Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

How Long It Will Take To Raise Your Credit Score

Everyones credit history and credit rating are different, so its difficult to say for sure how long it will take to raise your credit score by 200 points.

However, if you follow the right strategies, youll see noticeable improvement somewhere between a few months to a year. We werent satisfied with that estimate, though, so we decided to narrow it down.

We studied over 50,000 Credit Strong® clients who got a Credit Strong and tracked their results. Heres what we found:

- 25 points was the average increase across customers in their FICO Score 8 within three months.

- 70 points was the average FICO Score 8 increase for account holders who made all their payments on time for 12 months.

Your results will depend on your starting point and how well you execute your credit improvement planHowever, if you make all your payments on time and maintain healthy habits, its only a matter of time before you reach a good credit score.

Now, lets go over some steps you can take to increase your credit score.

Improving Credit In A Nutshell

Improving your credit scores can lead to great things. In fact, you can start right nowâlearn more about monitoring your credit, and then get to work trying to raise your credit scores.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Capital One does not provide, endorse or guarantee any third-party product, service, information, or recommendation listed above. The third parties listed are solely responsible for their products and services, and all trademarks listed are the property of their respective owners.

Your CreditWise score is calculated using the TransUnion® VantageScore® 3.0 model, which is one of many credit scoring models. It may not be the same model your lender uses, but it can be one accurate measure of your credit health. The availability of the CreditWise tool depends on our ability to obtain your credit history from TransUnion. Some monitoring and alerts may not be available to you if the information you enter at enrollment does not match the information in your credit file at one or more consumer reporting agencies.

Related Content

Don’t Miss: How To Raise Credit Score 100 Points

Rapid Rescoring For Fast Credit Score Updates

Theres one more service that can give you earlier access to credit score changes, but only in a narrow set of circumstances. If you’re applying for a mortgage loan, the lender may offer rapid rescoring, a service that will update your credit score within 48 to 72 hours.

Rapid rescoring doesnt work for every situation. You need to have proof that theres inaccurate information on your credit report, like a payment inaccurately reported as late.

Rapid rescoring is only available with certain mortgage lenders when you’re trying to qualify for a mortgage or get better terms its not a service available directly to consumers or with other types of businesses.

FICO’s new credit score systemthe UltraFICOmay help some borrowers boost their credit score right away by allowing access to bank information. Lenders who use UltraFICO may offer the score to you if you have an application turned down. UltraFICO can improve your credit score if you have a history of managing your bank account well.

The UltraFICO score was initially rolled out to a small group of lenders at the beginning of 2019 in a test pilot. Once the pilot phase is complete, and all is working in good order, the UltraFICO score will become available nationwide.

Identify Inaccurate Items On Your Reports

One of the best ways to raise your credit score is to identify and dispute any inaccuracies on your credit reports. If there are any errors, outdated information, or incorrect account balances, get in touch with the credit bureau and have them corrected. This can take some time and effort, but its worth it in the long run.

According to CNBC 1/3 of Americans have errors on their credit report, so youre certainly not alone. And the most common error? Outdated information.

Thats why checking your credit report often is key to a good credit score.

You can get a free copy of your report from each of the major credit bureaus Experian, Equifax, and TransUnion once per year at AnnualCreditReport.com.

I recently requested my credit report and it took less than 10 minutes to receive it. You will need to provide some basic information such as your name, address, Social Security number, and date of birth.

Its a simple 3 step process and well worth your time. Once you receive your credit report, comb through it carefully and look for any inaccuracies. If you find anything that looks incorrect, raise a dispute with the credit bureau.

