How Do I Get A Mortgage If I Have Bad Credit

Bad credit can limit your ability to get a mortgage. You may have options available to you, but the interest rates youâll qualify for wonât be cheap. If you donât want to put off purchasing a new home, there are immediate steps you can try taking to get a mortgage with bad credit. If youâre willing to wait, you should take time to improve your credit score and qualify for better mortgage options. Here are ways you can get a mortgage with bad credit.

Make a larger down payment

If your credit score isnât great, there are other ways to demonstrate your financial stability to lenders. Making a large down payment of 20% or above provides you with more leverage when working with lenders. It shows that you have a sizeable income and demonstrates your budgeting skills. It will also help you reduce your regular mortgage payments, making them more manageable in the long-run. In short, a larger down payment will often make you a more attractive borrower to mortgage lenders. You could also take advantage of first-time home buyer programs to get additional incentives and tax credits if you’re buying your first home.

Use an alternative mortgage lender

If your credit score falls below 600, you will have a very difficult time getting approved from Canadaâs major banks. Youâll more than likely have to work with an alternative lender.

Get a co-signer or a joint mortgage

Improve your credit score

Can I Get A Car / Auto Loan W/ A 638 Credit Score

Trying to qualify for an auto loan with a 638 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 638 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Pay Off Your Balance Quickly And Regularly

There are three basic problems with carrying a balance:

- Balances incur interest, and that raises the cost of having the card.

- It further reduces an already low credit limit.

- It increases the chance of you defaulting.

That last point needs more discussion. A major cause of fair or poor credit is a maxed-out credit card. Not only is the monthly payment more difficult to handle, but youre more likely to default because the card no longer provides the credit it once did. Default, and you can go from fair credit to poor credit in just a few weeks.

Recommended Reading: Primary Cardholder’s Ssn (last 4) Wells Fargo

Check Your Credit Reports To Understand Your Scores

Its a good idea to check your credit reports periodically to make sure there arent any errors or mistakes that could be affecting your scores. Its also important to check your reports so you can spot any potential signs of identity theft.

If you do spot any inaccuracies, you can dispute them directly with the credit bureaus. Credit Karma even lets you dispute errors on your TransUnion report directly with our Direct Dispute feature.

Fha Loan With 638 Credit Score

FHA loans only require that you have a 580 credit score, so with a 638 FICO, you can definitely meet the credit score requirements. With a 638 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

You May Like: Ccb Ppc Credit Inquiry

Is 638 Credit Score Good Or Bad

YourFICO credit score, created by the Fair Isaac Corporation, is used by lenders, creditors, landlords, and even employers to assess your credit risk. Is 638 a good credit score ?

The criteria for a good credit depends on what youre applying for. Although a 638 credit score isnt necessarily poor credit, it wont be enough for a high-end condo rental or mortgage. It also depends on where you live.

In cities like Boston, MA San Francisco, CA Seattle, WA Minneapolis, MN and Philadelphia, PA, theaverage credit score of renters is over 700. But in cities like Greenwood, MS Albany, GA Laredo, TX or Riverside, CA, theaverage credit score is below 650.

How To Improve Your 638 Credit Score

Think of your FICO® Score of 638 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

74% of U.S. consumers’ FICO® Scores are higher than 638.

You share a 638 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Also Check: How Long Does Car Repo Stay On Credit

Improving Your Credit Score

Fair credit scores can’t be made into exceptional ones overnight, and bankruptcies, foreclosures and some other negative issues that contribute to Fair credit scores only resolve themselves with the passage of time. But no matter the cause of your Fair score, you can start handling credit more, which can lead in turn to credit-score improvements.

Seek a secured credit card. A secured card can benefit your credit score, even if you don’t qualify for traditional credit cards. Once you’ve confirmed that the lender reports card activity to the national credit bureaus, you put down a deposit in the full amount of your spending limittypically a few hundred dollars. When you use the card and make regular payments, those activities will be recorded in your credit files. And as long as you keep your usage rate on the card below about 30%, and stay on schedule with your monthly payments, they’ll help you build stronger credit.

Pay your bills on time. If you could do only one thing to improve your credit score, nothing would help more than bringing overdue accounts up to date, and avoiding late payments as you move forward. Do whatever you can to remind yourself to pay the bills on time: Use automatic payments, set calendar alarms, or just write yourself notes and pin them where’s you’ll see them. Within a few months you’ll train yourself in habits that promote higher credit-scores.

Among consumers with FICO® credit scores of 638, the average utilization rate is 67.9%.

How To Improve Your 618 Credit Score

Think of your FICO® Score of 618 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

78% of U.S. consumers’ FICO® Scores are higher than 618.

You share a 618 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Read Also: What Is Syncb/ppc

What Credit Card Can I Get With A 638 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

What Can You Do With A 638 Credit Score

A 638 credit score is very low and should be repaired. As such, there are not many things youre able to do with a score this low at least, not easily. For example, three areas that are significantly impacted by a Fair credit score are loans, housing, and credit cards:

- Personal loans: If you want to take out a personal loan with Fair credit, you may be flat-out denied.

- Even if you can find a lender that is willing to work with bad credit, youll likely be facing steeper interest rates and higher down payments.

Fair credit can put a damper on much of your financial activity. The best way to overcome these obstacles is to create a plan to improve your credit moving forward.

Read Also: Does Sprint Report To The Credit Bureaus

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Does Bajaj Finserv Check Your Cibil Score For Home Loan And Balance Transfer

Yes. Like other lenders, Bajaj Finserv also checks your CIBIL score before giving the green signal on a home loan or a home loan balance transfer application. The Bajaj Finserv Home Loan offers you high-value financing, up to Rs. 5 crore, at one of the lowest interest rates in the country. You can repay your loan via a tenor of up to 30 years and make prepayments and foreclose your loan at no additional charge. Since it is an economical solution, you may want to transfer your existing home loan to Bajaj Finserv. You can do so quickly and with minimal documentation.

As a general rule, the minimum score for a home loan is 750. The minimum score for a balance transfer can be slightly lower and depends on internal policies and other factors.

Also Check: Free Credit Report Usaa

Best Auto Loan Rates With A Credit Score Of 630 To 639

A review of the best auto loan rates for new, used & refinanced vehicles based on credit scores between 630 to 639.

If you have a credit score in the 630 to 639 range, congratulations!

Your score is considered Fair credit and you will have multiple auto loan options to choose from.

Your auto loan options and the monthly payment could differ greatly based on whether you use a bank, credit union, or an online Lender.

Disclaimer: Credit score refers to the FICO score in this article. If you have a different score , that does not likely equal your FICO. For example, a 645 VantageScore could equal any FICO score 643, 644, 645? Who knows? You can get your FICO score here.

In this post:

Credit Score Mortgage Lenders

Below is a list of some of the best mortgage lenders for borrowers that have a 638 credit score. All of the following lenders offer conventional and FHA loans, and can help you determine what options might be available to you. If you would like some assistance finding a lender, we can help match you with a lender that offers loan options to borrowers with a 638 credit score. To get matched with a mortgage lender, please fill out this form.

You May Like: Walmart Klarna

Personal Loans With A 638 Credit Score

You might find it challenging to get approved for a personal loan with poor credit scores.

Given your current scores, you might not have the luxury of shopping for the best personal loans with the lowest interest rates. Instead, you may have to settle for a personal loan with a high interest rate not to mention other fees, such as an origination fee.

This could make a personal loan seem very unappealing to you, especially if your intention with the loan is to consolidate high-interest credit card debt. The APR on your personal loan could be just as high, if not higher, than the interest rate youre currently paying on your credit cards.

On the other hand, if your goal with a personal loan is to finance a major purchase, you should ask yourself whether its something you need right now. If it can wait until after you spend some time building credit, you may qualify for a personal loan with a lower APR and better terms later down the line.

If youre really in a pinch for cash and youre having a difficult time finding a personal loan you qualify for, you might be considering a payday loan. While everyones situation is unique, you should generally be wary of these short-term loans that come saddled with high fees and interest rates. They can quickly snowball into a cycle of debt thats even harder to climb out from.

Can I Get A Personal Loan With A Low Credit Score

The credit score is the first point of review when a person applies for a personal loan. Given below are the details of the possibility of a personal loan that can be sanctioned based on the credit score of a person.

A credit score from 300 to 599 is considered to be poor by any lender. It is like a warning for the lender of the bad credit history of the applicant and the non-viability of the loan. Hence, most lenders will reject the personal loan application of such applicants having such a low credit score. It is important for such applicant to immediately take measures to improve his/her credit score to get access to loans or credit cards.

A credit score ranging from 600 to 749 is considered below but not as risky as the previous range mentioned above. There are many lenders that may choose to overlook this score and provide personal loans to the applicant based on other factors like,

- Sound repayment capacity of the applicant

- Proof of income submitted by the applicant

- Loan against any security or collateral

- Employment history

- Relationship with the bank

However, note that even if youre granted a loan, the interest rate on it will be higher and the loan terms may not be favourable to the borrower.

You May Like: Centurylink Collections Agency

A 638 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Your credit scores are numbers calculated by credit bureaus, like FICO and VantageScore. Lenders use scores as at-a-glance information to help decide how risky they think you might be to lend to.

If your credit history includes signs of past credit challenges, such as late or discharged payments or accounts in collections, or little to no credit at all, you may find it more difficult to be approved for new credit. And if you are approved, you may find that approval comes with high rates and fees.

Building your credit scores can help. That said, theres no specific credit score that will guarantee approval or better terms or offers. Not only do you have multiple credit scores that are calculated using data from several possible , but its not always clear which score a lender might choose to check or what its criteria might be for approval.

We recommend thinking of your credit scores as a gauge to help you understand what lenders see when they check your credit. Understanding the factors that go into your scores can help you learn which ones to focus on to improve your overall credit picture in lenders eyes.

Heres what you need to know about building your credit and how to navigate credit applications in the meantime.

| 7.3 |

Ranges identified based on 2021 Credit Karma data.

Loan Options By Credit Score

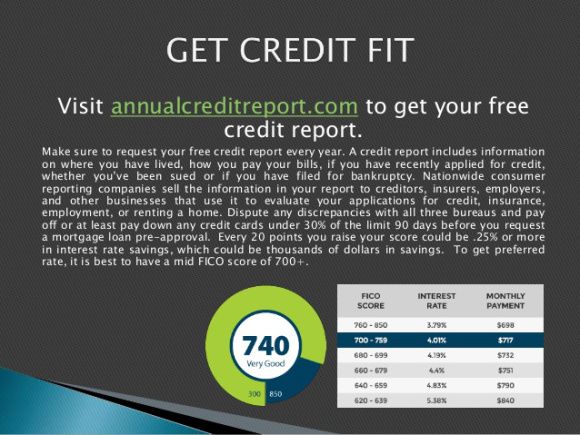

Lets look at the mortgage choices your personal credit score gives you:

- 300-499: Its highly unlikely any mainstream lender will loan to you. Take great care if you consider alternatives . These programs lack consumer protections and often end up harming the borrower.

- 500-579: FHA loans may be available to you but only if you have a down payment of at least 10% of the purchase price.

- 580-619: FHA loans are available with just a 3.5% down payment.

- 620-699: Youre eligible for most mortgages including those backed by a government agency and conventional mortgages . Only jumbo loans are probably beyond you.

- 700-739: You probably qualify for a jumbo loan along with all the other mortgage loan types listed above.

- 740-850: Youll have your pick of mortgage types and low interest rates. Even if your down payment is low, youll probably qualify for a lower mortgage insurance payment.

But remember the golden rule: The higher your credit score the lower your mortgage rate should be. A lower credit score will mean higher interest rates. So its always worth continually improving your credit score until its nearly perfect.

Recommended Reading: Chase Sapphire Preferred Score