If You Cannot Pay Your Student Loans

Sometimes money gets tight. In those situations, ask your lender about lowering or pausing your monthly student loan payments. You might be able to:

-

Sign up for an income-driven repayment plan if you have federal loans.

-

Apply for a modified payment plan if you have private loans and your lender offers this option.

-

Enroll in deferment or forbearance to temporarily pause your monthly payments.

Changing the terms of your loan does not hurt your credit. As long as you handle payments as agreed even if that means paying $0 per month your credit score shouldnt suffer.

Can You Get A Home Loan With 700 Credit Score

A 700 credit score meets the minimum requirements for most mortgage lenders, so it’s possible to purchase a house when you’re in that range. … A credit score of 700 also might not qualify you for the best interest rate on your mortgage loan, you may still want to work on improving your credit scores to save on interest.

Care Tweaks Reliance Home Finance Ltd’s Rating To A+

Reliance Home Finance Ltd.s credit rating has been revised to A+ by CARE. The credit rating agency has changed the companys rating from A to A+. The A+ rating has been given to Reliance Home Finance Ltds long-term debt program, market linked debentures, subordinated debt and non-convertible debentures public issue. Meanwhile, the A rating has been given to upper Tier-II NCDs. The credit rating agency stated that the revision of rating has taken owing to revision of rating of the parent company, Reliance Capital Limited and moderation in liquidity profile of the company.

7 March 2019

You May Like: How Do I Unlock My Credit

Grow Your Credit History

As mentioned earlier, various factors determine your credit score. Your credit historys length is one such factor, accounting for 15% of the entire score. This means that attaining that 800 score is impossible without factoring in the length of your credit history.

Therefore, the only solution is to build and grow that credit history over time. One incredible place to start is taking a student loan or a credit-builder loan.

For student loans, you dont require a credit check as most of them are federal funding. This makes it an ideal option for students without any prior credit history.

On the other hand, a credit-builder loan acts as a saving account. You get the loan but cant access it until youve paid all the necessary installments to clear the loan. Once youre through with the installments, you can now access your money. While its a personal loan, it helps build a saving culture while also growing your credit history.

Applying for a credit card can also help grow your credit history. And, if you dont qualify for an unsecured one, you can start with a secured one and grow your way up from there. A secured credit card requires a cash deposit as collateral.

See related:How to Save Money Fast on a Low Income.

Build Or Rebuild Your Credit History

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

A is a personal loan thats designed to help you add positive payment history to your credit report. Unlike a traditional personal loan, a lender doesnt directly deposit a lump sum of money into your account. Instead, it sets aside money in a savings account or certificate of deposit account , and you gain access to the funds after repaying the loan.

Using a credit card responsibly is another way to build your credit history. If you dont qualify for or dont want to use a traditional credit card, you can apply for a secured credit card instead. When you take out a secured card, youll be required to make a cash deposit thats held in a collateral account, which is equal to your credit limit.

You May Like: What Credit Score Does Care Credit Use

How Long Does It Take To Get 800 Credit Score

Depending on where youre starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

Types Of Credit Used And New Credit

Each accounts for 10 percent of your score. All debts are not created equal. A 30-year fixed mortgage is a good debt. A debt consolidation loan from a finance company, on the other hand, is not. A lot of new debt will lower your score. Lenders like to see a nice balance including a home mortgage, a car payment, and no more than two or three credit cards with no sudden increases in borrowing. Scores calculated for other purposes may add or subtract points for other kinds of debt. When you do obtain new credit for an auto or mortgage loan, or from a lender that provides auto or mortgage loans, shop for it within 30 to 45 days so that the inquiries will count as one inquiry instead of many.

Read Also: Does Affirm Report To Credit Agencies

How Many Points Can Credit Score Increase In A Month

For most people, increasing a credit score by 100 points in a month isn’t going to happen. But if you pay your bills on time, eliminate your consumer debt, don’t run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Re: How Long Does It Take To Get A 800 Credit Score

Doesn’t FICO8 ignore AU accounts for scoring? And OP, do you want the number for its own sake, or to get favorable conditions for a loan or credit card? You don’t need 800 to get top offers

EX 822

wrote:

Doesn’t FICO8 ignore AU accounts for scoring? And OP, do you want the number for its own sake, or to get favorable conditions for a lore oan or credit card? You don’t need 800 to get top offers

FICO08 can ignore AU accounts if it deems you are piggybacking…or not. No one knows for sure how it decides that you are. Howver, banks still use the old FICO models that do automatically factor them in.

wrote:Just wondering how long it takes people who are new to credit! Thanks!

For MOST people, ideally never. If you get much above 760, you’re wasting potential sign-up bonuses with no reward. You need about 740 for the best interest rates on most loans, give yourself some safety, but not too much. Maintain your FICO around 750-760 for best results. If it goes higher, app for a credit card that gets you a nice sign-up bonus

Don’t Miss: Does Self Lender Do A Hard Inquiry

How To Get A Credit Score Of 700 Or 800

5-minute readDecember 21, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

A credit score is a three-digit number that can have a big impact on your life. While a good credit score can open many doors, a bad credit score could leave you in a lurch.

Luckily, credit scores arent static numbers, and if you can figure out how to get a credit score of 700 or 800, you can enjoy some of the best rates and terms on financial products like mortgages, car loans, credit cards and personal loans.

If you dont know where to start, were here to help. Read on to learn more about the benefits of knowing how to increase your credit score and the best tips for doing so.

How Many Points Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. Thats way more inquiries than most of us need to find a good deal on a car loan or credit card.

Realistically, only a narrow group of people has good reason to be cautious about the effect inquiries could have on their FICO score, Watt said.

Heres who might be concerned, according to Watt:

- People who take an unusually long time to shop for a new mortgage or auto loan.

- Consumers who shop around in the same year for several different lines of credit not associated with a mortgage or auto loan.

- People who know before they begin applying for credit presumably from conversations with creditors that their credit score barely qualifies them for their desired credit offering.

Read Also: How Long Is A Repo On Your Credit

How Do I Get My Credit Score Up To 800

Home> > Understanding Credit Reports> What is a Credit Score & How is it Calculated?> How Do I Get My Credit Score up to 800?

You dont have to be a millionaire to know what achieving that financial ranking means.

Being a millionaire means you have crossed a huge economic threshold. Doors open. Opportunities are offered. Rewards are granted. You arent invulnerable, but you do have a comfortable status.

If you arent a millionaire but like the privileges that go with being one try pushing your credit score up to 800 and you too will qualify for some really nice perks. Bankers are your best friends. Credit card companies are begging for your business. Loans are practically automatic.

Granted, the people in the 800 Club dont have the same cache or economic clout as millionaires, but its still an elite status in todays economy. And the 800 Club is a lot easier to join. More than 40 million American consumers have 800 or better credit scores. Only 12 million are millionaires.

And all you gotta do to join the 800 Club is pay every bill, every month on time and be ultra, ultra conservative about using a credit card for spending.

OK, thats not ALL you have to do, but it is most of it.

On-time payment and credit utilization make up the bulk of your credit score. The rest comes from the length of credit history , new credit and mix of credit .

Fastest Ways To Improve Your Credit

It’s unlikely you’ll be able to get your credit score to where you want it in just 30 days, but there are some actions you can take that can improve your score more quickly than others:

Again, improving your credit can be a long process, but taking these steps can give you a head start and give you the chance to see improvements early on in the process.

You May Like: When Does Open Sky Report To Credit Bureau

Benefits Of A High Credit Score

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

How Do I Get My Credit Score From 700 To 800

- Score4.7/5

How to Get an 800 Credit Score

-

How to Get From 700 credit score to 800 in 30 days

Watch Youtube video

- Is Webull good for beginners?+ 23 related questions

You May Like: Does Eviction Notice Go On Credit Report

Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

So Is An 800 Score Worth It

The answer is yes! But a credit score of 750 is probably just as good.

Aiming for 800 and above might be enticing, but its not always necessary, Griffin said. Scores of 800 or above may earn you bragging rights, but they wont net you better terms. Your goal should be to have a score high enough to get you the best rates and scores greater than 750 will qualify you for the best rates.

So, the numbers game for credit scores is like every other statistical measurement in your life: How high is high enough?

If youre happy at 750 and getting the best rates you can go for it!

But if you want to feel like a millionaire without have the bank account to prove it take your best swing at 800 and let the privileges fall where they will!

5 Minute Read

Don’t Miss: Sync Ppc Credit Card

How To Raise A Credit Score In 30 Days

While it typically takes a few months to make a significant difference in your credit score, there are things you can do right now that can help you raise your score in a matter of weeks. Here are some suggestions to help give your credit score a quick boost:

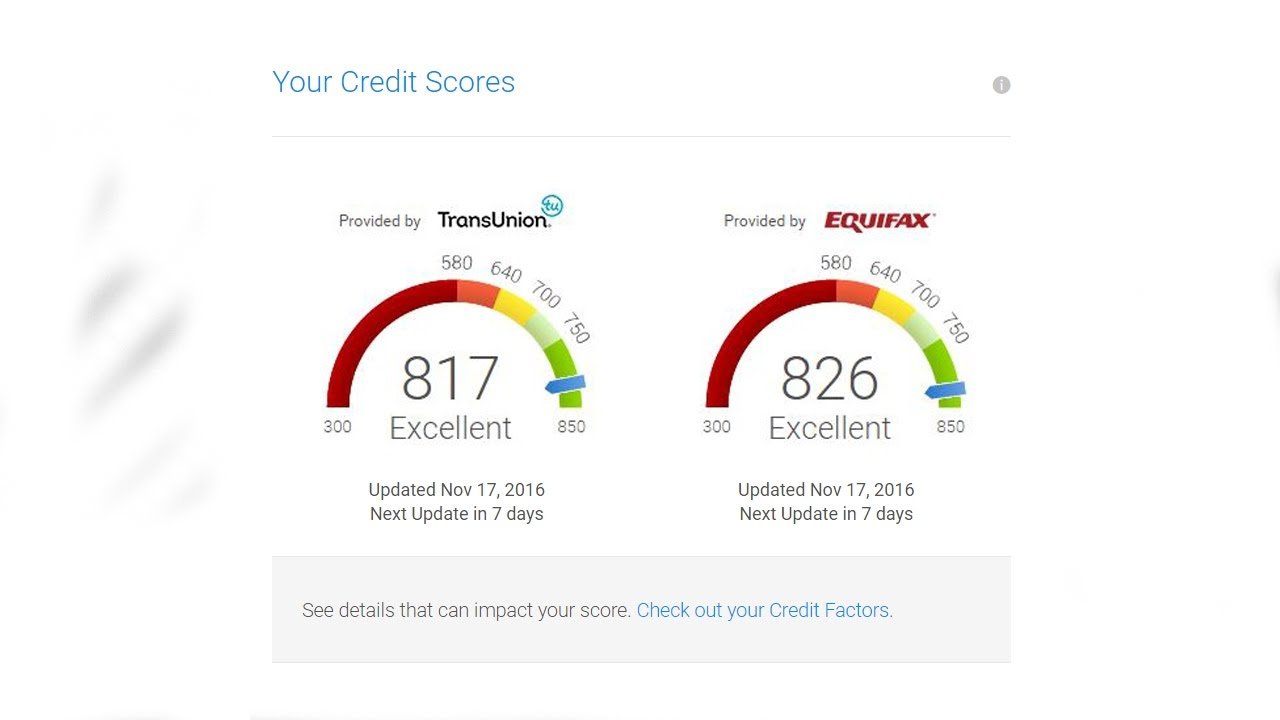

Fix any mistakes on your credit report Perhaps the fastest way to increase your credit score is to identify any errors on your credit report and have them rectified. Youre entitled to pull your from credit bureaus like Equifax or TransUnion and go through it to see if there are any mistakes that could be pulling your score down. If there are, fixing them can give you an immediate boost to your score.

Need to dispute an error on your credit report? Heres how you can do it.

Increase your available credit Asking for a higher credit limit from an established creditor can not only increase your available credit line but also raise your credit score.

Negotiate with creditors You may be able to ask creditors to accept partial payments for debt that is currently in collections in exchange for reporting the debt as paid.

Be an authorized user on someone elses account If you have any family members with good credit, adding you as an authorized user on their account can help increase your credit score. Each one of their timely payments will boost your record.

How Can I Raise My Credit Score By 100 Points In 30 Days

How to improve your credit score by 100 points in 30 days

Read Also: Is Opensky Reliable

Is It Better To Pay Your Credit Card Twice A Month

Making all your payments on time is the most important factor in credit scores. Second, by making multiple payments, you are likely paying more than the minimum due, which means your balances will decrease faster. Keeping your credit card balances low will result in a low utilization rate, which is good for your score.

Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

You May Like: How To Fix Serious Delinquency On Credit Report

Tips To Get A High Credit Score

For years, its been widely reported that fewer than one percent of American adults have a FICO credit score of 850.

So, how did Stevens and Ulzheimer climb to the top of the credit-score mountain? Both of them say it was a slow trek that was aided by responsible handling of debt.

Ulzheimer says some of the control over your credit rests with you, while some of the control is out of your hands.

Just like a professor who grades your college coursework, credit-scoring models grade you on your credit activity. So while you might think you deserve a perfect score, the professor or in this case, the credit-scoring model has the final say over your grade.

How do you improve your credit?

Theres no quick fix. Improving your credit health takes time, but the most important behaviors can be summed up as this: Pay your bills on time and reduce the amount you owe. It also helps to check your credit reports regularly and dispute any errors you see, such as a collections account that hasnt been removed from your reports after seven years from the original delinquency date.

Based on the experiences of Stevens and Ulzheimer, what follows are some things you can do to aim for the FICO 850 mark .

Keep in mind, though, that their circumstances are unique, and what theyve done to achieve a FICO 850 score might not work for you.

Heres the advice they gave: