Paypal Business Loans: Post Funding

PayPal will deduct payments from your business bank account every week. Though you can change the day of the week in which payments are deducted, you cannot change the frequency.

Its unclear if PayPal business loans have conditions similar to the catch-up payments or the 90-day rule with PayPal Working Capital.

Does Bnpl Require A Credit Check

Ordinarily, consumers who apply for loans or other forms of credit are subject to a hard credit inquiry, which allows lenders to view the consumer’s before making a decision. Each hard credit inquiry can knock a few points off your credit score. Soft credit pulls, on the other hand, have no impact.

Some BNPL providers conduct a hard credit check when you apply, while others don’t. The list of providers that use soft or no credit checks includes:

A hard credit check may be required if you’re using a special financing option offered by a buy now, pay later service. For example, Klarna requires a hard credit check if you’re applying for one of its six-month, 12-month, or 36-month installment loans. Otherwise, you may be able to avoid a hard credit checkand any harm to your credit scorewith BNPL financing.

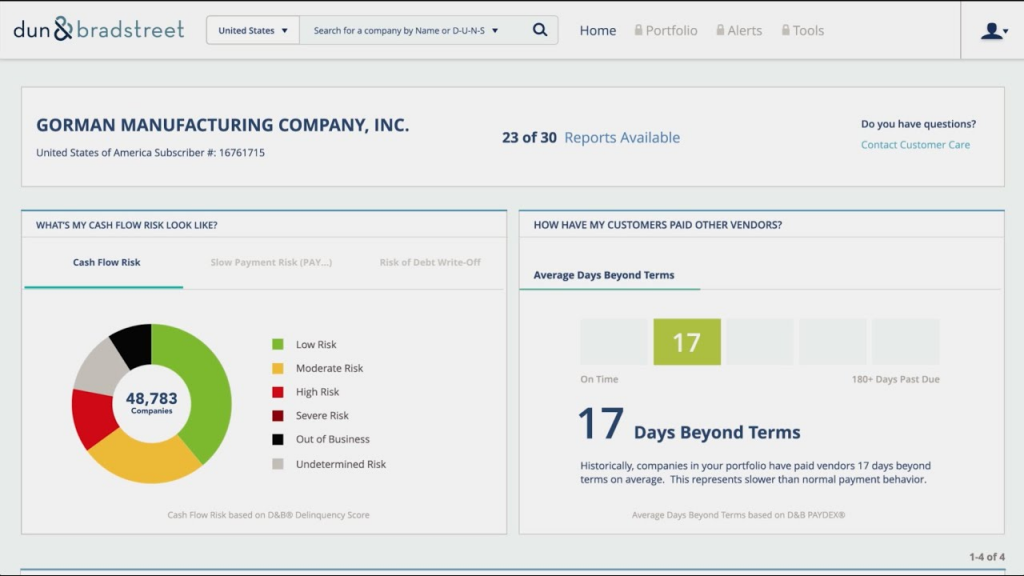

Monitor Your Personal And Business Credit Score

Stay up to date on when inquiries happen on your personal and business credit. *You get free access to your business credit reports and scores when you sign up for a free Nav account. Checking won’t hurt your credit scores.

Here we explain what to expect from a credit check for these suddenly very popular loans.;

Don’t Miss: When Does Citi Card Report To Credit Bureaus

Most Lending Institutions Require At Least A 600 Credit Score To Approve An Auto Loan Without A Downpayment

However, it is possible to purchase a vehicle with a score a score as low as 400. There are a lot of factors that determine your loan eligibility and what interest rate you are eligible for. These factors include:

- Are you paying money up-front. How much is the downpayment?

- Have you had past auto loans and did you pay them well?

- How much of a percieved risk is the bank taking to extend you this loan?

How Does Experian Boost Work

The Boost process is quite easy and takes just a few minutes. After creating an Experian account, you then link your financial institutions where you maintain your checking, savings or other bank or credit card accounts that you use to pay your bills, and enter your login credentials to seamlessly link them.

If you have multiple accounts at the same financial institution, Experian allows you to select which accounts you want included so you can just add the accounts you use to pay your bills.

Once youve linked your accounts, Experian will automatically go through all your recent transactions and identify payments that qualify to be added to your Experian credit file, such as utility bills. It then shows you a list of eligible bills and allows you to select which ones you want to add to your report.

