Low Interest Rates On Credit Cards And Loans

The interest rate is one of the costs you pay for borrowing money and, often, the interest rate you get is directly tied to your credit score. If you have a good credit score, youll almost always qualify for the best interest rates, and youll pay lower finance charges on credit card balances and loans. The less money you pay in interest, the faster you’ll pay off the debt and the more money you have for other expenses.

Maintain A Low Utilization Rate

Your credit card’s balance relative to its credit limit is also an important factor in your credit score. Credit scoring models use the balance and credit limit as they appear on your credit report to calculate your . Low utilization is better for your credit.

Limiting your card use, especially when you have a low credit limit, could help you maintain a low utilization rate. If you use your card often or for a large purchase, you can lower your reported balance by paying down your card’s balance before the end of your statement periodabout 21 to 25 days before your bill’s due date.

There’s no perfect utilization rate, but aim to keep it below 10% for the best credit scores.

V Tips To Fixing And Protecting Your Credit

While you donât want to have a low or poor credit score, it is pretty common and happens often to people. The good news is, you can take steps to fix your credit and can have dramatic score increases in relatively decent time.

However, the other part of this is to also protect your credit scores. With the digital advances comes more threats from others trying to open credit in your name and run up damage to your report. Just like there are tips to fix your credit, I have some insights on how to protect yourself as well.

Recommended Reading: Aargon Collection Agency Scam

Rate Shop Within A Two

What happens to your score when youre buying a new car or looking for a perfect mortgage? In some cases, multiple inquiries within a short period can cause it to drop. However, there is a trick to protect your score, which Dusi shares.

As you may know, repeated inquiries can cause a dip in your score. So, if youre rate shopping for a mortgage or auto loan, make sure you complete all loan applications within a two-week period and youll take advantage of FICOs 30-day credit inquiry grace period.

The exception to this rule is shopping for credit card accounts multiple applications within a short timeframe will hurt your score.

Monitor Your Credit Utilisation Ratio

Credit utilisation ratio is a calculation that measures credit usage against your credit limit. This ratio should always be 30% to ensure that your remains stable. To do this, you must ensure that you limit your spending. For example, don’t spend via your credit card up to its entire limit month after month.

Also Check: Does Paypal Credit Report To Credit Bureaus

Check Your Credit Report

Something people sometimes overlook when building credit is their report. Checking it regularly is key, as mistakes sometimes happen.

If you are looking to build your credit, its a good idea to read through your credit report carefully and check for errors that may be lowering your score. Common credit report mistakes include things that may seem harmless, like a misspelled name or wrong address, but could be signs of identity theft that could result in your score taking a hit, says Myles Ma.

Sometimes mistakes on your credit report are harmless. In more serious cases, it could be identity theft. What happens in the event someone steals your credit or is using your information? Ma gives detailed advice on what to do if youre in this situation.

If your identity has been stolen, you may also see accounts you dont recognize or duplicate accounts, or even delinquencies on accounts you dont have. All of these can have negative effects on your score, so its important to file a dispute with the credit bureau reporting these mistakes. Reporting an error, and ultimately having the mistake removed could result in a score increase. As the credit bureaus dont share information with each other, make sure youre looking at all three main credit reports for any mistakes and reporting them to the corresponding bureau.

Making Payments On Time

One of the simplest ways to maintain a healthy credit score is by making all of your payments on time. Even if a missed payment doesnt incur a late fee, if left unresolved for too long, it can still lower your score and can hang around on your credit report for upwards of a decade.

Set up payment schedules, turn on automatic reminders, and do everything you can to make payments on time.

Read Also: Is 626 A Good Credit Score

Say No To Late Payments

While this is a given, the list will not be complete without mentioning it. To get a decent credit score, you need to showcase your ability to pay off debts on your trade line from timely. Make no exceptions and at least pay off the minimum amount of the credit card or loan instalments.

Another thing to know about is the go-to collections account. If you neglect or postpone your payments, then it can ultimately mount and get turned to a collection agency. In such a case, even settling off the debt would leave a negative impact on your CIBIL score.

You can try to negotiate to see if they can make any exceptions.

Maintaining A Good Credit Score

A good credit score is a key that can open many doors. It can affect your ability to obtain a mortgage loan or to be approved for a lease when you rent an apartment or townhouse. It can affect your chances of getting an auto loan and buying a reliable vehicle. It can determine whether banks or credit unions will extend your personal loans if or when you need them. It can open the doors necessary to secure business loans and start your dream entrepreneurial venture. It can even impact your employment chances, as some employersparticularly those filling jobs that involve financial responsibilitieswill often conduct credit history checks as part of the background screening process.

For all these reasons and others, it is essential to do what you can to establish and maintain a good credit score. A credit score is more than just a number. Working to improve your credit not only opens doors, such as the ones mentioned above. It can also help you secure better interest rates on credit cards, mortgages, and loans, get approved for credit cards that offer better perks and benefits, and just generally live a more comfortable and secure lifestyle. Here are a few tips to help you build your credit and bring about all the benefits that doing so can have on your life.

