What Is A Credit Report And How Do I Access Mine

Institutions that have issued you credit cards and loans send regular updates about your accounts to , also known as credit reporting agencies. Credit bureaus collect all the data and combine it into a single file, known as your credit report. When you apply for new credit, the financial institution pulls your to determine whether you meet the qualifications.

To quickly figure out the likelihood that you’ll repay a loan on time, creditors may instead use your , a three-digit numerical summary of your credit report information at a given point in time.

It’s important to check your credit report periodically to make sure the information it contains is accurate, complete, and within the allowed reporting time limit. You can access your credit report online from any of the credit bureaus, but there may be a fee. You’re also entitled to a free credit report each year from the major credit bureaus.

Through April 20, 2022, the three major credit bureaus are offering weekly free credit reports through AnnualCreditReport.com.

As you read through your credit report, reference this guide to better understand some of the abbreviations you see. Different credit bureaus and credit report providers may use slightly different codes, and some codes may only appear on the reports issued to lenders. Well clarify as much as possible.

What Is Revolving Credit

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in regular payments. Each payment, minus the interest and fees charged, replenishes the amount available to the account holder.

Credit cards and lines of credit both work on the principle of revolving credit.

Rapid Access To Funds

As stated before, revolving credit allows you to continuously borrow money as long as you stay within your credit limit. This can allow you to access funds right when you need them, in case of an emergency. While this is convenient, it should be used as a last resort. You should still have other resources to pay for things if your current financial situation is tights. These may include a budget, a second stream of income and a healthy emergency fund.

Don’t Miss: Does Qvc Easy Pay Report To Credit Bureaus

How Resolve Can Help

If youre dealing with debt and not sure what to do, were here to help. Become a Resolve member and well contact your creditors to get you the best offers for your financial situation. Our debt experts will answer your questions and guide you along the way. And our platform offers powerful budgeting tools, credit score insights and more.Join today.

How To Avoid Being Sued By A Creditor

Your risk of being sued by a creditor increases after the six-month mark of nonpayment. Thats when many creditors charge off an account, meaning, they write off a debt as uncollectible and report it as a charge-off to the credit bureaus. However, youll still be expected to pay it. The six-month mark is often also the point when your creditor might typically hand your debt off to a third-party collection agency or sell it to a debt buyer.

To avoid a lawsuit, try to settle your debts before a charge-off occurs. Call the creditor or the debt collector and see if you can negotiate a settlement. If you have more than one debt, try to target one or two accounts to settle first, prioritizing those that are most likely to sue you.

You May Like: Does Fingerhut Do A Hard Inquiry

What Is A Revolving Credit Facility

A revolving credit facility is a line of credit that is arranged between a bank and a business. It comes with an established maximum amount, and the business can access the funds at any time when needed. The other names for a revolving credit facility are operating line, bank line, or, simply, a revolver.

A revolving type of credit is mostly useful for operating purposes, especially for any business experiencing sharp fluctuations in its cash flows and some unexpected large expenses. In other words, it is needed for companies that may sometimes have low cash balances to support their net working capitalNet Working CapitalNet Working Capital is the difference between a company’s current assets and current liabilities on its balance sheet. needs. Because of this, it is often considered a form of short-term financing that is usually paid off quickly.

When a company applies for a revolver, a bank considers several important factors to determine the creditworthiness of the company. They include the income statement, cash flow statement,Cash Flow StatementA cash flow Statement contains information on how much cash a company generated and used during a given period. and balance sheet statement.

