How Can You Repair A Bad Credit Score

The first step towards fixing a bad credit score is to check your credit report to see what’s holding your score back. Due to the COVID-19 crisis, you can check your credit score free once per week through April 2021 at AnnualCreditReport.com. If there are errors on your report that are hurting your score, you have the right to dispute them and request their removal.

If there are no errors on your credit report and you’re not sure why your score is low, tools like and can help. They can identify your negative credit score factors and give advice on how to improve your score.

In any case, one of the best things you can do to repair a bad credit score is to begin paying all your bills on time. Payment history is an important credit score factor in both the FICO and VantageScore scoring models.

You’ll also want to pay attention to how much of your available credit you’re using each month. A lower credit utilization rate generally has a positive impact on your score. Limiting your hard credit inquiries can also help to rebuild a bad credit score.

Finally, you may want to sit down with a credit counselor to get personalized advice on how to manage your debt and rebuild your credit. You can use the locator tool from the National Foundation for Credit Counseling to find an accredited counselor near you.

Building Your Credit Responsibly

Youâre not alone if you have a less-than-perfect credit score. Looking for a chance to adopt new habits that could help your score? You could start by learning more about what it takes to rebuild your credit or get a credit card if you have bad credit.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

What If I Have A Low Credit Score

If you fall into the so-called bad credit score range, remember that it isnt set in stone.

There are steps you can take to help build your credit. It wont happen overnightany promise of a quick fix could be a scam.

But with a sustained effort, you may see improvement within six months to a year, according to the Consumer Financial Protection Bureau , a government agency. Here are some ideas.

Also Check: What Credit Report Does Comenity Bank Pull

Keep Unused Credit Card Accounts Open

Don’t close your unused credit card accounts. And don’t open new accounts that you don’t need. Either move can damage your credit score.

If bad credit has made it difficult for you to get a regular credit card, consider applying for a secured credit card. It is similar to a bank debit card, in that it allows you to spend only the amount you have on deposit. Having a secured card and making timely payments on it can help you rebuild a bad credit rating and eventually qualify for a regular card. It also is a good way for young adults to begin to establish a credit history.

How Can You Improve A Bad Credit Score

There are many ways to improve a bad credit score. Your first step? Making on-time payments on all of your credit accounts every month. Since payment history is the biggest factor that goes into your credit score, its important to prioritize those on-time payments even if you can only make minimum payments right now.

Once youve gotten into the habit of making regular on-time payments, see if you can start paying off your balances. Getting out of debt can be hard, but any progress you make on your outstanding balances will lower your credit utilization ratio and help boost your credit score.

As your credit score starts to improve, you might want to consider asking for a credit limit increase or applying for a new credit card. Both of these options will increase the amount of credit available to you, lower your credit utilization ratio and help your credit score as long as you dont turn your new credit into new debt.

If you have so much debt that it feels overwhelming, you may need to ask for help. Look for a reputable credit counseling service that can work with you to create a plan to pay down your debts and get your credit score up.

Also Check: Cbcinnovis Hard Inquiry

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

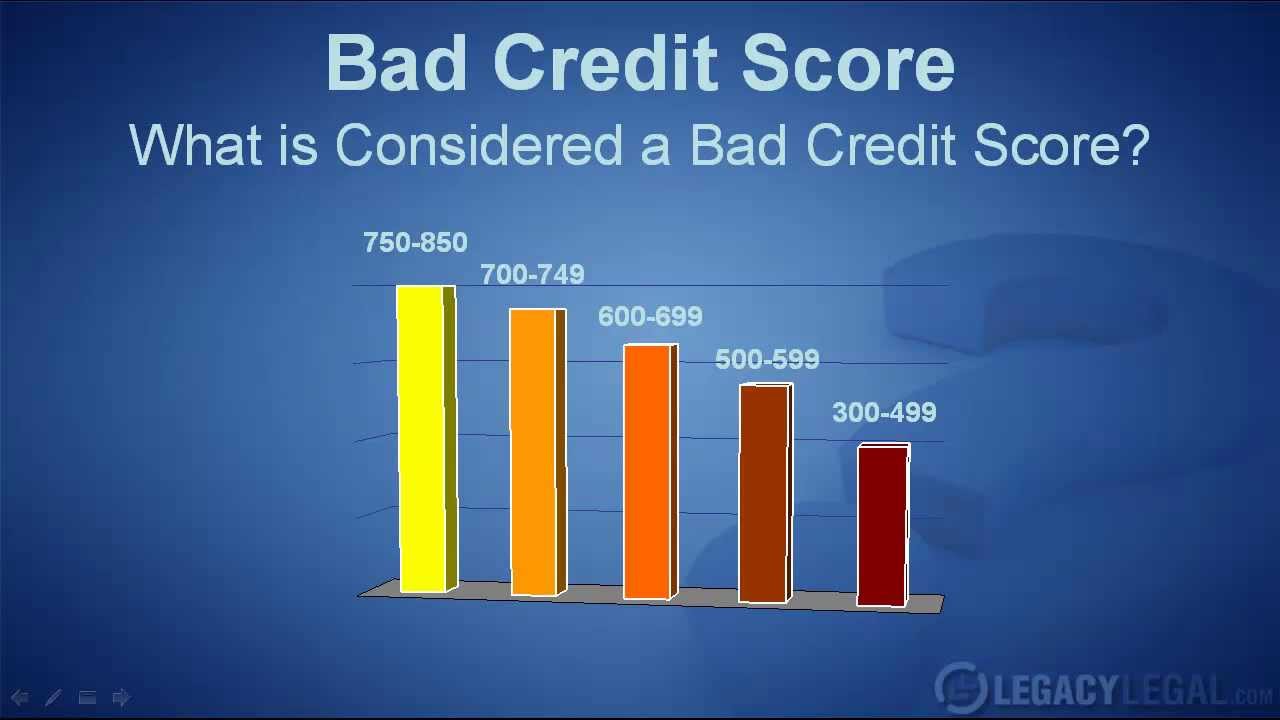

What Is Considered A Bad Credit Score

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

In the popular credit score spectrum of 300 to 850, when does a score start breaking bad? You might read 670 or 630 or 600, but each lender makes its own evaluation of credit scores considered to be risky.

For example, youll usually need a credit score of at least 620 to get a conventional mortgage , but someone with a credit score as low as 500 to 579 may be able to qualify for an FHA or VA loan.

One things for sure: A borrower with a bad credit score has limited choices and will likely pay substantially more over a lifetime than one with a higher score, thanks to higher interest rates charged and less favorable terms.

Read Also: Does Affirm Report To Credit Agencies

Building On A Limited Credit History

Millions of Americans have no credit score because they dont have enough of a history to calculate one. If this is your situation, you have at least two options.

You may want to consider taking out a secured credit card that will allow you to access a modest line of credit by putting down a deposit.

Making on-time payments is one way to potentially build credit over time that eventually may help you qualify for unsecured credit cards or loans with more favorable terms.

Another option is a credit-builder loan, offered by some smaller financial institutions. The lender loans you a particular amount of money, which it deposits into an account it controls. You make payments on the loan, and the lender reports them to the three main credit bureaus. When the loan is paid off, the lender gives you the money.

You could also ask a friend or family member to add you as an authorized user to their credit card account. An authorized user can use the account but does not have any liability for the debt.

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Knowing Your Credit Score Could Really Pay

When it comes to credit scores, knowledge is power. Knowing your credit score could be an important first step in managing your money and setting yourself up for the future.

Your credit score is how companies decide how financially reliable you are. Its based on your credit report which is like your financial footprint. It provides a record of how youve spent, borrowed and managed your money in the past.

A bad credit score can make it more challenging to get a loan or credit card, and could cost you more in financing rates on major purchases. A very poor credit score could even get in the way of getting a mobile phone contract. So it could really pay to stay on top of your credit score. Itll give you a good sense of where you stand with potential lenders and service providers. It also gives you a glimpse into what banks, utility companies and other companies know about you.

Requesting your credit report is also a good way to catch any mistakes that may have wormed their way on there. After all, you cant fix a problem if you dont know it exists. Heres how to check your credit score. So check your credit score and credit report at least once a year. Its free. Its your right. And you can do it in a few simple steps.

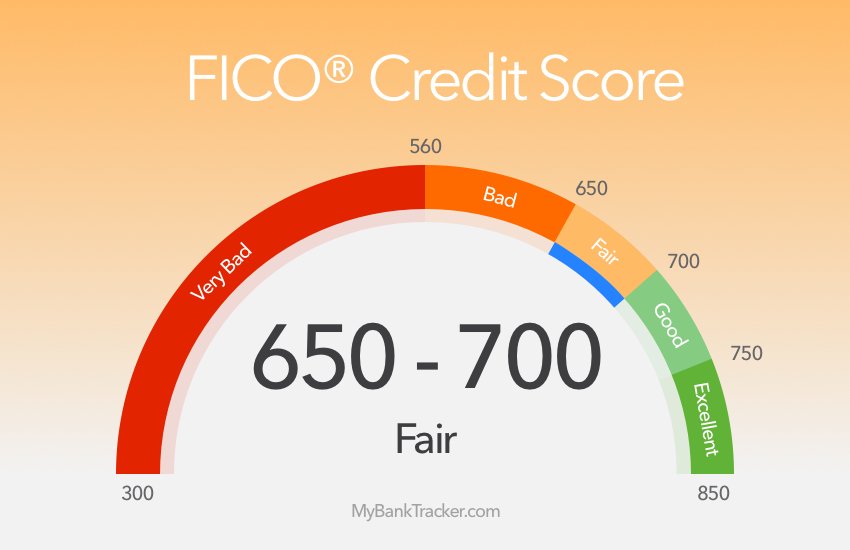

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Recommended Reading: Syncb Credit Inquiry

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Become An Authorized User

If you have a mystifyingly benevolent parent with impeccable credit, ask to be added to his/her account as an authorized user. This will not only help your credit utilization but it should also lengthen your credit history. Remember, this card is strictly for a credit boost, so do not under any circumstances, use the card when it arrives in the mail.

Don’t Miss: Is Creditwise Accurate

Do You Have A Poor Credit Score

All three leading credit rating agencies rate credit scores five categories: excellent, good, fair, poor and very poor. Depending on your credit score, youll fall into one of these categories. The important thing to remember is that each CRA uses a different numerical scale to determine your credit score. So a score of 500 could be good, great or bad depending on which CRA its from.

|

Experian |

|

|---|---|

|

280-379 |

561-565 |

The important thing to remember is that all three agencies base their scores on similar criteria. So if you got a poor rating from one, youre likely to get a similar rating from the others.

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Recommended Reading: Paypal Credit Affect Credit Score

Average Tenant Credit Score Ranges

What is the average number you can expect to see when checking into what should be considered an acceptable credit score for renting?

Here at RentPrep, we run a lot of for the landlords who use our services. This gives us some insight into what you might see from renters. We are not the only ones who have insight into acceptable credit scores, however.

These are some of the most popular numbers used as a measure of what is an average credit score for tenants in America.

649

This is the exact average score we have seen in one year of data among all of the reports weve completed. This means if the score is lower than 649, it should be at least a little concerning.

These numbers are based on the data we have here at RentPrep. We run thousands of credit checks every month and this is a result of our findings. Understand that this is not based on all renters, but it is based on renters of landlords who run background checks.

673 699

According to an article from ValuePenguin, the average credit score of Americans in a 2021 report was 688 for the Vantage scoring model and 711 for a FICO model. Keep in mind that this is not industry-specific it takes into account everybody and not just renters. Renters statistically have a lower credit score than homeowners.

662

According to Time.com, the most at-risk demographic are adults aged 20 to 29 who have an average score of 662. This score is considered fair, but any score lower than 579 should start raising serious concerns.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Read Also: Does Paypal Credit Report To Credit Bureaus