Mortgages Without A Credit History

Mortgage lenders accept borrowers without any credit history in certain circumstances. Some major banks, such as TD and CIBC, offer specialmortgage programs for new immigrantsthat have a limited or no Canadian credit history, or for foreign workers on a work permit. Private mortgage lenders may also accept borrowers without any credit history.

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Hack: Choose Fha If You Have A Low Credit Score And Less Than 20% Down

Many people assume that a conventional mortgage is always better than one backed by the government. But in fact, an FHA loan, which is backed by the Federal Housing Administration , may give you a lower monthly payment if you have a low credit score and low down payment.

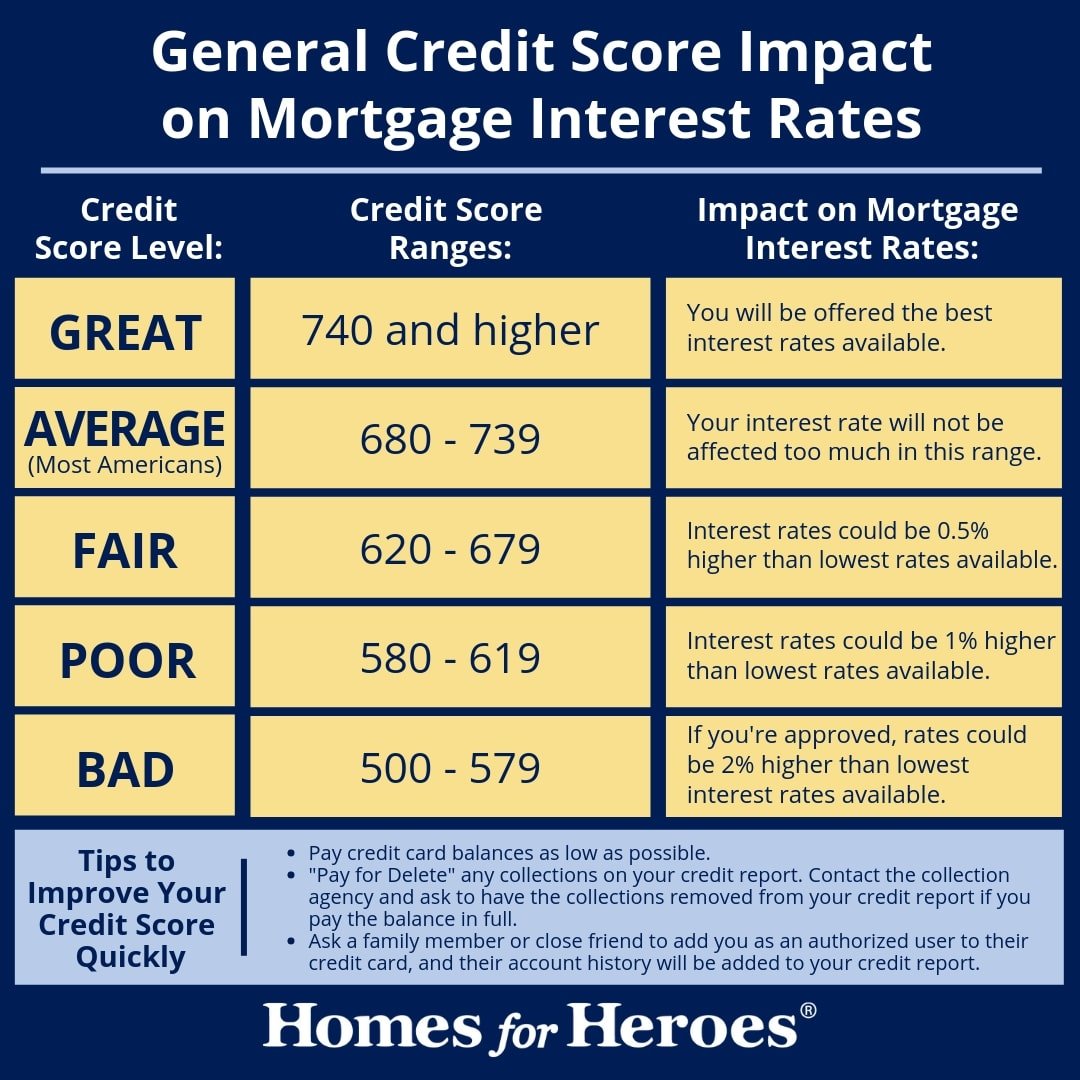

Due to loan-level price adjustments, your interest rate on a conventional loan can be substantially higher if you have a score below about 680.