Make your selections and within moments, Experian Boost factors in the new information and shows you your new FICO® Score. Since Experian Boost doesnt include missed payments, your FICO Score wont go down, but it might not change if there either isnt enough information from the added accounts or your FICO Score is already relatively high.

Even if it doesnt make a difference to your FICO® Score, the process is as easy as it sounds and literally costs nothing. And once you have it all set up, Experian Boost will continue to monitor your payments, and may increase your credit scores if future payments make a difference.

Read Also: What Does Filing For Bankruptcy Do To Your Credit Score

How Does Paypal Credit Work

PayPal Credit is a line of credit issued by Synchrony Bank. Approved PayPal users can use this virtual line of credit which functions similarly to a credit card, letting you pay for online purchases in installments, rather than upfront.

Approved PayPal users can use PayPal Credit as a payment option whenever they check out using PayPal, either from a website or at a brick-and-mortar store that accepts PayPal.

Note that PayPal Credit is not the same thing as a PayPal debit or credit card.

Despite filling a very similar niche, PayPal Credit is also not the same thing as PayPals Pay in 4 feature. You can think of PayPal Credit as being closer to a credit card, while Pay in 4 is more akin to POS financing. With PayPal Credit, youll have gone through the vetting process in advance and can utilize your revolving line of credit at will. You also have more flexibility in how and when you pay off your balance. In the case of Pay in 4, the financing decision is approved at checkout, after which youll have a very structured repayment plan.

Accept Offer & Get Funded

At this point, you can either accept the offer or go back and enter another borrowing amount and/or repayment percentage.

Once you accept the offer, PayPals partner lender WebBank will deposit the funds in your PayPal account in just a few minutes. You can use the funds as soon as they appear in your account.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Whats Good For Your Credit Score

While there isnât just one score, there are some general rules about what could affect your score positively, negatively, or not at all.

If you have a history of managing money responsibly then you’re likely to have a good credit score. Lenders often like to see a proven track record of timely payments and sensible borrowing.

Whether youâre working to improve a poor credit score or need to build up credit history from scratch, here are some basic pointers:

Downsides Of Experian Boost

Though Experian Boost is a great feature for consumers who might not have a strong credit file, it isnt perfect. Here are a few downsides of the feature:

- If youre a long-time avid user who charges everything for the rewards points and pays your bill on time and in full, Experian Boost may not be very beneficial. Your credit history already includes the payment history from your credit card payments . Adding a few more on-time payments is unlikely to have a large impact on your credit scores. Experian Boost is most beneficial for users who do not have a very robust credit file.

- Lenders might be using a version of a FICO Score or a different credit scoring model that doesnt work with Experian Boost. Theres no guarantee that using Experian Boost will increase your odds of approval for a specific credit product from a specific lender.

- Experian Boost looks at cell phone, utility and service payments. It would be more helpful if it could include rent payments as well. It is possible to get rent payments added to your credit report, thoughheres how.

- As Experian itself points out, adding utility payments to its records wont affect whats in your files with the two other major credit bureausEquifax and TransUnion. So depending on which bureau a prospective lender or credit card issuer uses, Experian Boost may not help you get approved.

Read Also: How To Boost Credit Score 100 Points

How Can You Monitor Your Report And Score For Free

Consumers have not always had access to their scores. Now, however, scores are;widely available to consumers for free from a variety of sources.;When picking a source of a free score so you can monitor your credit, look for one that includes free credit report information as well,;such as NerdWallet, which has scores and reports that update weekly. That gives you a convenient way to check your credit health any time and monitor your progress. It’s smart to choose a particular score and monitor that one, using the same credit bureau and scoring model.

Who Is Progressive Leasing

Progressive Leasing is the largest and longest-tenured virtual lease-to-own provider in the United States. Since 1999, Progressive Leasings fair and transparent lease-to-own option has helped millions of customers and their families, even if they have less-than-perfect credit or an inability to pay for their purchase up front. Progressive Leasing has also helped more than 30,000 retail stores drive increased revenue and improve customer satisfaction.

You May Like: How To Get A Bankruptcy Off Your Credit Report

What Will My Recurring Payment Be

Because we do not know what items you will select, we cannot yet tell you your recurring auto-payment amount, 12-month lease-to-own total, payment schedule, etc. These details will be in your lease-to-own agreement, which will be emailed to you after you apply, get approved, and select your items. Youll have an opportunity to review all of these terms before you sign. There is also a convenient payment estimator that you can use after you tell us where you want to shop. If you have any additional questions you can always speak with a Progressive Leasing customer service agent at 898-1970.

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

You May Like: Which Credit Score Is Correct

Do I Have The Option Of Paying Off My Lease And Owning The Product Before The Standard 12 Months

Yes. You can purchase the product at any time. You can take advantage of a 90-day purchase option as provided in your lease-to-own agreement. This is the least expensive lease-to-own purchase option and expires 90 days after your item are delivered. After this option expires, you can exercise an early purchase option for less than the total of remaining 12-month lease-to-own total, as described in your lease agreement.

Standard agreement offers 12 months to ownership. Early purchase options cost more than the retailers cash price . To purchase early call 877-898-1970.

Who Experian Boost May Be Best Suited For

Experian Boost may be best for an individual who has been making on-time cell phone, utility and/or service payments for some time but has never opened a credit card or another type of loan account.

Experian Boost doesnt work for everyone, though. The free feature is best suited for individuals who pay their telecom, utility or service bills through an eligible account. If the feature doesnt work for you, you can try other methods to boost your credit scores.

Nevertheless, with how fast it is to set up an account with Experian and start the process, it might provide an easy way to raise your credit score by a few points.

Don’t Miss: How To Get Fico Credit Score

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Minimize Appearance Of Hard Pulls

- Many credit card issuers dont like to see a dozen plus inquiries over the past year or two, so by trying to go for certain bureaus, you can minimize the appearance of being a credit savage.

Using the same example as above, if you were to apply to a bank that pulls TransUnion they would not technically see your recent Experian inquiries. So it would not look like you are aggressively pursuing credit as much as you are, which is a good thing.;

Also Check: How Long Does Debt Settlement Stay On Your Credit Report

Paypal Working Capital: Post Funding

Repayments begin 72 hours after funding is distributed. You can also make manual payments or pay the loan in full at any time, as there is no prepayment fee.

Earlier, we noted that each days payments are deducted the following day. If you dont have enough money in your PayPal account to cover the amount owed on yesterdays sales, PayPal will take catch-up payments from your account until you are caught up. For this reason, your repayment amounts wont necessarily rise and fall in tandem with your sales like they would with a merchant cash advance.

PayPal wont take catch-up repayments that put your balance in the negative. However, if your daily sales drop so low that youre behind more than 50% of your total amount owed, PayPal may consider your account in default. At this point, PayPal may put restrictions on your account or even demand that you repay the entire loan.

Instantly Boost Your Score

Each company may consider different information when working out your score and use a different formula. For example, your credit report held by each of the main credit reference agencies may contain different information. Firms also differ in how many points are awarded for each piece of relevant information, depending on the formula used and any lending policies. Scores are often expressed using different ranges, meaning they wonât usually be directly comparable.

The Experian Credit Score is completely free and gives you an indication of how companies may view your credit report. Itâs represented as a number from 0-999, where 999 is the best possible score, and is based on the information in your Experian Credit Report. You can check it without paying a penny, and itâll be updated every 30 days if you log in.

Don’t Miss: Does Closing A Credit Card Hurt Your Score

Should I Close My Syncb Account

Once again, closed accounts affect your utilization rate, which impacts your overall credit score. For the most part, if you don’t owe any debt, closing your recent SYNCB account will only negatively affect your credit score temporarily.

If you don’t ever plan to use this credit line and don’t want to have it out there, it’s probably a good idea to go ahead and close it. Of course, keeping it open won’t hurt your credit. However, if you don’t use it, then SYNCB will close the account for inactivity eventually.

Who Owns The Merchandise

Progressive Leasing will buy the leasable item you selected from the retailer and lease those items to you. If you complete all standard lease payments or exercise an early purchase option, you will own the item.

Standard agreement offers 12 months to ownership. Early purchase options cost more than the retailers cash price . To purchase early call 877-898-1970.

Also Check: How Much Does Transunion Charge For Credit Report

Why Isnt My Credit Score Listed On My Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you pull your credit reports online, you may be surprised to;realize;your credit score;is not;showing up.

Why isn’t;your credit score on your credit reports,;and what can you do about it?