Reporting Rent Payments To Credit Bureaus: Its The Right Thing To Do

Tenants can build credit based on almost all their financial activity. So, why shouldnt they be able to build credit off one of the highest bills they pay each month?

Tenants deserve to have their credit scores increased for on-time rent payments. This is a huge part of their spending habits, so it should be included.

Pros Of Paypal Credit

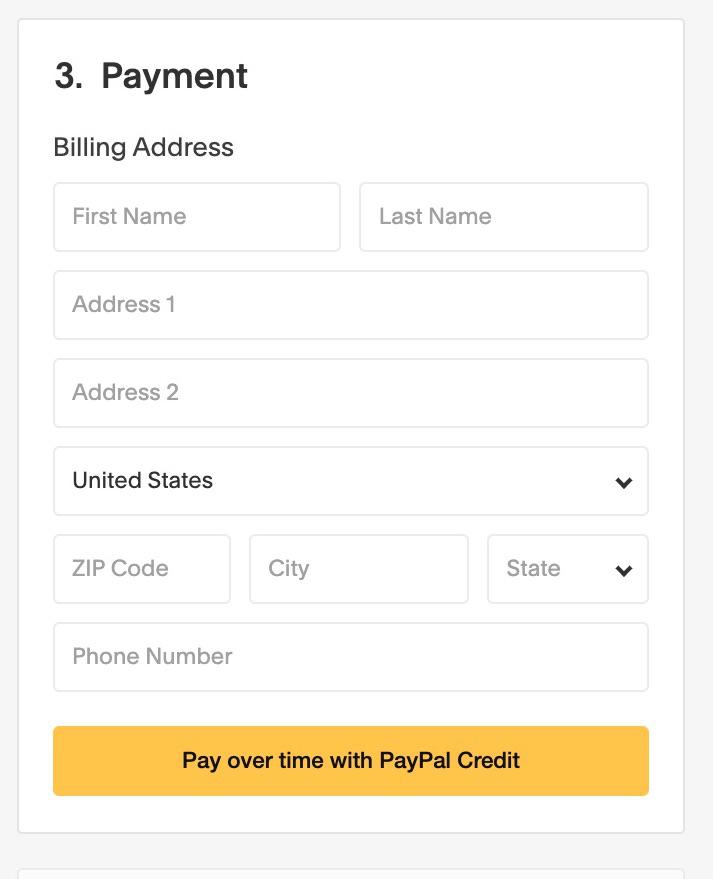

- Fast & Convenient:;You can use PayPal Credit to make a purchase as soon as youre approved . In comparison, you might have to wait a week or longer for a credit card youve applied for to come in the mail.

- Use Anywhere PayPal Is Accepted:;This includes thousands of websites and a growing number of brick-and-mortar stores as well.

