Error Detected Now What

Alas, your good word isnt good enough on its own. You will need the best available evidence. Been divorced five years, but your ex is still on your report? Present a copy of your divorce decree.

Payments made on time were recorded as late? Bank statements are your friend.

In short, you need documentation. Whatever is relevant applies: Loan documents, credit card statements, marriage licenses, divorce decrees, birth or death records, bank statements.

Investigators will be delighted to have help. Demonstrate that you are organized, reliable, and circumspect. Help them help you. Youve spotted an error, and you can back up your claim with the hard evidence of a paper trail .

Do Credit Bureaus Really Investigate Disputes

The credit bureaus hand off investigations to the original .

That is, when you dispute a late payment on a credit card, the credit reporting agency will forward your dispute to the credit card issuer for investigation. All this must be completed within 30 days of the disputes submission date.

The bureaus notify creditors of your dispute, and they, in turn, must provide evidence of the items legitimacy.

Perhaps there could be cases in which a credit reporting agency investigates a dispute directly. These cases may arise, for instance, if data was correctly distributed by a creditor but was corrupted in the systems of the credit agency.

Consider Suing The Credit Reporting Agency Or Creditor

If you were seriously harmedsay, the credit reporting agency continued to give out incomplete or inaccurate information after you requested correctionsconsider filing a lawsuit. Under the Fair Credit Reporting Act , you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner. Depending on the violation, you might be able to win actual damages, statutory damages, punitive damages, court costs, and attorneys’ fees.

You might also consider suing the creditor that supplied the inaccurate information. But these types of lawsuits are complicated, and the FCRA provides creditors with many ways to avoid liability. You’ll need to consult a lawyer if you want to pursue this type of lawsuit.

Also Check: How Long Do Collections Stay On Credit Report

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

Also Check: How Can You Build Your Credit Score

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

Follow Up After The Investigation

Heres what to expect when the investigation is complete:

- The results of the investigation, in writing, from the credit reporting bureau.

- A free copy of your credit report, if the report has changed.

What about parties who have seen your incorrect information? You can ask the credit bureaus to notify them of the corrections, the FTC says. This includes:

- Notifying anyone who received your report in the past six months.

- Sending a corrected copy of your report to anyone who received it in the past two years.

But what if the investigation doesnt resolve your dispute? If the furnisher continues to report the error, you can ask the credit bureaus to include a statement in your credit file that describes your side of the dispute and it will be included in future credit reports. For a fee, you can usually ask the credit bureau to send a copy of the statement to anyone who has recently received a copy of your report.

Also, if you believe you were treated unfairly or a valid error remains on your credit report, you can file a complaint with the Consumer Financial Protection Bureau. The CFPB is required to forward the complaint to the company with which you have an issue. The CFPB usually will provide you with a response within 15 days.

How long can it take for an error to be corrected on your credit report after the dispute is resolved? Credit bureaus have five business days after finishing their investigation to notify you of the results.

Read Also: How To Remove Repossession From Credit Report

How Often Do Errors Require Disputing Credit Reports

In a one-of-a-kind 2012 study, the Federal Trade Commission selected 1,001 Americans at random and asked them to review and dispute credit report information that they felt was wrong.

Heres what happened1:

- 26% of total participants identified one or more errors and disputed their credit reports

- 21% had changes to a credit report based on their dispute

- 13% saw their credit score change as a result

- 5% saw their credit score increase enough to improve their credit risk level by one tier

That last statistic is perhaps most important. As the FTC report notes, the credit report disputes by those 5% resulted in enough improvement to get them better loan terms should they seek one, including a lower interest rate.

Did you know? As an added security measure to help protect against fraud, American Express reports a reference number to credit bureaus instead of your actual account number.

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Read Also: How To Dispute Negative Items On Your Credit Report

Common Credit Reporting Errors

When reviewing your reports, some common personal information and account reporting errors include:

- Personal Information reporting errors. Check to see if your name, address, birthdate and Social Security number are correct. If your report contains inaccurate personal information, it could be a sign that your identity has been stolen.

- Accounts that dont belong to you. Its possible that someone with a similar name could have an account accidentally listed on one of your reports. This could also mean that someone has stolen your identity and opened an account in your name.

- Incorrect account status. When reviewing your reports, make sure your account balance, account numbers and credit limits are accurate. Also, double-check that closed accounts arent reported as open.

- Expired debt. Negative remarks, such as collection accounts and late payments, typically remain on your credit reports for up to seven years. In most cases, the negative information automatically falls off of your credit report. If it doesnt, this could mean the time clock on the debt was reset, which may be an error.

- Reinsertion of incorrect information. Incorrect information that was disputed and removed from your credit report in the past can sometimes reappear. This means you will have to redispute the incorrect information with the credit bureaus or the creditor that is providing the information to have it removed again.

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Read Also: What Is The Connection Between Credit Report And Credit Score

Disputes Related To Your Personal Information Or An Inquiry

- Added: This item was added to your credit report.