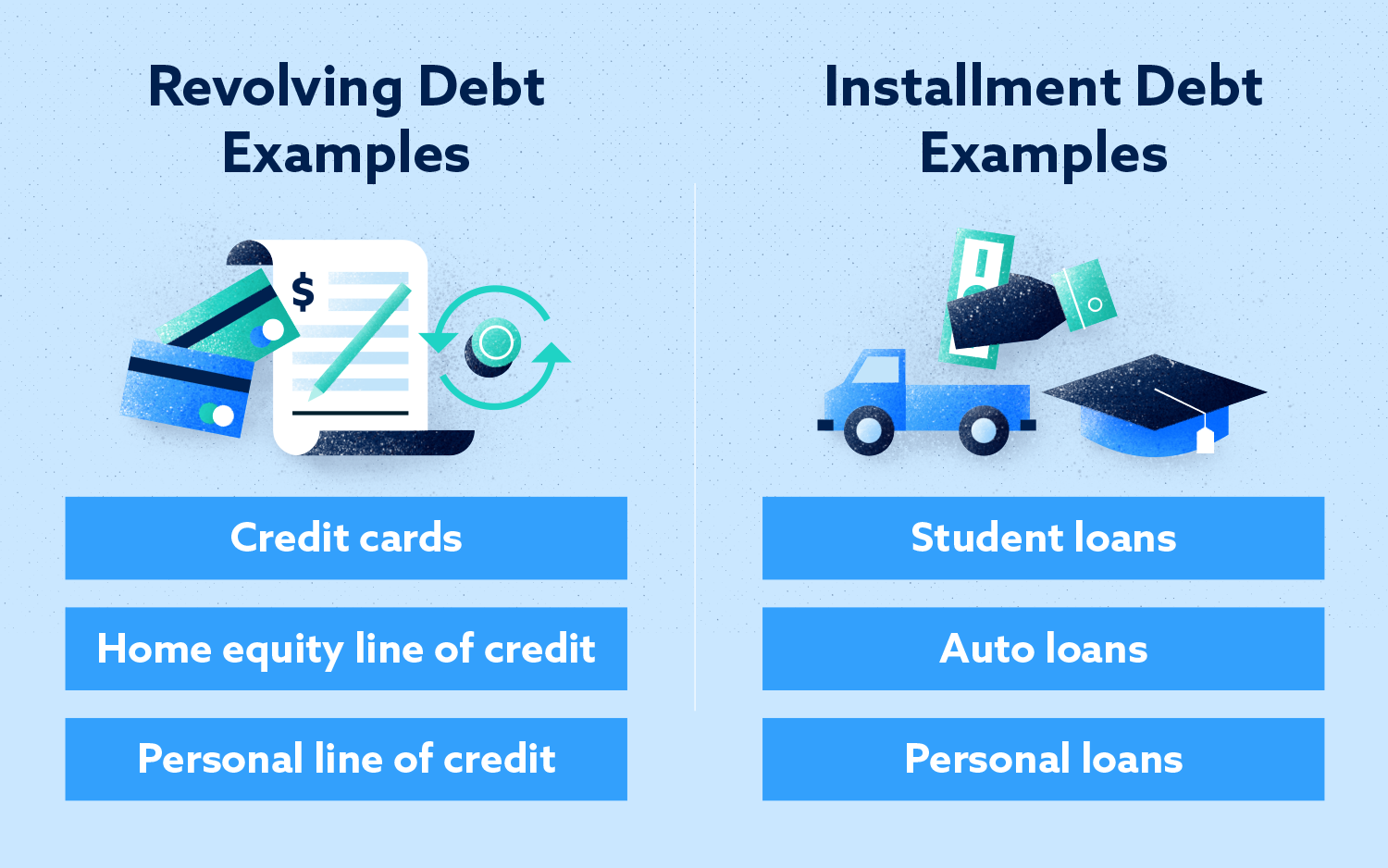

How Is Revolving Credit Different From Installment

There are two major types of credit: revolving credit and installment credit. Installment loans allow you to borrow a set amount of money and repay it over a specified period of time in fixed monthly installments. Auto loans, student loans and mortgage loans are examples of installment loans. Once you pay off an installment loan, the account is closed you can’t go back and borrow the same amount again. With revolving credit, as soon as you pay down your balance, you can draw or spend again within your credit limit.

Installment loans have their pluses and minuses.

The big plus: You always know how much you’ll be paying each month, which makes it easier to budget and plan.

The big minus: Installment loans aren’t as flexible as revolving credit. If money is tight one month, you can’t make a minimum payment on your mortgage or car loanyou have to make the full loan payment. But you can pay just the minimum on your revolving credit accounts.

