If You Pay The Debt Within 1 Month Of The Date Of The Ccj

If you pay the debt in full within 1 month of the date of the CCJ, you can;apply to the court have your entry in the Register removed. You’ll need to get a;certificate from the court to prove you’ve paid off the debt.

Youll have to pay for the certificate but the fee can be waived or reduced if youre on a low income.

If your entry is removed from the Register, the credit reference agencies will be told and details of your CCJ will be removed from your record.

You might be able to get credit again once the CCJ has been removed.

Get A Copy Of Your Credit Report

You can get a copy of your credit report from a credit reference agency to see if you have a CCJ against you. Youll have to pay a small fee for the report.

Its a good idea to check your credit report regularly to make sure your information is up to date.

You can get your credit report from credit reference agencies like Experian, Equifax and .

How To Deal With Derogatory Marks

You cant deal with a derogatory mark if you dont know about it, so Bruce McClary, spokesman at the National Foundation for Credit Counseling, recommends checking your credit reports at least once a month. Having a Credit Karma account can help you notice and dispute incorrect derogatory marks and generally keep tabs on your Equifax and TransUnion credit reports for free.

Here are steps you can take if you have a derogatory mark on your credit reports.

Recommended Reading: How To Get Fico Credit Score

Understanding County Court Judgements

A County Court Judgement is a court order that can be issued against a borrowers name if they fail to make repayments on a debt. They are used by creditors to reclaim the money owed, and can only be issued in England, Wales, and Northern Ireland Scotland uses a different method called enforcing a debt by diligence’.

When someone is unable to keep up with repayments on money they owe, or they have not reached an arrangement with their creditors to make up the missed payments, they could receive a County Court Judgement. A CCJ for credit agreements under the Consumer Credit Act must be preceded by a warning letter, such as a default notice or a letter before action, at least 14 days before any action is taken. The letter usually outlines steps the borrower can take to resolve the issue, and what could happen if it is left unresolved.

A Civil Judgment Creditor Can Use Local Law Enforcement To Collect

After winning a judgment, the creditor can file a write of garnishment and garnish wages, bank accounts or put a lien on your property. ;Additionally the creditor can schedule a supplemental hearing where they can make you show up in court and testify about your assets and their locations.; If you dont show up for this hearing post judgment, a bench warrant can be issued for your arrest.

Don’t Miss: What Credit Report Does Paypal Pull

Can A Debt Collector Try To Collect On A Lapsed Judgment

Under the Fair Debt Collection Practices Act , a bill collector may still contact you on a lapsed judgment and ask you to pay. However, a debt collector can’t threaten to garnish your wages or take other legal action to pressure you into settling that old judgment. If a debt collector lies to you about the age of the judgment and whether it lapsed under your state’s laws, that also might be a violation of the FDCPA.

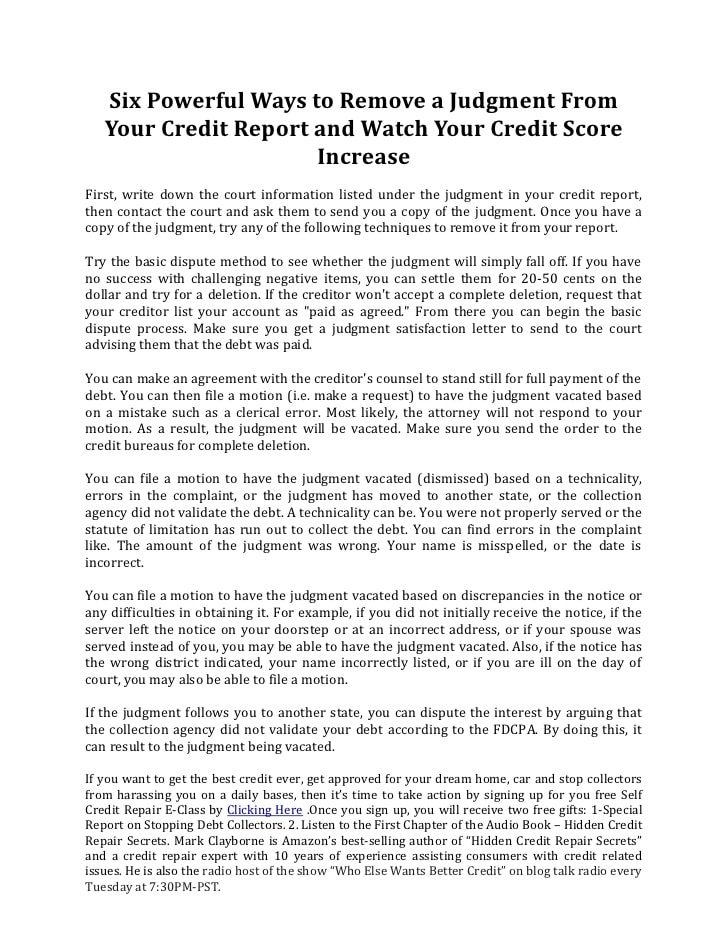

How To Remove A Judgment From Your Credit Report

Removing a judgment from your credit report may sound like a less successful venture than fighting City Hall. But I have some good news for those who aspire for credit redemption: judgments on your credit report dont always have to take seven long years to disappear.

Experian spells it out pretty clearly on their website: if a judgment is accurate, you cannot remove it. It will remain on the report for at least seven years.

While this is true, its also fair to assume that not every judgment is accurate. Thats where the opportunity for removal exists.

You may even think a judgment is rock solid. But why not go ahead and dispute it anyway?

If you do nothing, you will definitely carry that blemish for seven years. So it cant hurt to give it a shot.

UPDATE: All civil judgments are coming off all credit reports, for good. All 3 major credit reporting agencies are dropping civil judgments from their reporting after a Consumer Financial Protection Bureau study found issues with the ways that organizations reported these derogatory items to credit bureaus.

The rest of this article is in place for reference purposes. However, you should no longer need to remove a civil judgment from your report.

There are plenty of resources available to help you get a judgment removed. I know this because I once hired a firm myself.

I was deployed in a war zone at the time and was determined to have good enough credit to qualify for an auto loan by the time I got back to mainland.

Don’t Miss: How To Read A Transunion Credit Report

Get Your Judgment Removed Today

If youre looking for a reputable credit repair company to help you remove a judgment from your credit report and repair your credit, we HIGHLY recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Who Will See My Ccj

Your CCJ will be added to a public database called the Register of Judgments, Orders and Fines. There are two exceptions to this:

- If you pay the full amount within one calendar month of the CCJ being issued, it won’t be recorded

- If you dispute the CCJ and prove to the courts it was issued in error, your CCJ may be cancelled or ‘set aside’, meaning it won’t be recorded

If recorded, your CCJ will remain on the register for six years. Anyone can check the public register for a small fee â they’ll be able to see your name and address, the case and court number, and the amount of money owed. This CCJ check wonât show them who you owe the money to.

Recommended Reading: How Much Does Transunion Charge For Credit Report

Unsatisfied Judgments And Credit Reporting Longevity

The majority of judgments are allowed to remain on a consumers credit report for up to 7 years from the date the judgment is filed by the court. Unsatisfied or unpaid judgments are no exception to the 7-year rule.

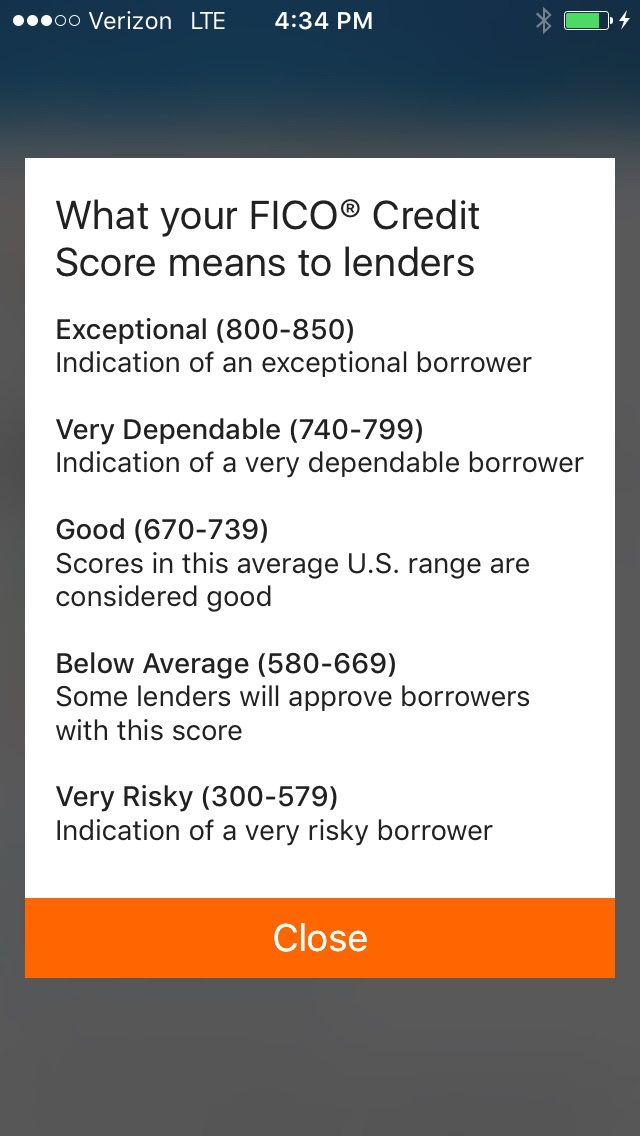

And, when it comes to your credit scores it should come as no surprise that judgments can have a serious negative impact.

Judgments are considered to be a major derogatory credit entry by both FICO and VantageScores credit scoring systems. The extent to which a judgment will impact your scores will lessen somewhat with time, but it will still damage your scores until the day it is removed.

Unsatisfied judgments also have the potential to come back and bite a consumer a second time as well.

The reason unpaid judgments may have an added downside for consumers is due to the fact that they have the potential to be re-filed.

If a judgment is re-filed before the initial 7 years expires then it can be picked up by the credit bureaus again and can actually remain on the consumers credit report for 7 years from the new filing date.

Remove An Entry In The Register Of Judgments Orders And Fines

If your CCJ is over 6 years old it will no longer appear on the Register of Judgments, Orders and Fines, even if it hasnt been paid.

You might be able to apply to have your entry in the Register removed if you can prove to the court that you dont owe the debt, or if you paid the debt off within a month of getting the CCJ.

Don’t Miss: Does Credit Limit Increase Hurt Score

Why Are Judgments And Tax Liens No Longer On Credit Reports

In 2015 the three major credit bureaus Equifax, Experian, and TransUnion made a settlement with 31 state attorneys general. The settlement brought about an agreement now known as the National Consumer Assistance Plan, NCAP for short.

NCAP triggered a series of policy changes the credit bureaus agreed to implement in order to make credit reporting more accurate. Some of those changes had to do with the way the credit bureaus collected and reported public record data.

Public records can harm your and make it harder for you to get a loan or . So, the states involved in the settlement wanted the credit bureaus to improve their standards to make sure any public record data included on a credit report was accurate. Per the states, too many consumers at the time could end up with public record data on their reports which was wrong or didnt belong to them.

At first the credit bureaus only removed some of the tax liens and judgments from credit reports.

You should know that the FCRA hasnt been amended when it comes to public records. So, its not illegal for the credit bureaus to change their policy and add public records back onto credit reports in the future.

How Can I Rebuild My Credit Rating After A Ccj

When you’ve repaid your CCJ it will be marked as ‘satisfied’ on your credit report; this looks better than an outstanding judgment, but it will still be difficult to get credit at good rates. But the good news is your credit rating should improve as your CCJ ages, so long as you manage any other credit agreements sensibly. You can check your score anytime with a free Experian account â it’s updated every 30 days if you log in.

There are several things you can do to try and improve your credit rating:

- Register for the electoral roll at your current address

- Meet the repayments for your CCJ and all other credit agreements. If you think you might default on a payment, contact the lender in advance to discuss your options

- Minimise the number of applications you make for credit. Aim for a maximum of one application every three months

- Get your statutory credit report and ensure your credit details are correct

- Connect for free to Experian Boost. By securely connecting your current account to your Experian account, you can show us how well you manage your money. Weâll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings accounts. All of these things could give your score a boost.

One way to stay in control of your finances â while you have a CCJ and after â is to .

You May Like: How To Remove Chapter 7 From Credit Report

How Does This Affect My Credit Report

A CCJ can stay on a for six years if not paid off in full within 30 days of receiving it.

As lenders may look at past performance when assessing future credit or loan applications, a CCJ on your can serve as an indicator of poor previous financial behaviour. If the borrower repays the money within the 6 years, the CCJ will be marked as satisfied.

Can I Negotiate A Ccj

When you receive your CCJ, youâll also get a reply form included with the letter of claim. You need to send the completed reply form to the creditor within 30 days of the date the letter was sent . Itâs really important to do this on time, else the court wonât take your circumstances into account.

When you reply, you can either agree that you owe the debt, or say that you want to dispute it. If itâs found that you do need to pay the debt in the CCJ, you can then negotiate how soon it is paid, and whether itâs possible for you to pay in installments.

Also Check: How Are Account Numbers Displayed In A Credit Report

Default Civil Judgments May Be Set Aside

Anybody who doesnt respond to a summons and complaint is subject to a default judgment, which means the party suing wins be default. ;Default judgments can be set aside, however judges are usually reluctant to grant such motions, especially if you admit to owing the debt.; Any motions to set aside a judgment must be filed with the judge who entered the original judgment.; If you have other debts you are dealing with you time and money might be better served hiring a bankruptcy lawyer to dispose of your debts or at a minimum negotiate a settlement on your behalf.

How Do Derogatory Marks Impact My Scores

A derogatory mark will damage your . But how much? That depends on a few factors.

A derogatory mark typically affect a higher score more than it will a lower score. Also, a minor derogatory mark, which can be caused by a late payment, generally damages your scores less than a major derogatory mark, which can be caused by something like a foreclosure.

The amount of time a derogatory mark stays on your depends on what type of mark it is. The chart below covers the different types of derogatory marks and how long they will likely remain on your credit scores.

Recommended Reading: How Long Do Inquiries Last On Your Credit Report

What Is A Consent Judgment And Why Is It Bad In A Collection Case

Youre trying to figure out how to handle your collection case and you have been chatting with the collection lawfirm about settling. ;Then you get an envelope from the lawfirm with;a piece of paper with the title, Consent judgment.

They collection lawyer says in a letter, Just sign it, because you wont have to show up to court if you do.

What should you do?

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Does Closing A Credit Card Hurt Your Score

Civil Judgments Can Last A Long Time

Civil judgments have a life span provided by state law. ;In Washington, a judgment lasts for 10 years and can be renewed at the end of that period.;;Therefore once you have a judgment entered against you it can last a long time and incur a large amount of;interest.

As you can see getting a civil judgment entered against you can have huge consequences and it should be avoided at all costs.; If you live in Washington state and have additional questions about civil judgments, give Symmes Law Group a call at to learn about your options.

What If I Dispute The Debt

To have the opportunity to dispute a judgement debt, you will need to apply to the court that issued the judgement to set it aside.

An application to set aside a default judgement must address the following:

- the reason you failed to file a defence within time ;

- any bona fide defence you have in respect of the claim; and

- the reason you have delayed in making the application .

Where you have paid the judgement debt, this may be regarded as admitting the validity of the creditors claim. This can make getting an order to set aside the default judgement very difficult.

Recommended Reading: What Credit Score Do You Need For A Conventional Loan

New Public Record Policy

In the past, there were three types of public records that could appear on your credit report: bankruptcies, judgments and tax liens. In recent years, however, there have been major changes that have reduced the number of public records added to credit reports to one.

While its still common today to find bankruptcies on credit reports, you typically wont find a judgment or tax lien.

The reason judgments and tax liens have gone missing from credit reports is because of new policies adopted by the three major credit reporting agencies Equifax, TransUnion, and Experian stemming from a 2015 settlement between the CRAs and 31 state attorneys general.

The landmark settlement resulted in the creation of the National Consumer Assistance Plan , an initiative designed to make credit reports more accurate and make it easier for people to fix any errors.

As part of the consumer-friendly changes, the credit reporting agencies agreed to implement new standards related to public records. Namely, for any public record to be included on a credit report, it has to satisfy the following criteria:

- The public record has to contain, at minimum, the consumers name, address, plus a Social Security number or date of birth.

- The public record information must be updated/verified at least once every 90 days.

Bankruptcy records already met these stricter requirements. Many tax liens and civil judgments, however, did not .

How Does A Judgment Affect Your Credit Score

A judgment is one of the most damaging things to have on your credit report. Unlike collections, which involve a dispute between two private parties and are almost always handled privately, a judgment occurs when a court-ordered mandate is to repay a debt.

This can occur in situations such as failure to pay child support, alimony, or civil and small claims lawsuits.

If you have a judgment on your credit reports, it will lower your credit score. Potential creditors will be hesitant to loan you money because they cant trust that youll repay the debt. Even if you are able to get a new credit card or loan, you can expect some of the highest interest rates on the market.

Recommended Reading: Does Requesting A Credit Report Hurt Score