- Address Updated: This may appear to you as Deleted, as your address is updated to the current address.

- Deleted: The item was removed from your credit report.

- Processed: The item was either updated or deleted.

- Remains: The company reporting the information has certified to Experian that the information is accurate, so the item has not changed.

Is It Better To Pay Off Collections Or Wait

From the viewpoint of repairing your credit score, its better to pay off a collection sooner rather than later, assuming you can afford to do so. However, a paid collection will only help your credit score if the collector agrees to remove the item from your credit report. Short of that, paying off a collection may have no effect on your credit score.

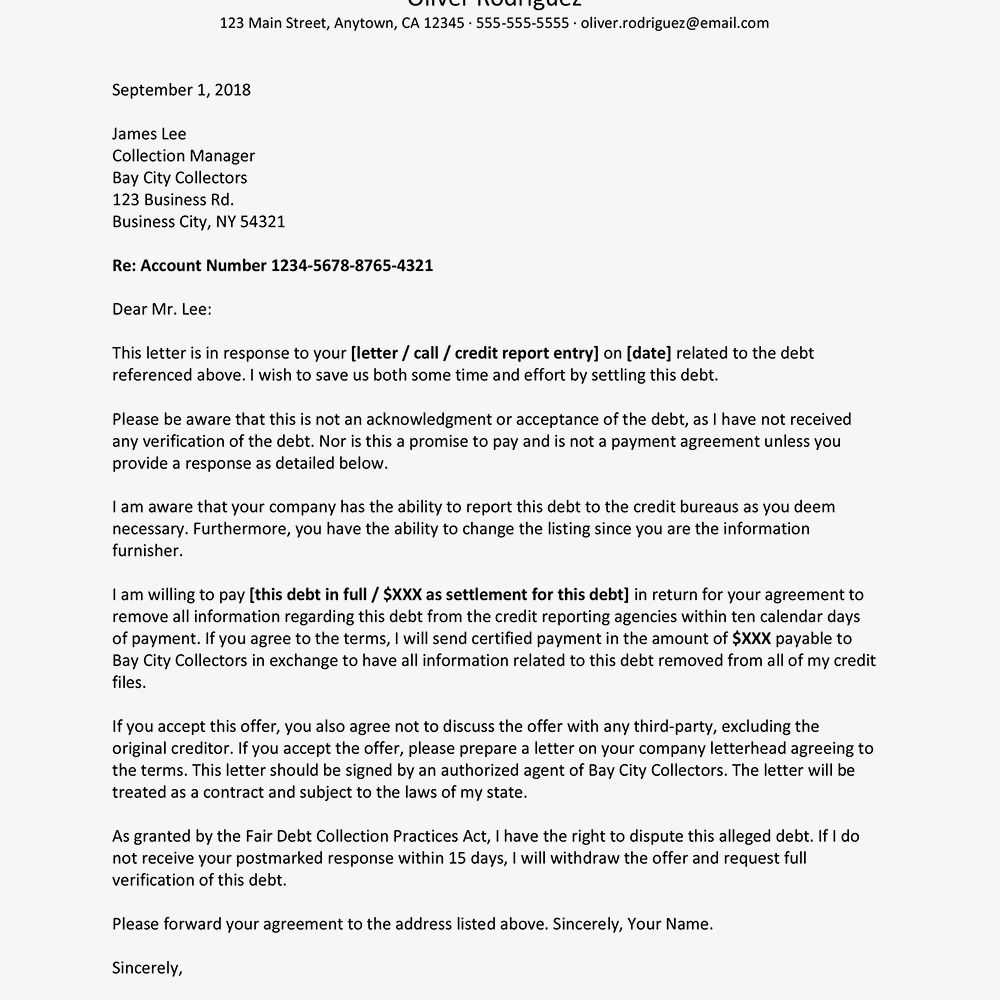

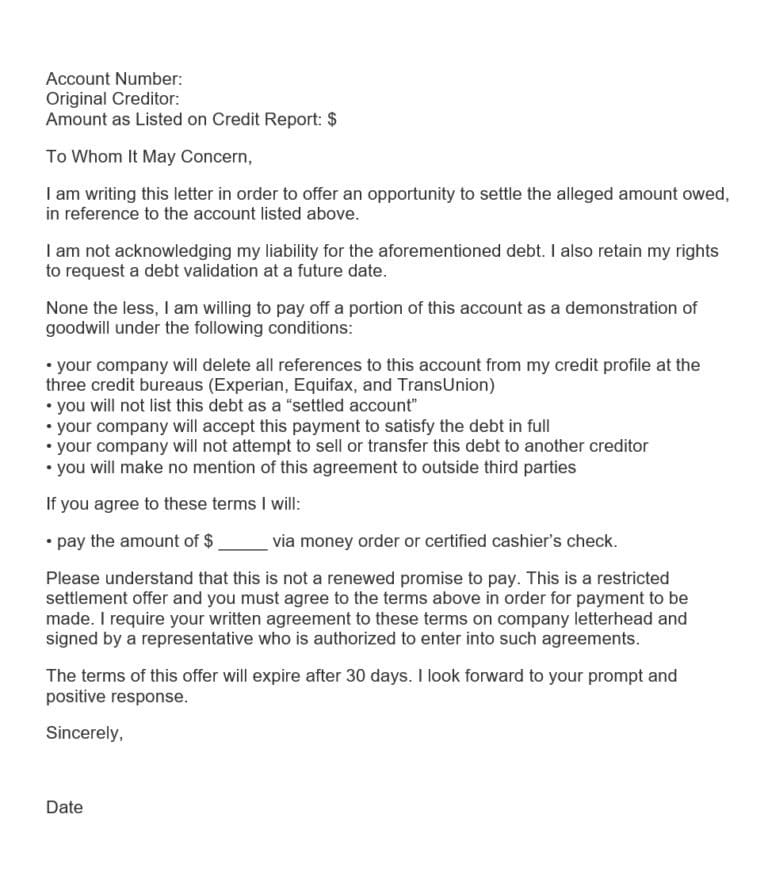

As explained above, you may have bargaining leverage with a debt collection agency. This manifests when you submit a pay for delete letter that offers to pay the debt in return for removing the collection item from your credit report. Your offer may be for the full amount owed, but you can request a partial write-down of the balance due.

For example, suppose you had a $10,000 credit card balance and were unable to make payments. Eventually, the card issuer wrote off your account and sold it to a debt collection agency for 20 cents on the dollar. The issuer collected $2,000, which means the collection agency must collect at least that much just to break even.

The fact that your original debt was $10,000 may be less important to the collector than to the credit card issuer. If the collector were to collect, say, $4,000 on the old debt, it would rack up a gross profit of 100%. Therefore, the collector may be willing to accept a pay to delete deal.

That is, a higher score will improve your access to credit and lower the amount of interest youll be charged. A higher credit limit will reduce your credit utilization ratio.

Recommended Reading: How To Raise Your Credit Score 100 Points

Is It Wrong To Dispute Correct Information

Im not the morality police, and you can do what you want to do, but you do have the right to challenge any information on your report whether its correct or not.

Its your right to have correct and verifiable information on your credit reports. I cant speak for them, but I imagine theyd also want your credit report to be fully accurate and verifiable.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Don’t Miss: How To Read Experian Credit Report

What Are The Most Common Credit Report Errors

Some of the most common credit report errors include the following:

- Errors around your identity

- Data management mistakes

- Incorrect balances

Not all errors are created equal. The errors on your credit report could appear in different sections and may have varying impacts on your credit score. For example, you may want to clear up an incorrect former address, alias or former employer, but those types of errors wont impact your credit score at all.

Missing or seemingly incorrect information isnt always an error. Creditors arent required to report your payments to all three credit bureaus and may only report payments to one or two of them. Or they might not report your payments at all. As a result, differences in your reports or lack of information may not be an error.

If you see closed and repaid accounts on your reports, those arent necessarily errors either. Accounts that never had a late payment can stay on your credit report for up to 10 years. If there was a late payment or if the account was sent to collections, the credit bureaus arent required to remove the account until seven years after the first late payment on the account. This can be the case even if the account was closed, if you paid off the balance with the original creditor or if you paid off the debt with a collection agency.

Here are some credit report errors you can dispute, and others you cannot:

Regular Reviews And Monitoring Can Help

You can dispute an inaccuracy in your credit report anytime you find one. But keeping regular tabs on your credit can help you avoid the inconvenience of a stalled or postponed credit application. Monitoring your credit proactively can make it easier to catch inaccuracies and get them resolved quickly.

Download and review your credit reports from all three credit bureaus at least once a year to avoid last-minute surprises. You can also sign up for free credit monitoring through Experian and receive free alerts when your credit score changes or new accounts or inquiries appear on your credit report. If you plan to apply for a loan or credit in the near future, consider checking your credit now so you can resolve any issues in advance.

Don’t Miss: How Long Will Judgement Stay On Credit Report

Determine If You Should Contact The Furnisher As Well

The CFPB also recommends that you contact the company that provided the information to the credit bureau. Companies that provide information to credit bureaus are also known as furnishers. Examples of furnishers include banks and credit card issuers. If the furnishers address is listed on your credit report, send your dispute to that address or contact the company for the correct address.

You can try going directly to the furnisher and asking them to correct their reporting mistake before contacting the credit bureau, says Kevin Haney, a credit bureau expert at Growing Family Benefits. That might save a step, since all the bureau can do in its investigation is communicate to the company that the consumer says its wrong, he says.

But if the error is an identity-related mistake made by a credit bureau, go to the bureau first.

Those are the most likely to get corrected, because the bureau owns the problem so it doesnt have to reach out to anyone, Haney says.

In this case, you should also check with the other major credit bureaus to make sure the identity-related error isnt on their reports as well.