How To Raise Your Credit Score As Fast As Possible

The individual or organization helping you get the advance will typically disclose how to do this to you. A large number of them don’t, so you should be acquainted with how to do it without anyone’s help. Unwind because anybody can do it. In the first place, read all that you can discover on layaway fix. Check the laws that apply to credit fix and find your privileges. Try not to get your assumptions too high about the cycle. Be reasonable.

Recall it requires some investment, perseverance, and work. If you’re industrious, a leaser will see the exertion you’re making and think of it when choosing whether or not they will propel your credit.

Acquire a duplicate of your credit report from Experian, Equifax, and TransUnion. They may have shifting data on your record somewhat, so it’s fundamental to get and concentrate on every one of them.

Search for any wrong information in your credit report and document a question letter for data you can’t help contradicting. Test debate letters can be found on the web. The credit department has 30 days to investigate the case. On the off chance that they neglect to prove the charge, they have no choice except to delete it from your credit report.

Customarily, individuals have an old obligation on their credit report and are oblivious that they can get it wiped out from their credit reports without much of a stretch.

Check Your Cibil Report For Mistakes And Rectify Them

In certain cases, CIBIL may make mistakes when it comes to updating your records, note incorrect information against your report, or delay recording details. This will also bring down your score. So, ensure that you check your CIBIL report from time to time. This will help you identify any errors and correct them by submitting a CIBIL dispute resolution form online. As a result, your credit score will improve. You can get your free credit score by simply adding some basic details.

Get Id Theft Coverage Before You Need It

These tips can get you on the right track to making payments on time, which can help you plan for your future and work towards your dreams! While youre taking on these tasks, remember to reach out to your American Family Insurance agent and request a quote on identity theft coverage. Youll have more peace of mind knowing youll have the right support when you need it most.