Don’t Miss: How Long Do Inquiries Stay On Chexsystems

How Revolving Debt Can Affect Your Credit

Revolving debt can either help or hurt your credit score, depending on how you use it. Your FICO Score the most commonly used credit scoring model by lenders is based on a number of factors, including:

If youre able to consistently demonstrate a credit utilization rate of less than 30% meaning, you only use less than one-third of the revolving debt available to you this can help increase your score. However, the variable interest rates that come with revolving debt could cause you to miss a payment, which would make your score decrease quickly.

Showing that youre able to responsibly use a diverse mix of revolving and installment debt can give your score a modest boost since that accounts for 10% of it. Another advantage to taking on installment credit is that it doesnt count toward your credit utilization ratio. The lower this ratio, the higher your score could be.

However, your debt-to-income ratio takes all your debts into account. If lenders feel you dont have sufficient income to pay off your existing debts, this could affect your ability to get funding in the future. If youre not sure what your DTI is, use this method to calculate your debt-to-income ratio.

Benefits Of A Revolving Debt

Revolving debt is useful for individuals and businesses that need to borrow funds quickly and as needed. A person or business that experiences sharp fluctuations in cash income may find a revolving line of credit a convenient way to pay for daily or unexpected expenses. They also allow the flexibility of buying items now and paying for them later.

Read Also: 626 Credit Score Credit Card

The Difference Between Revolving And Non

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

When it comes to credit, there are two major types you should know about: revolving and non-revolving. Understanding the differences is key to knowing which type to use in various financing situations and how each affects your credit long-term.

You May Like: Does Barclaycard Report To Credit Bureaus

How Do You Know If You Have A Revolving Utilization Problem

Sign up for Credit.coms free Credit Report Card. It provides a snapshot of your credit report and gives you a grade for each of the five areas that make up your score. That includes payment history, credit utilization, age of credit, credit mix, and inquiries. The credit report card makes it easy for you to see what might be negatively affecting your credit score.

You can also sign up for ExtraCredit, an exciting new product from Credit.com. With an ExtraCredit account, you get a look at 28 of your FICO scores from all three credit bureausplus exclusive discounts and cashback offers as well as other featuresfor less than $25 a month.

You May Like: Can A Public Record Be Removed From Credit Report

What Is A Debt To Credit Ratio

Reading time: 3 minutes

Highlights:

- Debt to credit and debt to income ratios can help lenders assess your creditworthiness

- Your debt to credit ratio may impact your credit scores, while debt to income ratios do not

- Lenders and creditors prefer to see a lower debt to credit ratio when you’re applying for credit

When it comes to credit scores, credit history and credit reports, you may have heard terms like “debt to credit ratio,” “debt to credit utilization ratio,” “credit utilization rate” and “debt to income ratio” thrown around. But what do they all mean, and more importantly, are they different?

Debt to credit ratio

Your debt to credit ratio, also known as your credit utilization rate or debt to credit rate, generally represents the amount of revolving credit youre using divided by the total amount of credit available to you, or your credit limits.

Whats revolving credit? Revolving credit accounts include things like credit cards and lines of credit. They dont have a fixed payment each month, and you can re-use the credit as you pay your balance down.

An example of how a debt to credit ratio may be calculated: If you have two credit cards with a combined credit limit of $10,000, and you owe $4,000 on one card and $1,000 on the other, your debt to credit ratio is 50 percent, as youre using half of the total amount of credit available to you.

Debt to income ratio

The difference between debt to credit and debt to income ratios

How To Interpret Revolving Credit Facilities

Many companies in the US use the flexibility of such credit and usually, you will find that they report back on their balance sheet.

Lets say, a company has taken a revolving credit facility from a bank. Now, where the company would report its revolving credit in the financial statementsFinancial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels.read more?

They would first set up their balance sheet. They will go to the section of debt and then usually, they will mention a note below the balance sheet where they will report about what exactly happens in regards to a revolving line of credit.

Now, what if they dont mention?

Then it would be difficult for an investor to find out where the debt has come from. If the company has done the calculation but doesnt show the calculation and the exact narration of how it happened under the balance sheet, it wouldnt be possible for the investor to understand it.

In the example below, we will show you how you would be able to do that.

Recommended Reading: Credit Score Of 830

Types Of Installment Debt

Some common examples of installment debt include home mortgages, student loans, and auto loans. Once the installment debt is paid off, the credit account is closed and cant be borrowed from again. Youd have to apply for a new installment loan and start the approval process again.

