What Is A Free Credit Report

The free My Credit Check and My Credit Expert services generate full free credit reporst which provide a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments youve skipped, judgments taken against you and what you owe your creditors.

Negative Information If Any

The negative information section will list accounts that haven’t been paid as agreed, collections and public records such as bankruptcies. Negative information generally stays on your credit report for seven years, with the exception of Chapter 7 bankruptcies, which stay on your report for 10 years.

In this section, youll want to make sure any negative information is accurate. If you see incorrect accounts or collections or if something is being listed after it was supposed to have dropped off, dispute the entries immediately to have them removed from your report.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Also Check: Does Speedy Cash Report To Credit Bureaus

Should I Add A Consumer Statement To My Credit Reports

There are three basic types of consumer statements on credit reports:

- General consumer statements

- Account-specific statements of dispute

- Account-specific statements of excuse

General consumer statements apply to your entire credit report, and can remain on your report for two years. Account-specific statements apply to individual accounts, and remain on your credit report until the accounts theyre associated with are removed.

A general consumer statement could be used to explain a situation like identity theft, for example, which may have wide-ranging effects on multiple credit accounts.

Or, you may want to add an account-specific consumer statement to your reports in response to fraud, a problem with a lender, or a dispute that didnt go your way.

Oftentimes, disputed accounts are verified as accurate by the lender or collection agency. If this happens but you still believe the account to be inaccurate, you do have some recourse an account-specific consumer statement of dispute. There are also account-specific statements of excuse, which arent associated with formal disputes and are more like excuses for negative activity.

Insider tip

Heard of 609 dispute letters to verify debts? Find out if theyre the solution to remove negative items from your credit reports here.

If You See Errors Dispute Them

If you spot inaccuracies that may be lowering your scores, gather documentation to back up your claim. You can dispute credit report errors with the credit bureau showing them. You’ll need to provide copies of documents proving your identity and showing why the item is wrong. The bureau has 30 days to investigate and respond, although the Consumer Financial Protection Bureau has guidance extending that to 45 because of the pandemic

You can request your free credit reports from the three major bureaus or a personal finance site that provides free credit report details, like NerdWallet. Then, review the information and check for inaccuracies.

Credit reports include your personal information, accounts, credit inquiries and any negative marks you may have, such as bankruptcies.

A good credit score is generally between 690 and 719. Learn more about the and how to build credit.

About the authors:Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: When Do Companies Report To Credit Bureaus

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

On Your Transunion Credit Report

Finally, the TransUnion credit bureau also has its own codes to summarize your credit history and payment behavior.

The main code you want to see is OK as this notation means that you are current on an account.

Besides an OK listing, there are four neutral codes on a TransUnion credit file. These are:

CLO Closed

N/R which means Not Reported

X which means Unknown

None of these codes harm your credit rating, so dont panic if you see them on your TransUnion credit report.

Read Also: How To Get Credit Report With Itin Number

How Experian Calculates Credit Ratings

Experian relies on the Fair Isaacs Company , which provides a score from 300 to 850 based on an algorithm. According to Experian’s website, some factors that impact a credit score include the following:

- The total amount of outstanding debt

- Number of late payments

- How long the accounts have been opened

- The types of accounts such as a charge card versus a car loan

Experian’s credit reports are more than a number, however. Instead, Experian provides lenders a thorough look into a person’s credit history, which includes every credit product or debt that a person has opened or applied for to analyze how that person managed that debt.

Also, lenders often create their own credit scoring models based on a person’s credit history. As a result, the information in a person’s credit report can be interpreted differently by creditors.

Also, even when Experian and Equifax have the same information, a persons credit score can be wildly different. It is possible to have a poor score with one agency and an excellent score with the other. The lack of consistency can sometimes be due to how lenders report credit to credit bureaus. If a creditor reports to Experian but not Equifax, the credit scores from the two agencies for that person will likely be different. There is no indication that either of these agencies gives more poor or excellent scores than the other.

Who Can See My Credit Report

Most people cant legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If youre worried at all, do some research and find out what the law is where you live.

Recommended Reading: Business Credit Cards That Don T Report To Personal Credit

Are Credit Score Apps Safe

Many credit scoring apps are safe to use, especially if you’re getting them through your bank or one of the credit bureaus. But always be wary of scammers. If a company you haven’t heard of asks for your payment or personal information in return for providing a credit score, that may be a sign of a scam. Similarly, if you get an unsolicited email offering you a free credit score or credit report, that could be a phishing attempt.