Recommended Reading: How Do I Unlock My Experian Credit Report

Set Up Automatic Bill Payments

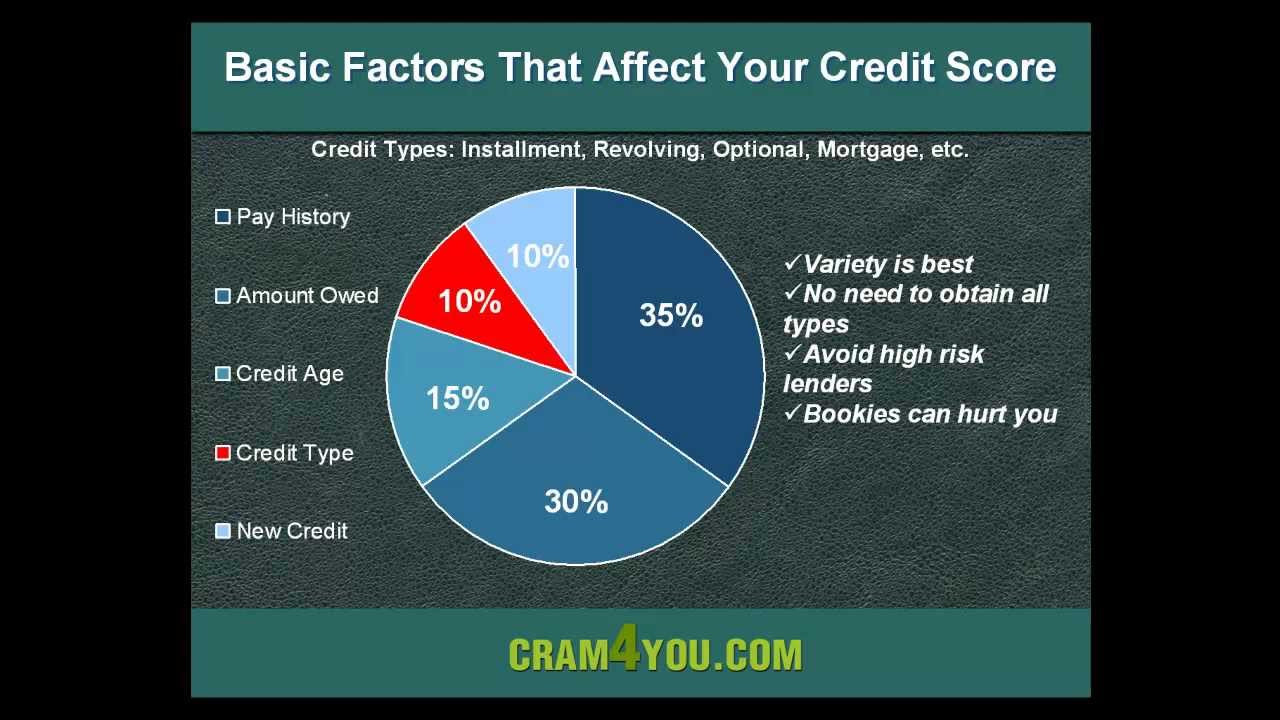

The most important factor in your credit score is payment history. Help protect your score from the adverse effects of a missed payment by putting your bills on autopay. Make sure you have enough money in your checking account to cover each bill every month to avoid an overdraft. When you know you won’t have to deal with a sudden score dip after a forgotten bill, you can focus on other ways to improve credit.

Reduce Your Credit Utilization Ratio

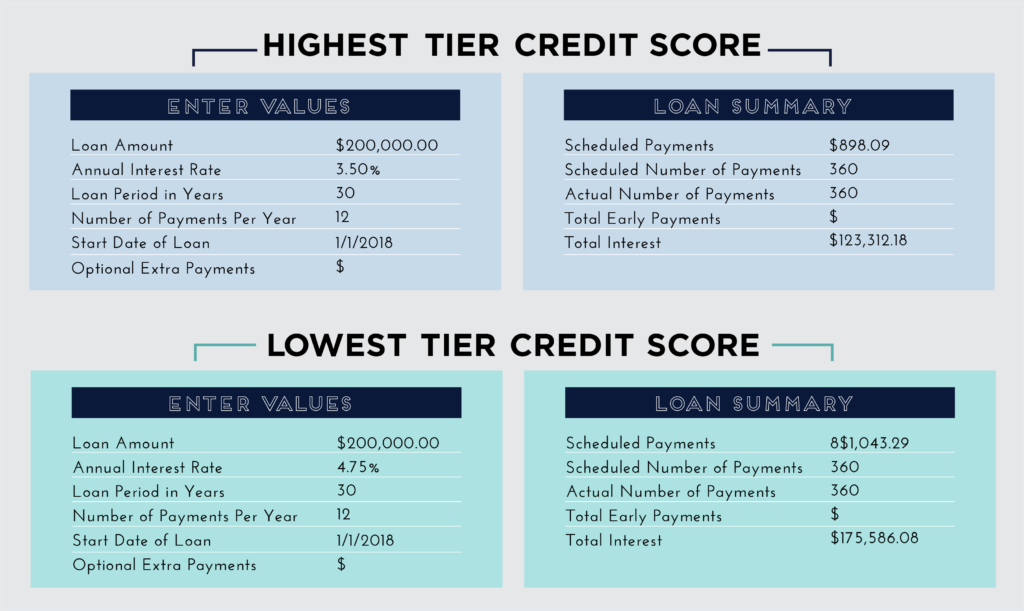

Several factors determine your credit score. Your credit utilization ratio is an influential metric because it is part of a factor that makes up 30% of your score. Credit utilization is simply how much credit you are using divided by the total amount of credit you have access to.

If you charged $10,000 to your credit cards and your total credit limit is $50,000, your utilization is 20%. Credit bureaus use your statement balance in this calculation, so you have utilization even if you pay off your balances in full each month.

A general rule of thumb is to use up to a maximum of 30% of your credit card limit. Many experts suggest keeping it below 10%, if possible. Most credit cards report your credit utilization once a month to the credit bureaus. In many cases, your most recent statement balance is the number that goes onto your credit report.

Here are three ways to keep your credit card utilization ratio below 30%:

- Only charge essential purchases like gas and groceriesor those that earn bonus points

- Split your purchases between multiple credit cards

- For large one-time purchases, make extra payments during the billing cycle

If you wont be making an extra payment each month, you can simply pay cash on purchases that would push your balance above the 30% threshold. If youre going to make additional payments, schedule them to post before the end of the billing cycle. This way your balance on your statement is lower.

Wallethacks.com

Recommended Reading: What Credit Score Does Carmax Use

Take Advantage Of Score

The number of accounts and average age of your accounts are both important factors in your credit score, which can leave those with a limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

Also Check: How To Remove Hard Inquiries Off Credit Report

Don’t Take Out Too Many Cards

Sometimes it seems like a good move to open a new credit card with a merchant to get a discount on an item. But try not to go overboard and take advantage of many discount offers over a short period of time. Each new card comes with a “hard inquiry” on your credit report by the merchant, which can have a negative impact on your credit score.

How To Get Your Fico Score For Free

Understand the reasons that help or hurt your FICO® Score, including your payment history, how much credit you are using, as well as other factors that influence your overall credit.

- Which Debts Should I Pay Off First to Improve My Credit?: Prioritizing certain bills can be important when you’re trying to increase your credit scores.

- : Learn the truth and don’t get caught off guard.

Read Also: Does Paypal Credit Report To The Credit Bureaus 2019

How To Increase Your Credit Score

There are a variety of strategies and suggestions for how to improve your credit rating yours. Well go over them in a moment, but no one can improve your credit score quicker or more efficiently than ensuring you pay bills on time and use your credit card with care.

If youre trying offer people suggestions to improve their score by pointing them towards these two aspects which are changeable can be a great starting base, said Tatiana Homonoff who is an assistant professor of Economics and Public Policy at New York University, who did a study over two years of credit scores. The researchers published a study on the subject in April of this year.

Homonoff, which is affiliated to the NYUs Robert F. Wagner Graduate School of Public Service at NYU Homonoff is affiliated to NYUs Robert F. Wagner Graduate School of Public Service at There are a few components that make up the algorithm for credit scores that are extremely difficult to attain, but paying your bills promptly and knowing your utilization of credit are 2 of the things that everyone can achieve, no matter what the extremely challenging financial situation.

Americans are paying more focus on. In July of 2020, it was announced that the median FICO score hit a record-breaking highest of 711 and 11 points, which is an increase of 11 percentage points from the previous year. This puts thousands of individuals in a better position to get low-interest affordable credit options.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Does Lending Club Hurt Your Credit

How To Build Credit

If you haven’t already, it likely won’t be long until you encounter a life situation where someone asks to check your credit. From buying a new cellphone to getting a mortgage, credit reports and scores are used by businesses to evaluate your creditworthiness and establish your borrowing terms.

Building a good credit score can take time, but the benefits of doing so are numerous. Even if you don’t expect to apply for credit anytime soon, it’s important to start working on it now so you can build a good score for when you need it.

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. Call your card issuer and ask if you can get a higher limit without a hard credit inquiry, which can temporarily drop your score a few points. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit. Some issuers may also be willing to work with you during the COVID-19 crisis.

Also Check: Is 524 A Bad Credit Score

How To Improve Your Credit Score Quickly

The major contributing factor to improving my credit score in just 30 days was decreasing my ratio. I lowered my credit utilization ratio by 19%!

This took two different steps.

First, I paid more than the minimum amount due on my credit cards. I do that anyway, but I bumped up the amount by about $25.

Second, I increased my available credit on one of my credit cards by accepting a credit line increase offer on my account. I would definitely suggest that you accept any credit line increase offer. Just be smart enough not to use it!

Its suggested that you request a credit line increase once every 6-12 months. Why? It helps with your credit utilization ratio, and that helps your credit score.

Your credit utilization ratio is the amount of debt you have divided by the total amount of credit youve been extended. Sign in to your credit card account online to see if a credit limit request is waiting for you, or call the number on the back of your card to find out about your options. The suggested utilization ratio is 30% or less on each individual account and all accounts combined.

Another major contributing factor is my perfect track record of on-time payments. According to Credit Karma, I have a 100% record of consistent, on-time payments. I manage to never miss a payment by maintaining my own personal bills calendar, which tells me when all of my bills are due. I even set reminders one week early to allow room for any mistakes.