Tip #1: Know how the system works

Tip #2: Pay your bills

Tip #3: Dont rely on minimum payments

Tip #4: Avoid high balances on your credit cards

Tip #5: Dont close old cards

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Where To Start With Improving Your Credit Score

Your credit score can take into consideration many years of your past bill-paying behavior. Even though credit score improvement isnt likely to happen overnight, the sooner you start incorporating positive financial habits, the sooner you will see an increase in your credit score.

Bottom Line: Just like other important areas of your life, there isnt a one-size-fits-all way to increase your credit score. Get started by taking a good look at your debt obligations, and develop a plan that works the best for your specific goals.

How To Get Good Credit

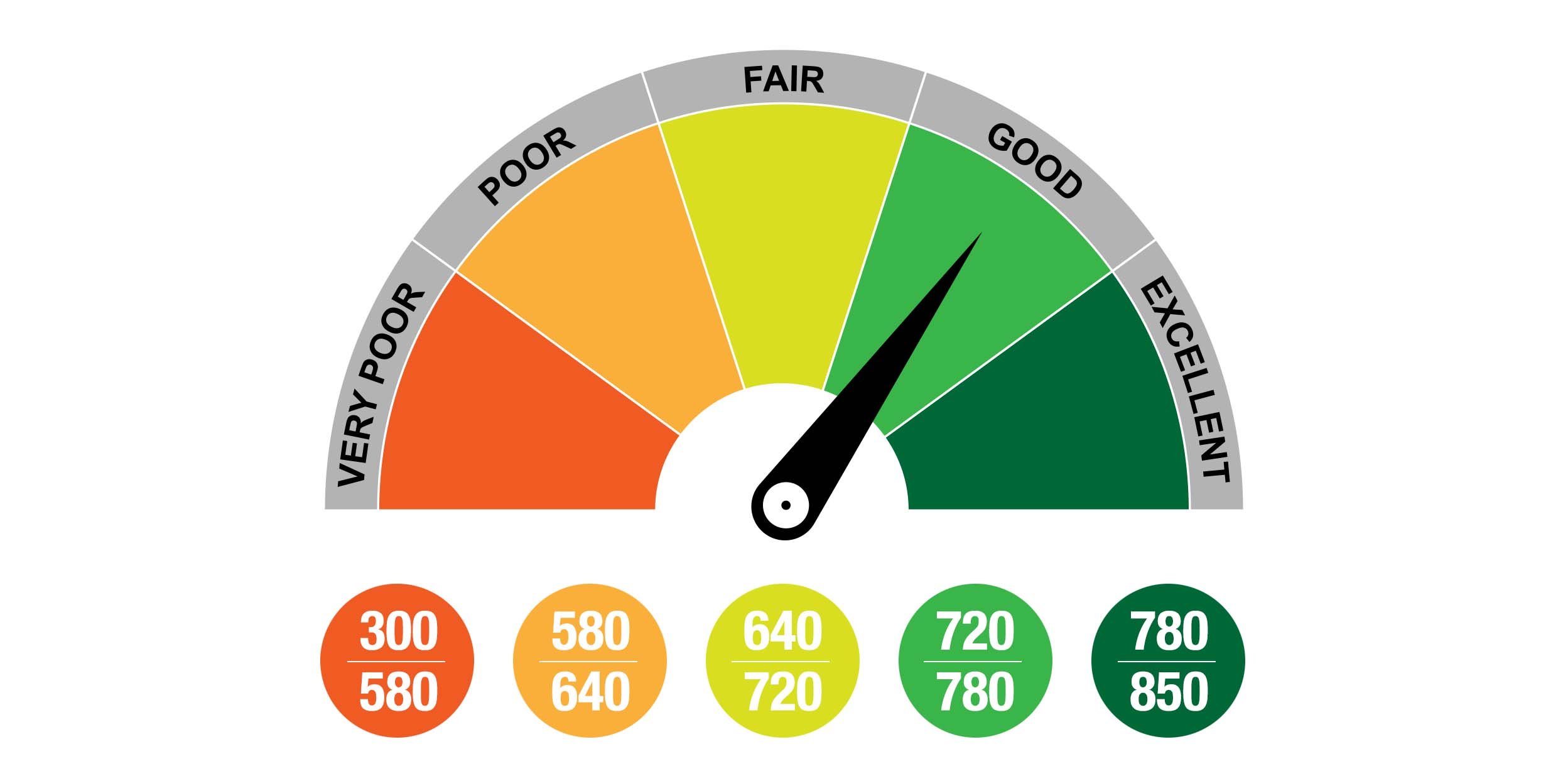

If you want a good credit score, you need to understand how credit scores are calculated and how to build credit.

Your FICO credit score is made up of the following five factors:

- Payment history: 35 percent

- Length of credit history: 15 percent

- 10 percent

- Recent credit inquiries: 10 percent

If you want to get your credit score into the good credit score range, you need to improve your credit habits as they relate to those five factors.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

How Is Credit Score Calculated

A credit bureau is an organization that gathers the information surrounding every credit user or borrowers credit history and related details. These bureaus pass on the gathered information to lenders in the form of credit scores and credit history. They may follow unique scoring models for arriving at the credit scores of borrowers. Credit scores are usually derived through automated processes.

The four primary credit rating agencies in India are:

Among these, TransUnion CIBIL is the first credit bureau to be established in India and one of the most trusted financial entities for credit checks.

Since different credit bureaus have different scoring mechanisms, a borrowers credit score may have minor variations across the scores offered by each of these. However, the weightage on certain criteria for obtaining a loan would be the same across. Listed below are these criteria:

- Payment history35%

- Length of credit history15%

- New credit10%

A credit score is calculated through a mathematical algorithm by taking into account all the variables mentioned above. All these put together help in determining a borrowers repayment ability, including timing of repayment and amount. A borrower must remember that the credit score can change periodically since it incorporates the latest available data from existing credit accounts.

Don’t Miss: Square Capital Credit Check

Why Good Credit Matters

Buying a house isnt just about picking out the perfect home its about being financially prepared to take on one of the biggest investments youll make in your life. When you apply for a mortgage, your lender truly wants to ensure youre ready to take on the financial responsibility of owning a home, which is why theres such a big emphasis placed on your credit history and score. As you can imagine, the higher your credit score, the better your chances of being approved for a mortgage.

Could You Be Rewarded For Your Everyday Spending

Rewards credit cards include schemes that reward you simply for using your credit card. When you spend money on a rewards card you could earn loyalty points, in-store vouchers airmiles, and more. The Motley Fool makes it easy for you to find a card that matches your spending habits so you can get the most value from your rewards.

Some offers on The Motley Fool UK site are from our partners its how we make money and keep this site going. But does that impact our ratings? Nope. Our commitment is to you. If a product isnt any good, our rating will reflect that, or we wont list it at all. Also, while we aim to feature the best products available, we do not review every product on the market. Learn more here. The statements above are The Motley Fools alone and have not been provided or endorsed by bank advertisers. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fools board of directors. The Motley Fool UK has recommended Barclays, Hargreaves Lansdown, HSBC Holdings, Lloyds Banking Group, Mastercard, and Tesco.

Some offers on The Motley Fool UK site are from our partners its how we make money and keep this site going. But does that impact our ratings? Nope. Our commitment is to you. If a product isnt any good, our rating will reflect that, or we wont list it at all. Also, while we aim to feature the best products available, we do not review every product on the market. Learn more here.

Related articles

Read Also: What Credit Score Does Carmax Use

How To Build Credit Without A Credit Card

While opening and using credit cards can be a good way to build credit, they’re not the only option. Loans and other types of accounts can also help if they’re reported to the credit bureaus.

When you’re starting out, you could look into , which are designed specifically for this purpose. Other common loans, such as student, auto and mortgage loans can also help you build credit.

As with credit cards, making payments on time with loans is the most important factor in building credit. Your remaining balance can also impact your scores, but it’s not as important as utilization rates on credit cards.

Other types of accounts, such as utility and phone plans, often don’t get reported to the bureaus or impact your credit. However, Experian Boost is a free service that allows you to add your phone and utility accounts to your Experian credit report so they can help you build credit. There are also rent reporting services that you may be able to use to add your rent payments to your credit reports.

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online you’ll just need to update your annual household income. Its possible to be approved for a higher limit in under a minute. You can also request a credit limit increase over the phone.

Read Also: Itin Number Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Improved Chances Of Credit Approvals

A borrower with a good score is considered low-risk and therefore has a higher chance of easily getting credit cards and loan approvals. Applicants of premium credit cards should ensure a high credit score to boost their eligibility. A good credit score widens the opportunities for borrowers to access different credit-lending products, including cards with low-interest rates or rewards, such as travel points and cash backs.

You May Like: How To Remove Repossession From Credit Report

How To Establish Good Credit

Building good credit doesnt happen overnight, but there are many ways you can strengthen your financial background over time. Its never too early to start working on your credit and the sooner you do, the better off youll be when it comes time to buy a home. Below, well highlight seven methods for building a strong credit history.

Check your credit score First things first, you should be aware of your current credit score and history. You can obtain a free credit report from each of the three reporting bureaus annually by visiting annualcreditreport.com. Not only does this information let you know where you stand financially, but it can also highlight any errors listed on your report which should always be fixed as soon as possible.

Keep your oldest line of credit open When it comes to building credit, you have to start somewhere. No one is born with great credit it must be established over time. Thats why its beneficial to get started early and to continue maintaining your very first line of credit even years down the road. For example, my credit history was established when I obtained a student loan to attend college. While I wouldnt call a student loan ideal, it does provide young adults the opportunity to begin building strong credit at a young age. By establishing my credit early and paying bills in a timely manner, I was able to take out a mortgage on my first home at age 24.

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

You May Like: Removing Hard Inquiries From Your Credit Report