Keep Old Accounts Open

A portion of your credit score is determined by the age of your credit accounts. Although the length of your credit history is less significant than your payment history or credit utilization, its still an important factor because it shows card issuers and other lenders that you have a solid history of managing credit. Unless youre paying a pricey annual fee, its better for your credit score to leave your old accounts open.

Your Credit Utilization Has Increased

Maxing out your credit card could cause a quick drop in your credit score. Depending on your card’s credit limit, making a large purchase or simply running up your balance can increase your , the second most important factor in calculating your FICO® Score. An increased credit utilization ratio can indicate to lenders that you are overextended and that, financially, you’re not well-positioned to take on new debt.

Your credit utilization ratio is calculated by adding all your credit card balances at any given time and dividing that sum by your total revolving credit limit. For example, if you typically charge about $2,000 each month, and your total credit limit across all your cards is $10,000, your utilization ratio will be 20%.

You should aim to keep your credit utilization ratio below 30%, and for the best scores, below 10%. So, if your total credit limit is $10,000, keep your balances below $3,000 at all times to help keep your score in good shape.

What Is A Good Or Bad Credit Score

Maintaining a good credit score has plenty of benefits, including potentially saving you a significant amount of moneyand stressover time. Good scores will help you qualify for more credit products at lower interest rates. Bad scores, on the other hand, may prevent you from qualifying for certain types of credit or may result in getting approved for credit products at higher interest rates, since your profile presents a bigger risk to the lender.

Credit scores are divided into different scoring ranges. Many scoring models, including the FICO® Score, use a range of 300 to 850. In that model, scores above 800 are considered exceptional, while anything above 700 is typically considered good. Scores below 669 are considered to be fair or poor. In 2020, the average FICO® Score in the U.S. was 710, according to Experian data.

You May Like: Does Sprint Report To Credit Bureaus

How Paying Down Credit Card Balances Will Skyrocket Credit Scores

If you have five maxed-out credit cards and pay those five credit card balances off, you can easily boost your credit scores by over 100 FICO points just by paying down your credit card balances. It is highly recommended that you pay down all of your credit card balances to 10% of all of your available credit limit for you to get the best possible credit scores possible. Prior to applying for a home loan, make sure that you pay down all of your credit card balances. Whenever loan officers pull credit, it is normally a hard credit inquiry. Each hard credit inquiry will drop credit scores by at least two to five FICO points.

How To Avoid A Drastic Credit Score Drop

Generally, the only thing that will cause your credit score to fall by 100 points quickly is a late payment. If you avoid those, you’ll usually manage to avoid drastic credit score drops.

To be clear, your credit score might decline by 100 points over time due to other reasons. But if you want to avoid such a rapid, seemingly instant hit, make sure to pay all of your bills in a timely manner. And if you think you’ll be late with a payment due to not having the funds, reach out and ask for some leeway. You never know when a lender or credit card company may be willing to work with you, and having that conversation could spare you a world of credit score damage.

Don’t Miss: Credit Report Without Ssn Or Itin

Have I Closed A Credit Card

Closing a credit card account may cause your credit score to drop. It will remove the available credit on that account, reducing your total credit limit. This in turn makes your credit utilization ratio higher. Closing an old account will also shorten your average credit age which can cause credit score drops.

So, when deciding whether to close a credit card account you should weigh up the benefits and negatives. If the credit card has high annual fees or you have a history of credit card debt, it may be best to close. But if keeping the account open has few financial disadvantages, you could keep it open for the benefit of your credit score.

Make sure to keep an eye on all of your accounts to make sure that your credit card company has not closed your account without your knowledge.

Youre A Victim Of Identity Theft Or Fraud

Fraudsters who get ahold of your personal financial data can do a number on your credit. If you discover that youre a victim of fraud or identity theft, contact the credit bureaus immediately and place a fraud alert on your credit report. You may also want to put a lock or freeze on your reports. You should also be aware that even though laws exist to help protect financial victims, you may still have to fight fraudulent charges. At a minimum, close any accounts youve identified as being compromised, report the fraud to the police or Federal Trade Commission, and monitor your credit closely.

You May Like: Can I Check The Credit Report Of A Deceased Person

How Do Lenders Determine The Qualifying Credit Score For Borrowers

The best way to illustrate how mortgage lenders determine the qualifying credit score on borrowers is to show by an illustration and case scenario.

For example, here is how lenders use a borrower qualifying score:

- may have a 500 FICO credit score on TransUnion

- 600 FICO credit score on Experian

- 700 FICO credit score on Equifax

- The middle credit score is 600 FICO credit score of Experian

- So that credit score will be used throughout the mortgage approval process

How Often Does An Underwriter Deny A Loan

In 2019, underwriters denied 8.9% of all home-purchase mortgage applications, according to data reported under the Home Mortgage Disclosure Act. The Consumer Financial Protection Bureau said about 9.2 million loans were included in HMDA data in 2019, which means roughly 819,000 purchase applications were denied. However, the rate of mortgage denials has steadily decreased since 2004, when about 14% of all loan applicants had their applications denied.

Most lenders are required to report mortgage denials and can choose from a list of nine reasons for the rejection. According to 2019 data, hereâs why applicants were denied and the share of applications for each reason:

Don’t Miss: Sync Ppc On Credit Report

Paying Cash Is Not The Solution

Even if you pay for furniture before closing with cash, your loan could still be in danger. Dont forget about the savings you need for your down payment and closing costs! VA and USDA loans are 100% financed, but other loan types require you to pay a percentage of the down payment upfront . And closing costs, or settlement costs, for any loan are the charges from your lender for the services they provided. Read our article on the two upfront costs you may see.

Lenders Want To Minimize Default

Aside from the Big Brothers watching the lenders, no bank wants to put themselves at risk for default. If you were to increase your debt load, it depletes your monthly resources. You might get in over your head, so to speak. What looks okay on paper might be more difficult to afford than you originally thought. After a few months of balancing the new mortgage payment along with your other monthly debts, you might find it too difficult to own a home. Because you just purchased it, your equity might not be very high, depending on how much money you put down. This could put you at great risk for letting the home go into foreclosure. This is what lenders try to minimize by pulling your credit again at the last minute.

Don’t Miss: Does Affirm Help Credit Score

Ways To Improve Your Credit Scores

If you’re looking to improve your credit scores, these tips can help.

- Pay your bills on time. This is one of the most crucial steps to getting and keeping a good credit score. The best way to pay on time is to set up automatic payments so you won’t miss a bill. But make sure you have enough money in the connected bank account to avoid an overdraft.

- Minimize overall debt. If possible, don’t lean on credit to buy items you’re not able to pay for in cash, or that you can’t pay off by the end of the month. This keeps your payments manageable and your ongoing credit utilization ratio low. Your goal should be to bring your credit card balance to $0 at month’s end.

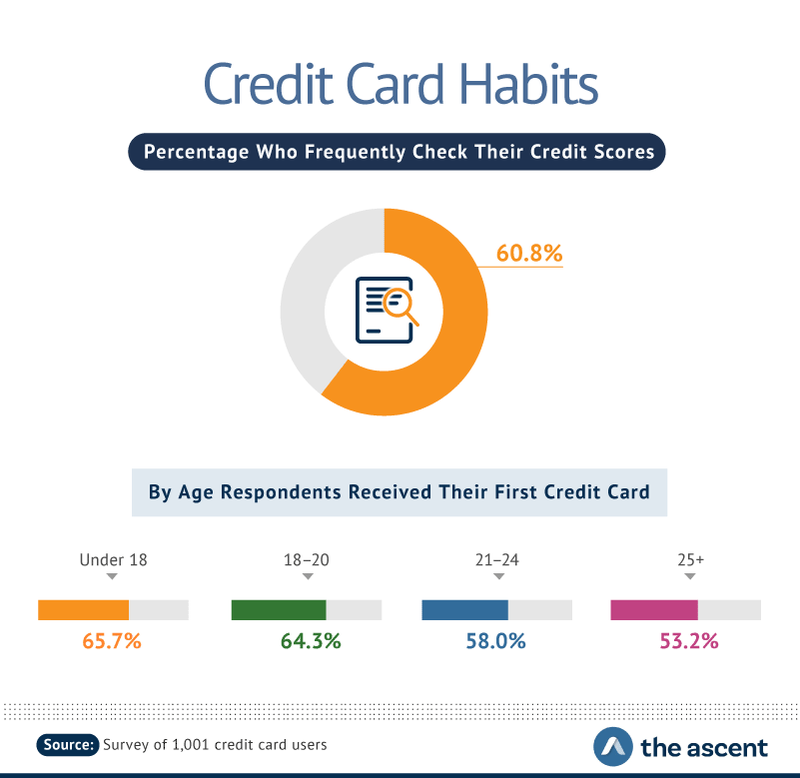

- Monitor your credit regularly. There are many ways to check your credit score for free, including via Experian. Doing so can help you identify dips in your score quickly and course-correct if necessary. Free credit monitoring from Experian can help you keep tabs on both your FICO® Score and credit report, and keep you updated when there are any changes to your credit report.

- Avoid applying for unnecessary credit cards. Not only do some cards have pricey annual fees, but an abundance of cards might result in more spending than you can handle.

- Practice responsible spending habits. Setting up a budgeteven a general one that categorizes your spending into a few overall buckets and doesn’t require too much upkeepcan help you spend within your means over the long term.