Loan-level price adjustments are essentially price increases Fannie Mae allows lenders to make when a borrower has a lower credit score. A low credit score indicates increased risk to the lender, and the rate increase compensates them for taking on that risk.

But the FHA loan program was designed to make homeownership accessible to people with lower scores. The minimum credit score requirement for an FHA loan with 3.5% down is 580. Because these loans are government-insured, the risk for lenders is reduced, enabling them to approve lower-credit borrowers potentially at lower interest rates.

What does that mean for you?

If you have a 640 score, the interest rate on an FHA mortgage could be about 0.50% lower than a conventional mortgage rate.

On a $250,000 mortgage with 10% down, your payment might be roughly $1,102 monthly based on the average current conventional rates.

It would drop to $1,037 if the rate is 0.50% lower or $65 less per month.

Read Also: Paypal Credit Report To Credit Bureaus

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

What Other Factors Do Lenders Review

Your credit score is an important part of your loan application, but it isn’t the only factor that lenders consider. They also review:

- Income and debts: Most conventional lenders require a DTI of 43% or less. To determine your DTI, lenders divide your mortgage payment and recurring monthly debts by your monthly pretax income.

- Down payment: The larger your down payment, the better chance a lender will consider your application. While there are low down payment options at least a 20% down payment will also help you avoid paying private mortgage insurance. You can calculate this percentage by dividing your down payment by the lesser of the appraised value or purchase price.

- Assets: In some cases, lenders require you to have assets in reserve after closing on your loan so you can continue making your monthly mortgage payments. Most bank accounts, stocks and bonds count as assets.

- Work history: Most lenders prefer borrowers with steady employment. They may require you to have been on your current job or in your current job field for at least two years.

Read Also: Why Is There Aargon Agency On My Credit Report

Final Thoughts On The Minimum Credit Score For A Mortgage

When applying for a mortgage, having a good credit score is important. Ideally, you want to make sure your credit score is over 680. If it isn’t, it doesn’t mean that you won’t qualify, but you might not be able to access the top lenders and the lowest mortgage rates. Here’s the good news: if your credit score isn’t where you want it to be, there are things you can do to improve your score.

This article was written by Tom Drake from MapleMoney and was legally licensed through the Industry Dive publisher network. Please direct all licensing questions to

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the mutual fundâs or ETFâs prospectus, which contains detailed investment information, before investing. Mutual funds and ETFs are not guaranteed. Their values change frequently, and investors may experience a gain or a loss. Past performance may not be repeated.

This information is for general knowledge only and should not be interpreted as tax advice or recommendations. Every individualâs situation is unique and should be reviewed by his or her own personal legal and tax consultants.

Read our privacy policy. By using or logging in to this website, you consent to the use of cookies as described in our privacy policy.

582059-v202175

Fha Lenders Dont Always Follow Fha Credit Score Minimums

Banks and mortgage companies that offer FHA loans are not required to follow FHA guidelines to the letter.

These are private, for-profit companies that simply approve loans based on guidelines provided by a government agency, namely the Federal Housing Administration, or FHA.

Most if not all lenders across the country impose tougher guidelines for FHA loans than does FHA itself. It doesnt seem to make a lot of sense until you realize that FHA penalizes lenders for approving too many bad FHA loans.

Yes, FHA actually penalizes lenders if they approve borrowers who default months and years later, even if the loan fits perfectly within FHAs published guidelines.

Heres an example.

A borrower applies for a loan and is approved based on FHAs guidelines. Six months later he loses his job and can no longer make his monthly payments. FHA records that bad loan on the lenders record.

Too many bad loans and FHA could revoke the lenders ability to offer FHA loans. That could put some mortgage companies out of business.

