Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

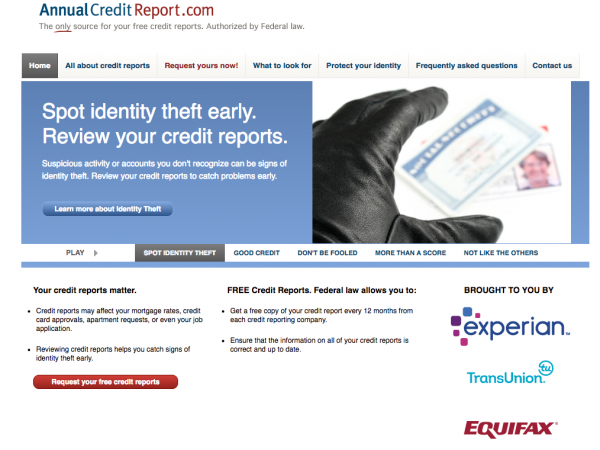

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Why Your Report Is Important

The information on your report is used to calculate your score. Banks consider your credit history when deciding whether to approve you for a credit card, mortgage, auto loan, or other type of loan.

Thats not all though.

Many landlords will look at your credit when deciding to rent to you.

This means that your credit can have a big impact on many areas of your life.

If your credit isnt good enough, it can stop you from getting a credit card or a mortgage for example.

How To Get Your Free Credit Report From Credit Karma

Another way to get free credit reports is through , a site that also allows you to keep tabs on your credit score. Credit Karma gives you access to your reports from both TransUnion and Equifax and will even highlight important information to make the reports easier to understand. Your reports can be updated as often as once a week, and you can check them as often as you want.

Team Clark recommends Credit Karma as a free way to monitor your credit. Here is Team Clarks full Credit Karma review.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Getting Free Credit Reports Under The Fcra

The three major credit bureaus have set up a central website and a mailing address where you can order your free annual report.

You may get your free reports at the same time or one at a time – the law allows you to order one free copy of your report from each of the credit bureaus every 12 months.

To get your free reports, visit AnnualCreditReport.com. You can also complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

What Makes My Credit Score Go Up Or Down

A credit score is based on information in your credit report. Some factors include how much money you owe, how long you’ve owed it, how many new accounts you have, how often you miss or are late with payments, and what type of credit accounts you have. Changes in any of those factors may cause a score to go up or down.

How To Order Your Free Credit Reports

One of the best ways to protect yourself from identity theft is to monitor your credit history. Now you can do that for free. Thanks to a new federal law, consumers can get one free credit report a year from each of the three national credit bureaus. Those bureaus are Equifax, Experian, and TransUnion.1 You can also get your reports for free from “specialty” credit bureaus. These companies prepare reports on your employment, insurance claims, rental and other histories.

Checking your credit reports at least once a year is a good way to discover identity theft. And the sooner identity theft is discovered, the easier it is to clear up. You can also identify errors in your credit reports that could be raising your cost of credit

You May Like: How To Get A Repo Removed From Your Credit

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

How To Obtain Your Free Credit Reports

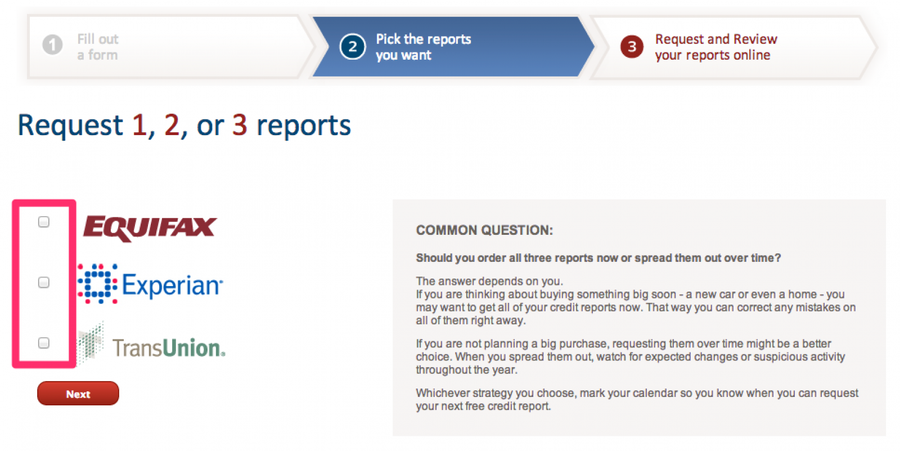

The three major credit reporting agencies in the U.S. teamed up to provide where you can order your free credit reports: www.annualcreditreport.com.

Once there, answer a series of questions to verify your identity, and select which reports to view. You can also call 877-322-8228 to request a copy of your credit reports by phone.

Recommended Reading: How To Notify Credit Bureaus Of Death

Whats A Credit Report

A credit report gives you a comprehensive list of your lines of credit and payment history. Equifax, Experian, and TransUnion, those three major credit-reporting companies I mentioned above, compile these credit reports.

Now, reports often include many pages, as they detail all the accounts that youve had.