Does The Lender Pull Credit On The Day Of Your Closing

January 31, 2017 By JMcHood

You received your mortgage approval, you figure everything is good to go and you are free to do with your finances as you wish, right? Unfortunately, this can hurt you in the end. Lenders have gotten smarter with their ways, especially after the housing crisis. Now, not only do they recommend that you dont open a new credit card, buy a new car, or rack up your current credit card balances before you close, they check to make sure you dont! Many lenders either pull credit a few days preceding the closing or even on that day, depending on when they provide the clear to close. This means they could pull their approval at the last minute if you changed anything regarding your finances.

Read Also: Can You Use Affirm In Store At Walmart

Do Underwriters Pull Credit Before Closing 2018

pullprior to closing

. Similarly, it is asked, how many days before closing do they run your credit?

Here’s the short answer: Most lenders who offer FHA loans will check your credit score at least twice. They do an initial pull shortly after you apply for financing, and they often do a second pull just before the scheduled closing day.

Beside above, does underwriter check credit again? Your loan won’t move on to closing until the underwriter says it meets all guidelines imposed by the lender and secondary authorities . To answer your question, yes, some lenders do a second pull shortly before the loan closes.

Thereof, what do underwriters look for before closing?

More specifically, underwriters evaluate your credit history, assets, the size of the loan you request and how well they anticipate that you can pay back your loan. They’ll also verify your income and employment details and check out your DTI.

What happens when credit score dropped during underwriting?

How Changes During Underwriting Process Affect Rates. If borrowers have increased in the mortgage process, the higher will be used to price and lock rates. If borrowers the mortgage process prior to locking the rate, then no worries.

Why Did My Credit Score Drop When My Balance Decreased

Although paying off debt is always a good thing, your credit score is a complex formula that can be impacted by both positive and negative behaviors. For example, closing an account may impact your credit mix, which might cause a dip in your score. Dont be discouraged. If you continue to manage your credit wisely it will bounce back over time.

Recommended Reading: Can You Use Klarna On Walmart

Have I Cosigned A Loan A Mortgage Or A Credit Card Application

Have you been avoiding late payments, managing your credit usage, and still your credit scores drop? If you have recently cosigned a new line of credit you may need to take a look at the other person in the picture.

Be sure to monitor whether the other person has late payments or high credit usage, and be ready to have a firm conversation if this is the case.

Your credit score may also be affected by another person if you are signed on as their guarantor or you receive a joint County Court Judgment.

To avoid this problem, apply to have your financial association with the other person removed from your credit report. You are allowed to do this if you do not hold any active accounts together.

You Have A History Of Missed Mortgage Payments

If youve previously been a homeowner, your underwriter will want to see evidence that you paid your mortgage consistently and on time, otherwise they may not feel its worth the risk to approve your loan for this new home.

Having a short sale or foreclosure on your record may also prevent you from getting approved for a certain length of time.

Recommended Reading: Chase Sapphire Preferred Card Credit Score Needed

Applying For New Credit

When someone applies for a new credit account, the issuer or lender runs a hard credit inquiry. Anytime a credit check is run, this can contribute to a temporary drop in credit scores. According to FICO, credit scores typically drops five points or less with each inquiry. It may not seem like a big drop, but several credit applications in a short period of time can add up quickly.

Can Lender Cancel Loan After Closing

The lender has no right of rescission. Once you have signed loan documents, you have entered into a binding contract, and the lender is legally bound to honor those signed documents. The right of rescission is a separate form giving you three days in which you can back out of the transaction without penalty.

You May Like: Does Affirm Show Up On Credit Karma

Change In Credit Utilization Rate

Your is another important factor in determining credit scores. VantageScore says that its extremely influential, and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month , it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 . If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 , your scores could start showing a decline.

What To Do If You See A Drop In Your Credit Score

Read Also: Sywmc On Credit Report

One Of Your Credit Limits Was Lowered

A lower credit limit has the same impact as charging an expensive item. If you have a balance on a credit card with a low credit limit, your goes up, and your credit score goes down. You may not have control over whether your credit card issuer reduces your credit limit, but if this happens, paying down your balance can improve your credit utilization and your credit score.

Does A Closing Disclosure Mean Clear To Close

5/5Closing Disclosureclosingmeansclear to closemeans

Correspondingly, is Closing Disclosure final?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage .

Also Know, how long after clear to close can you close? What happens next. Once you are clear to close, you‘ve entered the final stretch. On average, you can expect a 24- to 72-hour turnaround to be cleared to close, Baez says. Once cleared, your lender will wire funds to your closing officer.

Also, can loan be denied after clear to close?

Bottom line, yes, your loan can be denied after a ‘clear to close. ‘ It’s up to you to keep everything the same that is within your control to ensure that you still have the loan you want.

Is a closing disclosure the same as a closing statement?

Loan Closing StatementThis document may also be called a settlement sheet or credit agreement. The closing disclosure outlines details of the loan, including the interest rate, monthly payments, length of payments, fees, and any other provisions associated with the loan.

Also Check: Comenity Capital Bank Credit Score