What Is On An Experian Credit Report

One of the three big credit reporting agencies, Experian provides information on consumers credit backgrounds to businesses looking into someones creditworthiness and risk in lending. Most often, banks and lenders will request a consumers Experian credit report to determine a loan approval and amount.

Lenders arent the only entities who can receive an Experian credit report. Other screening services offered are:

- background checks to employers

- tenant screening to residential and commercial landlords

- patient financial screening to healthcare providers

You have the right to request and view a copy of your Experian credit report. Its important to carefully examine the information included in the report. Unfortunately, errors appear on credit reports all too often and carry serious consequences.

How Do I Correct Or Dispute Inaccuracies On My Credit Reports By Mail

If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. This is especially helpful if the information involves your name or address. Updating your personal information with lenders and creditors can help ensure the information reported to the three nationwide credit bureaus Equifax, Experian and TransUnion is correct.To file a dispute by mail, you may need to provide copies of documentation. Please;;to review documents that may be required. ;You can send your request and copies of documents to the three nationwide credit bureaus at the following addresses:Equifax Information Services, LLC

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

Don’t Miss: When Does Paypal Credit Report To Credit Bureau

What To Expect After Filing An Experian Dispute

Experian typically completes its investigation within 30 days. If you filed;an Experian dispute online, the credit bureau will keep you updated by email. If you mailed your dispute in, youll receive a letter in the mail with the results of the investigation.

Be sure to get your FREE credit report;through Experian to see if there are any unknown activity on your credit history that may require submitting a dispute.

When Does A Credit Dispute Hurt Your Score

A dispute doesnt stay on your credit report as any kind of lasting mark unless you request a dispute note after an unsuccessful attempt. Even that doesnt hurt your credit. The way you see a change in your credit score is after the dispute process, and in many cases, it will be a positive one.

For example, if you correct a large outstanding credit card balance thats listed on your report, youll see a jump in your score because your credit utilization will be lower. The same holds true with inquiries and late payments. The increase may not be enormous depending on the type and number of entries you get removed, but each one will contribute to an overall better credit history.

Also, be aware of the XB effect. XB is a code used on credit reports to indicate that a particular account is currently being disputed. During this time, Experian doesnt include that account as part of your credit score if it happens to be pulled.

So you may end up seeing a large jump in your credit score because that balance and any associated late payments arent contributing to your score at all. Once the dispute is over, the code is lifted. The account is once again included, but will also reflect any changes that were made as a result of the dispute.

Recommended Reading: Aargon Agency Inc Phone Number

Things To Look For On Your Free Experian Credit Report

The Consumer Financial Protection Bureau , the official U.S. federal government agency charged with protecting clients of financial institutions, has some sound advice for citizens who want to closely examine their credit reports.

The CFPB categorizes errors on credit reports with Experian as follows:

1. Identity Errors: A creditor may have reported your information incorrectly to the credit agency. For example, they may have misspelled your name, given an incorrect address, or failed to properly indicate your phone number.

These types of errors are less damaging, but there is a type of identity error which can be more malignant: accounts that belong to another person have been reported as your accounts. This type of error could happen if someone shares a similar name or other information. Lastly, fraudulent accounts could fall under this category.

2. Incorrect Account Status Reporting by Experian: The types of errors that can fall under this credit error category include closed accounts reported with a status of “open,” incorrect ownership versus authorized user status, incorrect payment, opening, or first delinquency dates, and duplicate debts or accounts. All of these errors can negatively impact your credit score and should be disputed as soon as possible.

R Shiny Scrollable Table

Kurulus osman season 2 episode 1 in urdu facebook part 5Keyword Research: People who searched file dispute with experian online also searched

Please enable JavaScript to view the page content. Your support ID is: 8099029053254028659. Please enable JavaScript to view the page content.<br/>Your support ID is …

Recommended Reading: Zebit Report To Credit Bureau

What Happens When You Initiate A Dispute

The Fair Credit Reporting Act says the credit bureau must investigate and correct any inaccurate information, which will usually happen within thirty days. The bureau presents your claim to the creditor that provided the information. The creditor then has to look into it and report back to the credit bureau. If the information does turn out to be wrong, they have to notify ALL of the major credit bureaus so your file can be corrected.

If you initiate the dispute online, youll have a tracking number so you can log in and check the progress of your case. If you do it by mail or phone, keep records of who you speak with or any correspondence you receive. The bureaus recommend you hold off on applying for new credit while the dispute is pending.

No matter what the outcome, when the investigation is complete, youll get the results in writing. If you still have a dispute after the investigation is done, you can ask for a statement of the dispute to be included in your file and in future reports.

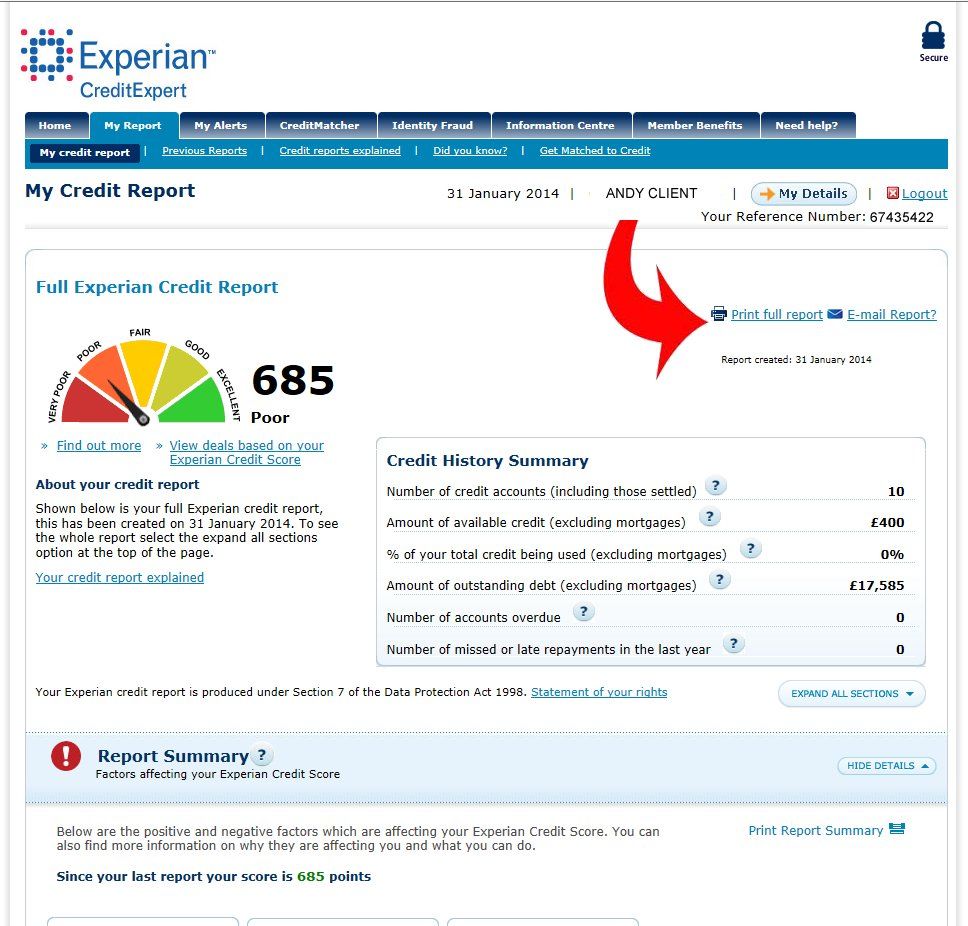

Obtain A Copy Of Your Experian Credit Report And Identify All Errors

The first thing to do to make sure there aren’t any inaccuracies on your Experian credit report is to obtain a copy of the report and review it carefully.

You can get a copy at no cost to you from AnnualCreditReport.com. You’re entitled to a free copy of your report from each of the major credit reporting agencies once per year, which can be obtained online by visiting that site.

Pulling your report is easy: you just need to provide some basic identifying information and verify your identity. Once you’ve obtained a copy, look at it carefully to see if there is any information that is not correct.

You should review everything on your report, including the names and aliases listed; current and former addresses; and all of the details about each of your accounts. Look for accounts you didn’t open, inaccurate payment history information, court records that don’t belong to you, and anything else that seems incorrect based on your knowledge of how you’ve used credit in the past.

Recommended Reading: How Long A Repo Stay On Your Credit

How To Dispute Something On Your Credit Report

Wrong information on your credit report? Heres how to dispute it, along with sample letters you can use.

Weve talked before about how important your and credit score are, both in your business and your personal life. Without good credit, its very difficult to get approved for a credit card, a loan, or receive payment terms from a vendor. Many landlords and employers also use credit reports as part of their evaluation process.

It is equally important to periodically check your credit report to make sure it doesnt contain any wrong information that might be detrimental to you. By law, youre entitled to one free copy of your report per year from each of the three major credit reporting bureaus. Many experts suggest getting them at four month intervals so you can cover the entire year. You can order your free credit report online or by phone at 1-877-322-8228.

What to look for on your credit report:

- Payments reported as late or missing that werent

- Accounts listed as open that youve closed

- Accounts that dont belong to you

- Incorrect names or other identifying info

- Bankruptcies reported after ten years

- Other negative credit info reported after seven years

If you find a mistake, its on YOU to contact the credit bureaus to let them know. You can do this online, in writing, or by phone.

When And How To Get Your Credit Report

You should review your credit report from the three major U.S. credit reporting agencies at least once a year, especially before making a large purchase, like a buying a house or a car.

Credit agencies typically charge fees for reports. However, you are entitled to one free credit report from each of the three major credit agencies once a year from www.annualcreditreport.com or call toll-free 1-877-322-8228. In addition, youre entitled to a free credit report:

- Within 60 days of being denied credit, insurance, or employment

- Once a year if youre unemployed and plan to look for a job within 60 days

- If youre on welfare

- If your report is inaccurate because of fraud, including identity theft

Don’t Miss: Removing Hard Inquiries From Your Credit Report

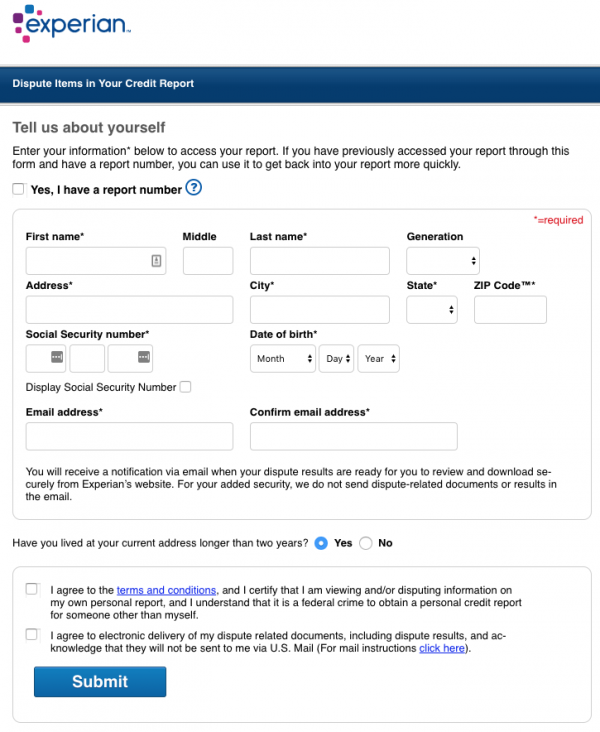

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

How Do I Correct Errors On My Credit Reports

To correct errors on your credit report, you need to contact the credit bureau that is showing erroneous information. Your FICO Score uses the information on your credit reports to calculate your FICO Score, so inaccurate or incorrect information on your credit report can hurt your score.

myFICO customers can use the following contact information to reach each bureau:

Equifax

All disputes with Equifax are handled online.

Experian

All disputes with Experian are handled online.

TransUnion2 Baldwin Place, P.O. BOX 1000Chester, PA 19022

Your File Identification Number is no longer needed by TU’s system. TU’s automated system may ask you for a FIN, but it is not needed to move the call forward and speak to a live agent.

Read Also: Does Opensky Report To Credit Bureaus

Sue For An Unsettled Experian Dispute

When you file a dispute by mail, online or over the phone, Experian has a 30-day window to verify that the disputed information is incorrect and fix the error.

