Check Your Own Credit Report

If you are applying for an overdraft, mortgage, credit card or other type ofloan, it is a good idea to check your credit report before you apply. It canhelp you spot any missed payments you did not realise were missed, or mistakesin your credit report.

Importantly, you can get incorrect information corrected. You also have theright to add a statement to your credit report to explain any specialcircumstance see Rules below.

How Does Borrowell Work

Free Weekly Credit Monitoring

Sign up in just 3 minutes for free access to your Equifax credit score and report, which we update every single week.

The first in Canada, our AI-powered Credit Coach helps you understand your credit score and gives personalized tips that may help you improve it.

Product Recommendations

How Much Will My Credit Score Increase When Negative Items Are Removed

Your credit score will likely significantly increase when you start removing negative accounts from your credit report.

Of course, its difficult to say exactly how much of a point increase youll see on your credit score. That said, some people have reported increasing their credit score more than 100 points by removing only a couple of negative credit accounts.

You May Like: What Is Syncb Ntwk On Credit Report

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

Recommended Reading: What Is Syncb Ntwk On Credit Report

A Few Credit Reporting Tips:

Consumer Protection BC is responsible for regulating credit reporting agencies with respect to what may be included in a credit report and who can see it. For more information and tips about credit reporting, and who to speak to if you have questions, please read through the credit reporting section of our website.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Also Check: How To Unlock My Experian Credit Report

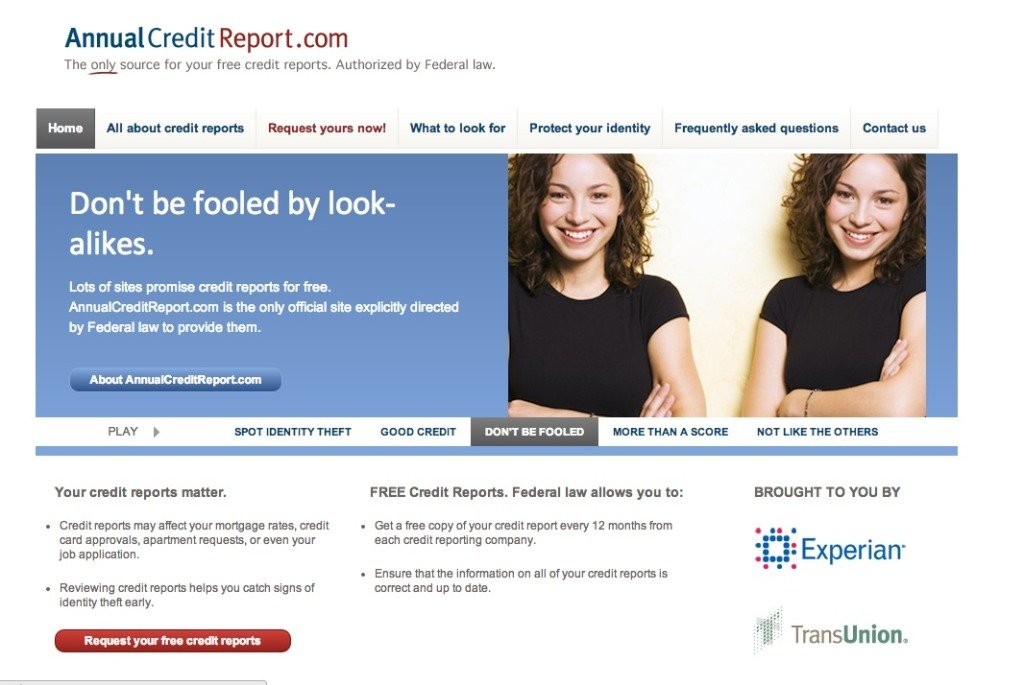

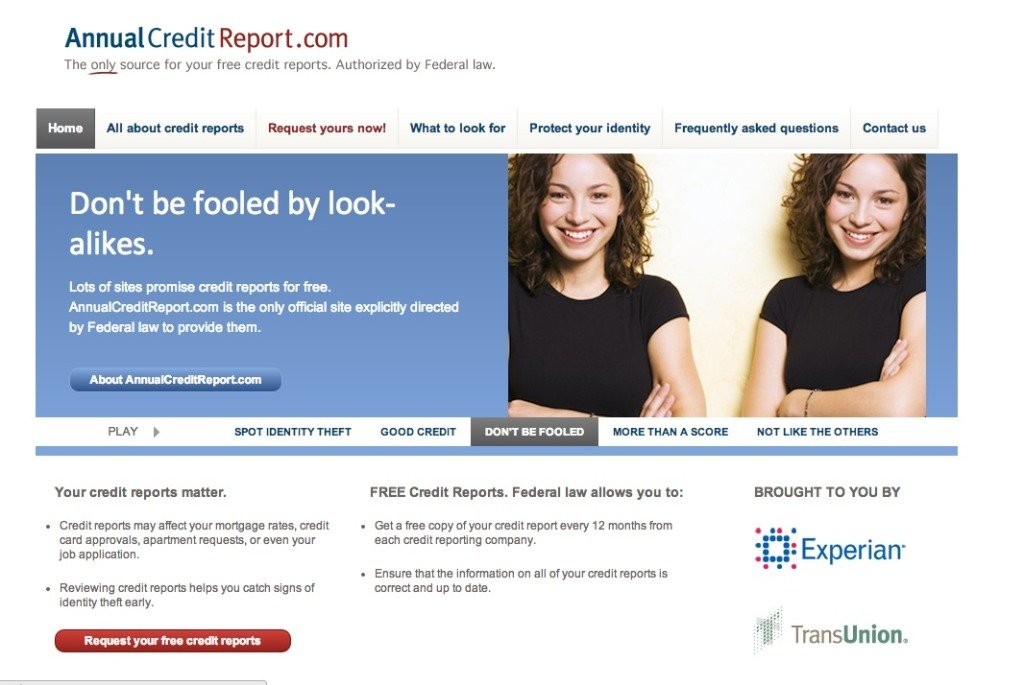

How To Get Your Free Credit Report

To request your free credit report, hop on over to AnnualCreditReport.com and follow these steps:

1. Tap “Request yours now!” in the top menu bar or click the “Request your free credit reports” button.

2. Click the “Request your credit reports” button on the next page.

3. Enter your information, including your full name, birthday, Social Security number and address into the form fields and hit Next.

4. Select which credit bureau report you want. You can choose one, two or all three. Click Next.

5. Enter the requested verification information, such as the last four digits of your Social Security number or your email address, on the next screen and follow any further instructions.

6. If the credit-reporting agency is able to verify your identity, you will get access to your free report. You’ll have to repeat the verification process for each bureau if you select more than one.

7. If your identity cannot be verified, you may have to call the credit bureau or submit a request by mail.

As noted, you can currently request a free report from each credit-reporting agency on a weekly basis, so it won’t make a huge difference if you get all three at once or spread them out over a few days.

Once you are limited again to one report per credit bureau per year, you should request all three reports at the same time only if you’re planning a big purchase like a home or car. Otherwise, it may be best to order one free report every few months.

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

You May Like: How To Unlock My Credit Report

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

Don’t Miss: Carmax For Bad Credit

Work With A Professional

Now that Ive outlined the do-it-yourself methods for removing something from your credit report, lets get into your other option.

You have the option of using a credit repair service to remove negative items from your credit report. This is a great option when youre in a hurry, or simply dont want to deal with negotiating with creditors.

Because credit repair companies specialize in dealing with the credit reporting agencies, they are more likely to be successful than if you do it yourself.

I suggest you check out Lexington Law Credit Repair. Give them a call at 1-844-331-6062 or Check out our review of their service.

Their credit repair service isnt free, but honestly, its more than worth the cost. Ultimately, youre going to save money by having a clean credit report and a higher credit score.

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Read Also: Why Is There Aargon Agency On My Credit Report

Does Checking My Credit Scores Hurt My Credit

Checking your free credit scores on Credit Karma doesnt hurt your credit. These credit score checks are known as soft inquiries, which dont affect your credit at all.

Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit.

Read more about the difference between hard and soft credit inquiries.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Recommended Reading: What Is Syncb Ntwk On Credit Report

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

How To Check All Three In One Go

CheckMyFile gives you a 30-day trial to see your Experian, TransUnion and Equifax reports in one place. After that, it’s £14.99 a month. It’s really only for those who want the monitoring, as a combination of Clearscore, Credit Karma and Experian will provide monthly snapshots of these three agencies for free.

To cancel, either call 0800 086 9360 or log into your account, then click through ‘Expert Help’, ‘I need help with my account’ and then ‘I’d like to stop my subscription’.

Tip Email

Also Check: How To Remove Old Addresses From Credit Report

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Also Check: Does Qvc Report To Credit Bureaus

How To Get A Free Copy Of Your Credit Report

Posted in Finance on 2015-06-16by Joan ::

When was the last time you checked your credit report? Many consumers dont know they have the ability to request a free copy of their credit report. In todays blog post, were going to show you how to do this!

In Canada, there are two credit reporting agencies: TransUnion and Equifax. Below are the step-by-step instructions on how to request a free copy of your credit report. It is important to know that there may be a cost for requesting an electronic copy of your credit report or to get access to your credit score. In order to verify your identity, you will need to provide copies of two pieces of I.D. with your request.

Is My Free Credit Score On Credit Karma Accurate

The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. Its possible that more-recent activity will affect your credit scores, but theyre accurate in terms of the available data.

If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

Recommended Reading: How Do Companies Report To Credit Bureaus

Request A Change To Your Credit Report

What can you do if there is incorrect information on your creditreport?

You have the right under the General Data Protection Directive toaccess the records held about you by credit agencies and to have incorrectinformation rectified. If you are not satisfied with how your request ishandled, you can appeal to the DataProtection Commission.

Central Credit Register

If you believe there is inaccurate, incomplete or out-of-date information inyour credit report, you have a right to apply to your lender and the CentralBank to amend the information held on the Central Credit Register.

You can get more information in the Central Banks factsheet Howto request an amendment to information on my credit report.

Irish Credit Bureau

If you want to have inaccurate information on your credit record amended,contact the lender concerned and ask them to forward the correct information tothe ICB. The ICB cannot change the information unless the lender asks themto.

Can you add a statement to your credit report?

It is possible to add a personal statement to your credit record to clarifyit. This is known as an explanatory statement or personal declaration .

For example, if you have had significant expenses due to relationshipbreakdown, bereavement, illness or another cause, you may add these details toyour record.

The statement must be factual, relevant to the information in the creditreport, and under 200 words. It should not contain information that couldidentify another individual .

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

How To Get Credit Collection Services Off Your Credit Report

Summary: You can resolve your debt and remove Credit Collection Services from your credit report.

If Credit Collection Services is calling you, you may be wondering who they are and why they want money.

That can be stressful in several ways. Youre likely to hear from them often, they may be aggressive, and they will place a collection account on your credit report, which will do serious damage to your credit. They could even sue you.

Heres what you need to know about the company: who they are, what they do, and how to resolve your debt and get their name removed from your credit report.

Ive Never Missed A Payment

Reader asks the Credible Money Coach how to get truck payment history report to credit bureaus.

Dear Credible Money Coach,

I am making truck payments directly out of my checking account. The company said that they cannot submit to the credit bureau because it will force them to hire more people in that type of transaction role department. How can I get them to report it? This will help me raise my credit score. I have never missed a payment. Jorge

Hello Jorge, and thanks for your question. Your good payment history certainly deserves recognition, and it can be frustrating to know youre doing something right and not getting credit for it. The fact that your lender wont report your positive payment history seems doubly unfair because its highly likely theyd find the resources to report it to the credit bureaus if you missed a payment or defaulted on the loan.

But the unfortunate reality is, lenders voluntarily provide consumer credit information to credit-reporting agencies theyre not required to.

Don’t Miss: When Do Creditors Report To The Credit Bureau