When you make a payment on a credit card or loan, the business that gave you that loan or credit keeps a record of how much you pay and how often you make payments, as well as the credit limit and loan balances. Those businesses and other sources will report your credit, loan, and payment history to the three major credit reporting companies.

Each of the credit reporting companies combine this information into a credit report. These companies prepare reports for people in the US.

The information on your reports may vary, as not all businesses report to all three credit reporting companies.

So, business one for example, might only report to Equifax and TransUnion, whereas, business two might report to just Experian and TransUnion.

Whats The Difference Between A Credit Score & A Report

Your credit report is not the same thing as your credit score.

A credit report offers information about your credit history.

On the other hand, your credit score is a number that lenders use to evaluate how safe or risky you are as a customer.

Basically, your credit score helps loan and credit providers to make lending decisions.

The most common score used to make credit decisions is the FICO score. This comes in multiple versions many of them are specialty scores for specific products, like credit cards or auto loans. Another one thats used in lending decisions is VantageScore.

So, your credit score is calculated based on the information in your credit report.

Important factors include:

- Your repayment history.

- How much money you owe compared to your credit limits this is called the credit utilization ratio.

- How often you have applied for credit recently this is known as a hard inquiry, but more on that below.

- How long youve had credit accounts. Or the age of credit.

- The types of credit you have. So this could be the type of credit with fixed payments, like an auto loan, or credit with variable payments, such as a credit card.

Don’t Miss: Does Opensky Report To Credit Bureaus

How To Review Your Credit Reports

To check your reports for errors or possible signs of identity theft, look especially at three areas.

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

How To Get Your Free Credit Reports Directly From The Credit Bureaus

If youd rather get your free reports directly from the credit bureaus themselves, thats possible in two of the three cases. TransUnion doesnt offer a free credit report online.

Equifax

To get your free credit report from Equifax, you must first sign up for the myEquifax program. As a member of myEquifax, you can get access to your Equifax credit report twice per year at no charge.

Beware, though, as Equifax may try to push you toward signing up for one of its paid products. It is not necessary to do this in order to get your free report.

Experian

You can sign up to get your free Experian credit report here. One nice thing about Experians offering is that you can access your credit report for free every 30 days after you sign up. This could be useful if youre in the process of trying to buy a house or car and want to keep close tabs on your report.

Again, beware of signing up for paid products with Experian.

TransUnion

Unfortunately, TransUnion does not currently allow you to access your free credit report online directly through its website. Instead, the company refers you to AnnualCreditReport.com and then tries to sell you its credit monitoring product for $24.95 a month. Dont do it! Heres why money expert Clark Howard says you should never pay for credit monitoring.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

How Can I Request My Free Statutory Annual Credit File Disclosure

When you order, you will need to provide your name, address, Social Security number, and date of birth. To verify your identity, you may need to provide some information on your credit report, such as the amount of your monthly mortgage payment.

Your free annual credit report does not include your credit score. A credit score is an additional service that can be purchased when getting your credit report. Along with knowing your credit score you will learn what factors positively or negatively impact your credit risk.

Read Also: Does Paypal Credit Report To Credit Bureaus

Your Childs Credit Report

Parents can place a Protected Consumer security freeze on their childs credit reports to help prevent identity theft. Check a childs credit report before they turn 16.

Youll need to provide the following:

- childs full name

- copy of social security card

- addresses for the past two years

- copy of the parents drivers license

- copy of proof of residence for the parent, such as a utility bill

- guardians should include guardianship papers

Send or submit the information to each of the three major credit reporting bureaus.

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

You May Like: Does Paypal Credit Report To Credit Bureaus

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Recommended Reading: Speedy Cash Loan Extension

How To Order Your Free Annual Credit Reports

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- *Onlineat annualcreditreport.com.

During These Times Of Covid

To maximize your protection from fraudulent activity, order one report from a different company every fourth month.

It is important to check all three reports because not all businesses report to all three credit reporting companies thus, the information on your reports may vary. It is also important not to confuse your credit score with your credit report. Your credit report and your credit score are not the same thing.

Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Read Also: Does Paypal Credit Report To Credit Bureaus

Cookies And Other Technologies

What is a cookie?

A cookie is a piece of information that a web server may transfer to your web browser when you visit this website. Cookies are commonly used by websites to improve your experience and to let computer systems recognize your browser. Only the information that you provide, or the choices you make while visiting a website, can be stored in a cookie. For example, the site cannot get your email unless you choose to type it. Allowing a website to create a cookie does not give that or any other site access to the rest of your computer, and only the site that created the cookie can interpret it.

For more information about cookies and how to adjust your settings to choose your cookie preferences, visit your browser’s help section.

Can I refuse to allow cookies?

You must allow cookies if you want to get credit reports from the nationwide consumer credit reporting companies through this website. If you do not wish to allow cookies, click here for alternative methods for requesting your credit report.

How we use cookies on this website

This website uses cookies to:

- Allow you to ask for a free credit report from more than one nationwide consumer credit reporting company during a visit without re-entering your information more than once

- Allow us to gather collective statistical data to help us manage and develop this website

- Help improve how you navigate this website