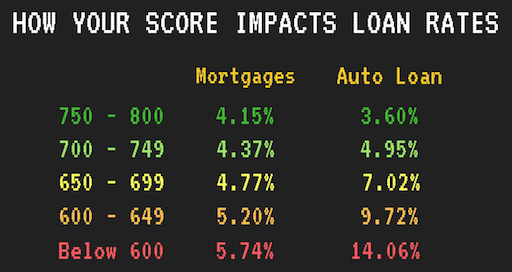

What Are Interest Rates Like For Each Credit Range

You have to separate loan rates for used cars and new cars because they vary greatly but here are some examples of what you can realistically expect:

| 18.33% | 12.42% |

Again, these numbers are just averages. For any credit rating you fall in, the interest rate youre offered may vary depending on what auto dealer you go to.

What Credit Score Do I Need To Buy A Car

A car is a necessity for a lot of useither for work, school or just getting around every day. But not everyone can afford a decent car outright. Enter the auto loan. Theyre a convenient way to split the cost into affordable monthly chunks. So, what is a good credit score to buy a car? In short, youll probably get a better interest rate if your score is over 661. But if your credit score is lacking, loans are available at nearly all credit levels.

In this article, well take you through the ins and outs of credit and car loans. Well start with a brief overview of the credit scores you need to aim for to get into the non-prime, prime and super prime lending markets. Then, well explore subprime auto loans. Finally, well talk about what you need to do to get pre-approved for a car loan.

Does Your Credit Affect Insurance Rates

While your car insurance policy will never impact your credit score, the opposite may be true. According to the National Association of Insurance Commissioners, 95% of auto insurance carriers use what’s called a to calculate premiums in states where the practice is allowed.

The score is based on your credit history but isn’t the same as the traditional FICO® Score that lenders use, though they consider many of the same factors.

States that prohibit or limit the practice of using credit information in insurance include California, Hawaii, Maryland, Michigan and Massachusetts. Additionally, Washington state has banned insurance carriers from using credit scores to set policy premiums through 2024, and Utah and Oregon have prohibited using credit histories for setting rates in certain situations.

Even in states where there aren’t such limitations, insurance companies typically can’t use a credit-based insurance score as the sole basis for increasing rates or for denying, canceling or refusing to renew a policy.

As a result, having good credit can help when you’re shopping for a new insurance policy or when your insurance company renews your policy. The opposite is also true. While a low credit score alone may not be enough to cause a premium hike, it can have that effect if there are other factors at play.

Also Check: Does Paypal Credit Report To The Credit Bureau

How Do My Credit Scores Affect My Car Loan

Your credit scores can affect your ability to get a car loan and the interest rate and terms you may be offered.

Before you begin car loan shopping, its generally a good idea to check your credit scores and understand how they can influence the terms you get from auto lenders for a new- or used-car loan. This is also an opportunity to check your credit reports for errors, which could bring your credit scores down.

What Credit Scores Do Car Dealerships Use

A dealership traditionally does not offer its own financing it may offer manufacturer financing or loans provided by a network of banks, credit unions and finance companies, and its these lenders that determine if you qualify.

Be wary of buy here pay here car lots that offer in-house financing and say things like no credit check, as they may come with high interest rates and other penalties.

You May Like: What Credit Score Does Carmax Use

What Does That Mean For You

In general, it means that although different lenders use different measures, people with exceptional credit scores may qualify for the lowest rates, while people with lower credit scores will often qualify only for loans with higher rates.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate

How Are Credit Scores Determined

FICO scores are largely based on a persons payment history and outstanding balances. Other considerations include the length of their credit history, recently opened credit lines, and their credit mix: how many credit cards they have and how much of that credit is being used, the number of retail accounts they have, their student loans, installment loans, etc.

In addition to the FICO score, a credit report will also note all open and closed credit sources, credit inquiries/applications made, and information on overdue debt, bankruptcies, or civil lawsuits. Lenders will further consider an applicants annual income to assess how large a monthly car payment they can afford.

Late or missed payments, debts that have gone to collection agencies, bankruptcies, exceeded credit limits, and outstanding tax liens all negatively affect FICO scores.

Read Also: Is 779 A Good Credit Score

What Is A Good Credit Score To Buy A Car

Thomas J. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting, personal investment and financial planning advice, and development of educational materials about life insurance and annuities.

Buying a new or used vehicle is an exciting experience. But before you start thinking about what color, make or model you want to purchase, youll need to ensure everything is in order: and one of the most important components of this is evaluating your .

