What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Factors In Determining A Credit Score:

- Payment history.;A good record of on-time payments will help boost your credit score.

- Outstanding debt.;Balances above 50 per cent of your credit limits will harm your credit. Aim for balances under 30 per cent.

- ;An established credit history makes you a less risky borrower. Think twice before closing old accounts before a loan application.

- Recent inquiries.;When a lender or business checks your credit, it causes a hard inquiry to your credit file. Apply for new credit in moderation.

The numbers go from 300 to 900. The higher the number, the better. For example, a number of 750 to 799 is shared by 27 per cent of the population. Statistics show that only two per cent of the borrowers in this category will default on a loan or go bankrupt in the next two years. That means that anyone with this score is very likely to get that loan or mortgage they’ve applied for.

What are the cutoff points? TransUnion says someone with a credit score below 650 may have trouble receiving new credit. Some mortgage lenders will want to see a minimum score of 680 to get the best interest rate.;;;;

The exact formula bureaus use to calculate credit scores is secret. Paying bills on time is clearly the key factor. But because lenders don’t make any money off you if you pay your bills in full each month, people who carry a balance month-to-month can be;given a higher score than people who pay their amount due in full.;

Check Your Credit Report

You should get into the habit of checking your credit report for errors that could hurt your credit score or indicate identity theft. Potential errors include:

- Unfamiliar accounts and account numbers you dont recognize

- Addresses youve never lived at

- Former spouses listed on credit cards, loans and bank accounts

- Incorrect reporting of account status, such as accounts incorrectly reported as late or delinquent

- Gather relevant documents to dispute credit report errors

Since disputes are reviewed on a case-by-case basis, youll need to provide documentation to support your claim. You will need to provide proof of your identity, including your Social Security number, date of birth and a copy of your ID . Depending on the specific error, you may need to submit copies of documents to support your case, which could include bank and credit card statements, loans or death certificates.

Also Check: What Credit Score Do You Need For Paypal Credit

Public Records And Other Information

The following information was reported to your file on the date indicated.

A collection was reported in 06/07 by ABC COLLECTION AGENCY in the amount of $550. Balance outstanding: $350. Creditor industry classification: BANKING. Collection Status: Unknown. Reference: ABC BANK. Date of last Payment: 04/07. Collection agency reference number: 999999.

A judgment was filed in 01/07 in C QUE MTL. Plaintiff and/or case number: ACME CO 9999123456789012345. Defendant / Other info: SUBJECT. The status is reported as Satisfied. Date satisfied: 02/10. Information verified in 08/08. Name of Lawyer: MCOURT & MCOURT.

A voluntary bankruptcy was filed in 03/06 in FED COURT. Case number and/or Trustee: 123454567 MCOURT & MCOURT. Liabilities: $80,000. Assets: $23,500. Item classification: Individual. The information is reported on the subject only. Date Discharged 12/2008.

A report was received in 10/10 by LAKE STORE for returned cheques DOLLARS CHEQUE NUMBER 123456789). Reason: NSF was due to financial issues.

A secured loan/Chattel mortgage was filed in 08/08 in Ministry. Company name and/or amount: 555512345 DCE INC 780,000 DOLLARS. Creditor industry classification BANK.

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the;Cifas website

You May Like: How To Get Credit Report With Itin Number

Experian Credit Monitoring Loose

loose credit document card credit sesame. Get your free credit report card immediately from credit score sesame and display your credit. No credit card need, no trials, no commitments. Credit score record investopedia. Breaking down ‘credit document’ credit reports encompass non-public data along with present day and former addresses, social safety numbers and employment history. Experian® reputable website experian. A hundred% loose credit score record no credit card required signals for rating modifications. Annualcreditreport professional website online. Experian has been visited by using 10k+ customers within the beyond month. Domestic generate credit card numbers that works.. Clean and loose manner to get credit score card numbers that works on-line 2016. What’s for your credit score document? Go to freecreditreport. Freecreditreport has been visited by means of 10k+ users in the past month. Credit take a look at® general creditchecktotal. Get your loose official experian® credit score document today! No credit score card required.

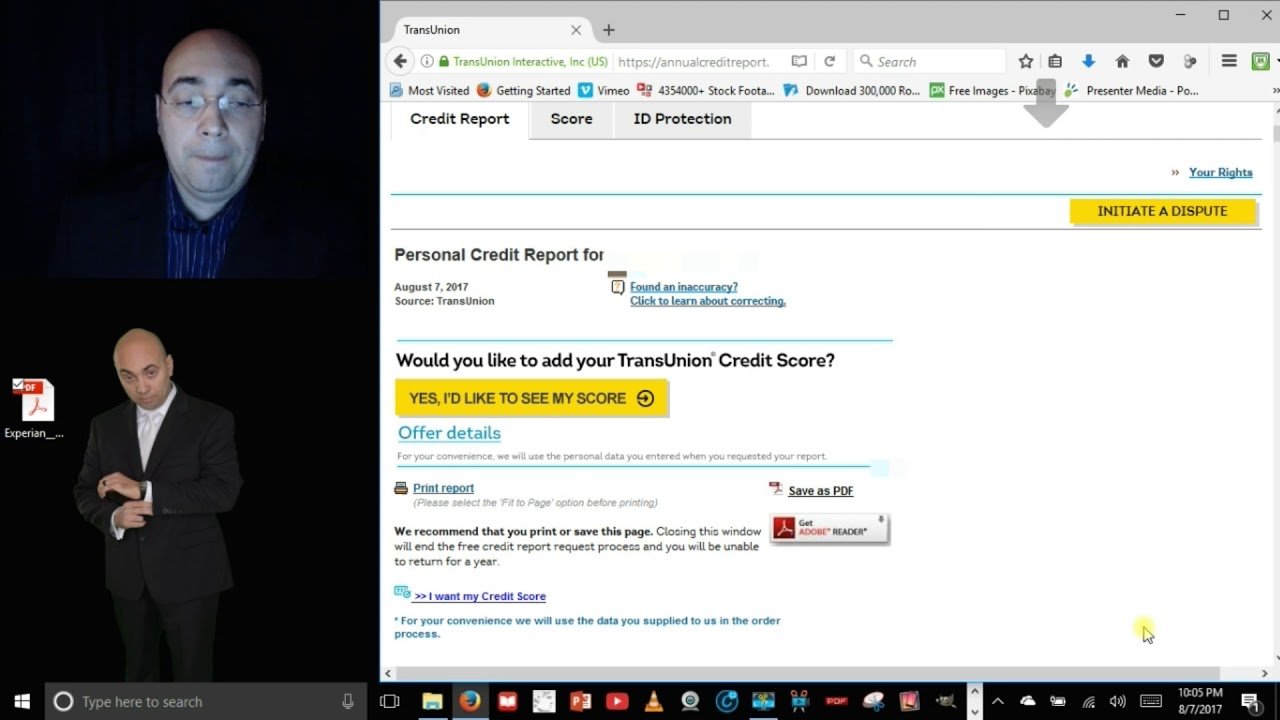

Why Arent My Credit Scores On My Credit Reports

Thanks to the Fair Credit Reporting Act , were entitled to one free copy of each of our credit reports every 12 months from the three national credit reporting agencies: Equifax, Experian and TransUnion.

But credit scores arent a part of credit reports theyre calculated separately, based on the information in those reports.

Since credit scores arent a component of credit reports, they arent required by law to be given for free . There are also hundreds of different credit scoring models so which should be the free score that everyone can see?

As part of the credit report ordering process, each of the three credit bureaus will offer you the option to add a credit score when requesting your free annual credit reports for a fee.

The right to access your credit reports for free wasnt granted until 2003, with the Fair and Accurate Credit Transactions Act FACTA for short which officially amended the FCRA to give us the rights we know today. Still, the New York Times reported in 2018 that only 36% of consumers were checking their credit reports. But that was better than in 2014, which saw only 29%.

Before you cry foul at the unfairness of it all, things are getting better for the consumer. Thanks to amendments to the FCRA from the Dodd-Frank Act, consumers are entitled to see certain credit scores for free, but only when theyve been denied credit or received less attractive loan terms as a result of those scores. This is known as an adverse action notice.

Also Check: What Credit Score Does Carmax Use

What If I Find An Error In My Credit Report

Well, you won’t be the first. In millions of files and hundreds of millions of reported entries, there are bound to be mistakes. Some are minor data-entry errors. Others are damaging whoppers. For example, we’ve heard of instances where negative credit files from one person got posted to the file of someone who had a similar name .

How To Read A Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Regularly reviewing your credit reports;lets you check for errors that might be lowering your credit scores, and it can tip you off to potential identity theft. You can use the dispute process to get;mistakes removed, which may help you qualify for credit or get better terms.

Don’t Miss: How Long Does Debt Settlement Stay On Your Credit Report

Does My Experian Credit Score Change When The Credit Report Gets Updated

Yes. Your credit score changes in respect to your credit usage. Therefore, if you have missed some payments or have paid the minimum amount due, it might have a negative impact on your score. However, if you have maintained discipline for paying your bills, your credit score might be the same or a bit higher.

What’s Not In Your Credit Report Information

There are a lot of misconceptions about the information your credit report contains and which factors affect your credit score. Here are a few things that don’t appear in your credit report or impact your score in any way:

- Your race

- Your age

- Your salary

- Your occupation or employment history

- Your level of education

- Your bank account balance

- Your shopping habits

The information in your credit report is strictly related to your history of credit management and does not contain any information unrelated to credit, apart from the basic identifying information outlined above.

You May Like: Does Bluebird Report To Credit Bureaus

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Review The Credit Bureaus Response

The Fair Credit Reporting Act requires any information considered inaccurate, incomplete or unverifiable to be corrected or deleted from your credit report within 30 days. However, due to the COVID-19 pandemic, as of April 2020, the Consumer Financial Protection Bureau has temporarily extended that deadline to 45 days.

Read Also: How Long Do Late Payments Stay On Your Credit Report

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.;

Request Your Free Credit Report:;

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:;

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Also Check: How To Help Credit Score

What Does A Cifas Marker On My Credit Report Mean

Cifas is a national fraud prevention service. It can place Protective Registration and Victim of impersonation warnings on your credit file.

Protective Registration

This;is a paid service for people who have recently been victims of financial fraud. It indicates to any lender that youre potentially vulnerable to fraud so that theyll make extra checks every time you apply for a financial product. While this can protect you, it can increase how long credit application approvals can take. It will stay on your credit report for two years.

Find out more, and apply, on the;Cifas website

Victim of impersonation

This;is filed by your lender for your own protection if youve been the victim of identity fraud. It will stay on your report for 13 months.

If one of these is on your credit report, it gives potential lenders a fraud warning. It tells them youve been a victim of fraud in the past, or could be particularly vulnerable to fraud in the future.

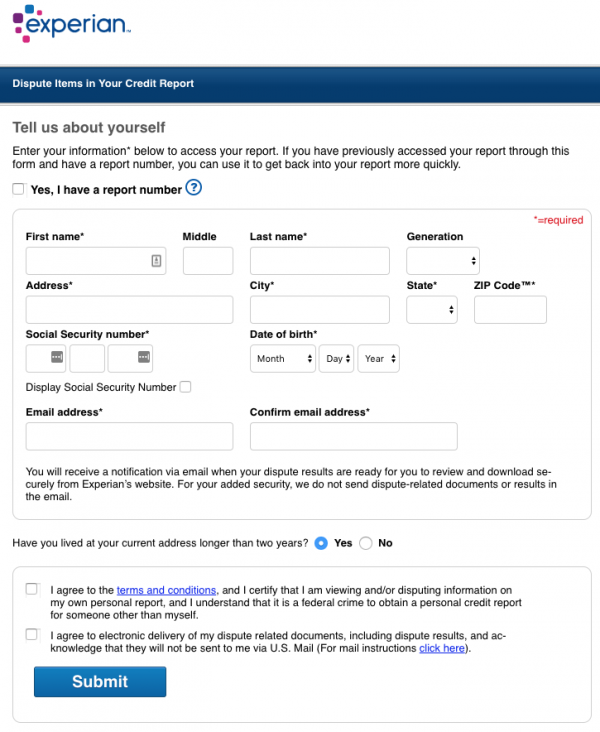

Dispute Credit Report Errors

Experian, TransUnion and Equifax all accept online disputes. You can easily fill in your information online or dispute by mail or over the phone.

- Equifax:;You can dispute online or by mail to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256. Dispute over the phone at 349-5191.

- Experian:;You can dispute information online or over the phone using the toll-free number included on your credit report. Dispute by mail at Experian, P.O. Box 4500, Allen, TX 75013.

- TransUnion:;Call the toll-free number 916-8800, dispute online or by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016-2000. Make sure to complete and include the request form on the website.

Also Check: Which Credit Score Is Correct

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.;

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Is My Experian Credit Report Accessible To Anyone

No. Only you and authorised members of the Experian credit bureau have access to your credit report. These authorised members are defined by the Credit Information Companies Act, 2005. Also, only those people whom you have granted consent to check your report when you apply for a loan or a credit card have access to your credit report.

Also Check: How To Get Charge Offs Off Of Your Credit Report

If I Have Absolutely New Credit How Soon Can I See A Credit Score Developing

Developing your credit score comes naturally as a result of building your credit history. Youve heard the saying if you build it they will come? It applies to credit scoring as well. If you build your credit history then your score will come shortly after followed by more creditors that will want your business. The credit scoring models are looking for two things before they will score your credit files: age and activity. For some credit score models, you must have at least one account that is greater than 3 to 6 months old and at least one account that has been reported to the credit bureaus within the last 6 to 12 months. The same account can qualify you for a score. So, a credit report with one account open for 9 months that has reported to the credit bureaus within the past 30 days will qualify for a score. Once youve built a score, the challenge is to maximize it.

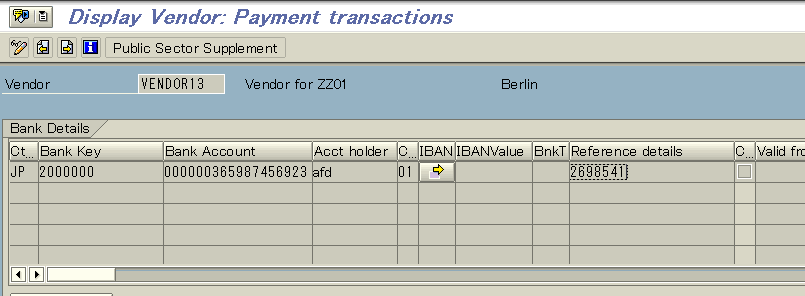

How To Find Your Bank Account Number On A Check

As mentioned, there are three sets of numbers printed at the bottom of paper checks. The first is the check routing number thats used to identify your bank.

The second set of numbers should be your checking account number. This number may be anywhere from eight to 12 digits, depending on your bank or credit union.

Your checking account number should be distinct from the routing number. The last set of numbers on your check represents the check number . This is typically fewer digits than either the bank routing number or checking account number.

Read Also: How Long Do Inquiries Last On Your Credit Report