Statistically, borrowers with lower credit scores default more often. Thats why most lenders require a higher minimum credit score than does FHA.

Here are credit score minimums as stated by FHA:

Most lenders require a score of at least 620-640. But that number could drop closer to FHAs published minimums because of the new policy.

You May Like: What Is Syncb Ntwk On Credit Report

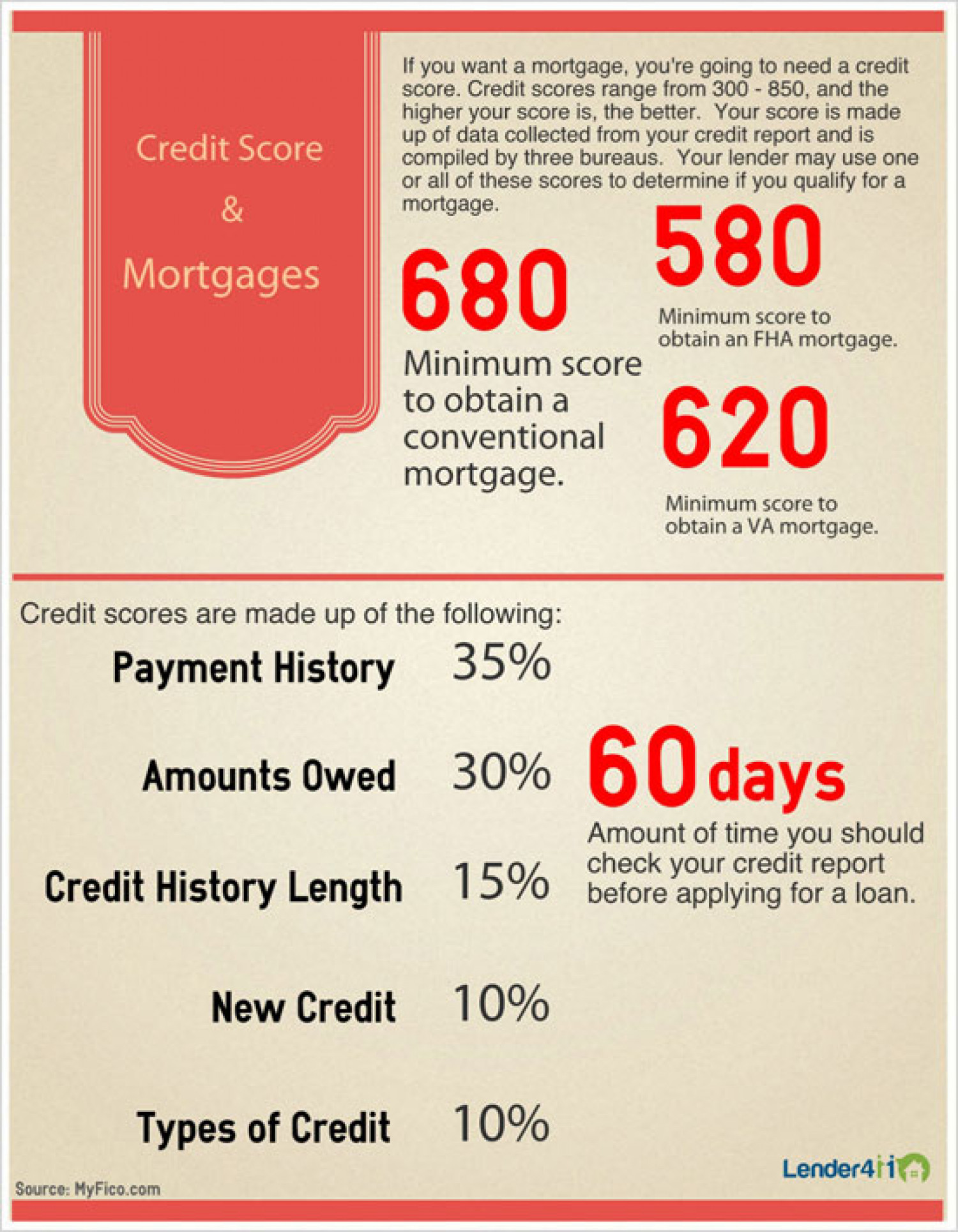

How Is Credit Score Calculated

Your credit score is calculated by Equifax based on the information filed in your credit report at a specific point in time. There are several important contributing factors that are considered in calculating your credit score. This includes the type of credit provider, the type and size of credit requested in your application, the number of credit enquiries and shopping patterns, directorship and proprietorship information, age of credit report, pattern of credit enquiries over time, personal details, court writs and default judgements, and more. To learn more about how Equifax calculates your credit score, you can visit the companys official website.

