give you a sense of which credit bureau will help decide the fate of your application.

Read Also: How To Get Fico Credit Score

What Is Ccb/bbbmc On Your Credit Report

CCB/BBBMC will show up on your credit report if you have applied for a Bed,Bath & Beyond Mastercard with Comenity Capital Bank. Applying for a credit card means a hard pull of your credit, which impacts your score. If CCB/BBBMC is on your credit report, but you didnt apply, Credit Glory helps you dispute and remove the error.

Recommended Reading: How To Get A Credit Report For A Landlord

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need; your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Also Check: Does Klarna Affect Your Credit Score

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

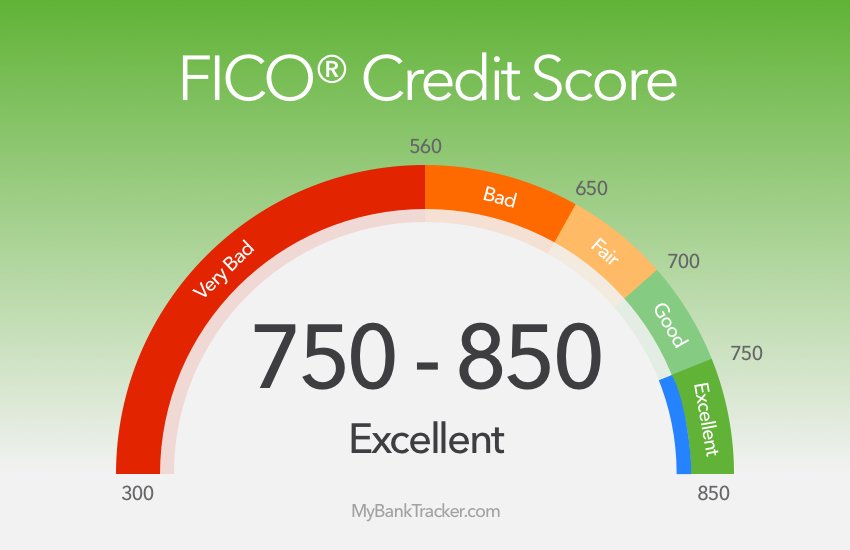

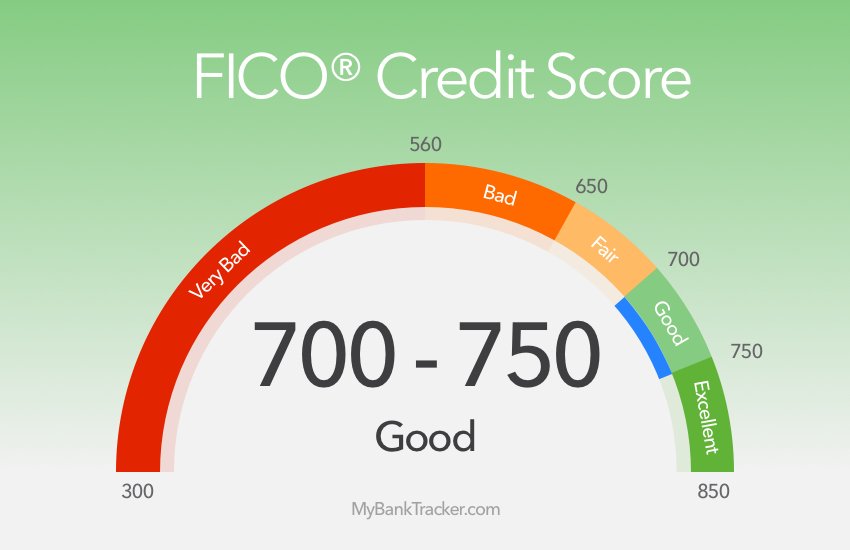

How Does A Credit Score Work

Your credit score is calculated whenever you apply for credit, such as a loan, credit card, mortgage, or even a mobile phone contract. How your score is worked out depends on the company youâre applying to â different companies have different methods and may use different information, so your credit rating may vary between them.

Lenders typically look at your borrowing history, your current borrowing, and other relevant information such as your income. Usually, theyâll look at information taken from the following:

Your credit report

You May Like: What Credit Score Do You Need For A Conventional Loan

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Applied Bank Secured Visa Gold Preferred Credit Card: Best For A High Credit Limit

| Put down $200 to $1,000 dollars as a deposit and get a matching credit limit

Increase credit limit up to $5,000 by making additional deposits after youre approved All cardholders get an APR of 9.99% No grace period on purchases Annual fee of $48 Our take: This no-credit-check secured card offers a chance at a high credit limit with a matching deposit, but its lack of a grace period on interest charges is a major shortcoming. |

To be frank, the Applied Bank Secured Visa Card is hard to recommend for the majority of cardholders, and it makes this list due simply to the scarcity of no-credit-check credit cards on the market. To start, it charges a ton of fees including a $48 annual fee, a $30 fee per additional or replacement card and a $12.95 fee for making your card payment by phone.

And though the card carries an otherwise impressive fixed APR of 9.99%, it comes with no grace period. This means youll be charged interest on purchases on the transaction date. Most credit cards charge no interest until after your minimum payment due date. Since this card also requires a security deposit, having no grace period essentially means you may end up paying interest on money youre borrowing from yourself.

Tip: If you decide to try this card, consider using it only for small recurring charges that you can quickly pay off. This will give you a better chance at minimizing interest charges while keeping the account active and your credit utilization low.

Read Also: Does Closing A Credit Card Hurt Your Score

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

In the UK, companies called credit reference agencies compile information on how well you manage credit and make your payments.

The three main CRAs are:

Current Auto Loan Rates For 2021 Bankrate

This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms. Generally, your credit score will;

Apr 29, 2021 In general, youll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate. If you have poorer;

Read Also: What Does Frozen Credit Report Mean

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and; include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.;

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.;

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .