Personal Debt Impacting Business Loans

If you have personal debt or a low personal credit score, this could hinder your prospects for a business loan. This will depend on if your business has a score of its own and what type of company organization you are.

Some lenders may only be interested in your business credit score or history. As we have mentioned above, this is usually reported by the three major business credit card bureaus .

Meanwhile, with working capital loans, the lender is more concerned with the historical health of your revenue streams and balance sheets rather than your credit score.

Loans you take out for business purposes could be influenced partially by your personal credit. If you are taking out a personal loan to help cover your business expenses, then your personal credit is important.

But even if you are only applying for a business loan, your personal credit history may play a part if your business is new and doesnt have its own history or successful revenue stream to look to.

Ways To Limit A Personal Loans Negative Credit Impact

If you ultimately decide that a personal loan is the right choice for your finances, there are steps you can take to limit its effect on your credit score:

- Apply for loans within a two-week period. The FICO® Score algorithm will recognize that youâre rate shopping, or comparing rates across multiple loans within the same category, if you submit applications within a specific time frame. That period is 14 days for older FICO® Score versions and 45 days for newer versions. To be safe, submit all loan applications within the 14-day time frame, since lenders may use an older version of the FICO® Score to assess your creditworthiness.

- Make all payments on time. Paying every bill on time is essential to maintaining a strong credit score. The same is true for your new personal loan. If 100% of your personal loan payments are made on time, the loan can help future lenders see that you can be trusted to follow through on your financial obligations.

- Pay off the loan in full. In addition to making on-time payments, itâs important to make every payment until the load is paid off. Paying off a personal loan early wonât necessarily improve your credit score, however. Once paid off, the account will be considered closed, and your score wonât benefit as much from your on-time payment history as it would if the account were still open and being managed responsibly.

Read Also: Does Paypal Report To Credit Bureaus

What Do Lenders Need To Report

The lender must report borrowers of SBA-guaranteed loans to commercial credit reporting agencies. However, they do not need to report on the guarantors of SBA loans.

Lenders report the name, address, and TIN of the borrower, as well as the amount, status, and history of the debt, and also the agency or program under which the debt occurred.

As well as being required by law, lenders need to report the transactional history of SBA loans to commercial reporting agencies because it gives notice to other creditors owed by a small business.

This lets other lending firms and institutions know a businesss total existing debt. Furthermore, the SBA has noted that business owners who are more conscious of their credit are more likely to pay on their accounts if they know their history will be passed onto credit agencies.

You May Like: What Is A Fair Credit Score To Buy A House

Sba Business Loan After Bankruptcy

You can also use an SBA 7a loan to buy or recapitalize a business even if you have a past BK. See below for more info on what matters to a lender in these situations, but we have helped many clients in various situations over the years and it all comes down to how the lender evaluates the risk in the transaction.

They will want to see that you are fully recovered and stable with regard to cash flow/income, personal credit and net worth .

What Does A Hard Hit Do To Your Credit Score

Because there are different credit bureaus, the level of impact to your credit score depends on which organization is pulling your credit.

Your Experian Intelliscore could be impacted by your initial inquiry into your business credit, while the FICO SBSS scores evaluate both your business and personal credit, and a high number of hard inquiries over a shorter period of time could have a negative impact, said Nathan Grant.

Scores from Equifax or Dun & Bradstreet PAYDEX should be unaffected by hard inquiries as the factors that impact those scoring models are related to your business financial data.

Hard hits or pulls lower your credit score, although usually temporarily. For some people, this isnt ideal even in the short term.

I may be purchasing a house in the next 6 to 12 months, so I wouldnt want any dent in my credit score, Calloway said.

You May Like: How Often Should You Check Your Credit Report

Find Partners To Invest In Your Business

Another creative option to consider is the possibility of taking on business partners. If you have the idea and technical skills to get your startup going, and you have friends or associates that have the capital, then this could be the beginnings of a lucrative business relationship. There are two main things to remember if you decide to take on a business partner or partners:

1. Always put everything in writing. It doesn’t matter if the person you are partnering with is your best friend. It doesn’t matter if you trust each other implicitly. Make sure to put everything in writing. How much of the business will they own? Will they be a silent partner? If they are going to be an active partner, how much time will each of you spend working at the business each week? If they are covering the expenses, will they be paid back? How much salary will you each be paid? These are all the types of questions that should be covered and agreed upon beforehand.

2. Be transparent. Don’t sugarcoat things, you need to be brutally honest. Your partner has the right to know what they are getting into. Ensure you have a solid business plan and that they understand it, and if they have any concerns that require the plan to be modified, it’s always best to do this before you enter the partnership.

Ppp Loan Recipients Wisconsin

1. Wisconsin PPP Funded Companies SBA.com Listing of companies in Wisconsin that have received PPP loans under the Paycheck Protections Program, according to data provided by the U.S. Treasury. Wisconsin businesses have been approved for almost 100,000 loans from and other lawmakers could see taxes cut after they

Don’t Miss: How To Maintain A Good Credit Rating

How Long Can A Personal Loan Affect My Credit

Even after youve paid off your personal loan, the account will stay on your credit report for years after it closes. This is good news if you managed the account well and always kept up with payments.

Debt accounts that were in good standing when they were paid off can stay on your credit report for up to 10 years after the accounts were closed, giving you a positive credit boost as long as they stay there.

Delinquent or charged-off debt can only stay on your credit report for seven years after the account was first reported as delinquent. However, the negative effects of the late or missed payments will likely begin to fade as time goes on, even before the account gets removed from your credit report.

Credit Karma Guide To Business Credit Scores

They do not impact each other, Detweiler says. However, there are a few business credit cards and financing options that may report to both

If you received a loan from a major lending company and think this applies to your report, call your lender and ensure they have all the correct information.

Read Also: Which Credit Card Companies Report Authorized Users

It Can Prevent You From Getting A Mortgage

Jake Blount: Basically it wasnt a client, it was actually myself. That makes it closer to home, more personal. Basically we had been planning on buying a new house for a while and renting out our current house to try to build up some rental income and kind of rental properties. And house had on the market on our street for a while and we finally were like, okay, I think this is the time its been on for a while. And so we were going to start to kind of go down that path. And so were like, great, we got our taxes done. Little bit of a rough start from the beginning of coronavirus, but we were able to get the PPP, which brings us to why were kind of talking about this now in the first place. Get the PPP in May, May 5th. It was the first round of getting it. Great. We got it in my bank account. I had lost a couple deals.

Bob Lotich: Got some money. Yay!

Where Does The Lender Report

The lender is to submit the report to at least one commercial credit bureau reporting agency. These agencies are abundant and each institution may have preferred reporting resources.

LendXP recommends the following three agencies, as they are respected within the industry and provide thorough, accurate, and timely documentation.

- Dun and Bradstreet

- Equifax Small Business Enterprise

You May Like: Is 750 A Good Credit Score To Buy A House

The Trends Of Commercial Credit Reporting On Consumer Credit

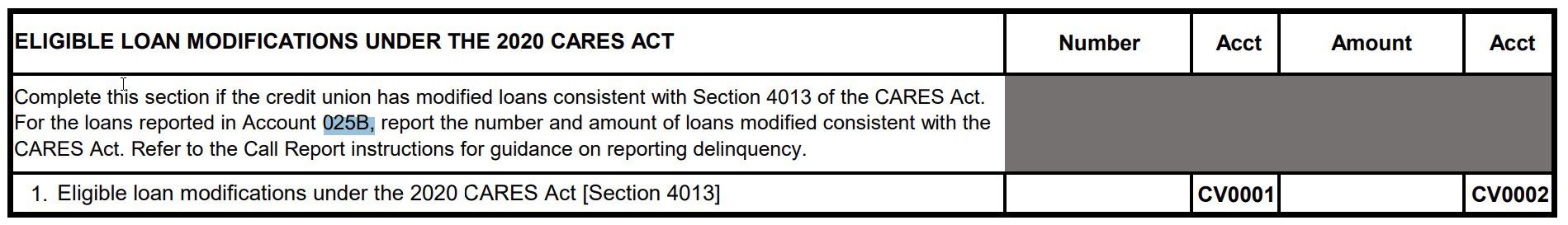

Product DescriptionConsumers Accounts FurnishersBusiness credit card2,3262,54536Business loan179154632Commercial installment loan129147212View 5 more rows

The Small Business Association does not specify a minimum credit score required to secure an SBA loan. However, SBA loans are provided by lenders who may

What Is The Credit Score Requirement For An Sba 7a Loan

The SBA itself doesnt assign a specific credit score to qualify for this financing. But remember, the SBA loan will come through a lender, and

More than 7500 lenders nationwide also rely on the Small Business Scoring Service, or FICO SBSS score, to make lending decisions, although they

2. Reports to Credit Reporting Agencies In accordance with the Debt Collection Improvement Act of 1996, Lenders are required to report information to the

Don’t Miss: How Much Will A Car Loan Drop My Credit Score

Home And Personal Property Loans

The SBA provides loans up to $200,000 for homeowners whose primary resident needs repair or replacement because of a declared disaster. Renters, as well as homeowners, may borrow up to $40,000 to cover personal property damaged in a disaster. However, unless your local building code requires it, you cant use the funds to make upgrades or additions to your home.

Recommended Reading: What Credit Score Does Comenity Bank Use

Do: Build A Relationship With Your Lender

You want more than a transactional relationship with your bank. You want a contact who knows you and your business. Then, when you need help youre not just a faceless request.

“Part of what you want to do as a small-business owner is build relationships with people youll need before you need them,” Alozie says.

About the author:Kelsey Sheehy is a personal finance writer at NerdWallet. Her work has been featured by The New York Times, USA Today, CBS News and The Associated Press.Read more

You May Like: What Credit Report Does Chase Pull

Is There A Deadline To Apply For Ppp Loan Forgiveness

To avoid making payments on your PPP loan, submit your loan forgiveness application within 10 months of the last day of your loan’s covered period. This period typically lasts eight to 24 weeks after your loan is funded. If you submit an application within this period, your loan payments will be deferred while your application is reviewed.

Are you too late? You can still apply for PPP loan forgiveness at any time up to the maturity date of the loan. Loans issued prior to June 5, 2020, mature in two years loans issued after that date mature in five years. However, when your coverage period plus 10 months have passed, you’ll need to begin repaying your loan while your application processes.

What If I Have Two Businesses In Different States

According to the SBA, the way you apply is determined by how you file your federal taxes. For example:

- If you operate three locations but report all sales in one federal tax return, you should complete one application for all of your locations or

- If you operate three locations and file a separate federal tax return for each location, you should complete a separate application for each location.

If you are a sole proprietor with multiple businesses:

- If you report your businesss revenues on a single Schedule C, you should complete one application

- If each of your businesses has its own tax identification number and you file separate Schedules C, you should complete a separate application for each business.

Check Your Business Credit To See What SBA Loans You Qualify For

When you sign up for a free Nav account. This will let you see if the business credit bureaus already have you on file. Checking wonât hurt your credit scores

Also Check: Is 661 A Good Credit Score

Does Sba Loan Show On Credit Report

This is a question our experts keep getting from time to time. Now, we have got the complete detailed explanation and answer for everyone, who is interested!

Asked by: Flo Mertz III

Individual lenders report SBA loans loans which the PPP program falls under) to credit bureaus, the SBA itself does not report to credit reporting agencies. Since these loans are made by the SBA, EIDLs should not appear on personal or business credit reports.

Other Financial Implications Of A 401 Loan

In addition to affecting your eligibility for other loans, a 401 loan comes with other undesirable financial implications that include:

- Opportunity costs: The money you take out of your retirement plan is no longer invested until you repay it. Thus, you stand to miss out on potential gains your nest egg would have realized if you left the money untouched.

- Tying you to your current employer: Leaving your current employer before youre done repaying the loan comes with tax consequences. If you dont roll over the outstanding balance into a qualified retirement account, youll need to repay it in full before that years tax return filing deadline. Otherwise, the outstanding balance will be treated as a distribution and incur a 10% tax penalty.

- Tax implications: Besides the tax levied on the loan and the potential tax penalty, a 401 loan also comes with another tax implication that often flies under the radar. To demonstrate that, lets assume youve borrowed $300 and your tax rate is 24%. To repay this amount and still cover taxes, youd need to make a little more than $394.

On the bright side, a 401 loan can help you pay off credit card debt, improve your credit score, and repay yourself at a lower interest rate. It can also come in handy in emergencies.

Recommended Reading: Cbcinnovis Inquiry

Also Check: Can Landlords Report To Credit Bureaus

Reporting Sba Loans To Credit Reporting Agencies Is Included In Sba Guidelines

According to SBA Standard Operating Procedure 50 57 , in accordance with the Debt Collection Improvement Act of 1996, lenders are required to report information to the appropriate credit reporting agencies whenever they extend credit via an SBA loan. They should also routinely report information concerning servicing, liquidation, and charge-off activities throughout the life-cycle of the loan.

This is reported by the lender to commercial credit reporting agencies, not personal credit reporting agencies. Even though a borrower must personally guarantee the loan, it is not reflected on a personal credit report.

At the time of writing, it is currently unclear what the responsibilities are for reporting PPP loans.

What Are Sba Disaster Loans

While the primary mission of the Small Business Administration is to support entrepreneurs, with special programs focused on women, veterans, low-income, and minority business owners, this agency also offers low-interest loans to assist business owners, homeowners, and renters after a disaster. No matter where you fall in the insurance spectrum whether youre covered well, are underinsured, or have no protection FEMA recommends applying for an SBA loan to cover gaps in insurance coverage or to provide bridge funding before the insurance check arrives.

Read on to find out more about the types of SBA disaster loans and to find the option that fits your situation best. Its time to get the financing you need to recover your business and your life.

Also Check: When Do Public Records Fall Off Your Credit Report

Where Does The Lender Report To

The lender must report to at least one commercial credit bureau reporting agency. There are many agencies out there and each of them has preferred reporting resources.

Three of the most reputable credit reporting agencies are Dun and Bradstreet , Equifax Small Business Enterprise, and Experian SmartBusinessReports. These agencies provide accurate, timely, and thorough information.

Reach Out Early For Help

Figuring out how to proceed when youâre unable to pay a business loan isnât simple. If possible, reach out to your lender before your loan goes into default. Because collections and legal action are costly for lenders as well, many will work with you to avoid default, possibly by restructuring your loan or accepting interest-only payments for a period of time. You may want to consult with a nonprofit credit counseling service, a debt settlement attorney or a bankruptcy attorney to help you navigate forward with as little damage as possible to your business and personal creditand to help you chart the best future course for yourself and your business.

Also Check: What Is Cbna On My Credit Report