Expert Insight On Dealing With Debt Collections

What’s the best way to handle debt collectors? There is no one right way, but it can pay to listen to the experts. MoneyGeek spoke to Byron Moldo, a bankruptcy attorney who is immersed in the debt world, and Rakesh Gupta, a professor at Adelphi University who developed and has taught Your Money and Your Life, a personal finance seminar for college students.

Associate Professor of Management and Decision Sciences at Robert B. Willumstad School of Business at Adelphi University

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

How Long Before The Collection Agency Reports To The Credit Bureau

Collection agencies must wait 31 days before reporting any debt. If you can pay a delinquent bill before that 31st day, you can likely avoid damage to your credit score and credit report. You have even more time with medical debt. When a collection agency has a medical debt, they have to wait 180 days before reporting it to credit bureaus.

Recommended Reading: 827 Fico Score

Review Your Credit Report As Soon As Possible

This can help you figure out whether the debt is indeed yours. Fraud and identity theft are real risks that could assign debts to your report that arent actually yours.

If you think there has been an error, follow guidelines from the Financial Consumer Agency of Canada for reporting the problem.

Using a service such as is a great way to perform these checks, since the inquiry is considered soft and wont further penalize your credit scores.

However, some debts in collection may not be on your credit report. Always ask a debt collector for written proof of your debt so you can verify that its yours.

Consider A Debt Management Plan

If you have the money to pay the debt and want to clear it up, you could talk with a not-for-profit credit counselling agency and arrange a debt management plan.

However, you must repay your debt in full, as this is a requirement with any payment plan through a credit counselling agency. A credit counsellor cannot settle your debt for less even if the collection agency is willing to accept less than the full amount.

A new note will be placed on your credit report when you enter into a debt management plan. This note will remain for two to three years from completion. However, some creditors continue to report your monthly payment made through a collection agency as regular transactions, refreshing the last activity date. So the debt can remain on your credit report for six years after you complete your debt management plan. Since a DMP can be anywhere from 1 year to 5 years, that one account could impact your credit history for a long time if you go through a credit counsellor.

Dont Miss: How To Boost Credit Score 100 Points

Also Check: Auto Buying Program Navy Federal

How Many Points Does A Collection Drop Your Credit Score

If your debt goes to collections, your credit score will take a hit. How much is hard to say. It depends on how healthy your credit score was to begin with. You could see a pretty serious drop of, say, 40 points if you have an excellent credit score, and maybe only a four-point drop if this is just another debt in collections and your credit score has been dwelling in the basement for years.

Credit Limit Increase Requests

When you request a credit limit increase, your card issuer may perform a hard pull of your credit. This can temporarily ding your credit score by a few points. However, there are times when credit limit requests cause no harm to your credit score, like when your issuer does a soft pull of your credit or initiates an automatic increase.

Read Also: How To Report A Delinquent Tenant To The Credit Bureaus

Consider Getting Professional Assistance

Canada-wide debt assistance organizations such as Consolidated Credit Counseling Services of Canada or local not-for-profit credit counselling agencies can negotiate debt settlements on your behalf as well as help you establish a plan to rebalance and improve your finances.

There are both advantages and disadvantages to dealing with debt through an official debt management program you can review them here as per the Office of Consumer Affairs.

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

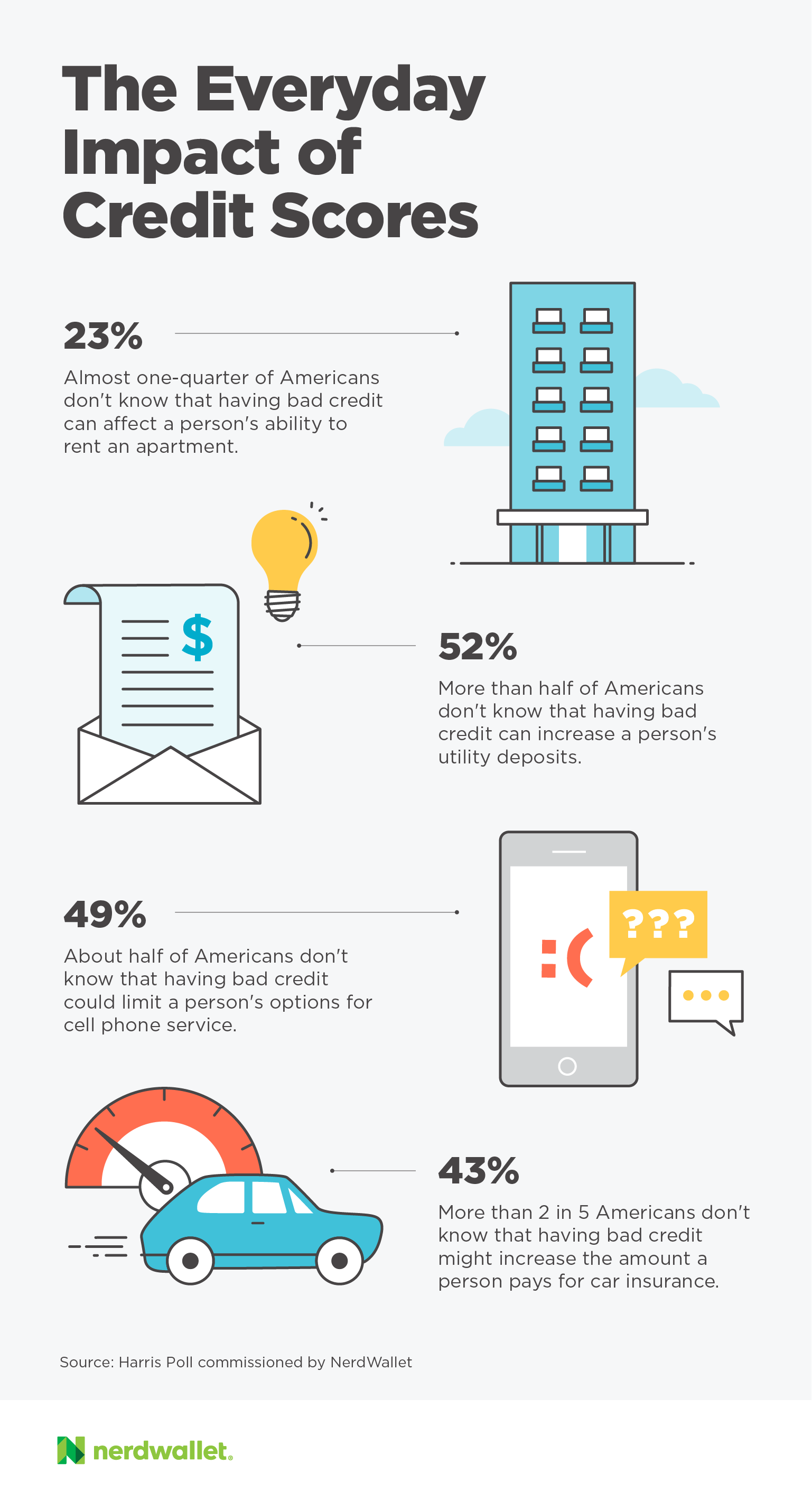

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

Read Also: Remove Student Loans From Credit Report

What Happens If A Medical Bill Is Sent To Collections

With the latest VantageScore® and FICO® credit scoring models, unpaid medical collections dont affect your credit score for 6 months.

Thats to give you, your insurance company, and your medical provider an opportunity to work out who owes what to whom.

Paid medical collections, like others, wont count against your credit score in the latest scoring models.

Unfortunately, your next lender might not use the latest FICO® or VantageScore®.

As noted in the previous section, the credit score your lender sees depends on the credit scoring model your lender has adopted, and if theyre using an older credit score model they may still see your credit score depressed by both medical and non-medical collections, whether or not theyve been paid off.

What Kinds Of Debt Are Sent To Collections

Generally speaking, unsecured debt like credit cards, student loans, medical bills, and personal loans will be sent to collections.

Unpaid mortgages generally result in foreclosure.

Unpaid car loans usually lead to repossession.

In some states lenders may still pursue you for the balance between the amount a foreclosed home or repossessed car receives at auction and the balance of your loan, and that amount can be sent to collections as well.

Also Check: How Long Can A Repo Stay On Your Credit

The Amount Of The Collection Debt Is Irrelevant

Regardless of how high the dollar amount is, your collection debt impacts your credit score the same way. In other words, if the debt is over $1, it does not matter how much you owe.

For example, if you have a debt of $200 and it lowers your score by 50 points, a $100,000 debt would drop your credit score by the same amount50 points.

Can You Remove Collections From Your Credit Report Early

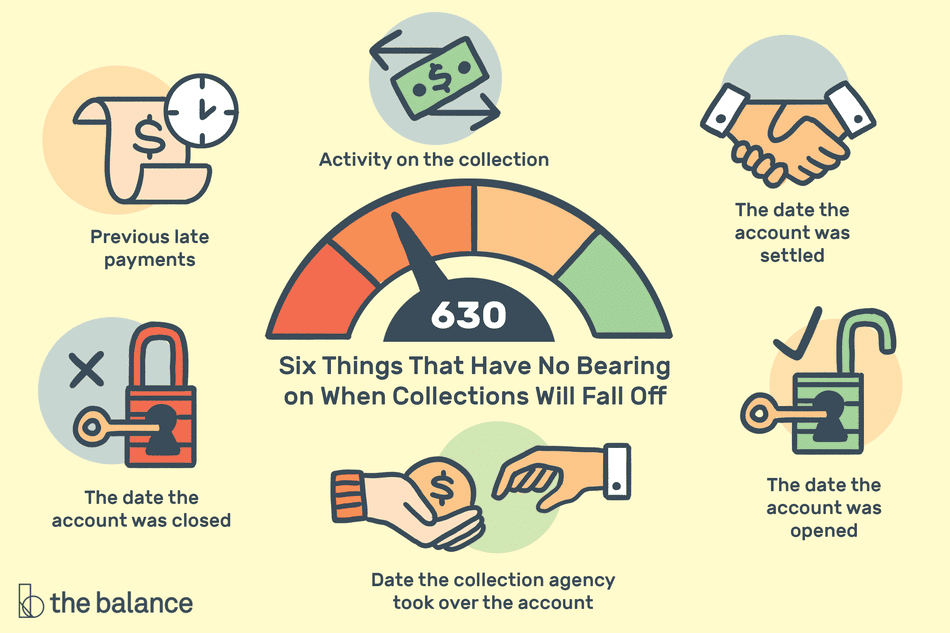

Derogatory remarks like charge offs and collections are legally allowed to remain on your credit report for up to 7 years from the date of last activity.

However, theres no legal minimum time for debt to be reported, and some collections agencies have a policy of removing paid collections from borrowers credit reports.

Others may be willing to request deletion as part of an agreement to pay a debt in full or in part.

If you are negotiating with a debt collector about resolving a collection, be sure to ask if they will delete the collection from your credit reports as part of your settlement.

A deleted collection is likely to have a positive effect on your credit score if it is the only derogatory remark on your credit report and is relatively recent.

On the other hand, deleting a single collection is unlikely to have much of an effect if your credit report still has other collections, late payments, or other derogatory remarks, or if the collection is very old.

Read Also: Realpage Inc Hard Inquiry

Tactics For Paying Off Your Collections Account

So, now that you know paying off your collections account is generally a good idea if you are looking to improve your credit, what is the best way to go about doing so? There are actually a few different ways you can go about doing this, which we will look at here. The three most common solutions are to simply pay the amount in full, to come up with a payment plan or to settle the debt for less than you owe.

Pay in Full

This is one of the easiest ways to quickly resolve your spat with a collections agency. Paying in full can help get the debt off of your back right away, so you wont have to worry about it anymore. However, it can be difficult to scrape together enough money to make this happen, especially if the debt is large and your income is relatively small.

Create a Payment Plan

This option still gets your debt paid, but over a longer period of time and on a more affordable schedule. This will ensure that the debt is being paid off, but without you having to spend your entire life savings to do so. You and your debt collector should come up with a regular payment and schedule that will work for both of you. Of course, make sure you always make these payments and do not make a habit of missing them.

Settle The Debt

How will debt settlement affect your credit? Find out here.

Depending on your unique financial situation, each option will have its own pros and cons, so its up to you to decide which is the best way to pay off your collections account.

How To Find Out If You Have Collections

Check your credit for free on Credit Sesame. On your account home page, youll see a letter grade for each of the major factors affecting your credit score. You can click the View Details link below the report card to see more information about each factor.

If you do this under Payment History, youll see a list of your accounts with negative marks.

You may need to view your credit report to find contact information for each creditor reporting a collection account. You can order one right from your Credit Sesame dashboard, or visit AnnualCreditReport.com for a free copy every 12 months from each of the major credit bureaus.

Recommended Reading: Comenity Shopping Cart Trick

Is Having Debt Bad For My Credit Score

Not all debt is bad. If you keep your credit card balances low and make all your payments on time, youll be on your way to having a strong and healthy credit score. The flip side to this scenario is having lots of debt that you cant afford to pay back and having your accounts fall into collections. When this happens, the negative marks that show up on your credit report can damage your score.

What Impact Do Medical Bills Have On Your Credit

Medical bills generally only appear on your credit reports if you donât pay the bill and your health care provider turns the account over to a collection agency. Thatâs because most health care providers donât report to the three major credit bureaus, according to Equifax®. And if your account is in collections, the account wonât show up on your credit reports right away.

The major credit reporting bureaus are required to give you a 180-day waiting period after the bill is considered delinquent before including medical-related collection accounts on your credit reports. And that waiting period gives you time to resolve the payment with your medical provider or insurance company.

If the account appears on your credit reports after that time, it may hurt your credit scores. For example, if your FICO® score started at 680, a collection item on your credit reports may cause the score to drop 45 to 65 points, according to the Consumer Financial Protection Bureau . And a score of 780 could drop by up to 125 points.

You May Like: Navy Federal Checking Line Of Credit – Myfico

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

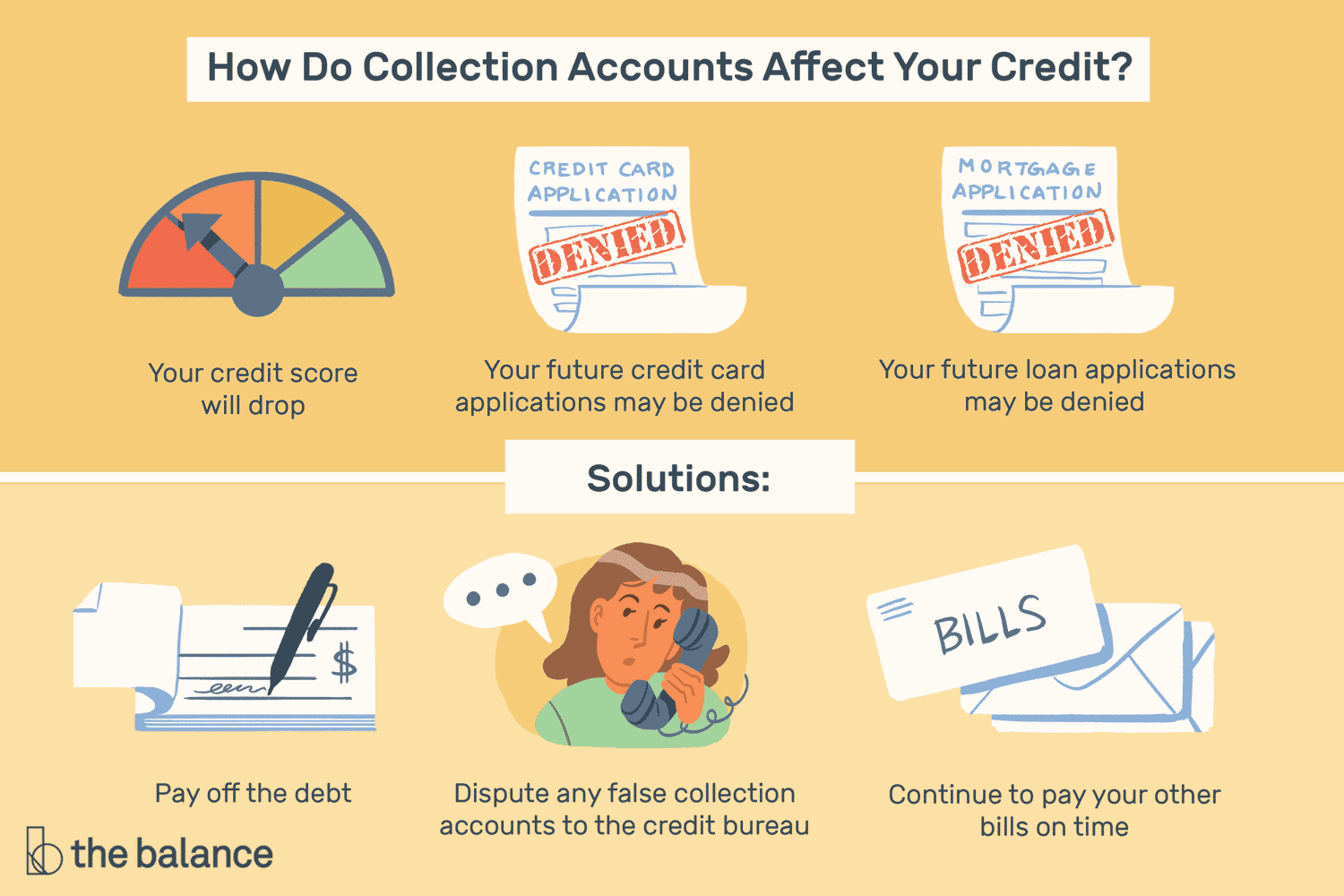

How Will A Debt In Collections Affect My Credit

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores. Thats why working hard to get current before an account enters collections can help your credit recover faster from a late payment.

Additionally, lenders also may consider frequency of debt collections. For example, someone whos had only one debt transferred to collections may have an easier time getting approved for credit than someone whose credit report shows multiple debt collections.

If you already have debts in collection, the good news is that the impact on your credit scores will diminish over time. And eventually the debt collection will fall off your credit reports completely. Generally, an account in collection will remain on your credit reports for seven years.

You May Like: How Can I Get Eviction Off My Record

How Does Debt In Collections Affect Your Credit

When a debt goes to collections, your credit score will go down, but there are ways to improve your credit if it does. The collection account will stay on your credit report for up to seven years even if you quickly pay it back. Lenders will be able to look at your credit report and see that your debt went to collections. The good news is that if it was only one or two debts and you paid them off and otherwise have a clean record, lenders may still extend credit to you.

What Are Collections Agencies

Collection agencies are companies that collect debts for companies that are owed money. How the collection agency gets paid can differ by the company and state laws. In some cases, if an agency collects money from a debtor, it will take 25% to 50% of the amount collected as a commission. Some debt collection companies purchase delinquent accounts from the original creditors for pennies on the dollar of the amount owed and keep 100% of whatever they collect.

Don’t Miss: Is Opensky Reliable

What Happens To My Credit When An Account Is In Collections

Payment history makes up about a third of your credit score so even before your account goes to collections, your credit score could drop quickly at 30 days past due. The factors that affect your payment history include:

- The types of accounts

- The amount of time past due

- Number of past due accounts

When a creditor writes off your account as a ‘charge-off’, your credit score drops dramatically. When the account is moved to collections, it drops even more. A charge-off remains on your credit report for seven years but as you keep other accounts current, the impact lessens over time.

The amount a credit score drops also depends on how high your score was before the collections was added to your credit report. It is important to note that credit reporting isn’t mistake-free. A consumer has a right to a yearly free credit report to ensure that accounts and payments are being recorded correctly. Collections, charge-offs and bankruptcies that show up on credit reports can greatly affect your ability to get loans, credit, housing, and employment.

What Are Collection Accounts

A collection account is an entry on your credit report that indicates default on a previous obligation. The original creditor either sold the defaulted debt to a debt buyer or consigned the debt to a collection agency. The goal of the collector, not surprisingly, is to work on behalf of its client to collect the defaulted debt from the debtor, or as much of it as possible.

Collection accounts often are reported to the credit reporting agencies, and are allowed to remain on credit reports for up to seven years from the original debt’s first delinquency date, per the Fair Credit Reporting Act .

Recommended Reading: Experian Unlock

What Is A Statute Of Limitations On A Debt

If youre contacted by a debt collector before a statute of limitations on a debt runs out, you could be sued over your unwillingness to pay what you owe.Generally, a statute of limitations lasts from three to six years. According to the Consumer Financial Protection Bureau, it depends on the state, what type of debt you have and whether the state law attached to your situation is named within your credit agreement.