Revolving debtunless its a home equity line of credit is typically unsecured, which means that financial institutions are unable to claim your property if you fail to make payments. This is what makes revolving lines of credit riskier in the eyes of creditors. Conversely, installment debt is sometimes secured, meaning that it can be tied to collateral, whether a car or a house, that can be repossessed if you default on the installment loan.

The amount of the installment loan is predetermined, as you borrow a fixed amount in a lump sum at the get-go. Installment debt usually comes with lower interest rates than revolving debt because it is less risky for a creditor to extend to borrowers . Installment credit is also useful for especially large purchases because creditors typically limit the amount available to borrow on revolving accounts, since the latter bears more risk.

How Does Debt Work

People take on debt because they need to purchase something that costs more than they can pay in cash. Or, in some instances, people may want to use their cash for something else, so they borrow money to cover a particular purchase.

Some types of debt may only be used for specific purposes. For example, a mortgage loan is used to purchase property, and a student loan covers education expenses. For these types of debts, the borrower does not receive the money directly the funds go to the person or organization providing the goods or services. With mortgage loans, for example, the seller or the seller’s bank receives the money.

Each person can only handle a certain amount of debt based on their income and other expenses. When a person has become overly indebted, they may need to seek legal relief of their debts through bankruptcy. This legal proceeding allows the debtor to be released from certain debts. Once the bankruptcy court discharges someones debts, creditors can no longer require payment.

Before filing bankruptcy, it may be beneficial to talk to a consumer credit counselor who can help you weigh your debt-relief options.

Don’t Miss: Comenity Cards Shopping Cart Trick

Examples Of Revolving Debt

| Common types of revolving debt | |

| Type | How it works |

| The credit card issuer allows you to borrow up to a set amount. Youre responsible for paying back a percentage of whatever you borrow each month, plus interest if you do not pay off the balance within the grace period. These payment amounts, as well as the interest rate, may change from month to month. | |

| Personal or business line of credit | The financial institution gives you an unsecured loan from which you may withdraw funds as needed through a card, checks or transfers to a checking account. Interest rates may fluctuate and extra fees may apply for each transaction. Because its not secured by an asset, you could pay higher interest rates. Unlike credit cards, youre unlikely to benefit from a grace period. |

| Home equity line of credit | The financial institution decides how much you can borrow based on the equity you have in your home. Youre given a set time limit by which you must pay back the funds. Like a mortgage, if you default on your HELOC payments, you could lose your home. However, you could get a lower interest rate for using your home to guarantee the loan. |

Consumers with strong credit, on the other hand, can open an unsecured credit card, perhaps one with a 0% APR promotional period for 12 months or more.

PERSONAL LINE OF CREDIT

Maintaining A Revolving Account

Revolving accounts have no maturity date and remain open as long as the borrower is in good standing with the lender. An important component of a revolving account is the borrowers available credit. This amount changes with payments, purchases, and interest accumulation. Borrowers are allowed to use borrowed funds up to the accounts maximum limit. Any unspent funds are referred to as the borrowers available credit balance.

Revolving accounts are maintained through monthly account statements that provide borrowers with their account balances and required payments. Monthly payments on revolving accounts change with the additions and deductions made on the account.

When a borrower makes a purchase, it increases their outstanding balance and decreases their available balance. When a borrower makes a payment, it decreases their outstanding balance and increases their available balance. Thus, a borrowers balance and available credit will vary each month.

At the end of a month, the lender will assess the monthly interest and notify the borrower regarding the amount that must be paid to keep the account in good standing. This payment amount includes a portion of the principal and interest accumulated on the account. Revolving account balances accumulate based on a borrowers purchase and payment activities. Interest accumulates each month as well and is usually based on the sum of daily interest charged throughout the month on any outstanding balance.

Recommended Reading: Unlock Experian Credit

What Is Amounts Owed

In a very general sense, Amounts owed refers to how much debt you carry in total. However, the amount of debt you have is not as significant to your credit score as your credit utilization. When a high percentage of a person’s available credit is been used, this can indicate that a person is overextended, and is more likely to make late or missed payments.