The Value Of Keeping A Card For Medical Emergencies

With the CareCredit account, you have a substantial unused credit line that is acting as an insurance policy in case of a medical disaster. Youve discovered that dental work can cost a small fortune, but so can an insurance deductible or a trip to the emergency room.

It might be nice to have this account at the ready in case you dont have cash for the bill. Instead, you can borrow and pay it off over time. However, you may need to contact the card issuer to see when the 0 percent promotional period expires and if it can be applied toward a new charge.

If you are extended a 0 percent interest promotional period, it is extremely important that you pay off the debt before that time because CareCredits typical APR is extremely high 26.99 percent.

How Your Initial Credit Limit Is Determined

To determine your initial credit limit, Goldman Sachs uses your income and the minimum payment amounts associated with your existing debt to assess your ability to pay.

In addition, Goldman Sachs uses many of the same factors that are used to assess whether your application is approved or declined, including your credit score and the amount of credit you utilize on your existing credit lines.

Learn how you can request a credit limit increase.

If You’re Approved But Your Credit Limit Isn’t Enough To Buy A Device With Apple Card Installments

You can;apply for Apple Card;when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments.;If your application is approved with insufficient credit to cover the cost of the device;you want to buy, you can choose a different device that’s covered by your credit limit. You can also choose a different payment method or;use Apple’s Trade-in program.

Don’t Miss: How To Get Credit Report With Itin Number

How To Prequalify For Care Credit

If you receive a positive prequalification, you can then decide if you want to complete the Care Credit application.

Getting The Most From Care Credit At The Vet

- Pay your balance off as quickly as possible. That frees up your balance to cover additional veterinary charges.

- If you can afford to pay for some vet services out of pocket, do it. Use Care Credit for those big expenses that are beyond your budget.

- Try to keep your balance on the card as low as possible. You never know when an emergency will strike or an unexpected vet bill will take you by surprise. You cant use the card if the credit line is maxed out.

- Ask for credit line increases if needed. Once you establish a relationship with Care Credit, they may increase your credit line to help you cover rising veterinarian bills. If you make your payments on time every month, theyre more likely to consider the increase.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Keep Prescriptions In House & Increase Average Ticket

With the average eyewear capture rate at just over 50%, the amount of potential revenue and patient satisfaction walking out the door can be considerable.1 When you capture just one more patient a day with an average spend of $769, you could potentially generate an additional $16,918 a month in revenue.2 When patients know upfront that promotional financing is available, it can help open their mindset to focusing on the products and care they truly want.

Dont Lose Patients To Your Competitors

32% of cardholders said they would have gone to another provider or not had a procedure/made a purchase if the provider did not accept the CareCredit card.3;52% of consumers surveyed say they want patient financing options and 66% would even consider switching providers for a better healthcare payment experience.3

Also Check: How To Get Rid Of Inquiries On Your Credit Report

How To Build Up Your Credit Score

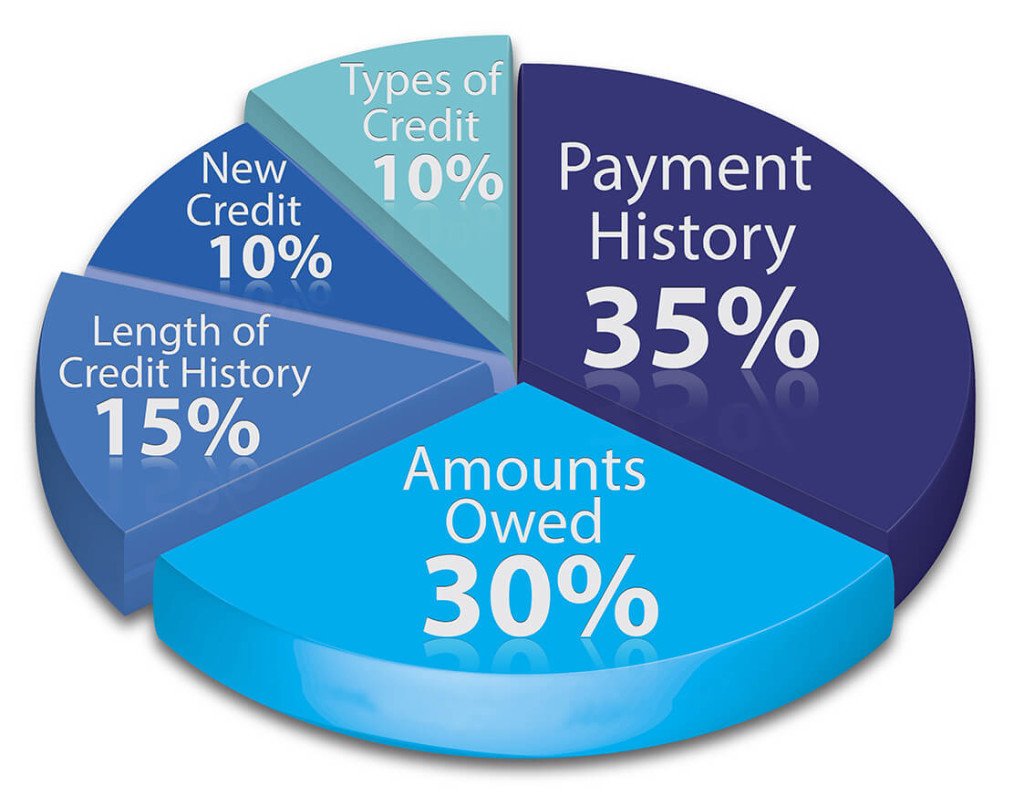

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.7 credit card accounts.

Seek a solid credit mix. No one should take on debt they don’t need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

Does Care Credit Hurt Your Credit

Does CareCredit do a hard pull? Well, if you only requested a prequalification, the process will only require a soft pull, so your credit score will not be impacted.;

However, to complete the entire CareCredit application, the process will trigger a hard pull. A hard pull will affect your credit score but generally no more than 10 points.

Similar Post: Legacy Visa Credit Card Review

Also Check: How To Remove Items From Credit Report After 7 Years

How To Get The Most Out Of This Card

You should treat this card as a temporary lifeline to pay off a medical bill before the short-term promotional period ends. The cards high regular APR makes deferred interest expensive, so pay off your card as quickly as you can.

If CareCredit offers you a long-term repayment period, know that the interest rates are pretty competitive. But, before you accept the terms, make sure you can cover the monthly payments since theyll be higher than the minimum payments you might be used to making.

And, before you apply for a CareCredit card, speak with your health care provider about other financing options. They may be willing to negotiate a payment plan that doesnt charge interest. If not, you may still be better off with a cash-back . Cash-back cards dont charge deferred interest, they typically offer a cash bonus for new cardholders, and its likely that the regular APR will be lower than CareCredits 26.99%.

If you want to keep the credit line open and active, you must use the card at least once per year.

Applying Is Fast And Confidential

The application process for CareCredit dental financing is completely confidential and takes less than ten minutes to complete. Over half of our recent applicants have been approved . You can also apply with a co-signer to improve the likelihood of being approved.;

Choose your clinic location below to…

1. Apply for CareCredit

Apply for CareCredit online now by choosing your clinic location below, or ask your Patient Care Coordinator for more information at your next appointment.

2. Pay Your CareCredit Bill

If you have an existing CareCredit account and would like to pay your CareCredit bill, you can also choose your clinic location below.

Also Check: How To Get A Debt Collection Removed From Credit Report

How Does Carecredit Work

CareCredit is a credit card that is intended to help you pay medical expenses not covered by your insurance. You can even use it to purchase healthcare equipment or use your Care Credit for pets.

;With CareCredit, you have access to promotional financing options that are not always available with other card issuers. The Care Credit card allows you to make monthly payments for major medical expenses instead of paying all at once in full.

How Your Apple Card Application Is Evaluated

Learn about the key criteria used to determine whether your Apple Card application is approved or declined.

Goldman Sachs1;uses;your credit score, your credit report;, and the income you report on your application;when reviewing your Apple Card application. This article highlights a number of factors that Goldman Sachs uses, in combination, to make credit decisions but doesn’t;include all of the details, factors, scores or other information used to make those decisions.

If you apply for Apple Card and your application is approved, there’s no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score. If your application is declined or you reject your offer, your credit score isn’t impacted by the soft inquiry associated with your application.

If your application was declined, learn what you can do to try and improve your next application.

If you’re combining accounts;for Apple Card Family, some of the credit factors mentioned above may be considered for both co-owners when evaluating a combined credit limit for a co-owned Apple Card.2

Personal finance companies, like Credit Karma, might display various credit scores, like TransUnion VantageScore. While these scores can be informative, if they’re not the FICO score that’s used for your Apple Card application, they may not be as predictive of your approval.

You can also contact Apple Support if you have questions about applying for Apple Card.

Also Check: What Does A Judgement Mean On Your Credit Report

Re: How Does Carecredit Affect Credit Score

Thanks everyone!

I’m new to rebuilding my credit and I’m not familiar to some of these terms. I hadn’t heard of the AAoA yet. Like I said, i’m just starting out and the only card I have is the Secured Capital One card. And I’ve only had it for about 6-7 months. If I understand the concept of AAoA from what I just read it seems to be important to have a long average age on your accounts and opening new ones lowers that. So since I’ve only had the card 6-7 months it’s not like I’d be loosing much there.

I only have my TU score and it’s 658 so I think they may approve me..

I was kind of looking as this as a quick way to boost my Utliization Ratio and pay it off right away if possible so it shows sooner than later.

Can I Get An American Express Card With Bad Credit

Its also available to people with bad credit, unlike anything Amex offers. None of the credit cards issued by American Express is especially easy to get because they all require a minimum of good credit. That means a score between 660 and 720, although a score of 700+ will give you the best chance.

You May Like: What Is A Good Credit Score Number

Getting Accepted For Care Credit

You can apply for Care Credit at Berclair Animal Hospital P.C. in Memphis. You can also apply online to receive an acceptance or denial within seconds. Calling Care Credit at 677-0718 to apply with a live representative is another option.

Care Credit does check your credit score when you apply. They look at your last two years of credit history to make their decision. If you have a credit score of at least 620 you have the best chances of acceptance, but that doesnt mean you wont get accepted with a lower score. You never know if you dont apply.

Before You Go Shopping

If you have time to delay your car purchase, work on building your credit. That means:

-

Paying bills on time. A payment that goes 30 days past due can devastate your score, so pay at least the minimum on time.

-

Keeping credit card balances low compared to your credit limits. How much of your limits you’re using is called your credit utilization, and it has a big effect on your score. You can try a number of tactics to lower your credit utilization in order to bump up your score.

-

Avoiding applications for other credit within six months of applying for a car loan.

-

Keeping credit card accounts open unless there’s a compelling reason to close them. Closing cards reduces your overall credit limit, which can hurt your credit utilization.

If you end up with a higher-rate loan than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

Don’t Miss: Why Is My Credit Score Not Going Up

Turning Doctors Into Salespeople

CareCredit and LendingClub, in reality, are wolves in sheepâs clothing, disguising predatory lending in a âhealthcare payment planâ box. These predatory lending practices put physicians in the uncomfortable position of offering financial âsolutionsâ to patients that they know can be harmful. Physicians conscious of their Hippocratic duties may rightfully be uneasy with this arrangement. Doctors are in the business of healing, not credit sales, and shouldnât be asked to pitch their patients on these exploitative products.

Your Healthcare Credit Card

CareCredit ® is a healthcare credit card for every member of the family. CareCredit® offers special financing on purchase of $200 or more;for healthcare costs not commonly covered by insurance, including hearing aids.

It’s the convenient way to improve your hearing health.;Learn more by contacting our office.

Also Check: Will A Sim Only Contract Improve Credit Rating

Below 700 Be Prepared To Explain

If your score is below about 700, prepare for questions about negative items on your credit record and be able to document your;answers, says Mike Bradley, internet sales manager at Selman Chevrolet in Orange, California. Matt Jones of the automotive shopping site Edmunds.com says the number may be closer to 680.

Both men say theyve seen people get financing sometimes even top-tier financing with scores that are much lower.

Although its possible to get a loan with a low score, anything under 500 is a flashing red light, says Dave Cavano, who manages the car-buying service for Auto Club of Southern California.

That means you wont qualify for an attractive interest rate, but it doesnt mean you cant get a car.

» MORE:;What Credit Score Do You Need to Lease a Car?

What Credit Score Is Needed For Carecredit

While Care Credit does not directly state the minimum required credit score, users on myFICO state having been approved with credits scores in the 600s. One user was approved with a score of 638, including three collections on their credit report.

One CareCredit user indicated in their as being approved for $2000 with a credit score of just above 550.

While applying with a credit score above 600 is the safest approach, CareCredit also offers a prequalification process to evaluate your chances of approval.;

Don’t Miss: How Much Does A Hard Inquiry Affect Credit Score

How To Get Pre

If you’re looking at getting a Care Credit credit card, you may already be pre-approved. Offering instant approval, Care Credit is easy to apply and qualify for. The downside is you’re likely looking at high APR, especially with bad credit. Luckily, repairing your credit with Credit Glory helps you qualify for better interest rates.

Car Loan Rates By Credit Score

Its smart to have some idea what dealers will see when they check your credit profile by checking your;free credit score.;You can also buy your FICO automotive score through that company’s website. That specialty score gives more weight to how you have repaid car loans in the past.;Many lenders use auto-specific credit scores that weigh past car-loan payments more heavily.

Someone with a score in the low 700s might see rates on used cars of about 6.05%, compared with 17.78% or more for a buyer scoring in the mid-500s, according to the data from Experian.

On a $20,000, five-year loan, thats a monthly payment of about $387 for the buyer with better credit versus $505 for the buyer with bad credit. The buyer with better credit would pay about $3,222 in interest over the life of the loan, while the buyer with lesser credit would pay $10,329. Plus, in most states, bad credit can mean higher car insurance rates, too.

You May Like: Does Closing A Credit Card Hurt Your Score

Who Is Carecredit Good For

A CareCredit credit card may help you afford a medical procedure not covered by insurance, or pay for a needed surgery.

If youre confident you can pay off your medical bills within CareCredits promotional period, applying may be worth it so that you can stretch out your payments over time. That may help you conserve cash for other uses. But make sure the payments fit into your monthly budget if you dont pay off your full balance before the promotional period ends, you could be looking at hefty interest payments over time once the deferred interest kicks in.

Before you apply for a healthcare credit card, you may want to explore other options. First, see if you can negotiate your medical expenses. Your provider may have a no-interest installment option you dont know about. And if youre truly pressed to pay, see if you might qualify for financial assistance.

Expensive Rates If You Cant Pay On Time

While CareCredits payment structure can be helpful in some situations, it can also be especially expensive if you cant afford to pay back your debt by the end of the promotional period.

If you dont pay your full balance on purchases over $200 by the time your promotional term ends, or if you miss a minimum monthly payment, youll face a high 26.99% variable purchase APR that could put you deeper into debt.

Plus, you wont just pay interest on your remaining balance. CareCredit will apply deferred interest to your account, which means youll be charged interest that would have accrued from the purchase date if the promotional rate hadnt been applied even for the amount youve already paid off.

Recommended Reading: Is 779 A Good Credit Score