Can Debt Collectors Remove Negative Information From My Reports

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms. Therefore, it’s just as important for them to see your negative credit history as your positive history.

If you discover, however, that negative information is still on your credit reports after seven years and you have paid off the amount as agreed, you should immediately file a dispute.

You can dispute the negative information sooner if it appears on your credit reports multiple times. You can also dispute the information if it’s a result of fraud or identity theft. It’s important to report the fraud or identity theft immediately to the three nationwide credit bureaus so that you can get your financial life back on track.

Be warned that there are many companies that claim they can have negative information removed from your credit reports for a fee. However, neither you nor a third party can get negative but accurate information removed.

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

What Goes Into Your Credit Report

This is your first line of defense Knowing what information goes into your credit report can provide you an idea of your financial health and also identify if youve been the victim of identity theft.

To find out if the information on your credit report is correct, the three main credit reporting agencies allow you to obtain a copy of your credit report once a year.

Due to the current COVID-19 pandemic, all three credit reporting agencies are now offeringfree weekly online reports through April 2021; this should be your first step.

Next, you have to find out what information makes up your score and what factors can improve or negatively affect it. Finally, ask how you can improve your score. Usually, that information is provided to you as a list of risk factors when obtaining a copy of your credit report.

Rod Griffin, Senior Director of Public Education for Experian, said risk factors tell you exactly what you need to work on in your credit report to make those scores better.

Also Check: Cbcinnovis On My Credit Report

Checking Your Credit Report

Now that youre aware of what can happen if theres than an inaccuracy on your credit report, lets talk about what kinds of common errors you may see on it:

- Inaccurate Personal Details Simple mistakes such as the wrong name, birthdate, or mailing address can spell disaster because you could end up with someone elses credit information .

- Wrong Account Information Its also possible that your lender didnt report your payment or account activity correctly. For instance, if you paid your debt on time but it was accidentally labeled as late or defaulted.

- Falsified or Stolen Accounts Identity theft and fraud are two of the worst things that can happen to your finances and credit report, not to mention complicated and time consuming to deal with afterward.

- Uncorrected Negative Information Missed payments and other negative credit actions stay on your report for several years . If so, a bureau may forget to remove the information after the allotted time period.

File A Complaint With The Cfpb

The Consumer Financial Protection Bureau regulates credit reporting agencies as well as many of the companies that furnish data to them. Generally, you will want to try the methods mentioned before to resolve the problem before you contact them. And they can’t help you remove accurate but negative information that you simply don’t want listed on your reports. But if you have a legitimate problem you have been unable to resolve, you can file a complaint. In turn, they may contact the parties involved and you may get results you weren’t able to get on your own.

Read Also: Open Sky Unsecured Credit Card

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Who Is Responsible For The Information On My Credit File

It is easy to see why people assume the CRAs are responsible for all the information that appears on their credit file. However, in reality, the lenders and telecoms and utility companies who passed the information to the CRA in the first place also have responsibilities for the information that appears on your credit file.

As a general rule, if the entry you are looking at has the name of a company on it, its likely to be that company who is responsible for that entry. The CRAs cannot amend this data without the permission of that company.

Having said this, we still expect the CRAs to take reasonable measures to ensure the information that is reported by lenders via their credit files is accurate.

The information that is generated by the CRAs and for which they are responsible, includes financial links, linked addresses and alias information.

Recommended Reading: Paypal Credit Hard Pull

How Student Loans Impact Your Credit Score Cnbc

Mar 10, 2021 Student loans are a type of installment loan, which means they appear on your credit report. Heres what that means for your credit score.

But once your loan has been delinquent for 90 days, your student loan servicer will report this delinquency status to the three major credit bureaus. This;

Jul 10, 2021 $124.4 billion in student debt is in defaulted student loans. reported to credit bureaus, severaly damaging the borrowers credit score.

Apr 19, 2021 8 ways to remove old debt from your credit report delinquent accounts is important when youre applying for loans or other new credit.

When you rehabilitate a defaulted student loan the default is removed from your credit report and any wage garnishments or Treasury offsets will end.

May 1, 2021 Look up the purpose of Section 609 if the Fair Credit Reporting Act. It requires CRAs to validate the debts from the loan companies. If they;

Falling behind on student loan payments can happen to anyone! We report loan information to each Delinquency and Default Disputing Credit Reporting.

Your credit score takes a hit when you are delinquent on your loans, and of course, Student loan delinquency may trigger collection calls, and payment;

No information is available for this page.Learn why

Sep 12, 2017 Normally, a defaulted debt will fall off a report after 7.5 years from the date of the first missed payment. This applies to private student;

Add More Positive Data To Your Credit Report

Whether your file is thin or fat, adding positive trade lines will always help your score. Negative information counts for less and less each month as it ages until it disappears altogether in seven years. But around year two, most negative items have lost their big impact.