If youre buying a car 100% in cash, your credit score will likely never even come up in conversation. However, if youre like most Americans, you probably cant afford to make such a large purchase in cashand thats where your credit score comes into play.

If youre worried that your credit score is too low to enable you to buy a car with financing, Ive got some good news and some bad news. The good news is that you can breathe a little bit more easily because rest assured, you will almost certainly find someone willing to finance the purchase of your car. The bad news is that if you have a bad credit score, its going to cost you a lot more to finance that purchase than it would if you had a spotless credit history.

So just how bad is badand how good is good?

How To Get A Car Loan With Bad Credit

If you have bad credit and don’t have time to wait for it to improve, getting a car loan is still possible. In fact, there are some lenders that work specifically with people with lower credit scores. Once you know your credit score, start speaking with potential lenders to see which ones might have options for someone in your credit range.

In addition to shopping around for deals, make sure to have other aspects of your application well-organized so you can compensate for a lower credit score. Here are a few ways you can prepare for financing a car with bad credit:

Don’t Miss: Does Klarna Report To Credit Bureaus

What Credit Score Do You Need For An Auto Loan

Everyone knows that cars are expensive , but rarely do people know how their credit score affects the final price they pay. Affording a new ride often requires us to find financing, usually through a lender in the form of auto loans. The interest rate attached to the loan could cost you thousands of dollars extra. What determines your interest rate? Your credit score.

How Do You Buy A Car With Bad Credit

If your credit score is less than optimal, thoroughly check your credit report. If you find an inaccuracy or mistake in your report, be sure to contact both the lender and the reporting agency to have it corrected. In a study conducted by the Federal Trade Commission, one in five people had an error on at least one of their credit reports.

Beyond that, youll have to work to improve a low credit score. Experts advise steadily paying down your existing debt especially high-interest credit cards and making all payments on time.

Also Check: Is 524 A Good Credit Score

It’s Time To Upgrade If You Need It

If you have a car that is worth trading in, Ryan says to heavily consider swapping your current vehicle for an upgrade. “There has never been a better time to sell your car,” he said. And as dealers are struggling to keep supply on their lot, they are willing to pay more for your trade in.

If you need to upgrade your vehicle, Reyes suggests to “keep the price of your vehicle to no more than 30% of your annual salary while keeping the monthly payments to no more than 10% of your monthly salary.”

If I Shop Around For An Auto Loan Wont Multiple Pulls Lower My Credit

Many people are nervous to shop around for auto loans since theyve heard that multiple credit pulls can negatively impact their credit score.

While there is certainly truth to this assumption, for the sake of comparing rates, the law states that all credit pulls that occur within 14 days must be combined into a single credit pull so that it doesnt negatively impact your credit score. So make sure to wait to compare loans and to have your credit pulled by a lender until you know you are ready to purchase a vehicle.

Starting April 20,2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through April 20, 2022 at AnnualCreditReport.com to help you project your financial health during the sudden and unprecedented hardship caused by COVID-19.

Also Check: How To Get Credit Report With Itin Number

So What Credit Score Do You Need To Buy A Car

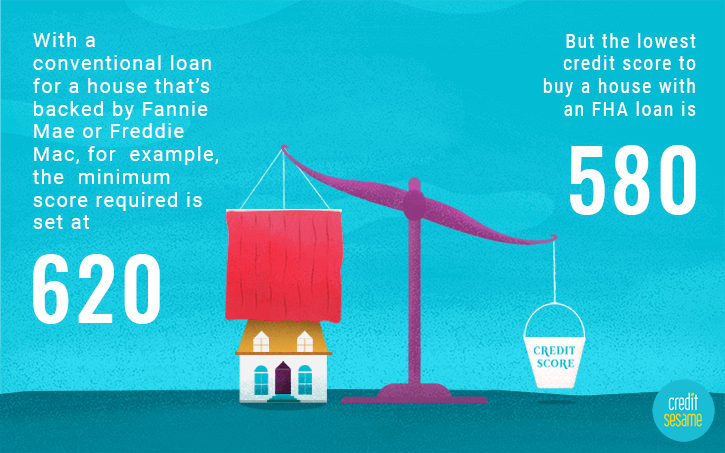

There’s no official industry standard minimum credit score that you need to secure a car loan. Like other loans though, the higher your score the better your terms will be, and moving into a better “tier” of credit score could lead to substantial savings.

To understand how auto lenders may tier their loan interest rates based on FICO Scores, review this example: Assume you want to secure a $22,000 car loan with a 4-year term, and your current FICO Auto Score is 652.

| FICO Score |

|---|

| $8,314 |

Source: Loans Saving Calculator based on rates from June 2020

Based on the interest rate table above, your monthly payment would be $566, and you would pay a total of $5,147 in interest over the life of the loan. If you increase your score to 720+, your monthly payment would be $67 lower, and you could save an extra $3,218 in interest fees over the 4-year term.

Knowing your FICO Auto Scores can help you understand what kinds of terms you may expect for an auto loan, and armed with this information, you can approach the financing interactions with more insights and confidence.

Tom Quinn

Tom Quinn is the Vice President of Business Development for myFICO and has over 25 years of experience working with consumers, regulators, and lenders regarding credit related questions and initiatives.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Higher Scores Mean Better Rates But People With Poor Credit Also Have Options

If youre planning to buy a new car, youll most likely need an auto loan to help pay for it. With the average cost of a new vehicle exceeding $40,000 today, the great majority of buyers in the United States do. Whether you apply for a loan through the dealership or at a bank, the lender will run a credit check on you as part of the process. Heres what credit score youll need to be approved for a car loanand what you can do if your credit is less than perfect.

Recommended Reading: Credit Report Without Ssn Or Itin

Explore Bad Credit Car Financing Possibilities With Land Rover Wilmington

Stop by Land Rover Wilmington near Newark if youd like to discuss your car loan options with a finance expert. Our team is happy to help you apply for financing and answer any questions about bad credit car loans, leasing vs. buying, gap insurance, and more. Start your financing application online today!

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Does Zzounds Report To Credit Bureau

How To Get Car Financing With Bad Credit

Even if you have bad credit, car financing may be possible if:

- Youve reduced debt levels over the past few years.

- Youve made on-time payments toward debts and bills.

- You can demonstrate positive financial actions.

When you apply for credit and speak with a lender, aim to show that youre in the process of recovering good credit standing, and that youre building a recent history of solid financial decisions:

- Demonstrate improvement. Many large outstanding debts are due to hospital bills, business debts, and student loans. If thats the case for you, lenders may understand that these debts may mean that your credit score doesnt reflect your true financial stability.

- Bring proof. Build your case with pay stubs, proof of address, cell phone bills, auto insurance documents, and proof of current employment.

- Bring collateral. If youre a homeowner or can come up with a down payment of at least 25%, lenders are far more likely to decide that youre a qualified borrower. You may be surprised at the interest rates you can get as a car-buyer with bad credit!

Be Flexible With Your Choice Of Vehicle

Ryan also suggests if your ultimate goal is to save money on your purchase, be flexible with the car you purchase.

If you are in the market for a “lower priced, new car” such as a Honda or Toyota, you could find yourself with few options, Ryan said.

He did note that German vehicles, Buicks and RAM trucks are recovering in their supply. According to CoPilot, as of July 2021, near-new trucks is the segment recovering the quickest in terms of supply. Coupes, sedans and crossovers are also replenishing quickly. According to the law of supply and demand, a higher supply could lead to lower prices for these types of vehicles in the near future.

If you are flexible with the type of vehicle and its accompanying features, among other details, you have a better chance of saving money and avoiding being stuck on a waitlist.

Read Also: How To Get Credit Report Without Social Security Number

How Do You Check Your Credit Score

Even if youre not buying a car right now, its wise to keep track of your credit score. Federal law allows consumers to obtain one free report each year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Many banks and credit card companies also provide free credit scores to their customers, so take advantage of that if you can. Checking your credit report regularly will not adversely impact your score.

Does Credit Score Matter Differently If Buying A New Vs Used Car

Whether youre buying a brand new car or a used car, your credit score will have a similar impact. Loans for new cars sometimes have better interest rates than used cars, but a borrower with good credit will typically get a good interest rate regardless of the type of car they choose.

For example, according to Experian, borrowers with a credit score around 700 would pay about 4.68% for a new car compared to 6.04% for a used car.

If you buy a reasonable, reliable used car with a slightly higher interest rate, youll still probably save a bundle compared to buying a brand new car with a lower interest rate. New cars cost more than used cars and lose most of their value when you drive them off the lot. Even with higher interest rates, buying a used car is typically a better financial decision.

In either case, you are usually better off buying a car with a loan than choosing a car lease. With a lease, you are effectively renting the car and have to give it back and the end of the lease unless youre willing to make a big payment to buy it outright. When you buy with a loan, you own the car at the end and can choose to sell it or keep it for years to come.

You May Like: Sync/ppc On Credit Report

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to: