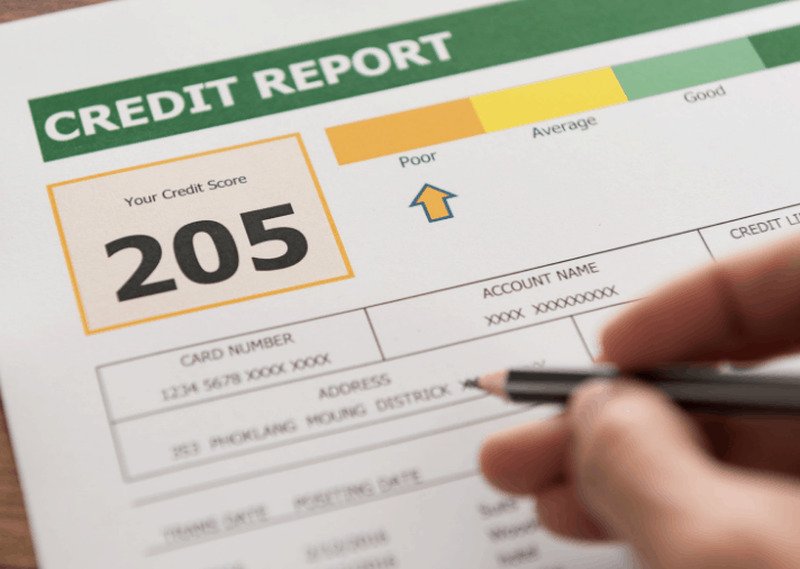

There’s An Error On Your Credit File

That credit score drop may not necessarily be your fault. If there’s an error on your credit file, it can decrease your credit score. Errors are more common than most consumers realize, which is why it’s so important to monitor your credit.

How to fix it — Request your credit report from each of the three major credit bureaus. You’re legally entitled to one report from each bureau per year, free of charge. See which of those three have the error, and then report it through the online dispute process each bureau offers.

For a step-by-step guide to disputing an item on your credit report, here’s how to do it with Equifax, Experian, and TransUnion.

To stay on top of changes to your credit file, you should pull your credit reports at least once every year. You can also sign up for a free credit monitoring service for immediate notice of any changes.

Youve Recently Opened Or Applied For Multiple Lines Of Credit

When you open several credit accounts in a short period of time, you represent more of a risk to lenders. For this reason, your credit scores may drop if youve had several hard credit inquiries placed on your credit reports recently.

Its important to point out that checking or monitoring your credit with tools like Credit Karma doesnt affect your scores because it only results in a soft credit inquiry.

If youre rate shopping, FICO® recommends that you do so in a short period of time. For example, if youre shopping for a mortgage or auto loan within a 30-day period, the credit bureaus will typically group the inquiries together. But if youre considering applying for a credit card, keep in mind that youll get a ding on your credit reports for each credit card you apply for, no matter how close those hard inquiries are over a matter of days. So be sure to only apply for credit cards that you truly need.

Why Did My Credit Score Drop After Paying Debt

There are several factors that make up your credit score, and paying off debt does not positively affect all of them. Paying off debt may lower your credit score if it changes your credit mix, or average account age. Here are some scenarios that could negatively affect your credit score:

- You eliminated your only installment loan or revolving debt: Creditors like to see that youre able to manage various types of debt. And if eliminating a particular debt makes your credit report less diverse, it can negatively affect your score. For example, if you pay off an auto loan and are left with only credit cards, your credit mix suffers.

- Youve increased your overall credit utilization: Keeping the overall utilization of your available credit low results in a better score. But when you pay off a revolving line of credit or credit card in its entirety and close the account or let the account go inactive , it decreases the total amount of credit you have available, potentially increasing your remaining utilization rate.

- Youve lowered the average age of your accounts: The longer your accounts have been open and in good standing, the better. Having a 20-year old account on your report is a good sign, even if you dont use it; closing that account and being left with accounts no more than five years old dramatically reduces the average age of your accounts.

You May Like: How To Report A Death To Credit Bureaus

Why Is My Credit Score So Low The Finances

Lets start with the obvious: the finances. Much of your financial history will show on your credit report, the good and the bad. Whats the bad? Well, it can be various things. First, if youve missed repayments on loan or debit, itll show on your report. Getting a repayment plan that works for you is imperative for keeping on top of your debts, which is why running a loan comparison first can help you find a deal thats affordable for you.

If you have an account thats gone into arrears, or your debt has been passed onto a debt collection agency, then thisll have a negative impact on your score when its added to your report. Furthermore, any County Court Judgements or Individual Voluntary Arrangements will bring your score down as lenders deem you too risky considering youve danced with the devil of debt in the past.

Why Credit Scores Could Drop After Paying Off Credit Cards

Paying off a credit card doesn’t usually hurt your credit scoresjust the opposite, in fact. It can take a month or two for paid-off balances to be reflected in your score, but reducing credit card debt typically results in a score boost eventually, as long as your other credit accounts are in good standing.

There are a few instances that you could experience a score drop, however. Below are some reasons why you might have seen a decrease in your credit score after eliminating a credit card balance.

Also Check: What Is The Highest Credit Score You Can Get

Why Did My Credit Score Drop And How To Save It

Have you taken a look at your recently and seen a drop? A decrease of even a few points can signal youâre not as qualified to access credit services as you were before, so it pays to spend some time learning about why this happens. Use our guide to discover what makes a score drop and what you can do to reverse the damage.

Why Did My Credit Score Drop 9 Possible Reasons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When your credit score takes an unexpected turn downward, you may feel angry or frustrated. Credit scores do fluctuate,;and a couple of points up or down is not a big deal but a downward trend or a big drop is.

Heres a list of things that might be behind your credit score drop, and tips for fixing them:

You May Like: How To Remove Items From Credit Report After 7 Years

Your Credit Card Balance Is Higher Than Usual

If you had unexpected expenses and you put them on a credit card or cards, your credit score could drop. Thats because a major factor in credit scoring is , or how much of your credit limit youre using. Generally, you want to use 30% or less of the credit limit on any card, and the lower the better for your score. If your credit utilization went up even if its still below 30% your score could drop.

The fix: Pay;down the high balances as soon as you can and return to using a small portion of your available credit. Or, you could consider asking for a higher credit limit.;Ask your issuer if it can be done without a hard inquiry on your credit;because those also cost a few points .

Here’s a;snapshot of the factors that;determine;your credit score, in order of importance.

Why Do Credit Scores Fluctuate

Reading time: 4 minutes

-

Its completely normal for your credit scores to fluctuate

-

Information in your credit reports is updated as it is reported to credit bureaus

-

The passage of time can also cause changes in credit scores

If youre tracking your credit scores over time, you may notice the three-digit numbers may change, even if the credit score is generated by the same credit bureau or company.

Its completely normal for credit scores to fluctuate. But why does this happen?

Changing information

Your credit scores are a snapshot in time that changes based on your credit behaviors and the information in your credit reports, which is updated;regularly. Credit scores are calculated based on;information in your credit reports. That information is updated;as new data is reported to credit bureaus by lenders, collection agencies, or other sources.

That data could include balance changes, the opening of new accounts, payments on existing accounts, or closed accounts falling off your credit report after a period of time has expired. If you check one credit score;in January and then again in March,; for instance, the credit score may have changed based on changes in account activity reported to the three nationwide credit bureaus Equifax, Experian and TransUnion during that time.;

Differences among credit bureaus

While a credit score from one of the three nationwide; may rise and fall, you may also see differences in credit scores furnished by the other two credit bureaus.

Don’t Miss: How To Up Credit Score

Six Reasons Why Your Credit Score Dropped

- You made a late payment

Financial institutions want to lend to a customer who is reliable at making their monthly payments. Thats why when you make a late payment, whether its only three days or thirty days late, your credit score will be affected. If you make a late payment, youll be charged a late fee, your interest rates may eventually rise, and it will decrease your credit score.

- Your credit utilization rate is too high

Your credit utilization rate measures your outstanding balance against your total credit limit. The general rule is the lower your credit utilization, the better. The standard advice is to keep your credit utilization below 30% of your available credit so that your utilization rate doesnt hurt your credit score.

For example, suppose you have a total credit limit of $2,000, and you owe a balance of $1,900. In that case, you are utilizing 95% of your available credit.; This suggests to lenders you arent managing your credit accounts responsibly.; You may be at risk of missing a payment, which is why they penalize your credit score.

With a $2,000 limit, try to keep it around $600, or about 30% of available credit. Try to keep your credit utilization rate as low as possible to avoid a credit score drop.

- You recently obtained or applied for a new line of credit

- You cancelled a credit card

- Theres a mistake or error on your credit report

- Youve been a victim of identity theft or fraud

Can I Buy A House With A 651 Credit Score

If your credit score is a 651 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s.

Recommended Reading: How To Raise My Credit Score 100 Points

How To Find Out Why My Credit Score Dropped

The smartest move you can make is using a free credit monitoring service like Wallethub or Credit Karma. The score you will get from these free services is of no use. But at least you can pull the latest copy of your credit report and discover what caused a drop in your credit score.

There are a few other related questions people often ask me when I explain why their credit score dropped. I am answering those questions here only. If you have similar questions in your mind, then clear your doubts right here.

Missing Or Late Payments

Itâs probably no surprise that paying late or missing a payment on a debt can negatively impact your score.

However, just one late payment, will have less of an impact on your credit score than if you always miss payments.

That’s why, even if it’s really late, it’s always worth making every payment. The longer you leave it to pay a missed payment, the bigger the dent it could make on your credit score. If youâre more than 30 days late making a payment, itâs likely that youâll see your score drop even more.

Also Check: Does Bluebird Report To Credit Bureaus

Why Did My Credit Score Change When I Didnt Do Anything

You pay the same bills, have the same number of loans and are continually responsible with your credit cards, yet your credit score changes from month to month. It can seem like a credit score fluctuates up or down like the seasons even if you seemingly havent done anything to influence it.

Sometimes your score does change based on factors outside of your control, but most times your behavior influences your score in ways that may not be obvious. Lets take a look at the factors that influence your score and a few reasons as to why it might change even when you dont think youve changed your behavior.

Why Credit Score Drops When Nothing Changed

Did you know that sometimes a ? Let me clarify; your credit score could drop just because you do the right things, like pay your bills off entirely.

Its odd when you think about it, but a credit score is an abstract conceptualization that controls so many aspects of your life. The only comparable comparison is the law.

The law is different from city to city and state to state. And yet the law is all-powerful, all reaching, and final in its judgment.

But the law is intangible and can only be manifested in the form of police officers and similar authority figures.

Well, a credit score works in a similar manner.

You can actually have three different credit scores. And there is more than one credit bureau. However, the Fair Isaac Corporation, also known as FICO, is the most prominent one.

Over 90% of all high-finance lenders and lending companies refer to FICO scores before making their decisions.

Your credit score, a three-digit number, is assigned to you by credit bureaus and the calculations of computer algorithms that autonomously average out your past credit use.

And your ability to apply for credit, a loan, buy a house, get a job, pay for utilities, start a business, and many other activities can be ultimately decided by a credit score.

All you have to do is pay your bills on time and in full and you will steadily gain a perfect credit score of 850.

Right?

For example, a credit score drops when nothing changed. Or rather, nothing negative necessarily happens.

Don’t Miss: How Are Account Numbers Displayed In A Credit Report

Did Your Credit Score Just Drop Blame It On Covid

The shaky COVID-19 economy has forced people to be much more cautious when it comes to debt. The same goes for lenders.

Some issuers will notify you before they decrease your limit but they dont have to do that. Your credit limit could plummet without you even knowing it, and so could your credit score.

If you havent checked your score in a while, its time to figure out whether youre an unwitting victim, and take steps to fix that.

Monitor Score Changes With Creditwise From Capital One

Staying on top of the information in your credit report can help alert you to potential problems. But waitâdoesnât checking your credit report hurt your credit score?

Thankfully, thatâs a myth. The Consumer Financial Protection Bureau confirms that requesting your credit report wonât hurt your credit score.;

You could use a credit monitoring tool like . CreditWise is free and available to everyoneânot just Capital One customers.;

With CreditWise, you can access your free TransUnion® credit reports and weekly VantageScore® 3.0 credit score anytime, without hurting your score. You can even see the potential impacts of financial decisions on your credit score before you make them with the CreditWise Simulator.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion. Just call 877-322-8228 or visit AnnualCreditReport.com to learn how.

Don’t Miss: Does Opensky Report To Credit Bureaus

You Applied For Additional Credit And Lenders Checked Your Credit Report

It might seem unfair, but your credit score will take a hit if you’ve applied for new credit and a bank or lender checks your credit report to assess the risk you pose as a borrower. As previously mentioned, when a lender looks at your credit report because you’ve applied for new credit, this is considered a hard inquiry which can lower your credit score.

But not all inquiries will hurt your credit score it all depends on the type of inquiries they are! For example, if you check your own credit report or credit history, this is considered a soft inquiry, and soft inquiries have absolutely no impact on your credit score.

Hard inquiries can stay on your credit report for up to three years, but they only account for about 10 percent of your overall credit score.

Change In Credit Utilization Rate

Your is another important factor in determining credit scores. VantageScore says that its extremely influential, and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month , it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 . If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 , your scores could start showing a decline.

Also Check: Does Applying For A Loan Hurt Your Credit Score

Applied For A New Loan Credit Card Or Mortgage Recently

Applying for a new loan, credit card or mortgage likely will lead to a hard credit inquiry, also known as a credit check. One hard inquiry isn’t much to worry about, but if you apply for several credit card accounts at once, the hard inquiries could pile up. Recent credit is considered low impact on the VantageScore® 3.0 model.;