Tips On How To Get A Good Credit Score

Dont lose hope if you do have an application rejected by your bank, as South Africas leading home loan comparison service, ooba Home Loans, can apply to multiple banks on your behalf, and have been successful in securing home loan financing for two in every three applications that are initially turned down by their bank.

ooba Home Loans also offer a range of home loan calculators to help make the home-buying process easier. Start with their Bond Calculator, then use their Bond Indicator to find out what you can realistically afford. Then, when youre ready, you can apply for a home loan with ooba Home Loans.

Do you know your credit score?

Check your credit score for free in minutes.

Don’t Miss: Can Lexington Law Remove Repossessions

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

What Is A Good Credit Score For Getting A Home Loan

To qualify, youll need at least the minimum credit score to buy a house, which ranges from about 500 680, depending on the mortgage program. But a higher credit score can boost your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

During the application process, lenders commonly check the borrowers FICO® credit score, which grades consumers on a scale of 300 850, with 850 being the highest score possible. The best credit score to buy a house is 760 or higher. According to FICO® data, borrowers with a credit score in this range tend to get the best interest rates on a home loan.

Read Also: Synchrony Ntwk Credit Card

What Is A Credit Score

FICO credit scores are a way for lenders to decide whether youre a good risk. The numerical value is assigned based on a number of factors, including how often you pay your bills on time, how many credit cards you have, how much debt you have, how much of your credit line youre using, whether youve ever filed for bankruptcy, whether youve defaulted on a loan and other payment-related issues.

An Excellent Very Good Or Good Credit Score Means Your Score Shouldn’t Impact Your Chances Of Getting A Loan Once You Get Below That You Need To Make Some Financial Changes

Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it!

How does your credit score affect your chances of getting a home loan? Lenders in Australia dont make their credit criteria public, and most lenders also dont rely credit score alone to determine your level of credit risk. That said, the higher your credit score, the better your chances of getting loan approval.

You May Like: Unlock My Experian Credit Report

How Can I Boost My Credit Score For A Mortgage

If your credit score is limiting your mortgage options, you have several ways to improve it:

Benefits Of An Fha Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify.

- Competitive Interest Rates You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Lower Fees In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

- Bankruptcy / Foreclosure Just because you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

Recommended Reading: How Personal Responsibility Can Affect Your Credit Report

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

What Low Credit Score Mortgages Are Available

If youre fed up with renting and want to apply for a home loan with bad credit, government-backed mortgage loan programs may help. Furthermore, if you dont have a credit score, theres still a way to get home loan financing.

- FHA loans: For traditional mortgages, the lowest credit score to buy a house is 500. Besides coming up with 10% for a down payment, youll likely need a solid income history, extra reserves and a lower DTI ratio. The FHA program is more commonly offered as a 580 credit score home loan for borrowers with at least a 3.5% down payment.

- VA loans: Although VA home loans dont have a particular minimum, your credit history is still important. If you have a poor credit payment history, other compensating factors such as extra reserves in the bank or a lower DTI ratio may be required.

- Nontraditional credit loans: Recent college graduates might not have enough credit history for a regular credit score. However, they still may be able to get a mortgage with no credit score by proving on-time payments for bills such as rent and utilities.

- Alternative mortgage loans: Recent foreclosures or bankruptcies may knock your credit score down, and in most cases, applicants must wait two to seven years before applying for a new mortgage unless they apply for an alternative mortgage loan. With a large down payment, alternative lenders may offer home loans to borrowers one day after a major credit event with scores as low as 350.

Recommended Reading: Paypal Credit Report To Credit Bureau

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.