Scams aside, some credit scoring apps may be cheaper, easier to use or more feature-rich than others. The features, scores and reports they offer or use can also vary depending on the provider.

Legitimate services that are freeand even some paid servicesmay sell or share your information with other companies. They also may make money when users sign up for financial products through the app. That doesn’t mean they’re unsafe, but it’s important to know how your information may be used.

How To Check Your Credit Report

It’s easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every 12 months.

Who Can Check My Credit Report?

The Fair Credit Reporting Act limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

Read Also: What Credit Score Does Carmax Use

How Experian Boost Works

Experian Boost is free to use and there are no existing membership requirements to sign up. To receive a boost, individuals create a free Experian account and navigate to the products page.

From there, users will be prompted to connect the bank account they use to pay their bills. For those wary of granting third-party access to their account, Experian explains that its product can access only read-only data from a bank, and doesnt have access to any of the funds. Once an account is connected, the feature scans transactions for on-time utility, cell phone and streaming video plans, including Netflix, HBO, Disney+ and Hulu payments. Experian needs at least three months of payments within a six-month window.

Experian Boost shows users which bills are pulled and when they were paid. The feature only pulls positive payment history, which means it wont report any negative information that could lower your credit score. Users also have the option to exclude any payments they dont want to be added to their file.

Read More: How to Review Your Credit Report

What Information Isnt On Your Credit Report

One of the most important things to realize about your credit report is that it does NOT contain your credit score.

It is your right and responsibility to review and potentially dispute any incorrect information on your credit report. However, typically need to be purchased separately, although you can sometimes view yours for free through a promotion from one of your .

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

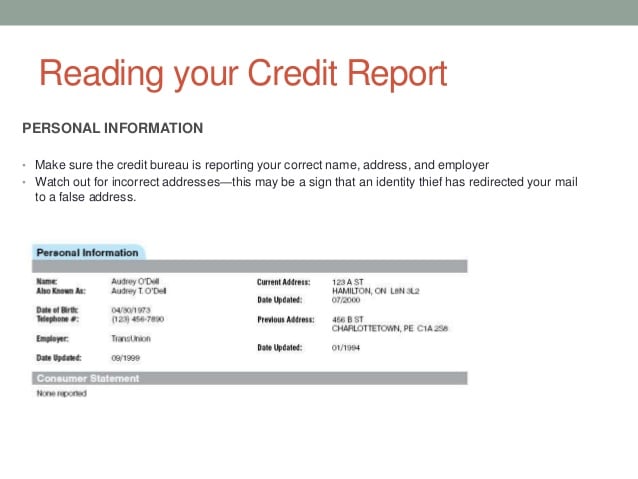

Employment Information And Past History

This section of the credit report will contain your employment history and information. This may include the company name, occupation, income, hire date, and release date if available.

This information along with personal information gets reported on your credit report by an individual inputting the information when you apply for credit.

Why Arent My Credit Scores On My Credit Reports

Thanks to the Fair Credit Reporting Act , were entitled to one free copy of each of our credit reports every 12 months from the three national credit reporting agencies: Equifax, Experian and TransUnion.

But credit scores arent a part of credit reports theyre calculated separately, based on the information in those reports.

Since credit scores arent a component of credit reports, they arent required by law to be given for free . There are also hundreds of different credit scoring models so which should be the free score that everyone can see?

As part of the credit report ordering process, each of the three credit bureaus will offer you the option to add a credit score when requesting your free annual credit reports for a fee.

The right to access your credit reports for free wasnt granted until 2003, with the Fair and Accurate Credit Transactions Act FACTA for short which officially amended the FCRA to give us the rights we know today. Still, the New York Times reported in 2018 that only 36% of consumers were checking their credit reports. But that was better than in 2014, which saw only 29%.

Before you cry foul at the unfairness of it all, things are getting better for the consumer. Thanks to amendments to the FCRA from the Dodd-Frank Act, consumers are entitled to see certain credit scores for free, but only when theyve been denied credit or received less attractive loan terms as a result of those scores. This is known as an adverse action notice.

You May Like: Is Klarna A Hard Pull

What Is The Most Accurate Credit Score App

Most credit scoring apps don’t create or determine the score they show you, so they might not be more or less “accurate” than others.

Apps that show you a FICO® Score or VantageScore based on one of your credit reports may purchase or be given your report and score and then share them with you. These are the same scores that many creditors usealthough your score may change between the time you check it and a it.

As you’re comparing programs, consider that:

- Free credit scoring apps may only include one type of credit score. And they may only offer scores based on one or two of your credit reports.

- Paid apps may give you access to more types of credit scores, and credit scores based on two or three of your credit reports.

- Apps may update your score in different intervals, such as daily, monthly, weekly or quarterly.

Be aware that apps that create their own educational scores rather than offering a FICO® Score or VantageScore might not align with the scores that a creditor will use when considering your application.

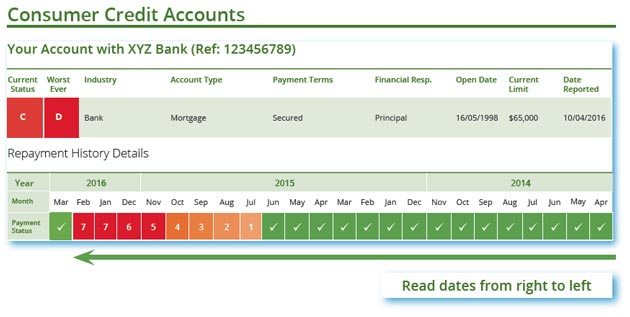

On Your Equifax Credit Report

Your payment history breakdown is fairly straightforward in Equifax credit files. Therefore, the meaning of the numbers, letters and symbols used in Equifax credit reports are generally pretty easy to understand.

Overall, you want to see a lot of asterisk signs that look like this: *.

Thats because an asterisk symbol on an Equifax credit report means pays or paid as agreed.

The vast majority of other notations indicate negative marks on your Equifax credit file, although there are a few exceptions to this.

For example: if a creditor simply didnt report information about you for some reason in a given month or year, that account history will be classified as Not Reported and you will see a code that says NR.

This NR code is neutral its not positive or negative for your credit file.

But pretty much everything else shows that you have credit blemishes.

Also Check: Does Paypal Credit Report To Credit Bureaus

Challenging Your Information With Experian

Experian now holds two databases of consumer information this information is used by financial services providers when performing a credit assessment and in some instances a score enquiry on consumers. We receive consumer data from financial services providers when consumers make an application or update their details with the service provider. We also receive payment information that reflects consumer payment behaviour, such as if theyve made payments on time, have skipped payments or closed an account.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Read Also: Carmax Finance Companies

Getting Your Free Credit Report And Score

Getting your free credit report and score

Since the acquisition of Compuscan in 2019, Experian provides free credit reports and free credit scores on My Credit Check and My Credit Expert, which are our easy-to-use, online portals that allows all South African citizens with valid South African ID numbers to access their credit information via their personal extensive credit reports.

Whether you are a first-time credit report user or not, My Credit Check and My Credit Expert will help you understand your credit data, show you how to monitor accounts, manage debt, and improve your credit profile.

You can access your personal credit reports through either the My Credit Check or My Credit Expert portals.

- My Credit Check

- The My Credit Check portal, available at www.mycreditcheck.co.za, references data from the Experian Sigma database, which is the historical Compuscan bureau database.

- Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Note: Your credit score based on the Experian Sigma Database may be different to the one based on the Experian Database because the formulas and variables used to create the scores differ. Currently, these two databases and the scoring models are kept separate.

Are There Any Legitimate Ways To Repair Your Credit And Credit Scores

It depends. According to the Fair Credit Reporting Act you have the right to ask that the information on your credit reports be verified as accurate and not outdated. The credit bureaus have 30 days to complete the verification process or they must remove or change the information to coincide with your dispute. Credit repair companies may assist you in writing and that is something that you can do on your own, for free. It is sort of like cleaning your gutters or changing your oil. You can do it yourself for a fraction of the costthe question is, do you really want to?

From this point forward is where it gets a little fuzzy. Disputing data that you know to be accurate isnt considered a legitimate dispute. And, the credit bureaus are likely to validate it as accurate and leave it on your reports. There are no surefire methods for repairing accurate credit data that you simply dont want on your credit reports.

Beware the company or individual who guarantees that they can remove delinquencies or create a new credit report in your name. These are not legitimate practices and are illegal in most states.

Also Check: How Long Does A Voluntary Repossession Stay On Your Credit Report