To rebuild your credit faster than just waiting for time to heal your wounds, try adding new accounts. Easy adds include gas and retail cards, secured credit cards, passbook loans and installment loans on small furniture purchases.

Adding positive information to your file will speed your score recovery by balancing or offsetting negative data quickly. Using programs like Experian Boost and UltraFICO can also be helpful in getting approved when you decide to apply for new credit.

Of course, be sure to make those new payments on time, every time, and youll be in the good credit column before you know it.

Remember to keep track of your score!

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Also Check: Why Is There Aargon Agency On My Credit Report

How To Get Something Removed From Your Credit Report

Categories

When it comes to the health of your finances, one of the most important things to have is a clean . After all, its often one of the first things that a bank, credit union, or alternative lender will examine when you apply for a new credit product, such as a personal loan, a line of credit, vehicle financing, or a mortgage.

Unfortunately, negative information on your report can lead to your application being denied, especially if you arent aware of it the information is wrong. To learn more about how credit report errors can affect your credit and how to get inaccurate information removed, keep reading.

How To Remove Disputes From Your Credit Report

When you get a mortgage you cant have disputes open. The dispute process lasts approximately 30 days, however, they arent always closed automatically after the 30-day window has passed.

When you dispute an account on your the Credit Bureau adds a comment that you disputed the accuracy of that account. That dispute notation can remain on your credit report long after the dispute is completed. Before you close on a mortgage you must have the credit bureau remove the dispute comments from the reports on your account.

Read Also: Is 779 A Good Credit Score

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Impact Of Identity Theft On Your Credit Report

![How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Read Also: How Long A Repo Stay On Your Credit

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Make A Goodwill Request For Deletion

With pay for delete, you can use money as the bargaining chip for getting negative information removed from your credit report. If youve already paid the account, however, you dont have much-negotiating power. At this point, you can ask for mercy by requesting a goodwill deletion.

In a letter to the creditor, you might describe why you were late, state how youve since been a good paying customer, and ask that the accounts be reported more favorably. Again, creditors dont have to comply and some wont. On the other hand, some creditors will make these deletions if you talk to the right person.

Also Check: Opensky Billing Cycle

Hire A Consumer Law Attorney

If all else fails, you may need to reach out to a consumer law attorney for help. If a violation of the Fair Credit Reporting Act occurred, you may be entitled to statutory damages of $100 to $1,000 per violation as well as actual damages for losses you suffered, emotional damages and/or punitive damages. A consumer law attorney familiar with the FCRA and state laws can help you determine whether this is the appropriate course of action.

If you want to see how negative items in your credit report are impacting your credit scores, you can get two of your credit scores for free at Credit.com, plus a personalized action plan for improving your credit.

First published on June 24, 2014 / 11:14 AM

Quotes delayed at least 15 minutes.

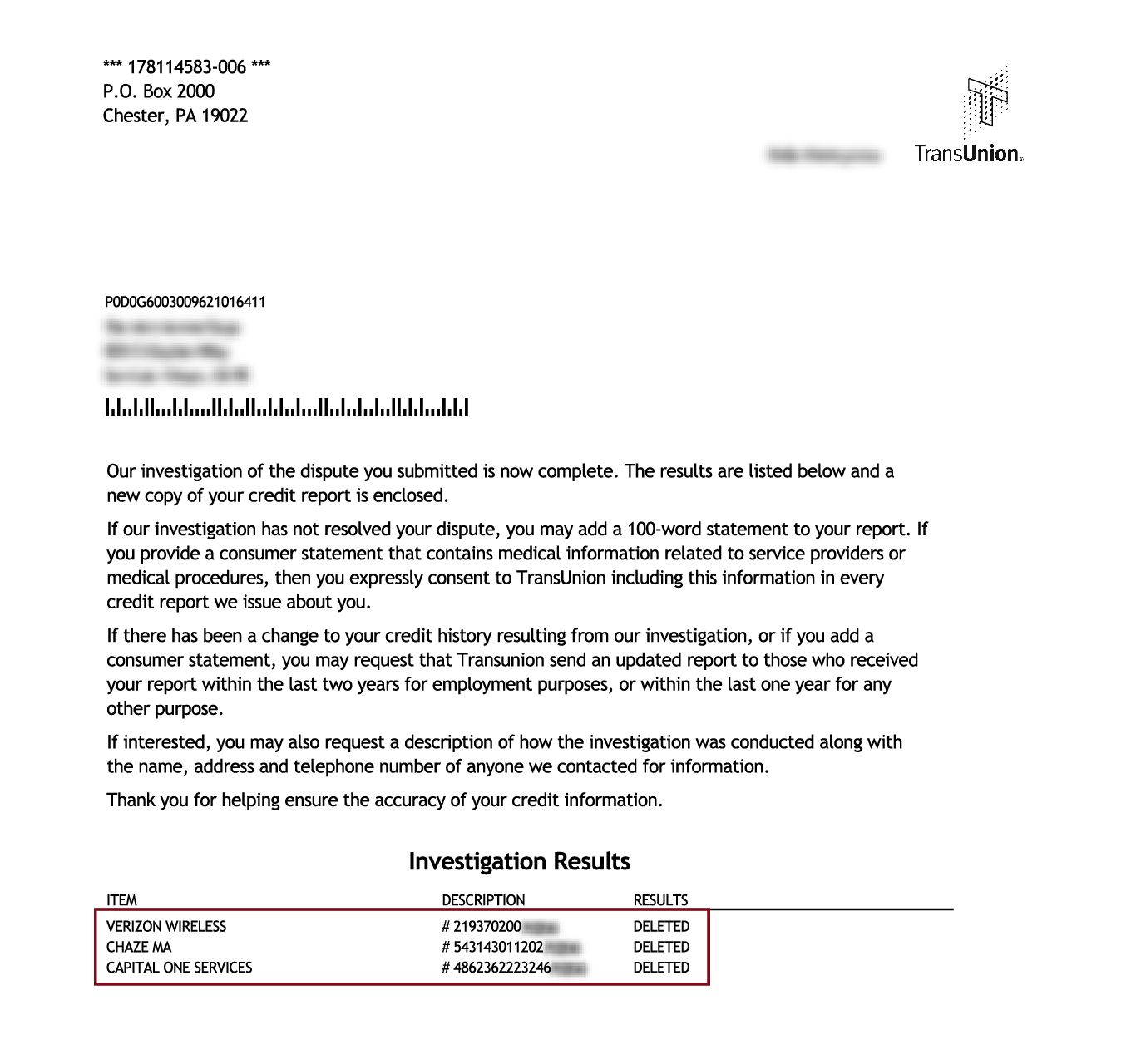

Dispute Submission To A Credit Bureau

The FCRA or the Fair Credit Reporting Act outlines the type of information that could be registered on your credit report and for how long. According to the FCRA, you have a right to receive a correct credit report. This provision allows you to dispute any potential errors with the credit bureau.

These disputes could get resolved via email. A recently ordered copy of your credit report can be submitted online to the credit bureau. In your email for dispute, write about the anomalies in the credit report and submit copies of proof. The bureau will investigate with the correct business and only then remove entries that are errors.

Don’t Miss: Innovis Consumer Assistance Letter

Things To Consider Before Calling A Credit Repair Service

You can call a credit repair company for a consultation at any time, but remember that credit repair can only remove incorrect or illegitimate listings. Keep these factors in mind before moving forward with a credit repair service:

- Expenses. Weigh up the costs of credit repair against the possible value of the service. For example, the long term benefit of a home loan with favorable terms outweighs the short term costs of hiring a credit repair specialist but the benefit depends on the service being successful.

- No guarantees. The agency will investigate your listings but cannot by law offer any certainty of removing them.

- Time factor. When studying your negative listings, also take note of when they will expire. Most credit black marks disappear from your credit file after seven years, so in some cases it may be worth waiting it out if youre not planning on utilizing credit in the near future.

Consider your credit report carefully and what may be realistically achieved through a credit repair agency before you take on the expense of this service.

A Great Way To Improve Your Credit Score

Removing negative items from your credit report can improve your credit score but be patient. From the time the dispute is reported to the time the correction is made, it would take approximately 60 days to see results on one’s credit score, Castaneda said.The Federal Trade Commission also advises that if your dispute is not resolved to your satisfaction or found in your favor, you can ask that a statement of the dispute be included in your file and future reports, Castaneda added.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

How To Remove Collections From A Credit Report

This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 10 references cited in this article, which can be found at the bottom of the page. This article has been viewed 49,515 times.Learn more…

You are only allowed to remove questionable or invalid collections from your credit report you cannot remove accurate, negative information from your report, such as a debt you have now paid. Otherwise, remove collection accounts from your credit report by either writing a letter of good will to the creditor to have the item removed, or by filing a dispute with the credit bureau, creditor, or both. Once you have filed a dispute, make sure to follow up with the credit bureau or creditor. If you have any issues with how the investigation was handled, you can always file a complaint. Remember that after seven years, most negative information will fall off your credit report .XResearch source