If your Experian disputes are ignored after 30 days and errors are not corrected, the attorneys at Francis Mailman Soumilas, P.C. are here to help you sue Experian. Fill out the online form to start your free case review or call us now at 1-877-735-8600.

Wait For The Results Of The Investigation

Equifax will review all the information you provide and, depending on the situation, may reach out to the business who you’re claiming is reporting the inaccurate information.

Equifax provides the company reporting the info with your documentation and asks them to take action to update their records if appropriate. The company will also be asked to submit a reply that may include their own documentation or may include notification of a change to what’s being reported.

Equifax will get back to you within 30 days of the time you submitted your dispute, or within 21 days if you live in Maine. You’ll be notified of the decision made in the investigation and, if appropriate, your credit report information will be modified to remove or correct inaccurate information that was on your report.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Errors & Fraudulent Activity On Your Experian Statement

But, there is another scenario you should be aware of. If a criminal is able to open a fraudulent credit account with your personal information, there is a 100% chance the criminal will become delinquent on the loan being reported to Experian.

This hurts your credit score with Experian. From the credit bureau’s perspective, you bear the responsibility for the fraudulent activity until you prove otherwise.

This “guilty until proven innocent” approach to reporting places the burden of monitoring on you, the consumer.

While this state of affairs is not fair, it’s up to you to do your research. Let’s learn about how you can identify errors on your Experian credit report and how you can fix the problems you find by disputing directly to the CRAs such as Experian.

Headline 2: How To Pull Your Credit Reports From Experian

It’s a fool-proof system, as you can see.

Sarcasm aside, here’s how you can pull your credit report from Experian in order to dispute the error.

Before you follow these steps, you should be aware that annualcreditreport.com is the official, government-mandated website where you can request your credit reports from all three major credit bureaus for free.

1. Navigate to annualcreditreport.com and click on the button labeled “Request your free credit reports.”

3. You will then have the option to view the credit reports from each agency in sequence. Make sure you review each report for errors and fraudulent activity.

How To Dispute Something On Your Experian Credit Report

If your Experian credit report has any errors, this step-by-step guide will help you through the process of disputing the inaccurate info.

Mistakes on your credit report are far more common than many people are aware of. Unfortunately, errors on your credit report can drag down your credit score. This can be a major problem, since your credit score is used in all sorts of ways.

Lenders use your credit score to determine if you can borrow, and what interest you’ll have to pay to do so, whether youre applying for a personal loan or a . Utility companies use your score to assess how big of a deposit you’ll have to make to connect to service, and cell phone companies use it to decide whether to give you a phone on a contract. Car insurers also use it to determine your rates, and employers sometimes check your credit as part of a background check.

Since your credit score is so important, you should be checking your credit reports regularly so you can take action if there’s any inaccurate information on your reports. If you do find an error on your Experian credit report, take the following steps to make sure it gets corrected.

Recommended Reading: Aargon Collection Agency Reviews

What Information Can I Dispute On My Credit Reports

There are certain things you could dispute on your credit report. Make sure you read and review your credit file;for accuracy and file a dispute if any of the following are incorrect:

Personal Information;

Make sure your name and its variations over time, such as your maiden name or middle name are spelled correctly. Confirm all present and past home addresses listed are correct. Dont overlook the review of your personal information names you dont use or home addresses you dont recognize on your credit report may be signs of identity theft.

Account Information;

Review your lines of credit, loans, and credit cards and make sure that the balances and payment history are accurate. Incorrect account information could negatively impact your credit score look for reported late payments, delinquencies, or other errors and dispute them to wipe them off your credit history. And if you find inquiries for credit card applications you dont recognize or other types of loans and cards you didnt apply for, you may be a victim of identity theft;or fraud.

Mixed Credit Files;

Mix-ups happen make sure all accounts listed are yours, especially if your name is common.

Duplicate Reporting of an Item;

Having a high amount of debt can affect your credit score. If one of your loans or cards is reported twice, your debt levels are double what they actually are.

Items Too Old to Remain on Your Credit History;

Here Are Your Rights Regarding Information On Your Credit Report

The Fair Credit Reporting Act is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application.

Your rights under the Fair Credit Reporting Act:

- You have the right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

- You have the right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

- Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

- You have the right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

- If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

- You have a right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

You May Like: 779 Credit Score