Join An Account As An Authorized User

You can also improve credit by joining a trusted family member’s or friend’s credit card account as an . You’ll be able to use the card to make purchases, and the card’s payment history will show up on your credit report. That makes it crucial to pick someone whose credit you will benefit from. Work with the primary cardholder to pay them for your purchases, as they’ll be ultimately responsible for any balance on the card.

Recommended Reading: How Long Do Inquiries Stay On Chexsystems

Sneaky Ways To Improve Your Credit Score

There are certain times when it pays to have the highest credit score possible. Maybe youre about to refinance your mortgage. Or maybe youre recovering from a bad credit history, and you want to get approved for a credit card.

Its always good to have a healthy score, of course.

But if youre in a place where you really need to up that score as soon as possible, there are a few under-the-radar ways to speed up the process.

Seek Out A Secured Credit Card

Another option for building credit is to get a secured credit card. It requires a cash deposit, typically between $200 and $3,000, which becomes your credit limit. You can then use the credit card as you would any other, and the deposit protects the issuer from the possibility that you won’t pay off your balance. If you use a secured card responsibly, you could upgrade to a traditional unsecured card down the line.

You May Like: Jefferson Capital Systems Verizon

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

What Is The Credit Repair Organizations Act

dispute negative information found on your credit reports. But in the past, some of these companies would overstate what they could do for consumers to drum up business.

The Credit Repair Organizations Act is a federal law that became effective on April 1, 1997, in response to a number of consumers who had suffered from credit repair scams. In effect, the law ensures that credit repair service companies:

- Are prohibited from taking any payment from a consumer until they fully complete the services they promise.

- Are required to provide consumers with a written contract stating all the services to be provided as well as the terms and conditions of payment. Under the law, consumers have three days to withdraw from the contract.

- Are forbidden to ask or suggest that you mislead credit reporting companies about your credit accounts or alter your identity to change your credit history.

- Cannot knowingly make deceptive or false claims concerning the services they are capable of offering.

- Cannot ask you to sign anything that states that you are forfeiting your rights under the CROA. Any waiver that you sign cannot be enforced.

The CROA adds transparency and due diligence to the credit repair process, making it less likely that consumers will be taken advantage of. However, regulators have still found wrongdoing among credit repair companies.

Don’t Miss: Itin Credit Report

Where To Find A Credit

CDFIs: If your credit union or community bank doesnt offer them, you might try a Community Development Financial Institution. These organizations exist to help lower-income communities, and there are about 1,000 of them in the United States.

Online lenders: An online search can bring up lenders that offer credit-builder loans. Not every lender is licensed in every state, though, so it’s important to check that. In addition, payments, terms and APRs vary widely.

Lending circles: One practice that can be used among families or friends is a credit-building plan offered through lending circles. The nonprofit Mission Asset Fund runs a lending circle program. Participants get interest-free social loans, with payments reported to credit bureaus. Availability is limited. Other companies also offer versions of lending circles.

In such groups, about 10 participants each agree to put in a certain amount per month, and the money goes to one person, in a round-robin fashion, each month until everyone has received a pot of money.

Pay Down Your Revolving Credit Balances

If you have the funds to pay more than your minimum payment each month, you should do so. Chipping away at your revolving debt can have a major impact on your credit score because it helps to keep your credit utilization rate low.

“How quickly depends on how quickly the individual creditors report the paid balance on the consumer’s credit report.” Triggs says. “Some creditors report within days of the payment, some report at a specific time each month.” Credit card companies typically report your statement balance to the monthly, but this could vary depending on your issuer. You can call or chat online with your card issuer to find out when they report balances to the bureaus.

The sooner you can pay off your balance each month the better. You can also make multiple payments toward your balance throughout the month so it is easier to track your spending, and it keeps your balance low. And although it helps to even pay off a portion of your debt, paying off the entire balance will have the biggest and fastest impact on your credit score.

You May Like: Will Paypal Credit Report To Credit Bureaus

What Is The Quickest Way To Build Your Credit

The fastest way to build a credit score from scratch is to open a credit card, maintain a credit utilization ratio below 10% and pay it off every month.

If you already have a credit card, aim for a credit utilization below 10% and never miss a payment. If you have a loan, like an auto loan or student loan, make payments on time and avoid opening new loans. It will still take several months to build your credit, so follow the steps above and be patient.