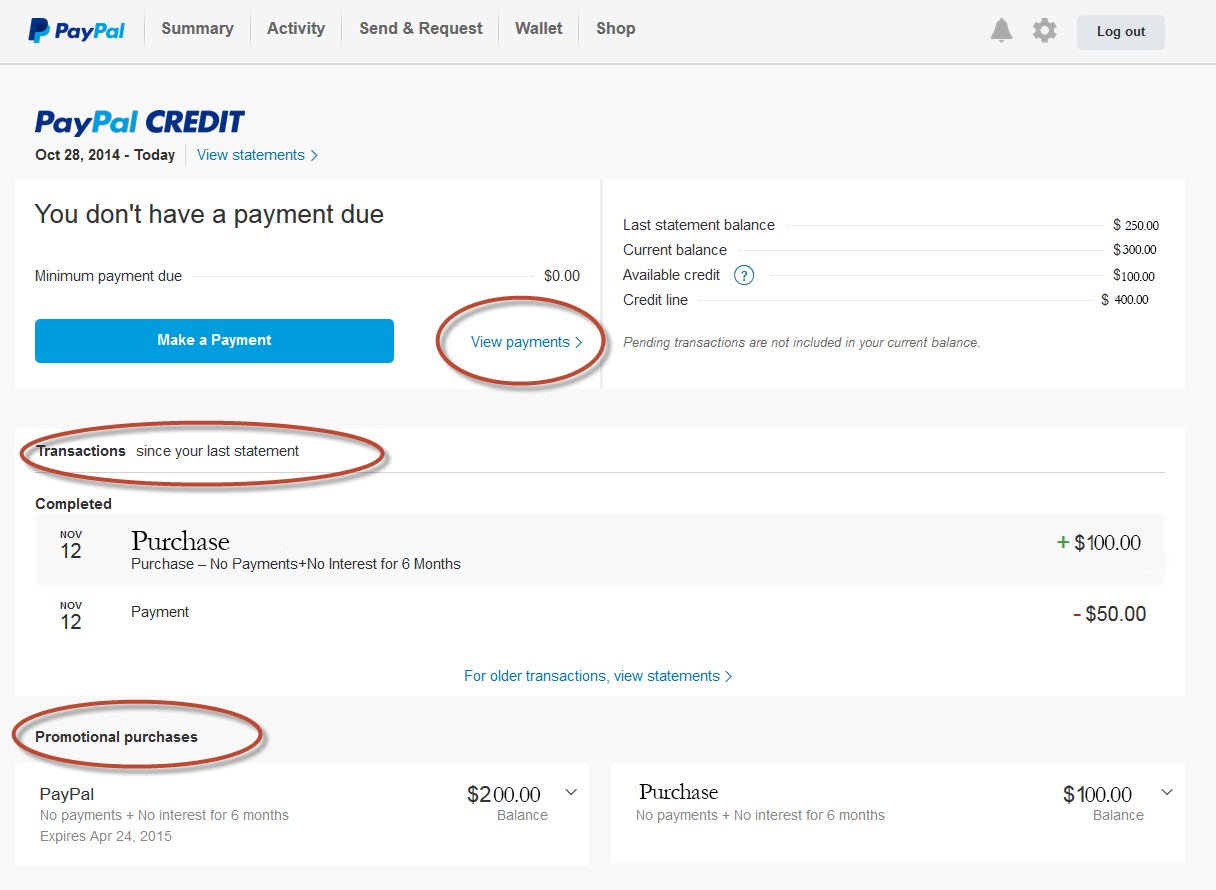

- Will Help You Build Credit: Prior to October 2019, PayPal Credit was considered a hidden tradeline because it didnt report your activity to the credit bureaus. PayPal then reversed this policy, and PayPal Credit now reports your payment activity to the big three credit bureaus .

- PayPal Purchase Protection:;If your online purchase doesnt match the description or doesnt arrive, PayPal will refund the full purchase price plus original shipping costs.

Does Paypal Pay In 4 Report To Credit Bureaus

Not find and info on this then. When you signed up, you are given/shown terms of the loan. Read that to see if its mentioned in there or monitor your credit report to see if it shows up there.

What are the terms and conditions for my Pay in 4 plan?You must read the loan agreement of your Pay in 4 plan before you submit your application. You will see the link to the loan agreement when you choose to apply for Pay in 4 at checkout. You will also have the option to download the loan agreement.;Once your plan starts, we will send you an email containing important information about your Pay in 4 plan, including how to locate your loan agreement.

Kudos & Solved are greatly appreciated.

Recommended Reading: When Does Paypal Credit Report To Credit Bureau

Does Paypal Credit Affect Credit Score

The first time I ever found out about credit scores, I was dumbfounded: my ability to take out a credit mostly relies on⦠this number?

I quickly started consuming as much content as I could on credit scores and researching tactics to get it as high as possible. I signed up for my first credit card, joined the electoral roll and fixed all the errors on my report.

Why am I saying all this? The point is, I put in quite a bit of work to make sure a low credit score wouldnât be the reason I would get a bad rate on my future mortgage or business loan. Itâs possible that you have too, and thatâs why youâre now doing your research to make sure PayPal Credit doesnât undo the hard work youâve put in maintaining your credit score.

Although PayPal Credit may seem like a good alternative to other credit methods, itâs still important to be aware of how it could impact your ability to take out credit in the future. Because yes, PayPal Credit will affect your credit score. Letâs dive into this a bit deeper⦠ð

Knowing When Your Loan Is Reported

“Buy now, pay later” loans may or may not be reported to the credit bureaus, depending on the service you use. Its important that you read through the fine print to understand how the loan may affect your credit. If you use a service that does report to the credit bureaus, your payments will affect your credit score. Generally speaking, on-time payments will help your credit score, while late payments may cause your credit score to drop.

Having a newly opened account can also cause a drop in your credit score, because it lowers your average credit age. Over time, your credit score can rebound as the account gets older, as long as you handle your other credit obligations responsibly.

Check your credit report to verify that the payment plan is reported accurately. You can order a free credit report each year through AnnualCreditReport.com. You can also use a free service such as Credit Karma or Credit Sesame to watch how your installment plan is being reported. You can dispute errors with the credit bureaus or directly with the financing company by sending a letter.

Otherwise, if the loan isnt reported to the credit bureaus, your monthly payments will have no bearinggood or badon your credit score. Defaulting on the loan, however, can hurt your credit score if the lender ultimately sends the account to a third-party debt collector for payment.

Recommended Reading: Do Lending Club Loans Go On Your Credit Report

What Are The Advantages Of Paypal Working Capital

If you use PayPal to process payments, PayPal Working Capital is usually straightforward to qualify for. Theoretically, borrowers dont even have to be in business for over three months. Typical business loan requirements, like credit score and profitability, literally have zero impact on your application.

The maximum term limit for PayPal Working Capital is just 18 months. Thus, PayPal Working Capital is considered short-term financing. Compared to the interest rates of traditional short-term business loans, PayPal Working Capitals fixed fee is pretty low.

Traditional short-term business loans might also have longer applications and take more time to distribute funding. With PayPal Working Capital, you can complete the application and receive funding in a matter of minutes. And unlike a business term loan, you dont have to remember to make manual payments. PayPal deducts the payments each day, with no manual effort on your part whatsoever.

Paypal Credit Pros & Cons

Its helpful to think of PayPal Credit as a great starter credit card or something convenient for PayPal users who like the interface and would like to use credit wherever PayPal is accepted. Those are some of the reasons it might work for you. But its low limits and high APR are not for everyone. Here is our list of pros and cons:

Also Check: Which Credit Score Does Carmax Use

How Do Credit Card Companies Report Authorized Users

Most travel credit card companies report to the Equifax, Experian, and TransUnion credit bureaus that you are an authorized user. However, some only report to two of the bureaus.

The national credit card issuers that report authorized users to at least one bureau include:

- American Express

- US Bank

- Wells Fargo*

Note: Reader feedback form April 2021 indicates that Wells Fargo may no longer report authorized users.

Regional banks and credits unions may be less likely to report authorized user tradelines on the credit report. Store charge cards reporting can also vary as it depends on the bank. If you are looking at a card from a mid-size or small bank, you should contact that bank before applying.

Select Your Funding Amount & Terms

Next, youll be asked to select your borrowing amount and repayment percentage . The size of your repayment percentage determines the size of your fixed fee.

After inputting your selections, PayPal will provide an estimation of how much time it will take to repay the full amount. You will then review the terms of the loan along with your fixed fee.

Read Also: Zebit Report To Credit Bureau

Does Paypal Credit Report To The Credit Bureaus

Before 2019, PayPal credit did not report information to the three credit bureaus. It was like a . However, this policy has since changed.

As they explicitly say in their terms of service, we may report information about your account to credit bureaus.

Late payments, missed payments, or other defaults on your account may be shown in your credit report.

So, if you make a late payment, miss a payment, or default on a payment, PayPal credit will report it to all three credit bureaus.

After PayPal provides the three credit bureaus with this report, it will appear on your next credit report damaging your credit.

Related:Best Credit Monitoring Services

Is Paypal Credit Protected Against Loss Fraud And Theft

If someone uses the account without your permission, you wont be liable for the charges, according to the companys site, as long as you report the theft within 60 days.

Were not going to hold customers responsible for any kind of account takeover, says Schmidt.

PayPal Credit will hold you accountable, though, for changes made by someone you once allowed to use the account.

You May Like: Does Klarna Report To Credit Bureaus

How This Statement Changes Over Time

Well make changes to this privacy statement from time to time. This helps us stay up to date with changes to our business and the most current laws. After a new version is published, well collect, store, use, and protect your personal data as we outline in that revised statement.

If the new version reduces your rights or increases your responsibilities, well post it on the Policy Updates or Privacy Statement page of our website at least 21 days before it becomes effective.

We may notify you about these changes through email or other communications.

How Can Credit Builder Help You Build Credit

Your credit score is an integral part of your financial life, yet the mechanics behind it can feel mysterious at best. And considering how much it can determine real-life things like approval for loans, lines of credit, apartment rentals, and more it matters!;

If youre currently using the Chime Visa® Credit Card¹ or considering signing up for our new secured card, its important to understand how it can help build your credit. To start, lets jump into the basics: how it works, what we report on, and what to expect!;

You May Like: Credit Report Without Social Security Number

Bnpl Plans Can Help You Build A Good Credit Historyor Get You Into Trouble

Buy now, pay later plans allow shoppers to pay for purchases in four or more installments, often interest-free. Dubbed BNPL for short, these point-of-sale installment loans are rising in popularity as people spend more time shopping online.

Overall, 60% of consumers say they’ve used a BNPL service at least once, and 51% did so during the past year. Though BNPL plans offer some attractive features, it’s important to understand what they can mean for your . We highlight some of the basics of buy now, pay later plans as well as some of the most common ones.

Advantages Of Using Paypal Credit

1. Convenient & Quick To Use

The greatest thing about PayPal Credit is that it is extremely easy to apply for, allowing you to purchase goods or services as soon as youre approved. Getting approved for it usually takes just a few seconds. Whereas, applying for a credit card and waiting to receive it in the mail to make your online purchase could take more than a week. So, if youre looking for a quick and convenient way to make a purchase, PayPal credit is a great option.

2. Can Be Used Anywhere PayPal is Accepted

The second great thing about PayPal Credit is that it can be used anywhere that accepts PayPal payments, and if youve ever purchased products or services online, you probably know that a lot of websites and online merchants accept PayPal as a form of payment.

3. PayPal Credit Can Be Used as a Tool to Build Credit

Since your payments for PayPal Credit are reported to the credit reporting bureaus, you can use this opportunity to improve your credit by making your payments on time. Making timely payments can provide a nice boost to your credit score since your payment history makes up 35% of your credit score. The more on-time payments you have, the better your credit score will be.

You May Like: Does Speedy Cash Report To Credit Bureaus

Retailer Financing Vs Point

Some retailers offer their own “buy now, pay later” options directly from their websites or in stores. There are a few companies offering online payment plans that you can use with a variety of websites. At checkout, you can choose the option to apply for this third-party financing. These payment plans are known as “point-of-sale installment loans.” The payment plan is broken down into a fixed monthly payment over a period of time, based on the total amount of your purchase.

Other Rights Related To Ccr Data

Direct marketing Personal information in your credit report cannot be used by a credit reporting body or a credit provider for direct marketing. But credit providers can ask credit reporting bodies to use your credit information to pre-screen you for direct marketing purposes. You can tell a credit reporting body not to do this.;

Preventing identity fraud If you think you have been a victim of fraud or have transactions you dont recognise you should contact CommBank. You can also inform the credit reporting body that you are a victim of fraud and not to use or give anyone your credit information.

You can also read our Privacy Policy;or visit;;for consumer education on CCR.

Don’t Miss: How To Unlock My Experian Account

What Do You Need To Apply For Paypal Business Loans

If you use PayPal to process payments, you do not need to submit any financial records because they will already be in the system. On the other hand, if you do not process payments with PayPal, you must provide four months of business bank statements. Depending on your businesss financial health, you may need to provide further financial information.

Additionally, you will need to enter similar information as PayPal Working Capital.

Should I Close My Syncb Account

Once again, closed accounts affect your utilization rate, which impacts your overall credit score. For the most part, if you don’t owe any debt, closing your recent SYNCB account will only negatively affect your credit score temporarily.

If you don’t ever plan to use this credit line and don’t want to have it out there, it’s probably a good idea to go ahead and close it. Of course, keeping it open won’t hurt your credit. However, if you don’t use it, then SYNCB will close the account for inactivity eventually.

You May Like: Is 524 A Bad Credit Score

How Do Landlords Benefit By Reporting Rent Payments To Credit Bureaus

While it might seem that this law only benefits tenants, it can significantly help landlords as well. Whether you are in California or not, landlords have the option of reporting rent payments to credit bureaus. And there might be a lot of benefits to doing so.

For landlords, here are some of the benefits that go along with reporting rent payments to credit bureaus:

The Late Payment Occurred More Than Seven Years Ago

If a late payment is correctly reported, it should fall off your credit reports after seven years.

Lets say youve missed a payment by 30 days, then 60 days and then 90 days. Even though this one late account can lead to multiple negative marks on your credit reports, the original delinquency is the one that starts the clock. That means the entire sequence should disappear seven years from the first date the payment was late.

If you see a late payment thats more than seven years old, it could be a mistake, and you may want to dispute it.

Read Also: Is 586 A Good Credit Score

You May Like: Does Barclaycard Report To Credit Bureaus

How Does This Impact My Credit Score

The SYNCB/PPC, SYNCB credit card, and any other SYNCB partnership counts as a line of credit in the eyes of the credit bureaus. That means any hard inquiries, credit misuse, and other activity will affect both your utilization and credit score.

In general, each new hard inquiry will lower your credit score up to five points. Of course, if you have multiple hard inquiries pulled, that number becomes compounded, lowering your score by the tens and maybe even twenties. Multiple hard inquiries also look bad to credit issuers, which will make it challenging to obtain a new credit card in the near future at a competitive interest rate.

Having closed accounts, on the other hand, affects your credit utilization rate. Closed accounts show that you have less credit. So, if you still owe any debts, having less credit causes your utilization rates to increase. This also has a negative impact on your credit score since it shows that you’re nearly reaching your credit limits with your current lenders.

Your closed accounts will still contribute to your length of credit history. However, it can take up to 10 years for closed accounts to be cleared from your credit report, granted they remain in good standingâi.e., you continue to pay off your debts on time and avoid late payments.

Remove An Authorized User

If you want to apply for your own credit card or no longer belong to a card with a negative history, you can stop being an authorized user. Most banks let authorized users remove themselves from the account. The primary cardholder can also remove you their account.

Making this move can possibly give your score an immediate boost once the tradeline is no longer on your credit report.

You May Like: Zzounds Credit Approval

What Kind Of Security Features Does Paypal Credit Offer

PayPal sends users an email each time the credit line is used, containing the purchase total and merchant, just as it does with other methods of payment.

You want to pay attention to those emails, says Eva Velasquez, president and CEO of Identity Theft Resource Center. If you receive one for a purchase you didnt make, notify the company immediately no matter how small the transaction, she urges.

Criminals might make small fraudulent purchases to see if an account is active. But those little charges can also serve as an early warning system for consumers as long as youre seeing the notifications, Velasquez notes.