Also Check: What Do You Need To Get A Credit Report

Raising Your Score Depends On Your Starting Point

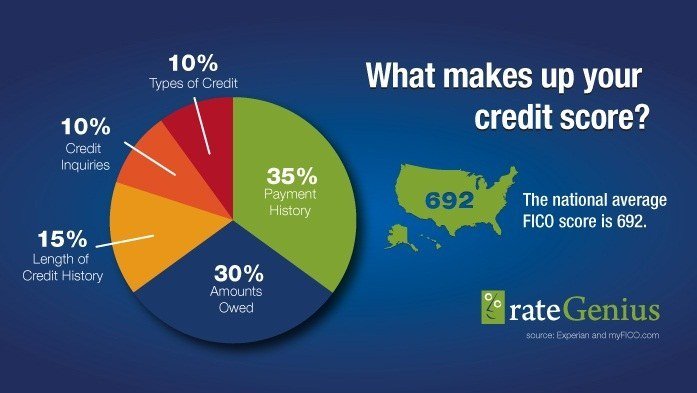

Your credit score isnt just a judgment call, its determined through a formula considering five different factors. Listed in order of importance, each of the following factors can raise or lower your :

- Payment history

- Length of credit history

- New credit

With a history of consistent payments being the most influential factor, a great opportunity is offered to those new to credit cards. Every month you pay your cards bill on time will bump your credit score up, so set a routine and you can grow your creditworthiness quicklyas long as you can avoid missing a credit card payment.

Your is how much of your total credit limit you use across all lines of credit. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing. Opening up new card accounts or getting a credit limit increase can help build credit by decreasing this ratio, but that isnt all it takes. By making the effort to pay off your outstanding balances youll help your credit utilization, thus improving your credit score.

The length of credit history is fancy-talk for the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit. There are cases where canceling a credit card account is the right move, but as a general rule youll benefit from keeping old ones open.

Dont Waste Your Money

Many debt relief companies make big promises. But you should be wary. The CFPB issued a consumer advisory warning people about paid . The fees these companies charge are often high, and you can accomplish the same results on your own. If someone promises a quick fix, go somewhere else because theres no such thing as a quick fix, advises Griffin.

Despite what some companies might claim, accurate negative information cant be removed from your credit reports, says Griffin. So you could end up paying your hard-earned money for nothing. Instead, focus on keeping up with your payments, keeping your credit card balances low, and avoiding new credit lines to improve your credit.

Also Check: How To Remove Old Closed Accounts From Credit Report

Read Also: Is 723 A Good Credit Score

Can You Raise Your Credit Scores In 30 Days

Building your credit typically takes time, but there are a few things you can do right now that may help you raise your credit scores in 30 days. Here are some suggestions that may give your credit scores a quick boost:

Make All Your Debt Payments In Full

Your payment history usually accounts for around 35% of your credit scores. As such, paying your debts and bills on time and in full is important in improving your credit scores. Any secured credit cards or lines of credit should be paid off in full whenever possible. The more you build a positive payment history, the more likely it may give your credit scores a boost.

Dont Use More Than 30% Of Your Credit Card Limit

Just because your credit card company allows you to spend a certain amount of money on your credit card doesnt mean you should max out your credit card every month. To help increase your credit scores quickly, its recommended to keep your debt-to-credit ratio around 30% and lower. This refers to the amount of credit youve used versus your total available credit limit. Doing so may increase your credit scores by 200 points or more quickly.

Fix Any Mistakes On Your Credit Report

Any mistakes on your credit report could be pulling your credit scores down. Identifying these errors on your credit report and having them rectified, is perhaps the fastest way to increase your credit scores.

Increase Your Available Credit

Negotiate With Creditors

Be An Authorized User On Someone Elses Account

Additional Reading

How Long Does It Take For Credit Score To Go Up

First off, whats considered a good score versus a poor one? Here are some general parameters:

- Perfect credit score: 850

- Good credit score: 700 to 759

- Fair score: 650 to 699

- Low score: 649 and below

While the score required varies by area and type of loan, lenders will generally look for a score of 660 or higher before they will grant a mortgage. If youre hoping to boost your credit score fast, here are some actions you can take.

You May Like: Does Heloc Affect Credit Score

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

Check Your Credit Score

Most people dont know their credit score until the time comes when they need it.

Dont be one of these people!

Good credit scores are your passport to competitive interest rates for mortgages, cars, credit card offers, insurance premiums, and more. Maintaining a high credit score is worth it because it will save you from the money youd pay in higher interest rates.

Luckily, its simple to learn your credit score. I recommend the following companies:

| Company |

Read Also: How Is Your Credit Score Calculated

How Long Does It Take To See Changes In Your Credit Score

The amount of time it takes to improve a damaged credit score varies depending on your circumstances, but it will likely require a bit of patience and won’t happen right away.

Some negative factors are easier to overcome than others. For example, it may take you less time to bounce back from one late payment or a few hard inquiries than from a foreclosure or having an account go into collections.

Most negative information, like late payments, will generally remain on your credit report for up to seven years. However, Chapter 7 bankruptcies can linger for up to 10 years.

Just remember: Improving your credit score takes effort and patience. There’s no one-size-fits-all solution that will change your credit score overnight.

Consider Experian Boost Or Ultrafico

When you have no credit history, adding extra accounts can boost your score. You have two options that could help you: Experian Boost and UltraFICO:

- Experian Boost evaluates your utility, streaming and other accounts and adds on-time payments from these accounts to your Experian credit report. If a lender or card company uses another credit bureau, they wont see any of your Experian Boost accounts.

- UltraFICO is a program from FICO that adds information about your bank account balances, cash flow and bank transactions. However, not every lender uses or accepts the UltraFICO score.

Don’t Miss: How Do You Get Your Credit Score

Use A Secured Credit Card

Another way to build or rebuild your credit is with a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help build your credit.

Impact: Varies. This is likeliest to help someone new to credit with accounts or someone with dented credit wanting a way to add more positive credit history and dilute past missteps.

Time commitment: Medium. Look for a secured card that reports your credit activity to all three major credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

How fast it could work: Several months. The goal here is not just having another card, although that can help your score a bit by improving your depth of credit. Rather, your aim is to build a record of keeping balances low and paying on time.

Ask For Late Payment Forgiveness

Paying on time constitutes 35% of your FICO Score, making it the most important action you can take to maintain a good credit score. But if youve been a good and steady customer who accidentally missed a payment one month, then pick up the phone and call your issuer immediately.

Be ready to pay up when you ask the customer rep to please forgive this mistake and not to report the late payment to the credit bureaus. Note that you wont be able to do this repeatedly requesting late payment forgiveness is likely to work just once or twice.

You have 30 days before youre reported late to the credit bureaus, and some lenders even allow as long as 60 days. Once you have a late payment on your credit reports, it will stay there for seven years, so if this is a one-time thing, many issuers will give you a pass the first time youre late.

How much will this action impact your credit score?

If youre a day or two late on a credit card payment, you might get hit with a late fee and a penalty APR, but it shouldnt affect your credit score yet. However, if you miss a payment by a whole billing cycle, it could drop your credit score by as many as 90 to 110 points.

Read Also: How Long Before Credit Card Shows Up On Credit Report

Get More Credit Accounts

One common cause of a low credit score is a thin credit profile. That means you dont have enough activity in your credit report for lenders to have confidence in you.

If youre a recent college graduate who didnt take on student loan debt or credit card debt in college, youll probably have this issue. The best way to address this is to open up a new account. This can be a credit card, credit builder loan, personal loan, or mortgage.

The positive effects of acquiring multiple new accounts are two-fold:

- Adding new accounts increases the diversity of your credit mix

- Building a positive payment history with multiple credit accounts has a more significant impact than just one account

It can be hard to qualify for new credit when you have a low credit score or no credit history. To be successful,target more accessible accounts. A good way to get started can be a secured credit card or a .

A secured credit card requires an upfront cash deposit, usually equivalent to its credit limit. Theyre much easier to qualify for since the lender can keep the deposit if you fail to pay your balance.

A credit builder loan follows a similar strategy. The lender will hold onto the loan amount until the final payment goes through. Once the loan balance and interest are fully paid off, the funds are released to the borrower.

Whichever accounts that build credit you choose to open, make sure you can afford them. The last thing you want is to overextend yourself and miss a monthly payment.

How Long Does It Take Your Credit Score To Improve

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

You May Like: Does Titlemax Report To Credit Agencies

Ask For A Credit Limit Increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip. Read up on how to ask for a credit limit increase.